NQ economists flag conflicting Australian Bureau of Statistics job modelling data

Townsville is caught in a jobs numbers tug of war, with mixed messages from the Australian Bureau of Statistics. See how a North Qld economist is trying to the bottom of it.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Townsville is receiving mixed messages from the Australian Bureau of Statistics about its employment trends, with one dataset showing the city lost thousands of jobs, while another model asserts that thousands more jobs were created.

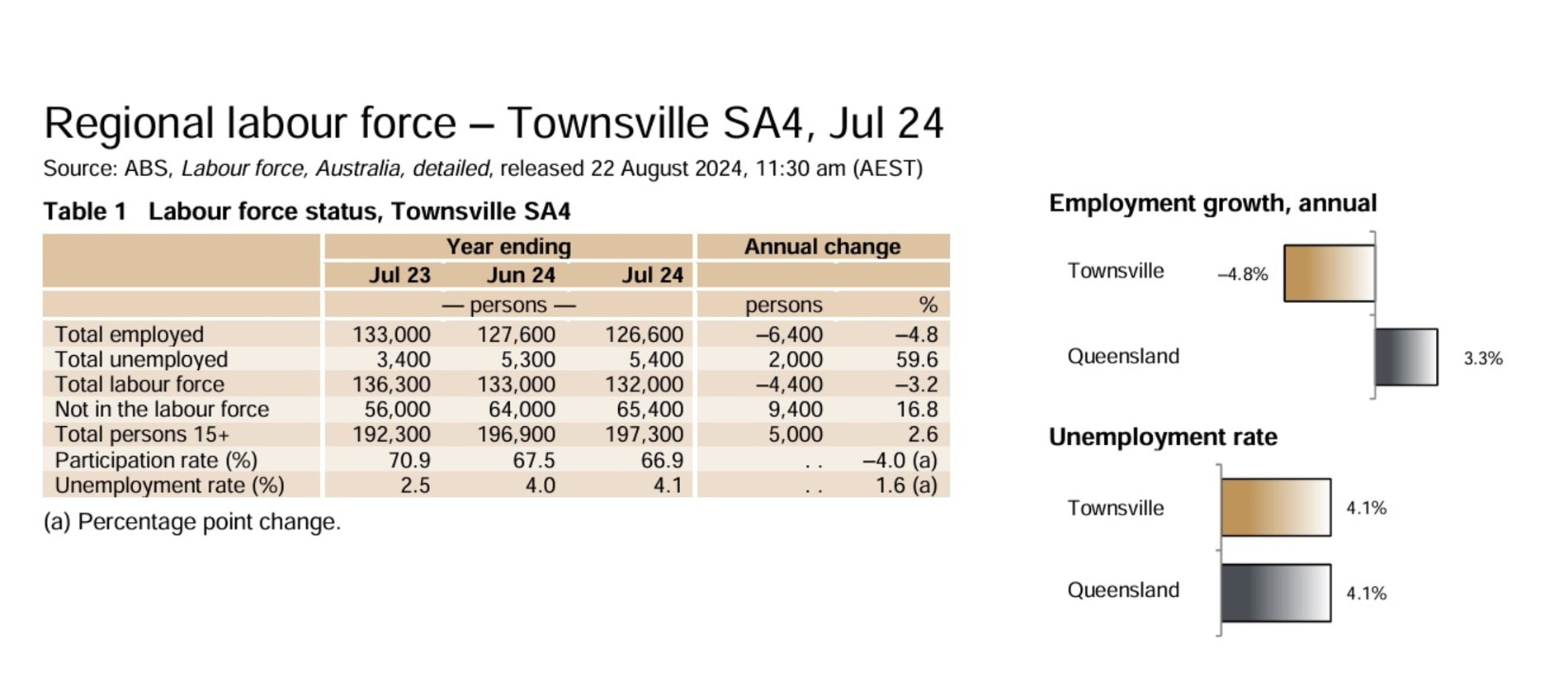

According to James Cook University adjunct professor Colin Dwyer, the jobs figures in the Townsville region dropped significantly over the year to July 2024 and the unemployment rate rose – influenced by higher borrowing costs and cost of living challenges.

Referring to the ABS’s 12-month survey data, TP Human Capital Director Clayton Cook Director said the number of jobs in the Townsville Region in July 2024 was 126,600, a decrease of 2500 jobs compared to two months ago and 6400 over the year.

“This is a 4.8 per cent drop in Townsville region job numbers for the year, the largest drop in job numbers for any Queensland region in the past year,” Mr Cook said.

“The unemployment rate in the Townsville region in July 2024 was 4.1 per cent, an increase of 1.6 per cent points over the year. The participation rate … was 66.9 per cent, a decrease of 4 per cent points over the year.”

The data quoted by Mr Dwyer was challenged by Far North Queensland economist Pete Faulkner, who cautioned against reading too much into the figures, saying they were “simply 12-month averages of original, not seasonally-adjusted data”.

“Our own Conus Trend series (seasonally-adjusted and based on the enhanced regional labour market data from the ABS) shows employment in Townsville was up 4500 in the year to July and up 700 in the past quarter,” Mr Faulkner said.

“The unemployment rate is 4.8 per cent, and it’s been between 4.7 and 4.9 per cent since June 2023. Participation rate increasing by 0.7 percentage points over the year is the reason the unemployment rate has been stable despite employment growth.”

The Queensland Government Statistician’s Office (QGSO) told Mr Dwyer they “didn’t think that the new modelling system was robust enough” and it lacked variables they regarded as important.

“Unfortunately for the Townsville region, those two data sets are moving in different trends,” he said.

Mr Dwyer said his data was supported by what he saw on the ground in Townsville in July.

“I could see that cafes and restaurants weren’t as busy, and those particular business owners were telling me that they weren’t busy and that they were putting staff off,” he said.

“It was a cost of living issue … having to pay higher electricity costs … higher insurance, and there were fewer customers coming through the doors.”

Six weeks ago, Mr Dwyer wrote to the ABS seeking to gain a better understanding of the differing models, but was yet to hear back.

This week he enlisted help from Queensland Senator Susan McDonald to look into the issue and prompt the ABS to respond to his questions.

ABS sets the record straight on tracking Townsville’s employment

ABS spokesman Joshua Paddon said they were in a transitional period where these new estimates had been added to their suite of labour market information, alongside our traditional products.

He said the ABS currently produced three three sets of estimates for Townsville:

1. The new modelled estimates that are produced using time series models.

2. Monthly direct survey estimates, that have limitations (explained in the ABS Regional labour market data guide).

3. Rolling 12-monthly direct survey estimates, which has been the traditional approach to addressing some of the limitations with monthly direct surveys.

“The new modelled estimates provide the best indication of change in the regional labour markets,” Mr Paddon said.

“These estimates also align more closely with the seasonally adjusted and trend estimates that local economists are also producing, such as Conus Consultancy in Far North Queensland (compared with either the monthly direct survey estimates or the rolling 12-month direct survey estimates).

The ABS noted this in specific advice in its July Labour Force release.

“The ABS recommends using the modelled estimates in MRM1 over the direct survey estimates whenever possible in reporting on employment and unemployment rates for regional labour markets,” it said.

“However, these estimates are new and currently only available for a short period of time (whereas the direct survey estimates have a long historical time series), and are currently only available at a high level (for example, they aren’t currently available by age sex).

“During this period they add important and improved insights, but as part of a suite of statistics that still includes traditional products.”

Originally published as NQ economists flag conflicting Australian Bureau of Statistics job modelling data