Why Telstra chair John Mullen believes business had a role in the Indigenous voice to parliament referendum result

As John Mullen stepped down from the Telstra board, he said being a good business is more than running a profit machine.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

John Mullen is not quite hanging up on his career as a chairman, although after retiring as Telstra’s chair and 15 years all up as a director of the telco, he has some perspective about the shifting sands now running underneath big business and their boards.

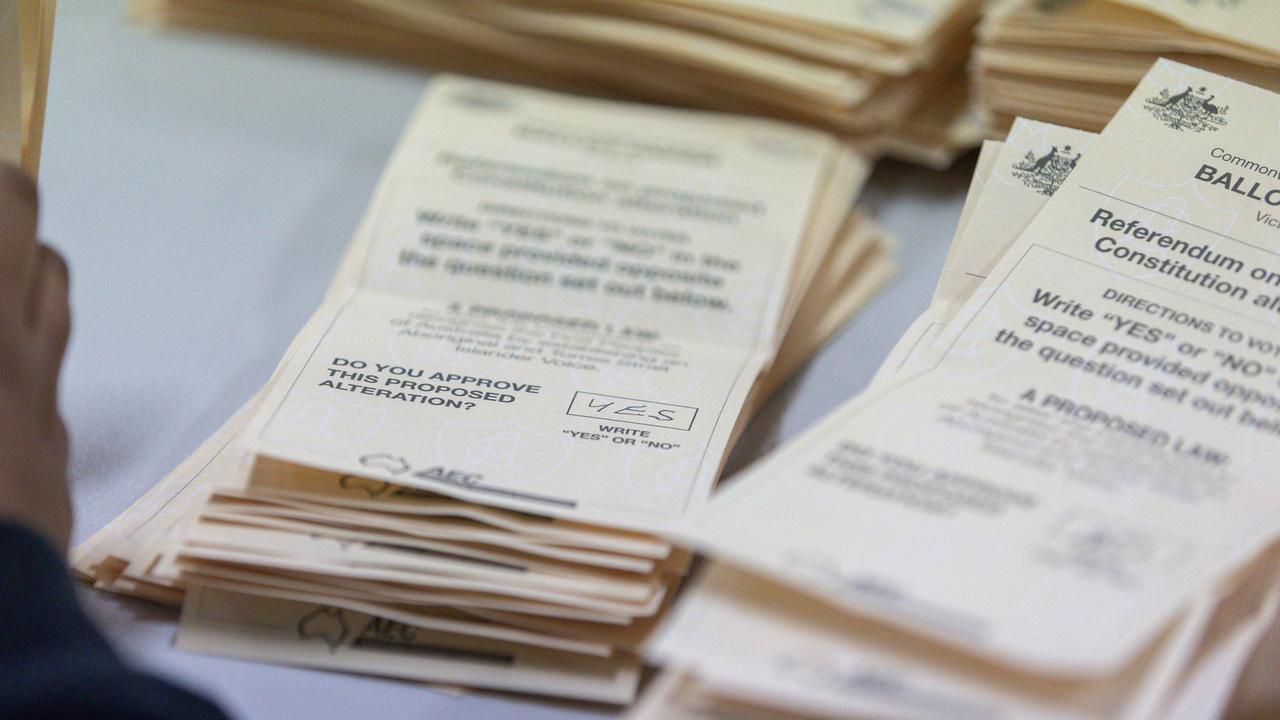

That shift has become even more pronounced following the disconnect between corporate Australia’s strong support – including financial backing – of the voice referendum with the way the majority of people voted.

Mullen was upfront to shareholders about Telstra’s decision to donate $1m to the Yes

campaign and its support of the campaign. He spoke on the issue at the top of his address at the telco’s annual meeting in Melbourne. Telstra as a company firmly believed reconciliation was in the best interest of Australia and therefore that meant it was in the best interest of Telstra, he said. The $1m donation reflected Telstra as “values-based company” that supported words with actions, he added.

Speaking to The Australian after the two -hour meeting, Mullen says he respects the outcome of the referendum but believes it remains the right business decision for the company.

“I absolutely stand by it despite the result,” he says.

“We strongly believe that reconciliation is a positive step forward for our country and for the economy, and therefore positive for our business and our shareholders.”

It was no single executive or board member that drove the support and he says there were opposing views among the board and management. Importantly, it was driven from within, not by an outside force of shareholders.

However, where there was agreement was that support of the referendum was in the best interest of the company. Part of the support was to encourage everybody to make sure they were informed and to make their own decision about the vote.

Much of the motivation was the unseen work in remote Australia by Telstra in providing telecommunication links with Indigenous communities where the proposal was strongly backed. Telstra is also a partner that builds infrastructure on Indigenous lands.

“If Telstra had not been seen to support it, it would just send a terrible message to all those partners,” Mullen says.

“Not everyone agreed around the table. But collectively, we believe it was the right decision for the company”.

‘No right or wrong’

The voice decision has also put a spotlight on the purpose of companies. And today that has become much broader than just a profit motive.

“It’s something we all grapple with,” Mullen says. “I don’t think it’s the place of companies to rush off supporting every social cause and spend money to do it.

“But equally I think the days of companies being able to say, ‘That has nothing to do with us, it’s the government’s issue’, and just getting on with life, that’s not the answer either.”

He says Telstra has highly committed and purpose-driven workforces. And as a telco and technology company it has a lot of young people working for it. Beyond that, there are other stakeholders from the community, customers, supplies and of course shareholders.

“They all want to know what their company stands for,” Mullen says.

“If you go back in time 20 years it was just shareholder value and making money for shareholders, everything else doesn’t matter. And today your social licence is really important and you have the responsibility to try and get it right.”

Sometimes it simply comes down to a judgment call.

“The same-sex marriage vote was another one where we decided that we would take a position on that like we did with the voice, but there have been others where it wasn’t appropriate,” Mullen says. “There’s no right or wrong on it.”

Four themes

Mullen’s post-CEO career has taken a wide path. He previously ran up ports operator Asciano until it was acquired and carved up between Qube and Brookfield in a $9bn-plus deal in 2016. He has been chair of global pallets major Brambles since 2019, and this week was elected as chairman of Treasury Wine Estates, with the Penfolds owner in the process of rebuilding following a thaw in Australia’s relations with China. Mullen is also a director of Canadian heavyweight Brookfield Infrastructure Partners.

He leaves Telstra in a strong position under a new chief executive, Vicki Brady. He argues it is a completely different entity from where it was 15 years ago.

It was forced to reinvent itself from the loss of its legacy network to NBN Co, as well as the disruption to traditional mobile services from messaging and data-based calling apps.

Mullen offered the Telstra board, now chaired by former AMP boss Craig Dunn, with some parting advice on four themes. They can take or leave it, he adds.

Telecommunications is fast evolving and remains highly competitive, Mullen says. The big disruption coming down the line he believes will come from satellite technology, especially in regional Australia. The challenge is for the policy and regulatory frameworks to evolve to provide incentive for the telco industry to keep investing in heavy infrastructure to support digital growth.

The second challenge comes back to the notion of trust and customer experience. And here Mullen acknowledges that Telstra has at times fallen short. The telco has made significant gains on this in recent years, measured against complaints, inbound calls and net promoter score.

But “even one error is one too many in today’s digital world”, and he urges his former Telstra colleagues to double down and be relentless in driving improvement.

Third, Mullen also wants Australian companies to rekindle their animal spirits and appetite for risk-taking. That is not betting the company, but it is about taking calculated risks.

“Sitting and waiting for the world to change, rather than driving the change, is guaranteed to ensure that one is always behind and not in front,” he says.

He even admits being too cautious on more than one occasion.

“At times I thought it was my money and if it was my company I definitely do, but I’d never convince shareholders and all the other stakeholders we had – so we wouldn’t do it,” he says.

“I think you’ll see that not every day, but it happens more and more in public company life.”

Finally he said the boards of big listed companies should not feel constrained by governance, regulation or even the general business environment.

These factors are only serving to play into the hands of private equity, which is increasingly having an edge in attracting the best talent and offering longer planning cycles.

One of the radical solutions he suggests is to rethink executive pay. That is to turn it upside down to motivate executives in tough environments. “It is even more in shareholders’ interests to motivate and reward executives for their hard work in challenging times than in good times,” Mullen says.

He says private companies have a far better balance between strategy and performance versus governance; decision-making processes are shortened; risk-taking is encouraged, investment is for the longer term and the remuneration process is simplified.

“There is a lot that we can learn from private equity and private capital in how to make companies leaner, faster and more efficient, and I hope that the pendulum starts to swing back a bit the other way as we still need a healthy and dynamic public company regime in Australia,” Mullen says.

johnstone@theaustralian. com.au

More Coverage

Originally published as Why Telstra chair John Mullen believes business had a role in the Indigenous voice to parliament referendum result