Anthony Albanese’s insurance intervention as community battles effects of Cyclone Alfred

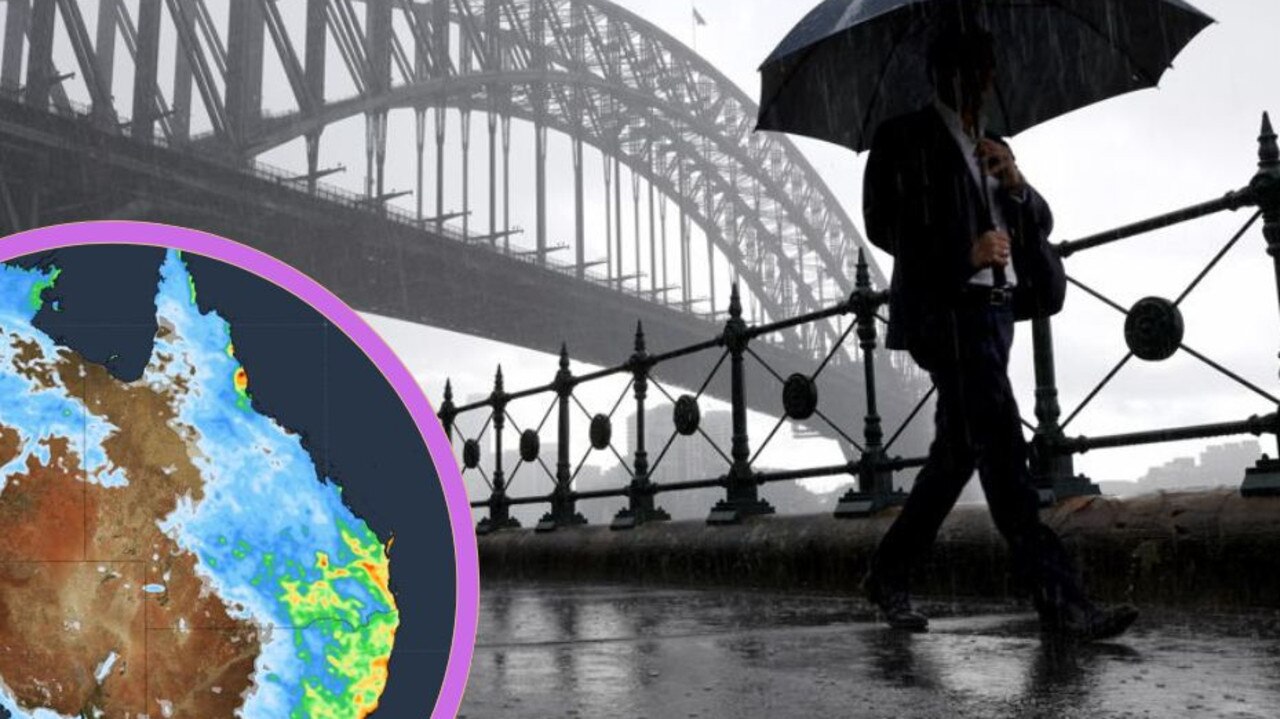

Anthony Albanese has put insurers on notice as NSW and Queensland brace for potential flooding in the aftermath of ex-tropical Cyclone Alfred.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

Anthony Albanese has put the insurance industry on notice, warning the government will “do what we need to do” to ensure flood victims across NSW and Queensland are paid their fair share.

The Prime Minister directed Treasurer Jim Chalmers to urgently meet with insurance giants as both states were on edge since Thursday waiting for the impact of the Cyclone Alfred, which was later downgraded to an ex-tropical cyclone.

The government’s intervention comes after a parliamentary inquiry found insurers had “failed too many people” in the 2022 east coast floods.

Families and businesses were waiting on insurance claims to be resolved for more than two years after the devastating natural disaster.

There were allegations insurers were coming up with different damage reports despite all covering the same area, and one of the most common points of contention was insurance payments being denied because of the condition of timber stumps under a home.

“We have a strong expectation that insurance companies will be ready to respond positively,” Mr Albanese said.

“In recent days brave Australians have followed advice and got cracking with preparations for this extreme weather. We expect insurance companies to get cracking on making payments.”

The comments also come after Peter Dutton floated a crackdown on the broader insurance industry three weeks ago. His treasury spokesman Angus Taylor walked that back last week, before u-turning and revealing a Coalition government would not hesitate on reading the riot act to insurers.

It’s understood the government has been reassured that insurers have placed disaster response specialists on standby to move into affected communities and help with claims.

“We will do what we need to do to ensure insurance companies meet their obligations,” Mr Albanese said.

Lismore state MP Janelle Saffin said the public would not hesitate in holding insurers to account after the parliamentary inquiry into the 2022 floods inquiry made 86 recommendations.

“People are concerned about insurance,” Ms Saffin said.

“The people will speak and they’ll speak loudly, they don’t hold back here.

“(Insurance companies need to) remember you’re delivering a service and it’s important that it’s done in what I call a competent and compassionate way.”

On Friday the Insurance Council of Australia said it was too early to tell the impact of the recent event, but the last cyclone to hit Australia, Tropical Cyclone Jasper, cost $409 million from around 10,500 claims in 2023.

The 2022 floods were the costliest insured natural disaster in the nation’s history.

Although the cyclone was downgraded early on Saturday morning, concerns for flooding remained over the weekend.

Premier Chris Minns said the ICA had been in contact about how insurers would be supporting communities following the impacts of Cyclone Alfred.

“This is welcomed and we’ll be watching to ensure processes are as easy as possible,” he said.

“For now, people should contact their insurer as soon as possible.

“People can lodge a claim without knowing the full extent of the damage. And take photos and make a list of damaged items.

“We all need to do what we can to ensure Northern NSW communities are back in their homes and businesses as soon as possible and that local communities are up and running again.”

More Coverage

Originally published as Anthony Albanese’s insurance intervention as community battles effects of Cyclone Alfred