ASIC boss Joe Longo’s plan for a faster, smarter, tech-savvy regulator

The ASIC boss is planning to remake the corporate regulator into a modern crime fighting machine.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

ASIC chairman Joe Longo set aside most of Wednesday afternoon for a session with his senior directors about the implications of new technology and specifically how artificial intelligence is set to change the game of regulation.

Longo, a corporate lawyer by trade, is coming at AI from a different direction.

While the businesses he regulates are rushing to get across how AI can drive cost savings and crunch vast volumes of data, Longo wants to get across the implications of the new tech on law enforcement. He sees the technology opening a number of new risks for consumers, market manipulation as well as the possibility of fraud.

There are also bigger legal questions about who should be held accountable when a machine goes rogue and makes decisions that cuts across consumers and markets. The session on AI is an indication of where Longo wants to take ASIC as the watchdog too is facing pressure to start a major replacement of the commission’s own ageing technology to turn the regulator into modern crime fighting outfit.

Treasurer Jim Chalmers this week gave Longo’s ASIC got a $61 million boost to its budget in coming years, although the additional funds are largely keeping the regulator on an even footing as inflation starts pushing up costs more broadly from wages to legal bills. As part of this was more than $4m to crackdown on greenwashing and a boost to target online investment scams.

Longo too is finalising plans for a rebuild of ASIC and its 2000-plus staff to make it faster and more responsive.

The existing structure has been in place for almost two decades and has seen the regulator spread across nearly a dozen units with more than 40 subsections. The heart of this is likely to see Longo combine ASIC’s supervision and regulation functions to speed up the time it takes to detect wrongdoing, investigations and legal actions. This will send a sharper message that Longo believes will act as a stronger deterrence to corporates.

Speed of enforcement is also part of Senate review of ASIC prompted by Liberal senator Andrew Bragg into a range of issues including how the regulator deals with disputes between businesses and customers.

As my colleague Joyce Moullakis revealed this week deputy chair Karen Chester has told colleagues she doesn’t plan to seek an extension when her term expires at the end of the year. Commissioner Danielle Press is keen to remain with ASIC when her current five year term expires in September. Treasury is has a search process underway with headhunters Korn Ferry leading the process to identify candidates for the commission vacancies including the vacancy left Cathy Armour last year. One factor in Longo’s new structure is ASIC no longer has a commissioner based in Sydney, where the bulk of the entities it regulates are based.

Other areas on Longo’s agenda include implementing a local version for the sustainability-related corporate reporting which is being implemented by the global network of securities commissions IOSCO.

A June deadline is approaching to finalise drafts for standards about how companies make green disclosures. The rules are designed to introduce consistent standards for investors to in order measure sustainable reporting but that represent some of biggest shake up of reporting rules in years. The new rules are slated to be introduced from the end of the 2024 financial year.

Elsewhere ASIC is keeping intense pressure on ASX with the stock market operator botching the replacement of its ageing settlements system after its blockchain-inspired model wasn’t able to get off the ground. ASIC is keeping stock market operator under close watch as well as looking at what was disclosed and when about the botched project. ASX’s board knows it is on the hook to deliver a proven settlements business that is fit for purpose for the Australian market.

Meanwhile arguments wrap up this week in ASIC’s legal action against ANZ over disclosure during the bank’s monster 2015 capital raising. The high-stakes case is set to finish earlier than expected with ASIC keeping its case narrowly targeted against ANZ, with the regulator arguing the bank improperly disclosed its shortfall in a $750m share raising. Its just one of a dozen legal actions that ASIC is running at any single moment but the stakes are certainly higher.

Behind the Bubs sacking

It’s a million miles from appearing on a video link in Washington being championed by President Joe Biden as one of the saviours of the US infant formula crisis to being dumped by the company you founded less than 12 months later.

That’s the highs and deep lows of the now former Bub’s chief executive and founder Kristy Carr, who found out about her sacking by the Bubs board as the budget was being handed down in Canberra on Tuesday night.

Carr has been dismissed “with immediate effect due to failure to comply with reasonable board directions”. The Australian has sought a response from Carr.

A Bubs spokesman declined to comment beyond a statement to the ASX.

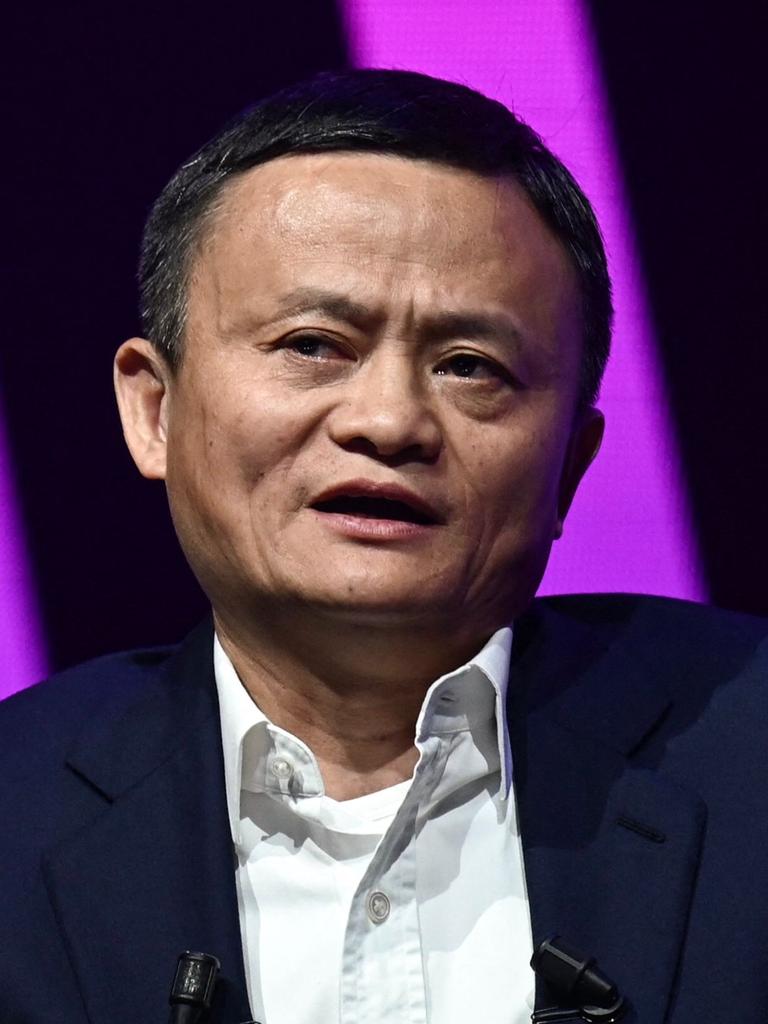

It’s a high stakes battle for the company that is backed by Jack Ma’s Chinese retailing giant Alibaba Group as its infant formula sales into China have stalled.

Carr had been on leave for the past three weeks, with relations between herself and the board rapidly deteriorating since the board last month sacked long-serving executive chairman Dennis Lin.

Last month’s board shake-up, led by new chair Katrina Rathie, was blamed on a deterioration in Bub’s financial performance as well as a need to tighten corporate governance at the infant formula company. No specific corporate governance issues were raised by the board, although it said Bub’s needed to align itself with the ASX Corporate Governance principles.

As Lin was shown the door, Carr posted a tribute to her former executive chairman on LinkedIn saying: “I 100 per cent stand by him”.

“He (Lin) has only ever acted with the highest level of integrity in the best interest of the business and all shareholders,” Carr said in her post.

These comments were taken by Rathie as a direct challenge to the board’s authority, but the new chairman was prepared to let it pass.

Carr took leave late last month citing personal reasons with the board separately launching a review of the global business which also took in “expenditure management and the Chinese market”. The review, which will specifically look at Bub’s marketing spend, is set to be finished by the end of June.

Bubs has a distribution deal with Alibaba’s TMall which sees its entire range of infant formula and baby foods sold over the platform

The review is being overseen by Jackie Lin, who has been seconded from Alibaba’s private equity arm C2. Alibaba’s stake in Bub’s is held by C2 Capital.

But the trigger for Carr’s exit came after Carr and Lim were understood to have held a series of meetings with Bubs shareholders and some customers in the past two weeks.

Rathie felt as though the board needed to move. Carr remained on leave from the company while meetings took place and Rathie argued to her board this was a sign that former boss was working around the board and the authority given to acting chief executive Richard Paine.

Now Bubs is without a chief executive, its US beachhead which relies on securing permanent FDA approval to sell in that market is up in the air, despite last year signing short term contracts with retail giants Walmart and Target. Significantly, its sales in China have failed to recover from the country’s reopening from Covid-19. Bub’s shares are down more than 50 per cent over the past year.

Bubs’ December half results show China sales were down 34 per cent on the previous corresponding period, and it wrote down $20m from its recently acquired Melbourne-based infant formula producer Australia Deloraine Dairy, which has a licence to export canned infant formula to China. Bubs paid $25m for the business less than three years earlier. At the same time, Bub’s costs were surging as the company established its US business, pushing it into a $22m operating loss for the half.

The question is whether Bubs with its shares languishing at 18c each could be a takeover target. A prospective buyer would be taking on the risk of not knowing the liability of possible shareholder class action. There is still the unknown for any potential buyer about what the internal probe will uncover, while a permanent ticket into the US market is yet to be approved.

johnstone@theaustralian.com.au

Originally published as ASIC boss Joe Longo’s plan for a faster, smarter, tech-savvy regulator