‘Perfect storm’ making Aussie businesses go bust

Calls to liquidators are up more than 50 per cent, as experts reveal the “perfect storm” pushing thousands of Aussie businesses over the edge.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Calls to administrators, liquidators and insolvency firms are up by more than 50 per cent in the last three months, as data reveals the “perfect storm” pushing thousands of Aussie businesses towards bankruptcy.

The number of Australian businesses going bust has risen dramatically in the past year, according to the latest data compiled by comparison site Insolvency Australia.

Companies appointing administrators, liquidators and insolvency firms — typically the last points of contact before a business collapses — increased by 57 per cent nationally in the last quarter, compared with the same time in 22, the data revealed.

NSW had the most businesses slip into financial strife in the last quarter, with almost 1170 corporate insolvencies.

Tasmania, meanwhile, recorded the largest year-on-year percentage increase in insolvencies, at 133 per cent.

The ACT copped a 64 per cent increase in corporate insolvencies compared with 2022, while NSW and Queensland both had a 59 per cent rise.

More businesses in other states were hit, too, as corporate insolvencies rose by 54 per cent in Victoria, 52 per cent in SA and 50 per cent in WA.

Insolvencies in the NT remained steady.

Insolvency Australia director Gareth Gammon said a “perfect storm” had led to an “insolvency wave” in the wilting Australian economy.

“Over the past year there’s been plenty of discussion in the sector about the incoming insolvency wave,” he said.

“It started with a trickle, and it’s now become more of a surge as economic pressures and the ATO’s debt collection activities combine to create the perfect storm.

“Beyond this last quarter, we’re now seeing an increase in court wind-ups by the big four banks, which means the next few months could well be equally challenging.”

The tax office and other creditors posed the biggest threats to cash-strapped Aussie businesses, as they try to recoup debts while facing financial woes of their own, Insolvency Australia warned.

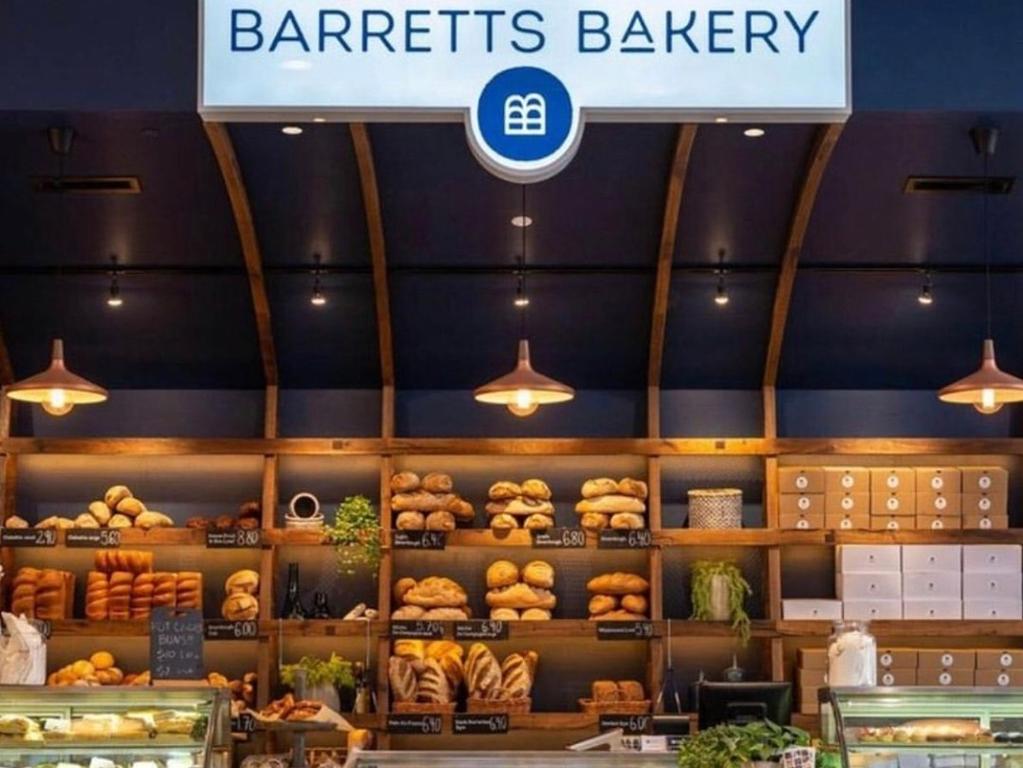

The warning comes after popular WA bakery chain Barretts Bakery collapsed, owing the Australian Taxation Office $2 million.

Administrators were given control of the string of bakeries, which first opened in Perth in 1998, on July 27, according to a notice published on the ASIC website.

Mervyn Kitay, the principal of the insolvency firm Worrells, said the business’s struggles during the Covid pandemic led to its $2 million legacy debt.

A legacy debt refers to debt that is above what could have been expected in relation to GDP and inflation behaviour.

The ATO has provided general advice that if legacy debt is not paid, the company director becomes liable.

“As a company director you are responsible for ensuring that the company’s tax and super obligations are reported and paid on time,” the advice states.

Originally published as ‘Perfect storm’ making Aussie businesses go bust