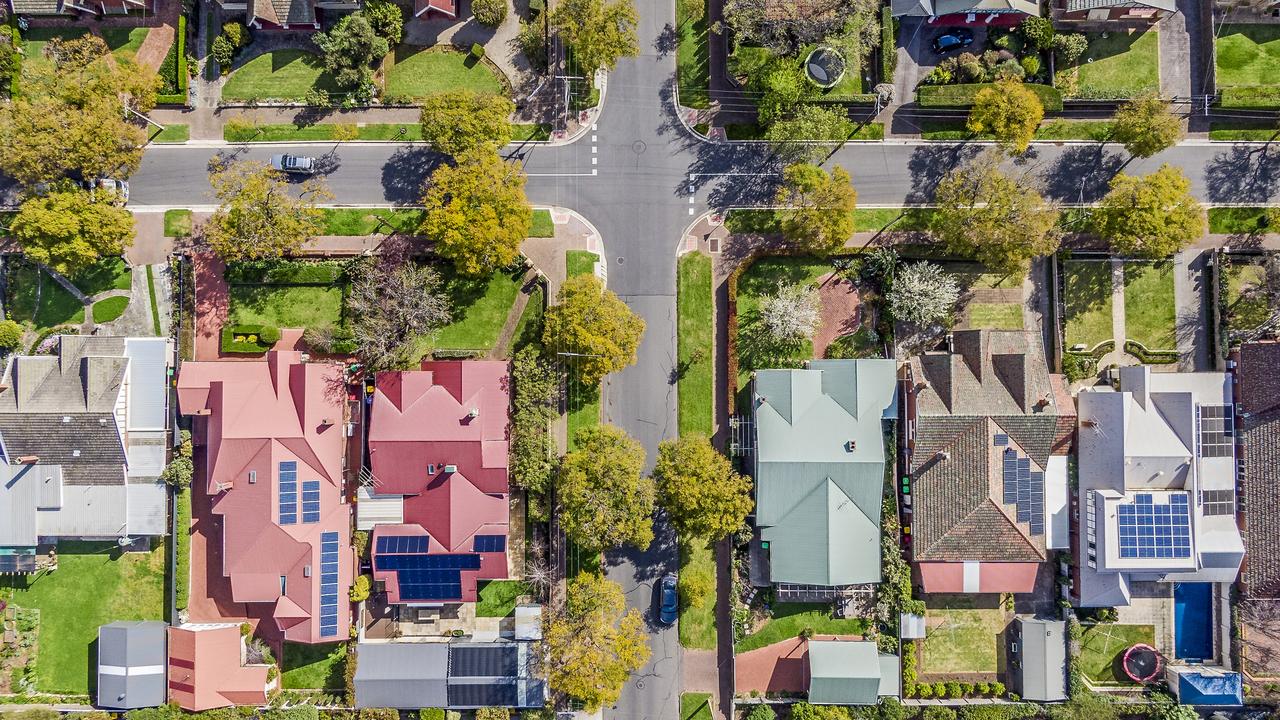

Why property investment does not need big bucks of borrowed cash

As real estate investors sell up, opportunities are opening for new ones, and they don’t need huge mortgages to get a foot in the door.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

It hasn’t been a great 18 months to be a residential real estate investor.

Mortgage interest rates repayments have climbed almost 60 per cent after a string of Reserve Bank rate rises, national property prices have been through a downturn, while some governments have introduced tougher rules to help tenants or punitive new taxes targeting property owners.

Given that the majority of Australia’s 2.2 million property investors often owe at least $1 million through their own mortgage and rental properties, it’s an expensive sector to play in when the cards are stacked against you.

While rents have risen strongly in the past two years, it’s nowhere near enough to cover the sharply higher mortgages many investors must fund.

A recent report by Property Investment Professionals of Australia found investors were heading for the exit doors, mainly in Victoria an Queensland, and the trend had potential to strip more than 200,000 dwellings from rental markets – making tight vacancy rates even tighter.

Author, investor and university lecturer Peter Koulizos said some investors sold to lock in profits from the Covid boom, diversify their money elsewhere or avoid paying sky-high interest rates on multiple mortgages.

“If you are going to invest in Sydney or Melbourne you are looking at close to $1 million,” he said.

“To build a portfolio you only need two mortgages and you are over $1 million.

“If your typical interest rate is 6 per cent and your investment property is only returning 4 per cent, that’s a big gap.”

Mr Koulizos said higher interest rates meant most property investors today were negatively geared – where their costs exceed rental income and they claim a tax deduction for the difference.

“Most can afford to be negatively geared on one property, but to be negatively geared on two or more each costing several hundred dollars a week can be quite difficult,” he said.

AMP head of investment strategy Shane Oliver said in previous years rental properties almost paid for themselves.

“Interest rates were so low that you didn’t need a lot of rental income to fund the loan, but that’s no longer the case,” he said.

However, Australians can invest in real estate without going all-in on a single expensive property.

“There are other ways to access property,” Dr Oliver said.

1 YOUR SUPER

Most Australians are already property investors through their superannuation savings.

Balanced super funds typically invest up to 10 per cent of people’s nest eggs in real estate in Australia and offshore, while many fund members can choose how much property they want to hold along with shares, bonds, cash, infrastructure and alternatives.

Several retail super funds offer access to specific local or global investment funds focused on real estate.

Author and Rethink Investing managing director Scott O’Neill said investors could also use SMSFs to secure high-quality investments.

SMSFs can employ existing savings to purchase properties, and potentially avoid paying capital gains tax if the asset is owned until super’s tax-free retirement phase.

2 FAMILY OR FRIENDS

An increasing number of properties are being bought by small family groups – generally siblings or parents with adult children.

Mr Koulizos said it could be financially rewarding to “partner up” to get a foot in the property investment door.

“Fifty per cent of something is better than 100 per cent of nothing,” he said.

Experts recommend property partners have proper legal documents drawn up that direct what happens if one party wants to sell some or all of their share later, and deal with other potential issues.

3 CHOOSE COUNTRY

“If people are looking to borrow less, I would encourage them to go regional,” Mr Koulizos said.

Plenty properties outside the major capitals could be bought for $300,000 or less, he said.

However, it is worthwhile doing plenty of research before buying property in any area in which you are unfamiliar. For example, is the region’s economy likely to grow? What are its rental yields and capital growth history? Can you find a good professional property manager rather than take long trips yourself?

4 LISTED PROPERTY TRUSTS

These days they are called real estate investment trusts, or REITs, and for decades they have been used by everyday investors to by stakes in properties ranging from shopping centres and factories to office towers and hardware stores.

Mr Koulizos said “you can get it with a few thousand dollars”.

However, REITs could be much more volatile than direct residential properties.

AMP’s Dr Oliver said REITs also offered property development exposure.

“But you do get the volatility that comes with the share market,” he said.

“A lot of the return of the REIT comes from income, and it doesn’t move around that much.”

Dr Oliver warned REITs were facing structural issues from the emerging trend of buying goods online – a negative for retail stores – and the post-pandemic trend of people working at home at least a couple of days a week, reducing office demand.

5 GLOBAL REITS

It’s easier than ever to buy international stocks, and global REITs can over good diversification and exposure to major property assets overseas. They can be bought directly or via managed funds.

LaSalle Investment Management Securities chief investment officer Matt Sgrizzi said global REITS were now trading at attractive levels after falling about 25 per cent since March 2022.

Their prices have fallen because rising interest rates lifted bond yields – which often compete with REITS for income-focused investors. Mr Sgrizzi said REITs delivered defensive and durable income, could smooth the impact of economic cycles, and regular rent rises made them a hedge against inflation.

“The global REIT investable universe is significant, spanning 23 countries, 450 listed real estate securities and 20-plus property types,” he said.

“This includes the traditional retail, office, industrial, multi-family and hotel and resorts REITs, as well as the more specialty focused companies which invest in such property types as data centres, cell towers, self-storage and healthcare. Some of these sectors are not readily available in Australia.”

6 UNLISTED PROPERTY

Not all REITs are listed on stock markets, and unlisted vehicles can hold similar assets – just without the volatility that comes with being bought and sold on the market rollercoaster.

Dr Oliver said a lot of fund management companies offered unlisted property assets and “there’s a whole universe of potential investment”.

“Fund managers offer property funds,” he said, but warned they were often less liquid than direct shares.

“And they focus mainly on commercial property rather than residential property.”

7 EXCHANGE TRADED FUNDS

Another way to buy a piece of the property pie is through ETFs, which have surged in popularity in the past decade.

These spread each dollar invested across multiple stocks or other investments, often tied to an index such as the S&P/ASX 200. Rather than putting all your money into one stock, they deliver much more diversification and reduce risk.

Stockspot senior manager of investments Marc Jocum said there were four Australian property ETFs and two global property ETFs listed on the Australian Securities Exchange.

“Exchange traded funds provide a great avenue for investors to gain access to property,” he said.

8 SMALL COMMERCIAL PROPERTY

Some commercial real estate investments can cost a lot less than a typical house.

Rethink Investing’s Mr O’Neill said an excellent example of properties below $500,000 would be small industrial warehouse units in Brisbane, Perth, Adelaide and Hobart.

“The incredible appeal of this type of investment stems from their high demand, primarily attributed to businesses’ need for storage space,” he said.

“Businesses range from trades, online firms, and even diminutive manufacturing companies.

“According to CBRE, the vacancy rate for industrial properties in Australia is strikingly low at 0.6 per cent, positioning it among the most constricted markets in the developed world. This makes it a superb sector to invest in, offering both substantial yields and robust capital growth.”

Mr O’Neill suggested commercial property investors begin modestly, and engage a knowledgeable buyer’s agent.

Mr Koulizos warned that commercial property investment was more complex than residential property, and there was no such thing as a residential tenancies tribunal to assist with disputes.

Leases also differed greatly, he said. “A residential lease is a standard four pages – almost everything is the same, whereas no two commercial leases are probably the same.”

9 FRACTIONAL INVESTMENTS

Fractional property platforms allow people to buy portions of an individual property and then share in its costs, income and capital growth.

Examples include BrickX, which picks individual properties across Australia then divides them into 10,000 “bricks” for people to buy and sell, and DomaCom, a fractional investment platform chaired by former Liberal Party leader John Hewson that allows people to invest with as little as $1000.

10 PROPERTY SYNDICATES

Another way for investors to pool money to buy big assets, property syndicates fell out of favour after some had financial issues during the global financial crisis 15 years ago.

However, syndicates still operate throughout Australia and typically focus on commercial properties with individual investors holding significant stakes, sometimes more than $200,000.

The Australian Investors Association said people should consider issues such as how long their money might be locked away, tenants, interest rates and management.

More Coverage

Originally published as Why property investment does not need big bucks of borrowed cash