Construction boss sells properties to pay back $5.7m debt

The boss of a failed building firm has been forced to sell two of his properties and will have to sell his most valuable one to pay back creditors.

Leaders

Don't miss out on the headlines from Leaders. Followed categories will be added to My News.

EXCLUSIVE

The boss of a failed building firm has been forced to sell two of his properties and will have to sell his most valuable one to pay back creditors.

But so far, the company appears to have been dragging its heels about paying the proceeds of the past two sales to administrators, according to documents obtained by news.com.au.

Last year, Sydney-based residential builder Willoughby Homes sensationally collapsed after a news.com.au investigation found the company appeared to have been non-functional for some time.

Build sites had stalled for as long as a year, the company’s home building insurance had not been reinstated, staff were not paid and finally, all its offices were cleared out with phone lines going straight to voicemail.

In August last year, the eponymous director, Steve Willoughby, appointed David Mansfield and Jason Tracy of Deloitte’s turnaround and restructuring department as voluntary administrators.

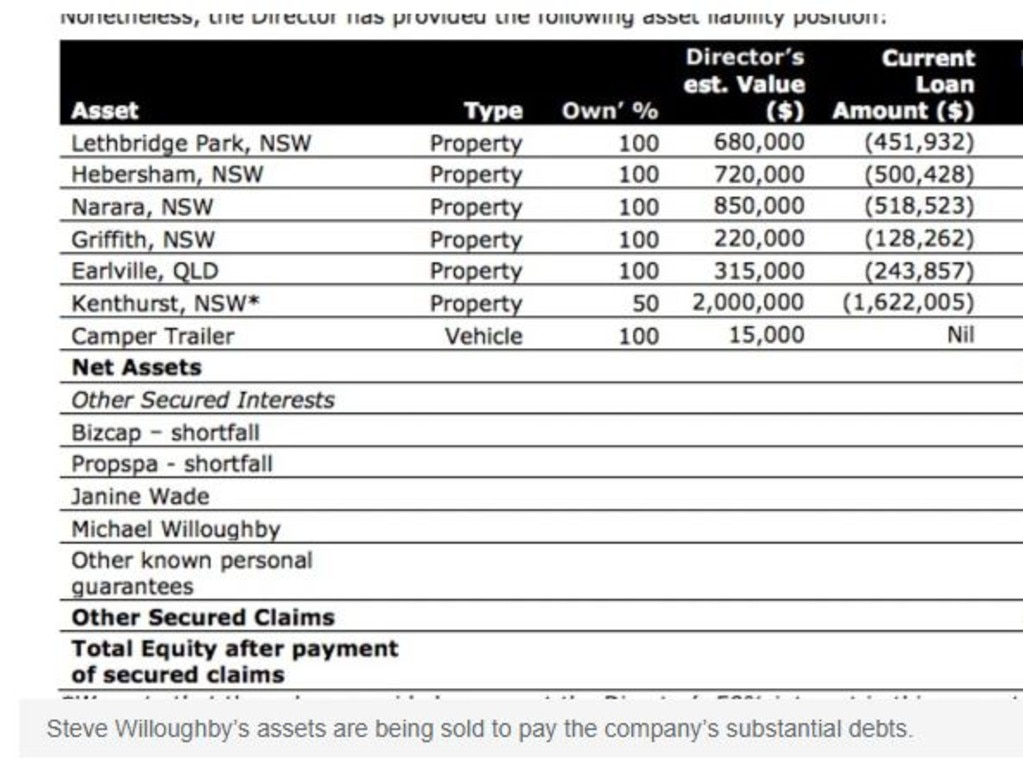

It later emerged that Mr Willoughby had seven properties dotted around NSW. He proposed to sell the properties which would generate $1.3 million in assets to distribute among creditors.

In the preceding months, Mr Willoughby has sold two of those properties but is seeking an extension to sell one more.

Mr Willoughby’s seven properties were from Lethbridge Park, Narara, Earlville, Griffith, Hebersham, Kenthurst and Harden in NSW, ranging from $220,000 to $2 million in value.

He has since sold the Lethbridge Park and Hebersham properties.

Willoughby Homes remains in administration rather than liquidation because of a deed of company arrangement (DOCA) which promised $1.3 million be returned to creditors through the sale of these properties, which creditors agreed to.

But in an update on Monday, the administrators revealed that the construction boss had missed a key deadline which could put these plans in jeopardy.

They also revealed they have yet to receive any funds from the two properties which have already been sold.

Willoughby Homes “had until 21 June 2023 to meet the agreed DOCA contributions”, which it failed to do, the administrators said.

“We confirm that we have not received any contributions … we have not received any proceeds from the sale of the abovementioned properties,” they added.

The construction company’s demise impacted 57 customers with homes at varying stages of completion as well as other creditors who say they are cumulatively owed $5.7 million.

Most unsecured creditors are only expected to receive between 1.7 cents and 5.7 cents for every dollar they are owed.

The Kenthurst property is the most valuable of Mr Willoughby’s properties but half of it is owned by his wife Rochelle.

It has five bedrooms and four bathrooms and had a pool, and was sold to them in 2018, and has since been renovated. Parts of the property are still under renovation but Mr Willoughby told administrators he has run out of the funds to continue the building works and wants to sell it as is.

To placate creditors, Mr and Mrs Willoughby have agreed to give the entire proceeds of the property to creditors, rather than just half. Legally, Mrs Willoughby did not have to give up her share of the property as she was not involved in the running of the company.

This will spare Mr Willoughby from having to sell his four remaining properties.

They have been given three months to sell the Kenthurst place.

“We understand that the Director & Mrs Willoughby have listed, or are about to list, the Kenthurst Property for sale … and the resulting surplus, after costs, is estimated to be sufficient to fund the DOCA in its entirety,” the administrators said.

If Mr Willoughby fails to meet the deadline, the administrators have reserved their rights to pursue him personally.

“In the event that the sale does not occur, or, is not occurring within a reasonable time frame, we have reserved our right to enforce our security against the properties,” they warned.

News.com.au understands the company must be put into liquidation if the next deadline is not met.

In an earlier statement to news.com.au, Mr Willoughby said: “Whilst I do not have an obligation to do so, I am proposing to creditors to sell properties that I have owned for 10 plus years.

“The economic climate has not been good for anyone.”

News.com.au contacted Mr Willoughby for additional comment.

Gyprocking company Regno Trades began winding up proceedings against Willoughby Homes in early July over an unpaid debt of $184,000 and three supporting creditors also joined the case – H & R Interiors, owed $73,925, an ex-employee owed $53,000 in unpaid wages and Finese Electrical and Air Conditioning, owed $4531.

Administrators also found that Willoughby Homes had been trading insolvent for 18 months and had taken deposits from 41 customers even though they didn’t have the insurance to do so, an administrator’s report, filed with ASIC, found.

“It appears that Willoughby Homes may have been insolvent from at least 21 April 2021,” the report stated.

April 21 was the day that state insurer iCare refused to renew the insurance for Willoughby Homes, which meant the builder was not able to start construction projects costing more than $20,000 as it would not be insured.

“Our investigations to date have identified 41 creditors totalling $709,578 who have paid deposits to the companies to construct their properties,” the report added.

“We are not aware of any of these deposits being covered under the HBCF (Home Building Compensation Fund).”

An earlier court case where creditors attempted to get the company wound up deemed that Willoughby Homes had been “hopelessly insolvent” and that the company had “failed so miserably”.

However, the Victorian Supreme court did not order Willoughby Homes into liquidation so that the DOCA could be proposed.

Mr Willoughby blamed the failure to obtain insurance as one of the main reasons for his company’s collapse, as well as Covid-prompted lockdowns, tough market conditions and increasing costs of materials and labour.

alex.turner-cohen@news.com.au

More Coverage

Originally published as Construction boss sells properties to pay back $5.7m debt