WA man issues warning after waking up to find $15k drained from his ANZ credit account

A Western Australian business owner has detailed his horror at waking up in the morning to find himself lumped with a massive debt.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A small business owner has detailed his horror at waking up to find $15,000 had been drained from his credit account.

The horror deepened when he realised he was now in debt and would likely still be expected to pay it off.

Aaron Scott, who works in the fitness industry in Albany, Western Australia, checked his phone and saw a text message from ANZ saying his password had been changed one morning at the end of May.

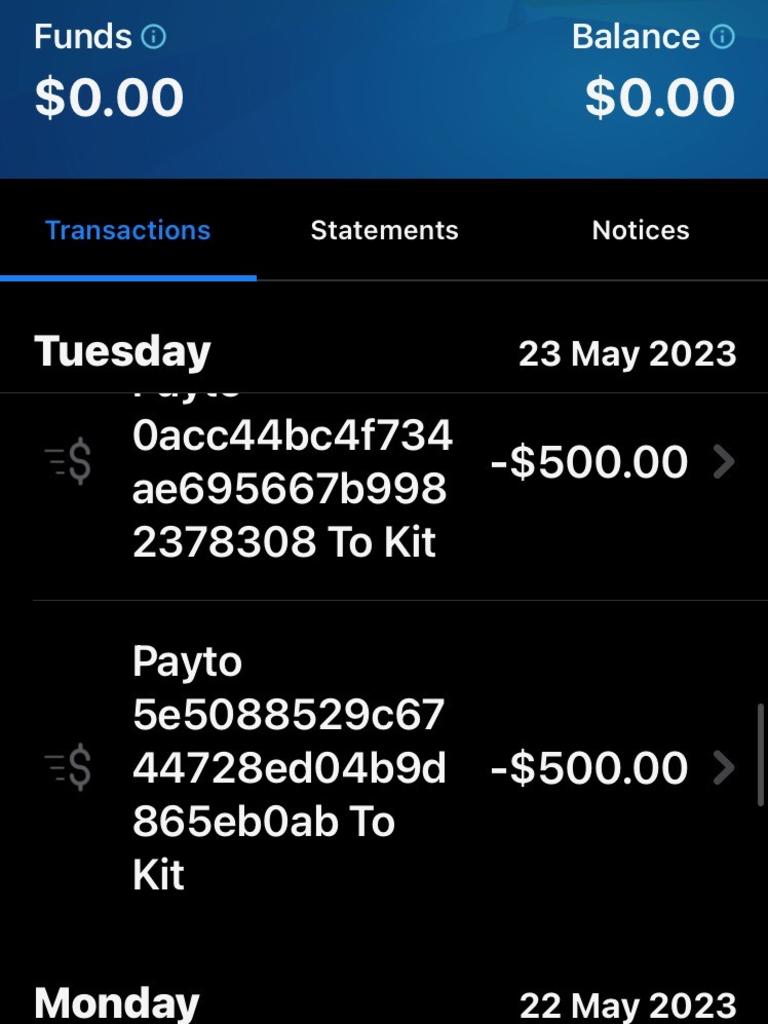

When the 54-year-old checked his credit balance, he saw that $8000 had been “milked out” of the account around 4am that day.

Mr Scott frantically rang the ANZ customer helpline, where he was informed he should visit his local branch in person to get the account shut down.

But in the 10 minute drive there, another $7000 was taken out of the account.

In total, this added to $15,000, which were taken out in increments of $500 and $1000.

“If my money is not safe in the bank, where is my money safe?” Mr Scott asking, speaking to news.com.au.

“We genuinely thought we were going to be left with a debt.”

As Mr Scott frantically tried to secure his account, he was left astounded by the response from banking staff.

“I spent 40 minutes on the phone to the fraud squad, they couldn’t give me any answers,” he recalled.

“They basically sat there like a dummy on the other end of the line with 60-second silences. They have no answers.”

ANZ chased the money to another bank but later informed him the funds were unrecoverable.

He still has no idea how the hacker was able to get into his credit account.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

Wanting answers, he has visited his local branch multiple times over the next few weeks.

Once, a staff member asked if he might have given away his credit card details, or accidentally given scammers remote access to his accounts.

“I’ve started to get a little flustered and sweaty,” he said. “There’s no way I gave remote access to anyone.”

Later, a bank investigation concluded that the transfers had happened due to an “unauthorised transaction”, absolving him of any blame.

For a month, he’s had this cloud hanging over his head, facing paying off a $15,000 debt even though it wasn’t money he spent.

“It’s just been distressing, you lay in bed, it’s the first thing you think of (when you wake up),” he said.

Mr Scott was so sure the bank wouldn’t reimburse him that he lodged a form with AFCA, the Australian Financial Complaints Authority, over the weekend.

Within several hours of news.com.au contacting ANZ on Tuesday, he was reimbursed.

“It was poorly handled. Whilst I’m not their biggest customer, I’ve had those accounts for 27 years. It was a sh*t experience,” he said.

He has also lodged a report with police.

Shaq Johnson, Head of Customer Protection at ANZ, said in a statement to news.com.au that scams are an “insidious problem” the bank was battling.

“We always try to work constructively and positively with our customers – we know this can be a stressful time for them,” he added.

“We consider all cases for reimbursement on their specific circumstances. In the last 12 months we have increased our reimbursement and goodwill payments for fraud, scams and unauthorised transactions.”

alex.turner-cohen@news.com.au

Originally published as WA man issues warning after waking up to find $15k drained from his ANZ credit account