Interest rate pain: five things you should do with your mortgage

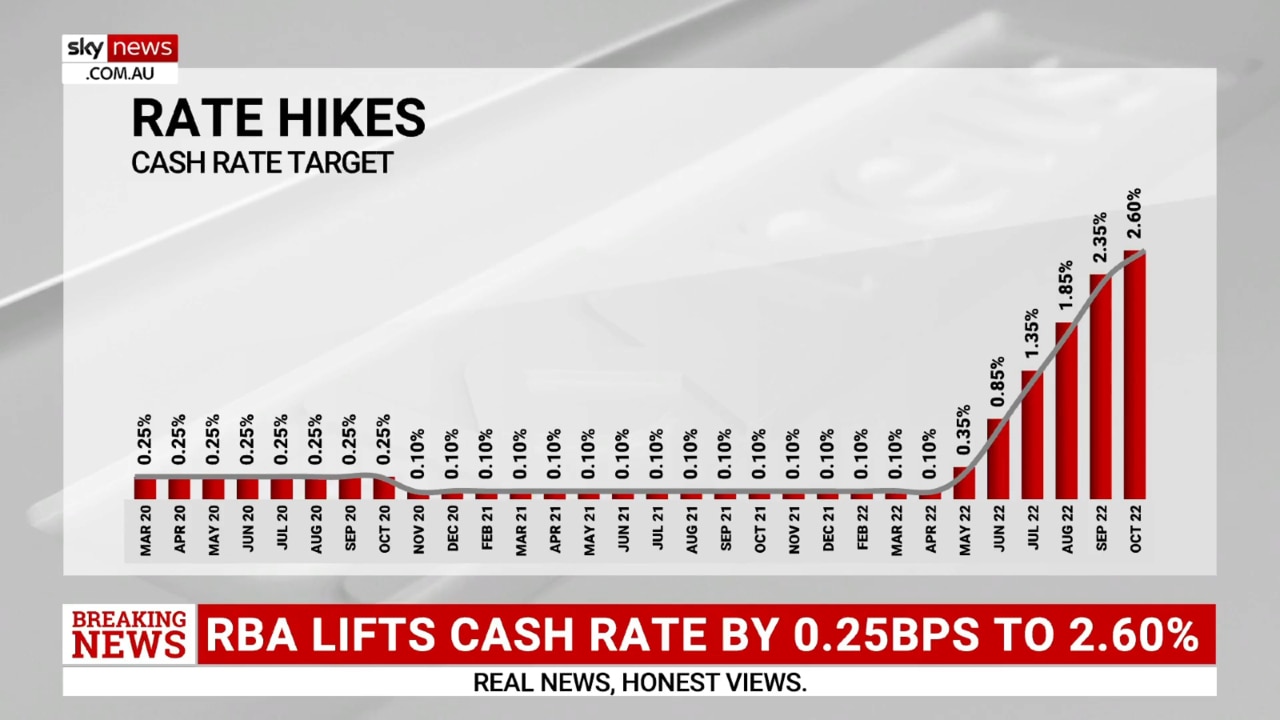

Tuesday’s rate rise means borrowers will pay 36 per cent more on their mortgages than six months ago. Here’s a survival checklist.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Interest rate rises totalling 2.5 per cent in just six months will hurt almost all borrowers in some way.

Tuesday’s Reserve Bank rate rise of 0.25 percentage points takes its official cash rate to 2.6 per cent, and many people’s home loan interest rates beyond 5 per cent, increasing their mortgage repayments by 36 per cent since early May. In dollar terms, it now costs about $710 a month more to repay a typical $500,000, 30-year mortgage.

Recent home buyers on variable mortgage rates are hurting the most, but the sharp rises have been hard to digest for even relatively comfortable borrowers, while property investors with multiple properties are being hit on multiple fronts.

Ignoring these rises could be disastrous, considering financial markets and some economists are forecasting a cash rate near 4 per cent next year.

Fortunately there are things borrowers can do now to take control, cut costs and hopefully get through this rate-rise cycle, which is the harshest in decades and hopefully will be over soon.

CHECK AND COMPARE

Millions of Australians do not know their home loan interest rate.

Of course, it’s tricky keeping track of it when the RBA lifts rates every month. On Tuesday morning I received letters from my lender confirming September’s 0.5 percentage point rate rise, and by Tuesday afternoon the repayment numbers were obsolete as the RBA rose again.

Head online to comparison websites, or speak with a mortgage broker, to see how your current rate compares with the competition. A handful of lenders still offer variable rates below 4 per cent, although this won’t last.

TALK TO YOUR LENDER

Keeping communication open is vital.

If you are struggling financially with rising repayments, speak with your lender quickly as they have hardship teams that can help people through these tough times – as they did during the early months of Covid.

If you’ve discovered that your mortgage rate is not competitive, talk about that too. Demand a better deal, and ask your lender to match their competitors.

PREPARE FOR MORE PAIN

Tuesday’s rate rise is unlikely to be the last, so it’s important to understand what future rate rises will cost you.

There’s a pile of free mortgage repayment calculators available online, so plug in your numbers to see just how much you will be paying if rates follow financial market predictions and head higher.

DON’T IGNORE THE CLIFF

People who took out fixed-rate home loans below 2.5 per cent in the last couple of years have escaped this year’s string of rate rises.

However, a cliff is looming that will see their mortgage repayments potentially balloon my more than $800 a month in one hit when their fixed term expires. Prepare for this now, and have your household budget ready to handle it.

JUST DO IT

Whatever your position, the time to act is now.

Know your options, whether it’s to help get through this torrid time or use your financial strength to get a better deal.

Competition among lenders remains fierce, especially beyond the big four, so be prepared to switch lenders to save money.

More Coverage

Originally published as Interest rate pain: five things you should do with your mortgage