Getting the band back together: Behind banking’s extraordinary day

A series of cascading executive moves in one day, including a high-profile defection, are reshaping the top of the nation’s banks.

A series of cascading executive moves in one day, including a high-profile defection, are reshaping the top of the nation’s banks.

Throughout the history of food trade, tariffs have followed. That’s why its worth listening to the cooler heads at the farm gate.

This week our Share Tips columnists have chosen large, quality companies as turmoil strikes Aussie and global stockmarkets.

The boss of big-four bank NAB has more skin in the game than most in Donald Trump’s tariff war. There are also lessons for Australia out of this.

New Hope chairman Robert Millner says Australia must cut red and green tape to help the economy after a marathon battle over a Queensland coal mine.

If many families lived with a Kia Carnival for a week, it may well reduce the obsession with dual-cab utes and SUVs.

With a 112kg wild boar which was causing chaos on local farms now permanently mounted on a country Qld pub wall and his animal preservation service in hot demand, this “normal bloke” takes us into the fascinatingly feral world of taxidermy. *Graphic.

There are billions earmarked to be spent, and this Perth-based engineer is among those on the front lines of a defence revolution.

New boss Steve McCann has his work cut out to come up with a deal to save the casino. But he is fast running out of options.

A quarter of a century after predicting the dot.com crash, influential US billionaire investor Howard Marks sees some worrying signs returning to shares.

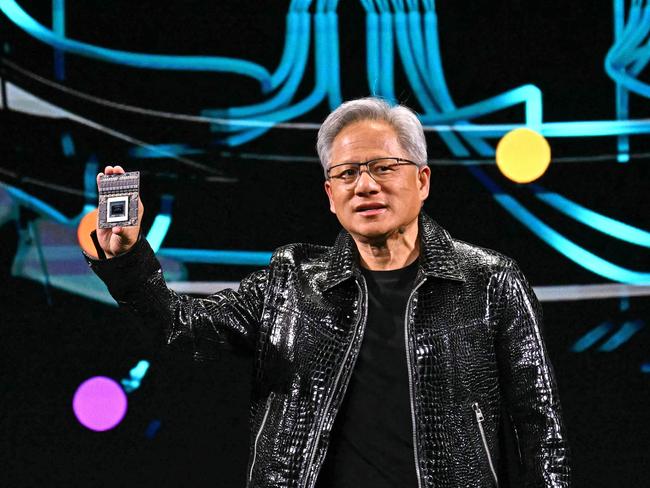

Jensen Huang is betting Nvidia’s future is far bigger than the chips powering today’s AI boom.

The under-pressure broadcaster was prepared to bet big on television and lost. Now it has a fight on its hands to prove it should stay together.

Hefty new taxes on US imports from various countries was a Trump election platform, but what does it mean for your shares?

Shares surged higher in 2024 and their returns will be tough to repeat in 2025, but other investment opportunities appear attractive.

Original URL: https://www.thechronicle.com.au/news/queensland/charleville/business/page/9