‘Savings severely curtailed’: What was missing from tradie’s viral sign

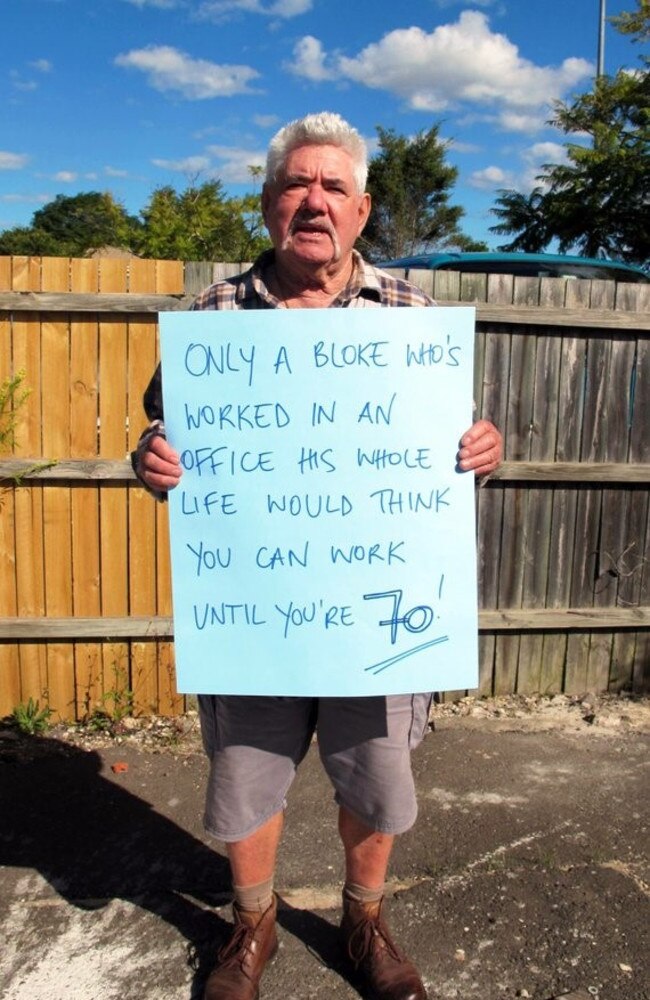

As a posterboy tradie’s revolt against Australia’s retirement age goes viral, others might need brace for worse in the years to come.

At Work

Don't miss out on the headlines from At Work. Followed categories will be added to My News.

As a photo of a hardworking Aussie tradie questioning the nation’s retirement age continues to go viral — other demographics are being urged to start preparing for their final clock off even decades away.

Last week thousands took to the viral citizen campaign opposing a plan to raise the pension eligibility age from 65 to 67 as the resurfaced photo of the tradesman became the poster boy.

The outcry was reignited by the news that Australia’s pension age is preparing to increase to 67 on July 1 of this year, and new research suggesting the retirement age may need to rise to 70 by 2050 added fuel to the fire.

Plenty agreed 70 years is far too long to keep up the hard yakka.

“I’ve been a sign painter climbing ladders since I was 16. I’m 67 now and had a hip replacement three years ago due to wear and tear,” one worker described working into old age.

“We need to elect a few tradies into parliament and start getting things back on track,” another suggested.

Another added: “I think it should be younger for tradies or labourers.”

Others shared that “wearing out” isn’t limited to hard labour workers.

“I worked in retail till I was 68. I had been doing it for 30 years. My body couldn’t take it anymore. I have a lot of back and shoulder pain,” one retiree explained.

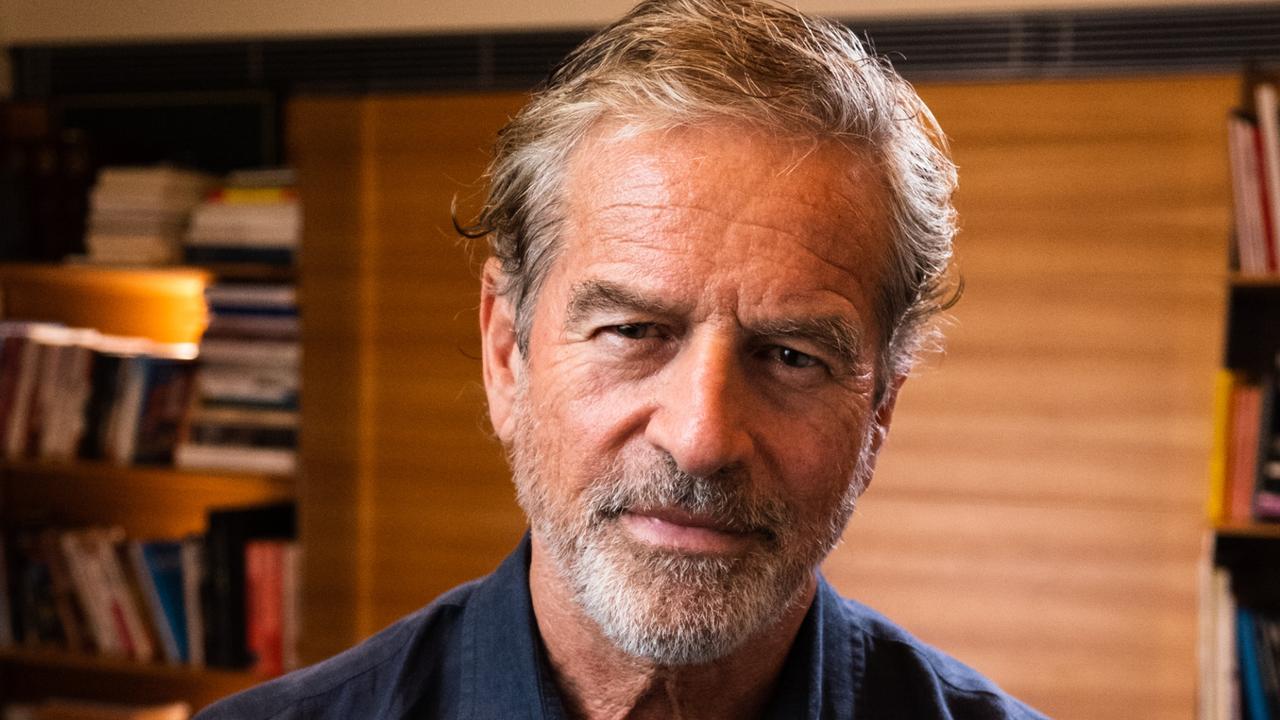

But Dr Lisa Denny, a workforce demographer and Adjunct Associate Professor with the Institute for Social Change at the University of Tasmania, told news.com.au that another demographic should brace for a long career – even though the current retirement day is almost a half-century away.

Speaking concerning younger Australians in the workforce: she said: “Even though there are avenues available to save more than the compulsory superannuation contribution, in the current climate of high inflation, rent, interest rates and low wage growth as well as the cost of living pressure, the ability to actually contribute more to savings is severely curtailed.”

“With homeownership much harder these days, the likelihood that younger generations will have to work for longer is pretty high compared with those who choose to work longer now and those who have no choice – Younger generations will fall into the latter,” she continued.

A group of academics, led by Professor Hanlin Shang from Macquarie University Business School, recently released a report suggesting three additional increases in the pension age over the next 27 years, proposing raising the retirement age to 68 by 2030, 69 by 2036, and eventually 70 by 2050.

Professor Shang pointed to Australia’s low birth rate as a critical factor impacting the future workforce.

“(Fewer) people in the working group and more in retirement will make the old age dependency ratio (OADR) higher,” he said.

“What this means is there are fewer working people to support elderly people, and this will create a burden for the government pension system.”

Dr Denny agreed with public sentiment that working until 67 or beyond is a tall order for people in hard labour jobs.

“There’s definitely physical limitations for people who work hard labour, whether it be a brickie or even nurses, they find it difficult to continue on in those roles even sometimes from 55,” she said.

“But you’ll find that most people still working beyond 65 – or after they can access private superannuation – are either those who want to continue working, or those that have to.

“Increasingly, it is coming down to “can I afford to retire?” – you may not want to work, but some people can’t afford not to.

“The public pension is becoming harder to access, and with private super, we haven’t necessarily saved enough for what we need to live comfortably on, particularly for women.”

On the plus side Dr Denny said people approaching retirement today had a good crack at a favourable housing market – a luxury younger Australians likely won’t have.

“Homeownership has always been something to help sure up retirement, and the people you see retiring now have probably done very well in the housing market – if they’ve been able to buy themselves a house or two, then they are much better positioned to be able to exit the workforce than the younger generation is going to be able to,” she explained.

“They have been able to accumulate wealth through homeownership.”

She said housing aside, there are still ways for youngsters to prepare for retirement, suggesting the earlier, the better.

“We don’t do a lot of forward planning, particularly our younger generation, and they often don’t understand what superannuation is for,” Dr Denny said.

“We saw a lot of people access their super during the pandemic, which will have long-term implications for them down the track.

“If we don’t want to work until we’re 70, then we need to make sure we’re planning appropriately for that – we already have compulsory super, you can salary sacrifice, and we do have some employers who pay more and encourage you to contribute more – there are things you can do to save for the future.”

Interestingly, in her home state of Tasmania, Dr Denny said older women, those over the age of 55, were entering the workforce and have become a significant growing demographic attributed to low super funds and a rise in divorce rates.

Originally published as ‘Savings severely curtailed’: What was missing from tradie’s viral sign