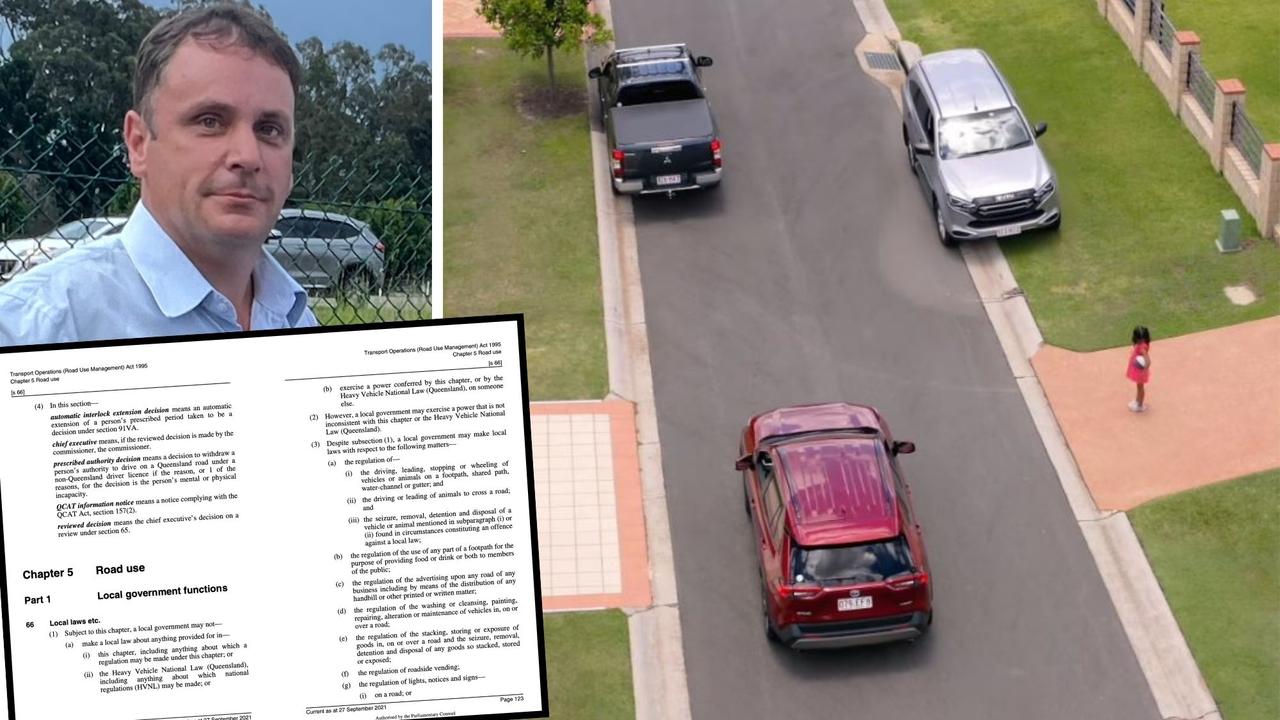

Gold Coast lawyer Beau Hartnett, SV Partners insolvency trustees lodge defences in Federal case

A disgraced Gold Coast lawyer claimed he intended to pay $584,589 he owed an elderly man by borrowing against his wife’s $3.25m home. Anthony Bell is still waiting for his money.

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

A disgraced Gold Coast lawyer claims he intended to pay $584,589 he owed an elderly man by borrowing against his wife’s $3.25 million home, his lodged defence says.

The Federal Court is examining how Beau Hartnett, 58, was able to declare he was broke and avoid paying hundreds of thousands to creditors while maintaining a millionaire lifestyle.

A scathing claim, lodged by Inspector-General in Bankrupcty Timothy Beresford,

seeks to set aside what the inspector-general alleges is an “unreasonable” personal insolvency agreement, which saw creditors receive less than three cents for every dollar owed.

The claim alleges Mr Hartnett’s insolvency trustees did not scrutinise “very suspicious” creditor claims which helped him avoid paying his debts, including $584,589 owed to Lismore man Anthony Robert Bell.

The contentious insolvency agreement was passed by a majority of creditors, the largest of which was a trust held by Mr Hartnett’s wife Suzanne Weel.

Mr Beresford’s claim said the trustees should have further investigated the Hartnett trust debt and also should have given greater scrutiny to three minor creditors before allowing them to vote on the agreement.

It would not have passed without those creditors.

Both Mr Hartnett and his insolvency trustees Anne Meagher and Adam Kersey of SV Partners, lodged their defences to the claim late last week.

Ms Weel prepared the defence for her husband.

The trustees’ defence outlined multiple ways the trustees had sought to verify the claims of each minor creditor before admitting them to vote, including corresponding with accountants and by analysing available financial records.

It said they had “acted prudently, rationally and properly in recommending that creditors vote in favour” of the agreement, in light of how “Mr Hartnett’s financial affairs were structured”.

Among the creditor claims described as needing more scrutiny was one from a property valuer, who claimed Mr Hartnett owed money for a valuation of the family home at Surfers Paradise, despite not being the registered owner.

Identically-worded paragraphs from both Mr Hartnett and the trustees said the valuation debt was scrutinised by Ms Meagher.

The defences said that Mr Hartnett had told Ms Meagher he had been “personally seeking finance to make an offer to pay Mr Bell that judgment that Mr Hartnett owed to him”.

The finance attempt is not referenced further in the court documents.

In their defence, the trustees denied the inspector-general’s claim they had failed to adequately investigate Mr Hartnett’s financial situation and potential transfer of assets.

The trustees’ defence said they “neither consent to nor oppose” the agreement being set aside.

Mr Hartnett’s defence said he opposed the bid to set aside his insolvency agreement.

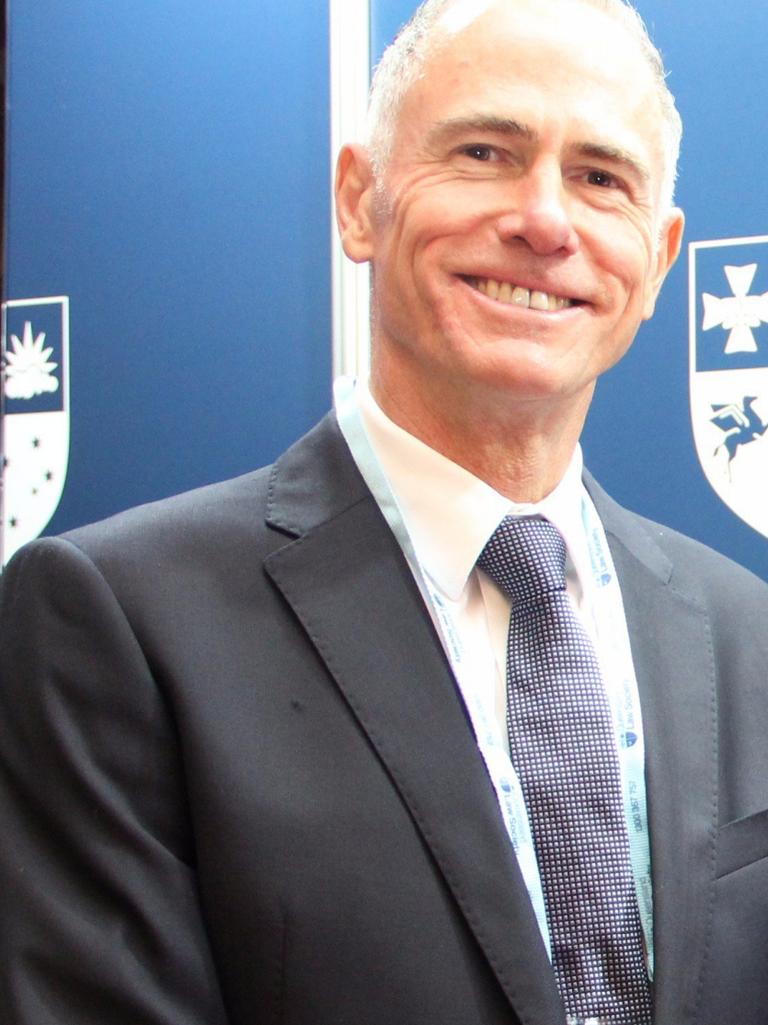

Mr Beresford referenced the case, sparked by questions from the Gold Coast Bulletin, in a speech to the Australian Institute of Credit Management National Conference earlier this month, saying the “potential misuse of personal insolvency agreements to protect some creditors over others” had become a focus of his agency.

“Through this and other actions, we’re sending clear signals to our regulated community that system abuse won’t be tolerated.”

A hearing has been set down for three days from January 28, 2025.

More Coverage

Originally published as Gold Coast lawyer Beau Hartnett, SV Partners insolvency trustees lodge defences in Federal case