Share market drops 0.1% sparked by miner sell off.

Share prices in the mining sector have plummeted on Monday, triggered by the declining price of one product.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

The Australian share market has begun the week flat with a sell-off of miners stocks.

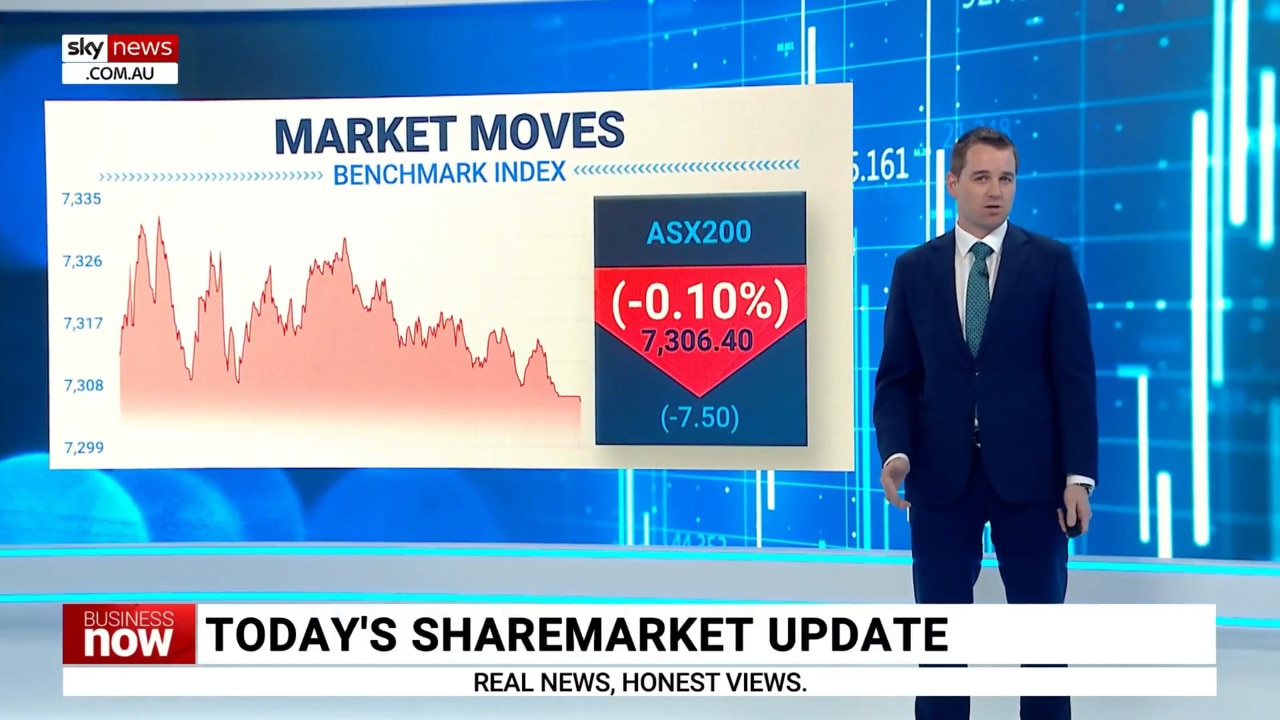

The ASX200 closed with 7306.40 points on Monday after dropping 0.10 per cent or 7.50 points across the day.

The miners were overall the biggest losers, with materials companies dropping 1.41 per cent across the board – one of four sectors that did not end up in the green.

Shares in consumer staples and information technology also fell by 0.34 per cent and 0.14 per cent respectively.

The bottom performing companies were all made up of mining companies, a result of a decline in the price of lithium.

Australia’s newest lithium miner – Core Lithium – announced on Monday that it expects production of raw lithium known as spodumene would reach 80,000-90,000 tones this financial year, lower than study estimates.

That sparked a mammoth 17.24 per cent drop in its share price, the largest fall of the day, bringing it to $0.72 per stock.

It was followed by Sayona Mining which fell by 11.77 per cent to close at $0.15 and Lake Resources which fell by 5.88 per cent to $0.24.

Pilbara Minerals and Allkem were next on the chopping block, seeing their prices decline by 5.75 per cent and 5.58 per cent respectively.

While the miners took a tumble, the energy sector Energy on the other hand received a boost of 2.20 per cent.

New Hope and Whitehaven Coal were the two companies raking in the biggest boost of the sector, taking up spots three and four in the top five gainers on Monday.

New Hope finished trading with a share price of $5.39 after an increase of 3.65 per cent while Whitehaven was selling for $7.23 a share by the close of business with a 3.14 per cent rise.

Woodside Energy’s price increased by 2.34 per cent to $37.25, Santos saw its price rise by 2.20 per cent to $7.90, while Ampol had a boost of 1.08 per cent to $32.89.

Despite energy’s rise, the top gainer on Monday was Telix Pharmaceuticals which had its price boosted by 7.72 per cent to $11.16 followed by Healius Limited with a 3.87 per cent rise in price.

The banks also fell on Monday, with the financial sector down 0.07 per cent.

NAB saw the largest fall from the big banks, its price dropping 0.75 to $27.69 followed by ANZ which fell 0.16 per cent to $25.12.

Commonwealth Bank shares fell by 0.11 per cent to $104.43 and Westpac suffered a 0.09 per cent fall to $21.96.

Originally published as Share market drops 0.1% sparked by miner sell off.