Technology company WiseTech’s shock bounce back on Australian share market

One company has managed to secure top spot on the Australian share market after losing nearly 20 per cent of its price the previous day.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

A technology company that had its stock price torn down has managed to top the list of gainers on the Australian share market on Thursday.

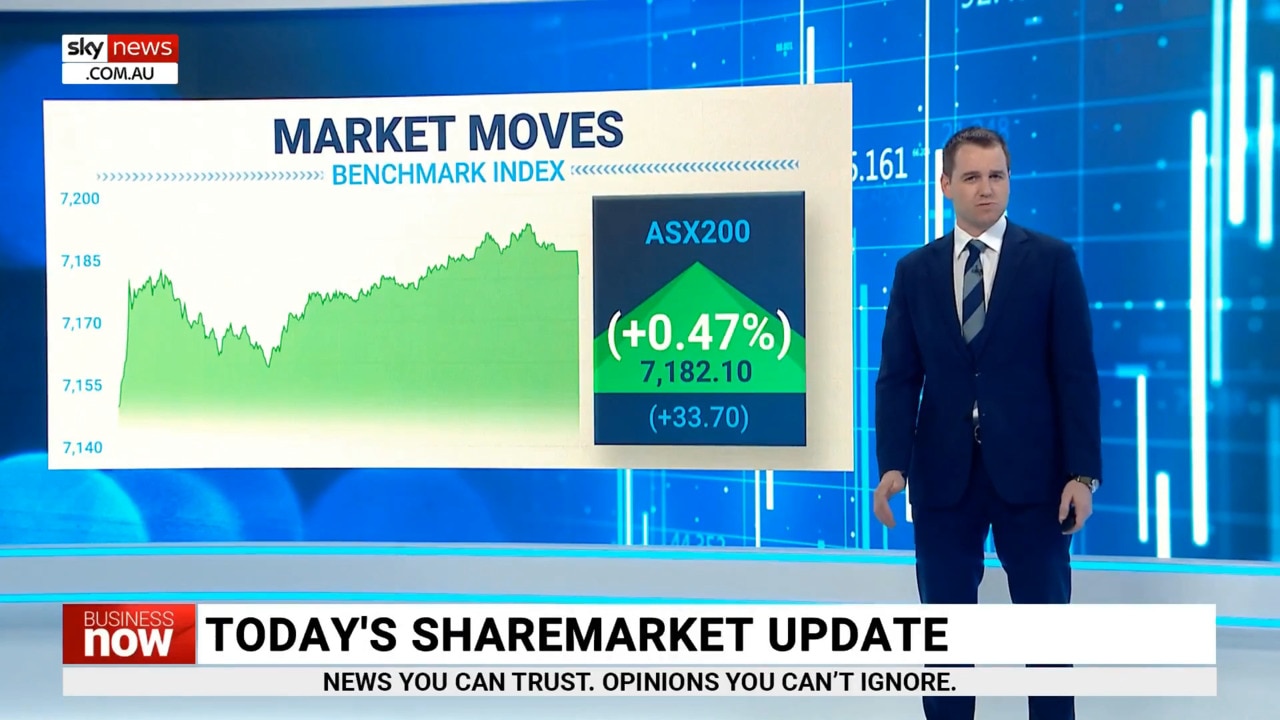

The S&P/ASX200 extended its winning streak this week, closing up Thursday gaining 33.70 points or 0.47 per cent to 7,182.10.

Topping the list was software company WiseTech Global, which saw its price rise 8.12 per cent to $75,25, making up some of what it lost on Wednesday.

The market reacted badly on Wednesday after WiseTech reported weaker-than-expected earnings, wiping a whopping 19.62 per cent off of its share price.

The rebound occurred as traders “had second thoughts about yesterday’s earnings disappointment”, market analyst Tony Sycamore said.

Along with WiseTech’s win, the entire IT sector received a boost of 4.20 per cent on Thursday, arguably due to strong results from Nvidia, an AI company favoured on the US’s Nasdaq index.

“The local market took the opportunity today to celebrate the quarter‘s most highly anticipated earnings report in the US, as AI poster child Nvidia lived up to the hype … Nvidia reported revenues of $13.51bn v $11.1bn expected and EPS of $2.70 v the $2.07 expected,” Mr Sycamore said.

Back to the local market, one of the biggest announcements on the ASX today was Qantas recording a record full-year underlying profit of $2.47bn.

The full-year results to June 30 are more than $800m higher than the airline’s previous profits record in FY2018 when it posted an underlying profit before tax of $1.6bn.

Despite the huge announcement, Mr Sycamore said the company’s share price “failed to take flight”, gaining just 0.65 per cent to $6.21.

“Investors in a cautious mood, given that pressure on airfares is expected to intensify as capacity is added and as the outlook for travel softens in line with cost-of-living pressures and higher interest rates,” he said.

As reporting season continues, not all companies are winners.

Losing the most on the ASX today was Ramsay Healthcare which saw its share price plunge by 11.95 per cent to $48.71 after it halved its full-year dividend while horticulture company Costa saw its price drop 10.84 per cent to $2.96.

That drop came after Costa announced it was “uncertain” if its planned $1.62bn transaction with Pain Schwartz Partners, a New York private equity firm, would come to fruition.

The miners were mixed with BHP down 0.57 per cent to $43.78 while Rio Tinto was up 0.92 per cent to $108.83 and Fortescue increased its price by 0.19 per cent to $21.06.

The big banks all enjoyed boosts this Thursday led by Westpac which was up 1.37 per cent to $21.43.

That was followed by NAB, up 1.25 per cent to $28.39, CBA, up 1.17 to $100.61 and ANZ up 0.45 per cent to $24.56.

Mr Sycamore said that this week’s stronger results have brought “some late respectability to the scoreboard” this month, but warned that trouble may lie ahead.

“Before traders consider rushing to add to long positions in the ASX200 at August‘s discounted prices, a reminder that the worst month of the year, September, is just around the corner,” he said.

“Over the past five years, the ASX200 has recorded an average monthly loss of 2.91% in September. For those who prefer a larger sample size, the reading isn‘t much better, with the ASX200 averaging a decline of 2.29% in September over the past ten years.”

More Coverage

Originally published as Technology company WiseTech’s shock bounce back on Australian share market