Where’s the legal obligation of service providers to compensate victims, ask consumer groups

As scammers repeatedly fleece Australians, consumer groups say planned federal legislation is inadequate and should stipulate tech companies, telcos and social media are liable to pay compensation.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Consumer groups say the federal government’s proposed scam prevention legislation contains “huge gaps” and should clearly stipulate that victims are compensated if technology companies, banks or telcos fail to meet their obligations.

Eight consumer groups made a joint submission on the proposed Scams Prevention Framework and the enacting legislation, arguing Australia needed to move swiftly on the issue of scams, but with a focus on better protecting the public from scams that are becoming increasingly sophisticated.

The deadline for submissions on the proposed legislation was last week.

Consumer Action Law Centre chief Stephanie Tonkin told The Australian the proposed legislation was “so high level” it was difficult to ascertain what the system would look like, and how a customer would be compensated in a timely way if a company failed to meet their obligation.

“You’ve got each industry pointing the finger at other industries about who should bear the cost of scams in this country and investing in prevention measures,” Ms Tonkin said. “It’s hard to see how that culture of denying liability might change.”

Ms Tonkin said banks were reimbursing just 2-5 per cent of scam losses currently.

Scams cost Australians $2.7bn in 2023 and more than 601,000 scam reports were made, the latest analysis by the competition regulator showed. That reflected a drop in the total amount of dollar losses but an increase in the number of scam reports being made.

The Scams Prevention Framework aims to impose tougher obligations on banks, telcos and social media companies to stop and prevent scams, and if they fail to comply fines of up to $50m can be applied.

The consumer groups want the legislation amended to ensure regulated entities have to compensate scam victims if they fail to meet their obligations.

They also support independent Zali Steggall’s proposed amendment that places the burden of proof on the entity to show it has met its obligations.

The submission was made on behalf of the Consumer Action Law Centre, CHOICE, the Australian Communications Consumer Action Network, Financial Rights Legal Centre, Super Consumers Australia, Financial Counselling Australia, Westjustice and the Consumer Credit Legal Service WA.

It also called for a faster implementation of a scams framework, given Australia was “well behind” other jurisdictions on the issue.

“Treasury’s 2025 planning has indicated that in the best-case scenario, the framework will come into force at the start of 2026,” the submission said.

“With the federal election looming there is a real risk that the status quo of no scam laws or consumer protections – and continued scam losses for Australians in the billions – will remain for even longer.”

Britain has moved to a reimbursement model on scams, meaning companies have to reimburse all victims, bar limited exceptions.

Assistant Treasurer Stephen Jones on Wednesday said while he and the department were keeping across the lodged submissions around the proposed scams framework, the government was keen to push ahead with the legislation.

“We’ll look at all of the stuff that comes through, but (we’re) keen to get that legislation through in those next two sitting weeks in February,” Mr Jones said.

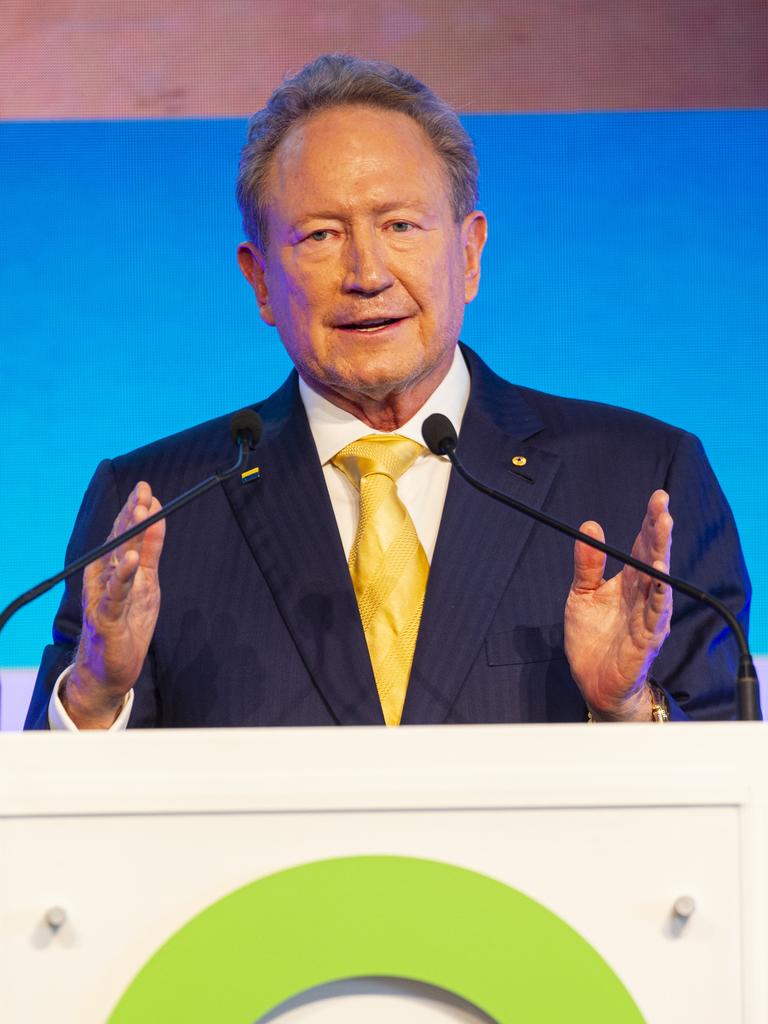

Billionaire Andrew Forrest’s private investment unit, Tattarang, also weighed into the debate with a submission calling for a strengthening of the anti-scam laws, saying social media companies had skirted their responsibilities to crack down on criminal conduct.

Dr Forrest, Fortescue’s executive chairman, has faced years of criminals misusing his identity for scams and fraud, and has attempted to sue Meta over its failure to stop them.

Tattarang’s submission said Meta’s attempt to hide behind its US parent entity, when dealing with Australian litigants, made policing the company harder.

The document said the corporate entities named in the legislation could “change overnight”, and that laws must be constructed to capture any such attempt.

“The fundamental jurisdictional and enforcement issues must be addressed,” Tattarang said.

A voluntary code introduced last year by large technology groups drew criticism for not leading to a notable uplift in the response to scams and frauds on the platforms.

In its own submission, social media giant Meta argued the government’s planned anti-scam legislation would require telcos, banks and social media companies to divvy up compensation and create an insurance-like system for scammers. It said that would make Australia a more attractive destination for criminal attention.

Meta also took aim at the proposed laws, saying they were “not evidence-based” and could dis-incentivise investment to stop scams and frauds.

Meta, which operates WhatsApp, Facebook and Instagram among its stable of platforms, said an effective response to scams required industry and government to work together.

Meta said the proposed external dispute resolution envisaged by the framework could lead to platforms fighting it out in a blame-shifting exercise to avoid liability, and “perversely create an insurance policy for transnational organised crime”.

“Having the reassurance that any scam losses they may incur will be reimbursed will increase consumers’ risk tolerance and therefore lower their guard when engaging with potential scam actors,” Meta’s submission said.

It said the company had “every incentive to combat scams”, but the social media giant has come under fire over its handling of fraudulent and scam activity on its platforms.

Meta has recently faced criticism for failing to take down two Facebook pages – highlighted in the Australian Banking Association’s submission – that allowed users to buy and sell access to bank accounts. Those accounts were intended to be used for money-mule activity, hiding the source and destination of illegitimate funds, often derived from scams or financial crime.

Meta only took down the pages when the matter was raised by The Australian earlier this month, with a spokesman saying the company had “removed the pages for violating our policies”.

Meta’s position on the scams framework lines up with the view of Digi, the peak body for the digital sector, which has said the banks and not tech companies should be on the hook for fines and compensation contemplated under the scam framework.

Digi argued social media sites “are not an equal vector as the banking and telecommunications sector in relation to scams”.

Google also raised issues with the proposed anti-scam laws, saying they would lead to legitimate content being caught up in the purge.

In its submission, Google said potential court action by scam victims would drive “strong incentives to remove considerably more content and to suspend more advertising accounts” than they otherwise would under current circumstances.

“The potential unintended consequences of the framework as drafted are significant,” Google said.

Google also questioned why it appeared it was the only search engine to be captured under the current Australian scams proposal. It said that could lead to a shift of scammers to other platforms including Amazon, Yelp and Booking.com and lull Australians into a “false sense of security” when dealing with these sites.

Google said those sites and others should also be caught in any framework, should one be legislated.

More Coverage

Originally published as Where’s the legal obligation of service providers to compensate victims, ask consumer groups