ACCC Telstra rejection could force TPG to make brazen Optus switch

Consumers still might take convincing they would get a better deal with two players in the future than three players on offer today.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The competition regulator is hoping to engineer a brazen switch by TPG into the arms of Optus, as it blocks the path for arch telco rival Telstra to get even bigger in regional Australia.

By standing in the way of a plan for Telstra and TPG to sharing mobile network infrastructure outside the major cities, the competition regulator is pinning its hopes on Optus’s Kelly Bayer Rosmarin being good to her word and massively building out its regional coverage as returns per mobile user have been pressured.

All the signs point to the regulator being prepared to back – and even overtly encouraging – a stronger second player than what it sees as entrenching the dominant position of number one player Telstra.

This line of thinking also assumes that TPG will never become a third force in remote and regional Australia. That means it is all upside for Bayer Rosmarin because even she dosen’t enter into a network sharing deal with TPG, the status quo is just as good.

For mobile users outside the cities the landmark ruling might take some convincing that the certainty of three players today in regional Australia (Telstra, Optus and TPG as an effective reseller) would be better than the prospect of just two majors many years in the future.

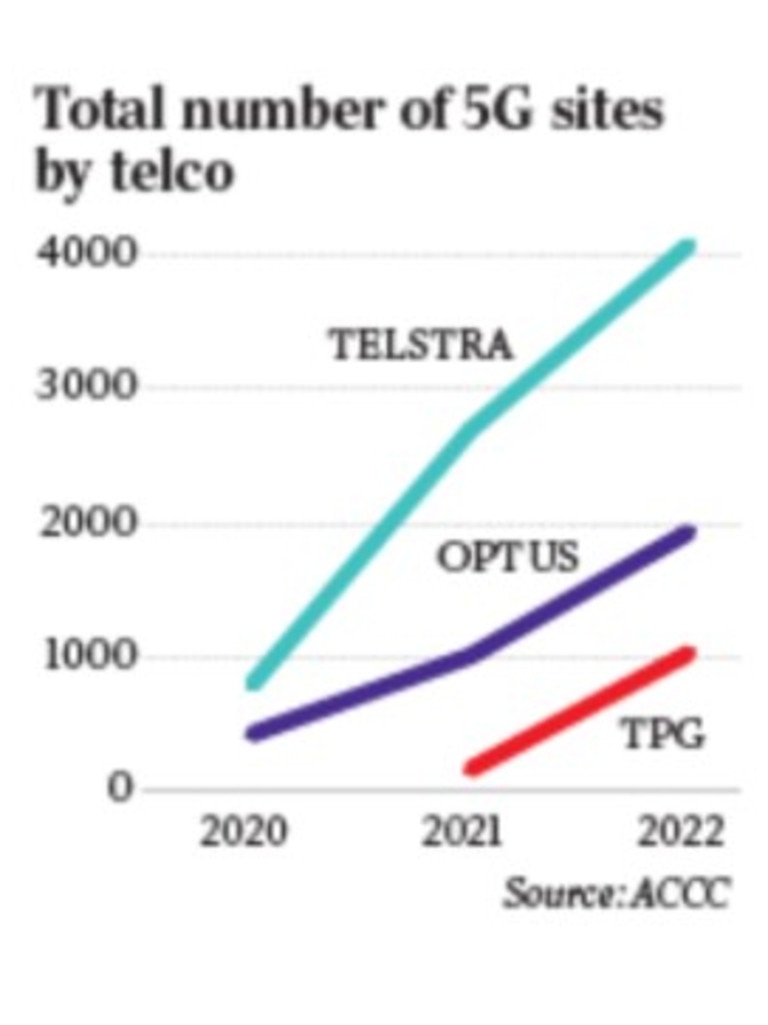

Given its sheer size, Telstra was always going to have a tough time convincing the competition regulator to back a mobile network tie-up with a smaller rival TPG in regional and urban fringe areas of Australia where around 17 per cent of Australians live. Based on current numbers Telstra has more than 4000 5G sites in operation around Australia, Optus has just over 2000 and TPG 1000.

Significantly, the deal as proposed and based on models used in markets including Canada, would give Telstra access to TPG’s mobile spectrum outside the metropolitan areas which could be used in the shared regional network.

TPG would roll up its existing 170 mobile towers sites into Telstra’s regional network and pay Telstra up to $1.8bn over the life of the deal giving its customers access to its ultra-fast 5G network in the regions over the next decade.

Here Telstra was betting on the arguments of the high cost and marginal returns in setting up a high-speed 5G mobile network in sparsely populated areas of Australia. Coverage of 5G requires more base stations than 4G coverage. It also sees a more efficient use of limited spectrum which would give users an overall better experience.

It also maintained Optus actually has more spectrum per user in regional Australia compared to a combined Telstra-TPG so it was on the smaller telco to put its money where its mouth is and spend up.

The revenue generated from TPG, Telstra argued, was money that could be spend upgrading the network for the regions and preparing the network for 6G services coming around the end of the decade.

On Wednesday the ACCC firmly knocked back the plan on two tests. That is the deal wouldn’t substantially lessen competition and the likely benefits from the arrangements would outweigh the likely public detriments.

Telstra chief executive Vicki Brady, who grew up in country NSW, has said she will appeal the decision. TPG is also preparing to work up its own appeal.

Brady described the decision as a “massive missed opportunity” for regional Australia saying it could have unlocked TPG’s unused spectrum.

The decision follows nearly a year of deliberation, 170 submissions to the regulator, more than 40 witness statements and going through confidential documents across Telstra, TPG and Optus. The SingTel-backed Optus had been bitterly opposed to the tie-up with former NSW premier and newish telco executive Gladys Berejiklian helping to spearhead the campaign.

Without an agreed network merger TPG can now go two ways, it can continue to invest in its own 5G network in regional Australia, which is unlikely while it battles for market share in more lucrative metropolitan areas.

In the ACCC’s mind it also has the choice of switching teams and entering into talks with Optus to strike a similar deal. On paper at least the economics are compelling.

Optus has previously held talks with TPG about such an infrastructure sharing arrangement. The two already have a “live” roaming arrangement in metropolitan areas around where gaps exist in TPG’s current 3G and 4G network

But in its evidence given to the ACCC, TPG has pushed back hard against Optus. It says there is no real commercial likelihood that it would be able to successfully negotiate a roaming or active network agreement with Optus in the foreseeable future.

Even if a deal is struck, TPG maintains it would not be feasible for at least three to five years, it has also been highly critical over Optus’ inferior 5G footprint in regional Australia and poor commercial terms on offer, meaning there is limited upside in doing a deal.

TPG has previously said Optus is using the competition regulator to use this authorisation process to effectively give Optus another opportunity to force TPG to accept a worse deal.

ACCC commissioner Liz Carver who oversaw the decision, acknowledged under a network deal there would be a short term boost for customers as Telstra gets access to TPG’s spectrum and TPG can expand its geographical reach for customers, but consumers would soon be worse off on a number of levels.

Here the regulator believes the infrastructure sharing would entrench Telstra’s substantial market lead in regional areas particularly on 5G and by gaining access to TPG’s mobile spectrum it would effectively lock up the already large holdings of spectrum Telstra has.

Critically also believes the onset of a much bigger player in the form of Telstra would simply be a disincentive for Optus to spend money in regional areas because it cannot catch up.

“It is our view that the proposed arrangements will likely lead to less competition in the longer term and leave Australian mobile users worse off over time, in terms of price and regional coverage,” the ACCC’s Carver said.

Telstra and TPG have until January 11 to lodge an appeal with the Australian Competition Tribunal. A ruling by the tribunal could take as long as July.

johnstone@theaustralian.com.au

More Coverage

Originally published as ACCC Telstra rejection could force TPG to make brazen Optus switch