Exactly who will pay for the new $8 billion Medicare plan

Everyone is asking how Anthony Albanese and Peter Dutton will fund the new $8 billion Medicare plan – and the answer isn’t brain surgery.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Australia’s ‘free’ GP visit plan is being paid for in part by delaying personal income tax cuts as both sides of politics sneakily use bracket creep to raise more revenue.

Anthony Albanese and Peter Dutton were in a mad rush over the weekend to spend $8 to 9 billion over the next four years to deliver ‘free’ GP visits.

Now everyone wants to know ‘how they will pay for it’.

The answer isn’t brain surgery. They pay for it by raising more taxes or spending cuts.

And given there’s no signs of $8 billion in cuts to the health portfolio over the next four years, you can take it as read that the majority of the money will come from taxing you more.

The sneaky and time-honoured way that both sides of politics raise more income taxes without actually announcing a tax increase is bracket creep.

What is bracket creep?

Bracket creep occurs when rising incomes cause individuals to pay a higher average tax rate, even though there may not have been changes to marginal tax rates and thresholds.

As your wages go up, so does your income tax bill.

And that’s good for governments trying to sneakily raise more revenue without expressly increasing income taxes.

Every few years, Australian governments give back what they have already taken in bracket creep in the form of ‘tax cuts’ and expect voters to stand around applauding them.

How much is bracket creep set to raise?

Economist Chris Richardson told news.com.au that personal income tax payments will blow past $300 billion in the coming year

“How do you pay for something like the Medicare changes? Well, by 2027-28 these new policies will cost around $4 billion a year,’’ Mr Richardson said.

“And guess what can pay for something that costs around $4 billion a year? Putting off tax relief for families.

“Every year that the government waits between tax cuts currently hands it almost $4 billion a year extra.

“So the $4 billion yearly cost of the Medicare changes is roughly the same as a year’s worth of bracket creep.

“These Medicare changes aren’t perfect, but they’re probably the best policy either of them have announced in a while.

“So how do you pay for it? By taking your hands off the wheel and delaying the next tax cut for a year.”

A time-honoured tax rip off

As Matthew Taylor, the Director of the Centre for Independent Studies (CIS) Intergenerational program explains, bracket creep is a time-honoured tradition.

“Bracket creep lifts average tax rates even when nominal incomes are rising no faster than inflation — and real income is therefore unchanged,” he said.

“Under a progressive tax scale, an increasing proportion of income is taxed at one’s highest marginal rate. This happens whether or not income growth puts taxable income into a higher marginal rate bracket.

“Historically, governments of both stripes have allowed this mechanism to keep going until average rates — and marginal rates at average incomes — became so high that the burden became politically intolerable. This is when we finally get tax cuts.

“One important test of such cuts is how much they do to offset past bracket creep.”

Stage 3 tax cuts

Still, given the huge amount the Labor Party is handing out under the Stage 3 tax cuts surely that will fix the problem?

Well, the answer is no. On this issue, the CIS notes the various claims made about the Coalition government’s original three-stage personal income tax plan that was more generous to high income earners.

The revised Stage 3 tax cuts

The focus of criticism of the original Stage 3 cuts before the Albanese Government revised them was how it delivered a $9000 gain to high income earners.

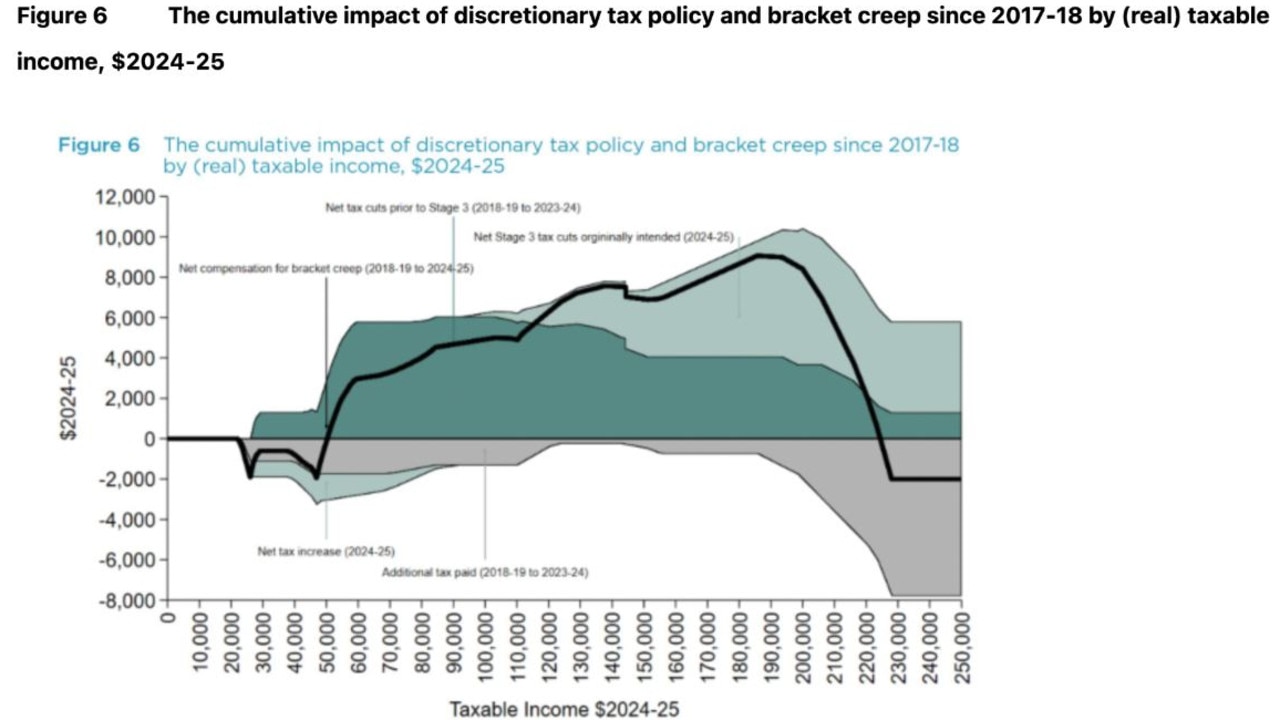

Simple comparisons of average tax rates in 2024-25 with those in 2017-18 — just before the tax cut plan started — did reveal a reduction in average rates from around $90,000 compared with seven years ago.

However, the CIS notes such calculations fail to take into account the extra tax paid in each of those years as a result of bracket creep. Indeed, this failure of measurement applies at all income levels.

Using a more comprehensive methodology, CIS research has recalculated the cumulative effect of bracket creep and discretionary tax cuts over those seven years and found that even under the Coalition’s original plan, the main beneficiaries of tax policy since 2017-18 have been those on incomes between $50,000 and $224,000.

“Far from ‘$9,000 gifts to the rich’, those with incomes above $224,000 are slightly worse off over the period — and that’s if they had received the original Stage 3 tax cuts in full,” the CIS said.

The Albanese government’s redesign of Stage 3 lowers the range of incomes that have been overcompensated for bracket creep to around $48,500 –$214,000, and also delivers a cut to those on $34,000 –$39,700 they would not otherwise have received.

“However, if we look back further to 2010-11 — the year the last major tranche of tax cuts were fully implemented — the results are dramatically different.

“The Coalition’s three-stage plan undercompensated everyone above $35,000; while Labor’s revision increases the extent of under-compensation above about $146,000 and slightly reduces it below that level.

“The conclusion is that while any government is free to shape the distribution of a tax cut as it sees fit, relief from bracket creep is one important criterion, which provides no justification for the Albanese government’s Stage 3 renovations.

“As a result, the bottoms of the 37% and 45% brackets ($135,000 and $190,000) will become pressure points sooner than otherwise.

“Second, to the extent some taxpayers are being overcompensated for past bracket creep, future bracket creep will eventually devour that benefit.”

“The government’s Stage 3 tinkering might buy those taxpayers who benefit some more time … but not much.

“Discretionary tax cuts under indexed tax brackets are genuine tax cuts — not merely the return of the additional money the government had taken in previous years.

“And fourth, if indexation is not adopted in future (and there is no sign that it will be) there has to be a better understanding that under the practice of widely spaced discretionary tax cuts, larger absolute dollar cuts at higher incomes are necessary unless average tax rates are to increase inexorably above a certain income level.

“Over time, that ‘certain’ level will become lower in real terms, capturing an increasing number of taxpayers; with all that implies for the effect of the tax system on incentive and aspiration.”

What has Peter Dutton said about the Stage 3 tax cuts

Liberal leader Peter Dutton hasn’t offered any pledges to reinstate the Stage 3 tax cuts as it pertained to higher income earners. They were revised in January, 2024.

On Friday, he was asked at The Advertiser’s Future SA conference if further tax cuts were on the election agenda.

“Well, the Prime Minister trumpets the passage of the stage three tax cuts, but what he forgets to tell you is that stage one and two, and in fact, three, were legislated by the former Coalition Government,’’ Mr Dutton said.

“So is our desire to reduce taxes and make it fair and simpler? Of course it is.

“But we’ve got a Government that’s spent an extra $350 billion, which is why inflation is higher, why interest rates are higher for longer. Interest rates started to come down in the US, the UK, Canada and France, five, six, seven, eight months ago in some of those cases, and it already should have come down here.

“So you need to be careful about how much money is being spent in the economy, and that’s exactly what Michele Bullock has said, and it’s the reason there is no second rate cut coming at the March 31 meeting, and in fact, the Reserve Bank still has a concern about the government stimulus in the economy and what that could lead to in terms of a future interest rate increase.

“So I think Australians, yes, welcome $77 a month for a $500,000 mortgage with a 25 point reduction, but they also know that if the Government keeps spending, rates are going to go back up under a Labor-Greens minority government.”

Decisions taken but not announced

In the budget, there’s a line item known as the “hollow log” before an election which accounts for decisions taken but not yet announced.

“Around $5.4 billion of the $8.5 billion that we’re announcing today we already provisioned for in the mid‑year budget update,’’ the Treasurer told Insiders on Sunday.

“This shows what’s possible when you help engineer a $200 billion improvement in the Budget, you knock out those 2 surpluses to pay down Liberal debt, and this is what’s possible when you do that. You make room for what really matters to Australians and in communities, and particularly in household budgets, and it’s hard to think of a more important investment than this.”

Originally published as Exactly who will pay for the new $8 billion Medicare plan