ASX 200 hovers over two-month low as miners, Qantas take a hit

Big hitters on the Australian sharemarket have suffered blows to their stock prices, but one sector is keeping things afloat.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

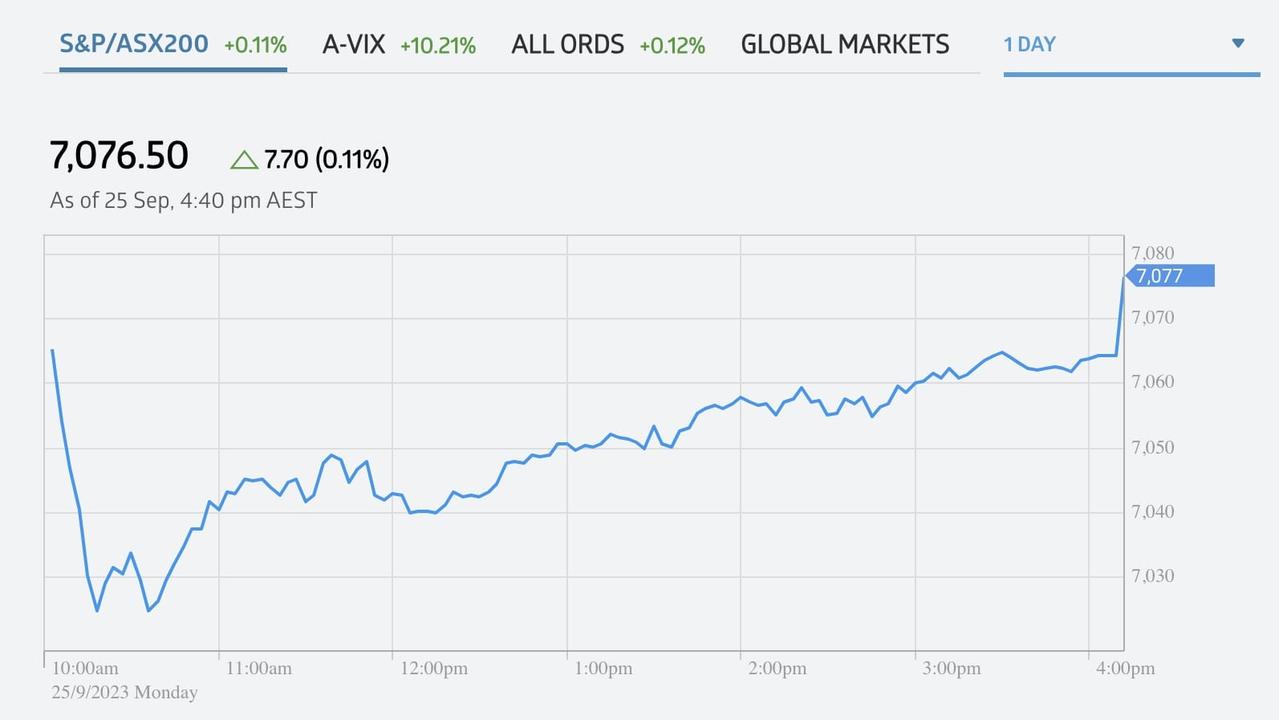

The Australian sharemarket has scraped through Monday to close higher despite China-related losses threatening to bring it to a new low.

The ASX/S&P 200 closed just 0.1 per cent or 7.7 points higher to finish at 7042.7, just shy of its lowest point since July 11.

The All Ords rose by 0.12 per cent, while the A-VIX shot up by 10.21 per cent.

Materials suffered the biggest loses on Monday, with the entire sector down 0.87 per cent on the news that China’s economic growth rate is due to slow.

Ratings agency S&P changed its forecast for China’s growth from 5.2 per cent to 4.8 per cent, citing limited fiscal and monetary easing.

That resulted in iron ore futures in Singapore plummeting by 4.1 per cent to $US116.25 per tonne, a fall from last week’s figure of $US123.60 per tonne, which was the highest reached in the past six months.

Iron ore miners were quick to feel the flow-on effects, with Fortescue falling by 1.30 per cent to $20.54, followed by Rio Tinto, which dropped by 1.21 per cent to $113.18.

BHP shares also dropped by 0.43 per cent to $44.15 per share.

Lithium miner Allkem fell by 3.3 per cent after it announced a $640m blowout in costs from three major projects in Canada and South America due to higher labour and material costs.

Not everyone in the materials sector was left worse off on Monday, with uranium miners reaping the benefits of a price rally earlier this month.

Paladin Energy rose 6.09 per cent to $1.05, Boss Energy lifted by 5.11 per cent to $4.73 and Bannerman Energy skyrocketed by 11.74 per cent to $2.76.

The losses from the mining sector were offset by gains in tech stocks, which shot up by 1.52 per cent on Monday.

Technology One enjoyed the biggest surge, its share price up by 4.00 per cent to $15.87, while health tech company PolyNovo jumped 3.28 per cent to 1.26 after it reported a $7.7m surge in revenue in August.

The surge means that PolyNovo has brought in $14.9m in revenue from January to August, up from $7.7m in the same period last year.

Embattled airline Qantas is closing in on a one-year low as its shares fell by 1.51 per cent to $5.23.

Plagued by numerous scandals and falling public opinion, the flying kangaroo has flagged $80m in customer improvement costs and $200m in rising fuel costs.

The banks all suffered minor blows on Monday, led by ANZ that fell by 0.20 per cent to $24.98, followed by Commonwealth Bank, which dipped by 0.18 per cent to $99.88.

Westpac and NAB fell by a measly 0.09 per cent and 0.07 per cent respectively.

Originally published as ASX 200 hovers over two-month low as miners, Qantas take a hit