Westpac brings forward restructure plans amid hot property market, books cash earnings of $1.58bn

Westpac has pulled forward a restructure program in response to a margin crunch, which the bank expects to continue for the remainder of the 2022 financial year.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Westpac has shaken up its risk function and pulled forward a restructure and simplification program in response to a margin crunch, which the bank expects to continue for the remainder of the 2022 financial year.

Chief risk officer David Stephen and head of financial crime, compliance and conduct Les Vance will both leave Westpac, with the roles to be combined and run by Ryan Zanin, who is in charge of risk at Federal National Mortgage Association (Fannie Mae) in New York.

Shares in the troubled lender lifted on Thursday despite an eight-basis-point collapse in the net interest margin (NIM), from 1.99 per cent in the second half of last year to 1.91 per cent in the December quarter, with the exit margin in December a further four basis points lower.

The share-price gain, up 2.3 per cent to $21.07, reflected low market expectations for the quarterly trading update and better-than-expected progress on Westpac’s much-trumpeted plan to slash annual costs to $8bn by 2024.

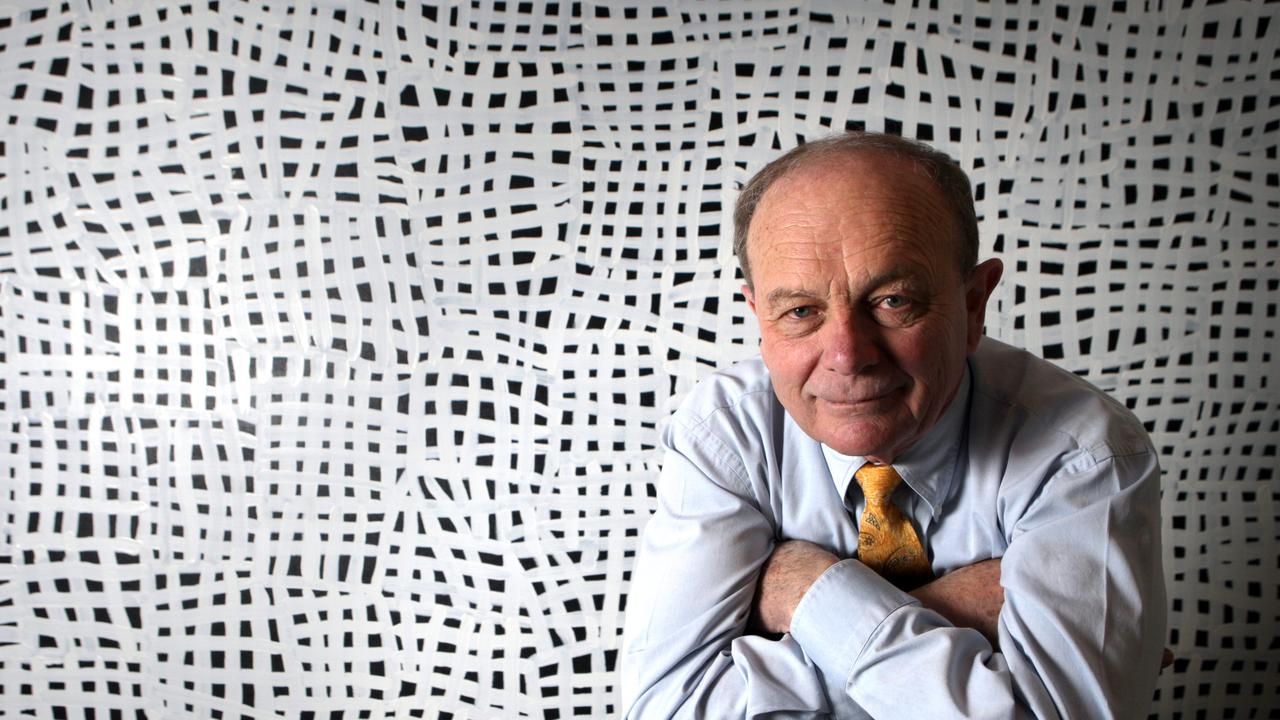

Announcing unaudited cash earnings to $1.58bn for the three months to December 31, up 1 per cent from the quarterly average of the September half-year excluding notable items, chief executive Peter King said the economy was doing well.

Even if the Reserve Bank acted on governor Philip Lowe’s latest assessment that an increase in official rates this year was “plausible”, he said unemployment was low, wages were growing and there was a bit of inflation.

“The risk is that it overshoots but the RBA has said it’s watching things closely,” Mr King said.

Chief financial officer Michael Rowland said Westpac had made a sound start to the year, with benefits starting to flow from the bank’s restructure. However, the environment, remained highly competitive, and the pressure on margins was continuing.

Westpac was therefore bringing forward its simplification plans and changing its operating structure to improve efficiency and move people closer to the customers they supported.

Citi analyst Brendan Sproules said in a note that the result beat consensus estimates by about 13 per cent, largely due to about $200m of extra revenue from treasury and markets.

Asset quality also appeared to be holding up well, despite the emergence of the Omicron variant of Covid, although Westpac had conservatively added $118m to provisions.

“Underlying trends remained supportive, particularly against low expectations,” Mr Sproules said.

“Guidance on a lower, underlying NIM shouldn’t come as a surprise, given competitive tensions in the mortgage market.

“However, early signs of cost reduction should provide investors with some comfort that costs will likely decline through the 2022 financial year as guided.”

The main factors behind the erosion in the NIM were competitive pressure in mortgage and business lending, strong growth in lower-margin fixed-rate mortgages, and an increase in holdings of expensive liquid assets.

Customers swept into cheap fixed-rate mortgages in the September half-year, up from 40 per cent of flows to 53 per cent.

However, the trend has reversed more recently, with fixed-rate products back to the mid-30 per cent range.

Westpac has also resorted to discounting to restore growth in its key franchises, as well as boost its liquid assets by $29bn ahead of the expiry of the Reserve Bank’s committed liquidity facility at the end of this year.

“We chose to grow in the last few years when competition was increasing because we needed to get the franchise moving again,” Mr King told The Australian.

Against that, Westpac achieved a $191m reduction in expenses, excluding notable items. The number of full-time equivalent employees fell by 1100, of whom 900 were third-party contractors, despite further investment in the franchise and ongoing programs to improve risk management.

Mr King said the bank was now implementing a key plank of its 2021 cost reduction strategy – creating a smaller, more focused head office and reducing the size of corporate functions by 20 per cent.

“The changes are primarily across head office and support functions, and not customer-facing roles,” Mr King said.

“Bringing our workforce closer to the frontline, combined with the increases we have already made to the number of bankers, will further strengthen our franchise for customers.”

As part of the changes, Mr Stephen and Mr Vance will leave Westpac, with both their functions to be taken over by Mr Zanin, currently chief risk officer at Fannie Mae.

Mr King also said two new divisions would be created to drive further efficiency and productivity – corporate services, as well as customer services and technology.

Corporate services will be run by Carolyn McCann, group executive, customer and corporate relations, while customer services and technology will be the responsibility of chief operating officer Scott Collary.

Mr Stephen will remain in his current role until May, when Mr Zanin will join the group subject to regulatory approval.

Westpac said it expected to incur a small restructuring charge at the half-year and additional charges at the full-year.

Originally published as Westpac brings forward restructure plans amid hot property market, books cash earnings of $1.58bn