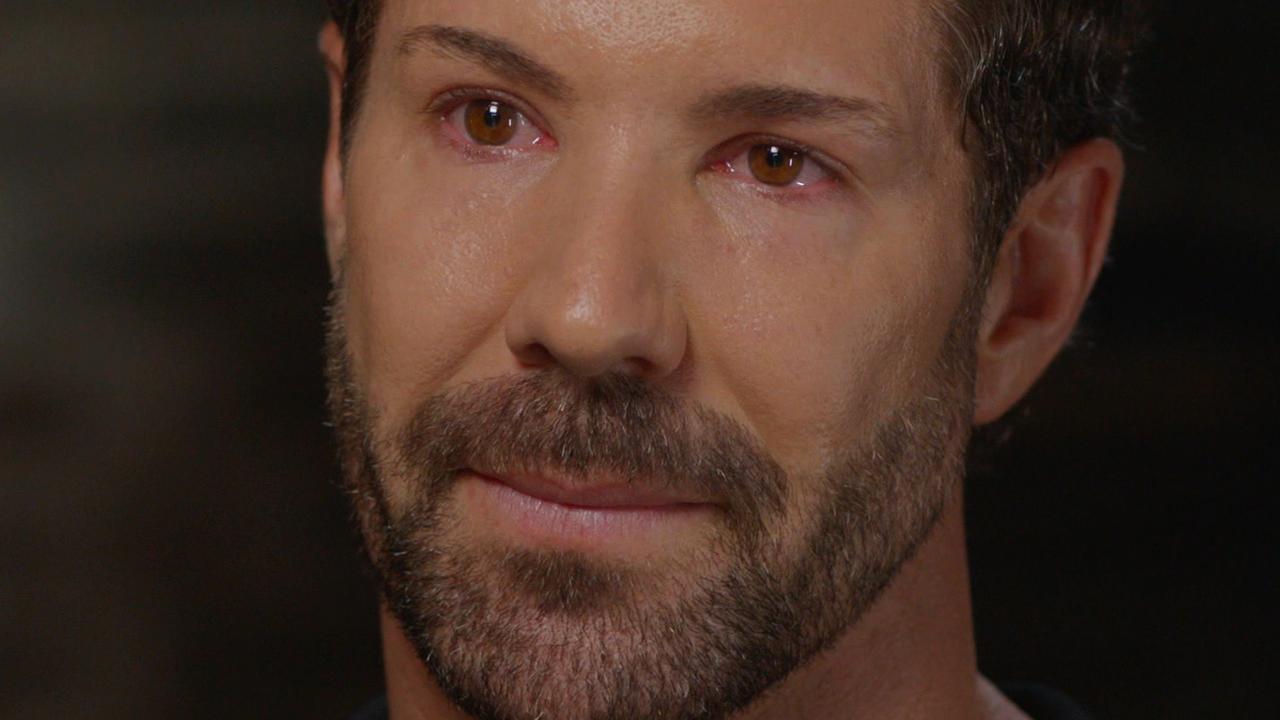

Westpac CEO Peter King warns of business rate hike pain, as borrowers get some respite from bottoming house prices

Westpac’s CEO says businesses will bear the brunt of loan stress in a slowing domestic economy, while borrowers will take some comfort from stabilising house prices.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Westpac chief executive Peter King says businesses will bear the brunt of loan stress in a slowing domestic economy, as consumers markedly curb their spending and mortgage borrowers take some comfort from stabilising house prices.

His comments came as Westpac posted a 22 per cent rise in first-half statutory net profit to $4bn, but he cautioned of a tougher period ahead given just eight of 11 Reserve Bank rate hikes had made their way through to individual and business loan repayments.

“Business is where it ends up in terms of the stress and the reason is if you’ve got a job you prioritise the house … the roof over your head and you cut back on everything else,” Mr King told The Australian.

“The trend is clear that it’s going to get harder.”

Mr King also said tentative signs house prices were starting to rise again would complicate the Reserve Bank’s inflation fighting task as it seeks to cool demand throughout the economy.

“If consumers feel like housing prices have bottomed that normally improves sentiment and sentiment means more spending. So it’s a really tricky balance for the Reserve Bank to take demand out of the economy and not do it in a way that it’s sharp.

“I was a little bit surprised at the speed of the housing prices bottoming. But in part that’s because there’s not a lot of stock.”

Westpac is tipping house prices remain steady this calendar year, before rising 5 per cent in 2024. The bank expects the RBA will keep the official rate steady at 3.85 per cent until next year when it anticipates 1 percentage points of rate cuts.

Mr King also urged governments to reassess planning and development processes in the housing market, as supply remained a key issue.

“Release more land is the critical piece, there might also need to be when we build we’ll go higher rather than out,” he said.

“If you take Sydney we probably need to go up in the right way, and with the right quality of building … it’s actually speed of land release, speed of planning approvals and how do we build more quickly.”

Westpac’s profit announcement on Monday rounded out the major banks’ reporting season. It saw the big four post combined first-half statutory profits of about $17bn, the highest six monthly combined results since EY started tracking the major banks’ earnings in 2009.

Westpac has moved to providing statutory profit as its preferred measure this half, unlike its peers that focus on cash profit – a measure of ongoing and underlying operations. The statutory results included a gain from notable items of $178m, after tax, due to the impact of hedging and proceeds from the sale of Advance Asset Management.

Westpac’s net interest income climbed 10 per cent to $9.1bn in the six months ended March 31, while non-interest income declined 3 per cent. The latter largely reflects fee revenue.

The net interest margin, what the bank earns on loans less funding and other costs, rose by 5 basis points to 1.96 per cent compared to the same period a year earlier, but was flat on the prior six months. That comes against the backdrop of more intense competition and discounting to woo mortgage customers, with Westpac signalling further margin pressure ahead.

Westpac said its core net interest margin peaked in October 2022, and that mortgage competition in Australia was the biggest drag on the metric. Mr King flagged the bank wouldn’t widely participate in the tussle for home loan market share while pricing remained at current levels.

“This is not the right time to take share,” he said, highlighting Westpac was growing its mortgage book at slower than industry rates, and was instead seeking growth in business lending and the institutional bank.

Mr King’s comments reflect that banks believe pricing had become unsustainable in the mortgage market. They come as Commonwealth Bank – the nation’s biggest mortgage lender – prepares to withdraw cashback offers from its home loans from mid year.

Westpac’s results briefing showed it was retaining about 84 per cent of customers that were rolling from fixed rate mortgages to variable ones in the half, but it still has another $95bn to changeover through the next 12 months.

The bank’s shares rallied 1.8 per cent to $21.74 on Monday, beating the S&P/ASX200’s 0.8 per cent gain, as investors applauded a better-than-expected profit and dividend.

“Westpac Banking Corp can absorb margin pressure and ensure its earnings remain solid over the next two years,” S&P Global Ratings said. “We forecast Westpac’s credit losses to remain low at about 15 basis points in the next two years.”

Matthew Davison, a Martin Currie Australia portfolio manager, said the bank’s shift to ramp up efforts in business lending wouldn’t prove easy given rivals were also targeting the space.

“Recent lending growth in the Westpac business bank has been modest and key peers have been investing and focusing on the space, so it doesn’t appear an easy segment to pick up quality share as an alternative to ongoing subdued mortgage returns,” he added.

Westpac expects the Australian economy’s growth will slow to 1 per cent this year, while credit growth is tipped to moderate to 3.2 per cent.

Westpac’s consumer, business and institutional banking divisions all delivered increases in earnings, but the bank’s New Zealand arm posted a 33 per cent net profit decline. That reflected that the prior corresponding period included the gain on the sale of the bank’s life insurance arm.

Westpac’s board declared an interim dividend of 70c per share, fully franked, up from a 64c final payment last year and a 61c a year earlier.

The bank’s credit impairment charges were $390m during the half, or 10 basis points of loans, up from 4 basis points a year earlier. But Australian mortgage 90-day delinquencies were 0.68 per cent in the first half, edging lower from 0.82 per cent a year earlier.

Westpac raised impairment provisions by 5 per cent to $4.9bn, above its base case scenario for the economy, as it readies for higher levels of loan losses.

“We’re early days and it’s (rate hikes) not all fed through, so it’s probably a good time just to remain cautious,” Mr King said, noting Westpac was navigating the environment from a position of strength.

The bank’s common equity tier one capital ratio was 12.3 per cent at March 31, about $3.6bn above the top of its target range.

Westpac is still aiming to sell its investment platform division and its Pacific business, as part of a divestment drive in the past four years.

Asked why the bank was persevering with the platform unit sale, after a protracted divestment process, Mr King said: “If there was no chance that I could get a transaction that was acceptable, I’d bite the bullet and say right we’ll run (it). Invest in it and run it … there will be a point where we say to the market ‘thank you but we’re better off to retain it’. We are not at that point yet.”

Despite a decline in first-half operating expenses, Westpac dumped its $8.6bn absolute cost target which was aimed at achieving that figure by its 2024 financial year. The bank said instead it would focus on improving its cost-to-income ratio relative to its peers.

Westpac’s rivals ANZ and National Australia Bank last week reported interim profits, while Commonwealth Bank – which has a June 30 year-end – delivers a quarterly trading update on Tuesday.

Originally published as Westpac CEO Peter King warns of business rate hike pain, as borrowers get some respite from bottoming house prices