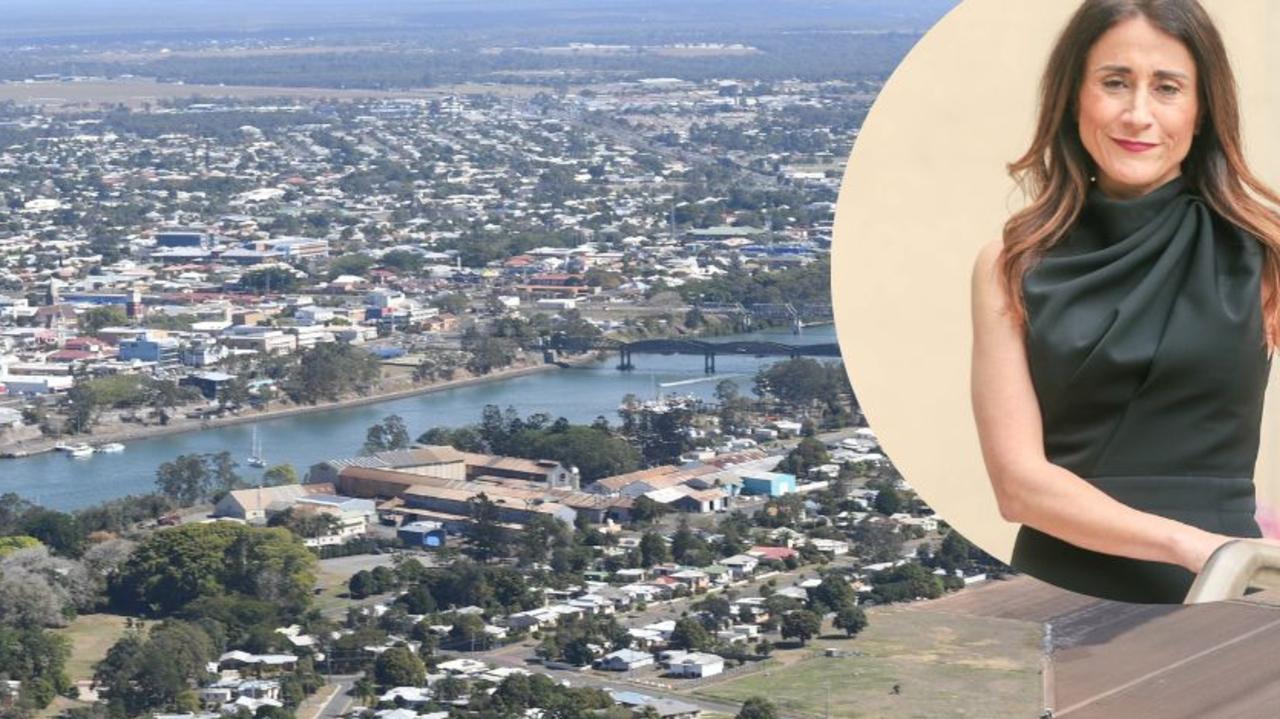

House, unit prices rises 15.19 per cent in 12 months

The cost of buying a home in Bundaberg has risen higher than anywhere else in Queensland in the past year, and Hervey Bay is not far behind. See the latest figures:

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

The housing market has boomed in recent years, driven by the pandemic, interstate travellers relocating and inflation.

In July of this year, the Courier Mail reported sellers were benefitting from the demand, with 30 per cent of sales coming from homes purchased less than three years earlier as investments.

That demand equalled a 15.19 per cent rise in the average house price in Bundaberg from 2022-2023, the highest rise in the state for that period.

With the average cost of a home in Queensland now $650,000, the Bundaberg median price of $555,000 (up $97,5000 in 12 months) is significantly higher than the state average rise of 5.26 per cent or $34,190.

For a unit, Bundaberg recorded an average annual rise of 15.45 per cent, also much higher than the state average of a 6.91 per cent.

On the neighbouring Fraser Coast, house prices have risen 10.71 per cent in the past 12 months, and units 17.73 per cent.

In Q1 2023, Hervey Bay recorded a median house price of $608,750, and a median unit price of $419,000.

There is hope for first home buyers trying to break into the market.

Real Estate Institute of Queensland CEO Antonia Mercorella said while prices would not be going “belly-up” any time soon, they were settling.

“The dust has settled and we’ve returned to a much more stable sales market, with steady growth for owners and more time for buyers, and that’s a great market to be in,” she said.

“It’s unsurprising that buyers are increasingly recognising the value and appeal of apartments, particularly those wanting to get out of the strained rental market and on to the property ladder.”

Ms Mercorella predicted immigration to the southeast corner of the state, including Bundaberg and Hervey Bay, would continue to drive property growth, with the 2032 Olympics playing a role in bringing people closer to Brisbane.

“While these results are somewhat surprising given rising interest rates, Queensland’s market is buoyed by population growth and a lack of listings hitting the market,” she said.

“It’s slim pickings for buyers hoping to secure a slice of the Sunshine State, and this creates competition and puts upward pressure on prices.”

More Coverage

Originally published as House, unit prices rises 15.19 per cent in 12 months