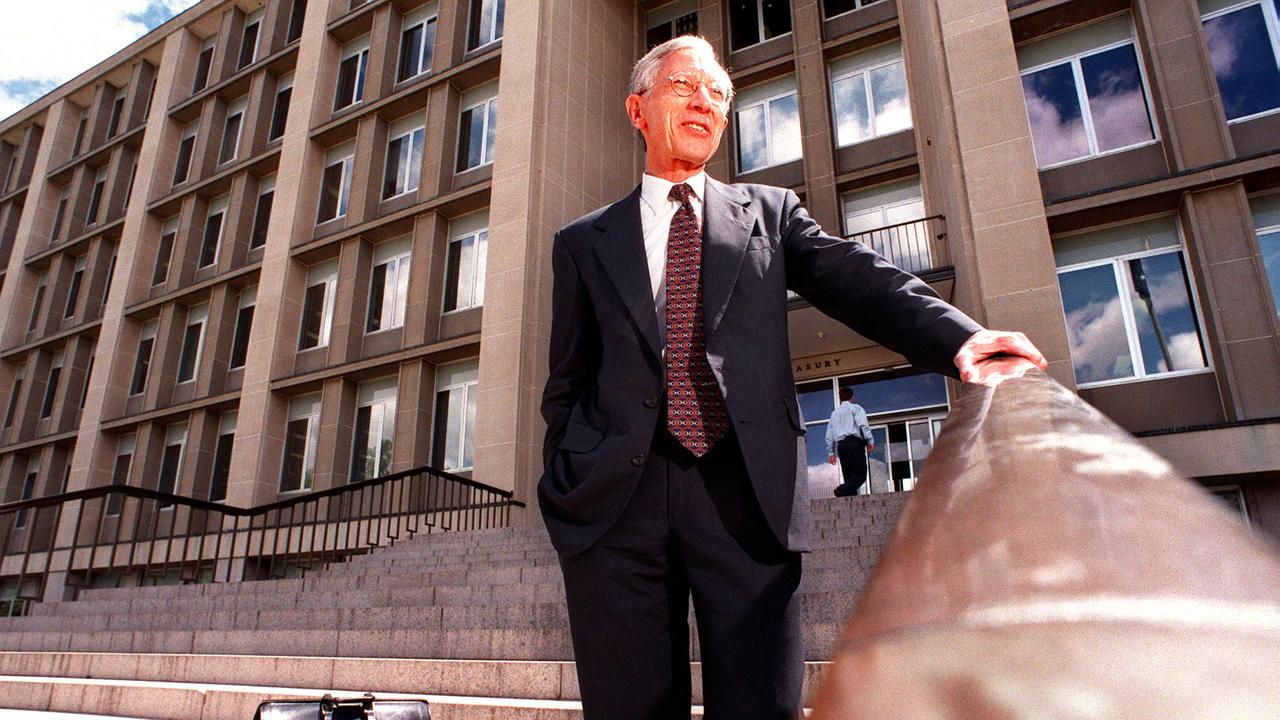

Vale Stanley Fischer, one of the most accomplished and influential economists of his generation

Guy Debelle reflects on the legacy of the late Stanley ‘Stan’ Fischer, and the former Reserve Bank deputy governor says he was one of the most influential economists of our time.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

He was the smartest guy in every room.

Indeed, it would be hard to find an economist who hasn’t heard of Stanley Fischer.

Students of economics will have read at least one of his text books on macroeconomics.

Many of his post-graduate students went on to be leading figures in central banking circles.

Through his academic work at the Massachusetts Institute of Technology and policy making at the World Bank, the International Monetary Fund, the Bank of Israel and the U.S. Federal Reserve, Fischer was one of the most influential economists in decades. He trained a generation of central bankers and policymakers and dealt with financial crises along the way.

Fischer was 81 when he passed away last Saturday from complications of Alzheimer’s disease.

“Stan was pretty much at the centre of the global macroeconomics profession there for a while,” recalls former Reserve Bank deputy governor Guy Debelle who was his teaching assistant for a time. “I mean, everyone pretty much looked up to him.”

In 1998, The Times called Fischer “the closest thing the world economy has to a battlefield medic.”

He had just negotiated a rescue package for Russia by mobile phone while on vacation and standing on the top of a sand dune on an island off the coast of Massachusetts.

As a professor at MIT, he was a thesis adviser and mentor to future leaders, including Ben Bernanke, Fed chair from 2006 to 2014; Mario Draghi, president of the European Central Bank; Kazuo Ueda, the current governor of the Bank of Japan; and IMF chief economist, Olivier Blanchard.

Former students also included Christina Romer and Gregory Mankiw, both of whom chaired the US Council of Economic Advisers, and Lawrence Summers, who served as Secretary of the Treasury.

Together with the late Rudi Dornbusch, Fischer was the key academic influence on former Reserve Bank of Australia governor and current chair of Future Generation Australia, Philip Lowe; current chair of Funds SA, Debelle; current RBA assistant governor for financial markets, Christopher Kent; and Johnathan Kearns; a former head of economic research at the Bank, now chief economist at Challenger.

Debelle was Fischer’s final PhD student when he returned to MIT in the early 1990s between his time at the World Bank and the IMF.

They co-authored an academic paper on the independence of the central banks and whether they should have goal and instrument independence from governments.

“We said probably the best outcome is where the government sets the goals and then gives the central bank the independence to get on with it,” Debelle tells The Australian.

“That’s probably the right division of labour in a democracy.”

He recalls presenting the paper in front of the likes of Milton Friedman at a conference at the San Francisco Fed in early 1994 as one of the highlights of his academic years.

“Rudi was a lot more volatile than Stan. Not volatile in the shouting at people way - though he could do that - just bouncing around and very vibrant. Stan was much calmer.”

That temperament allowed him to straddle the “saltwater/freshwater divide” in the macroeconomics academia and policy making circles that only worsened in the 1970s during the damaging combination of high inflation and low economic growth known as “stagflation”.

“Even as macro was going through wars of religion, there was no sense of ‘us versus them’ but instead an openness to alternative views, reflecting perhaps the fact that Stan and Rudi had spent time at Chicago (School of Economics), but also intellectual humility and the notion that there was much to learn from other approaches,” wrote Olivier Blanchard in 2023.

Using monetary and fiscal policy to steer the economy, as advocated by followers of John Maynard Keynes, was attacked by the rational expectation theory championed by the late Robert Lucas, a future Nobel laureate who trained under Friedman at the University of Chicago.

His critique argued that if the central bank cut interest rates to boost jobs, workers would rationally expect higher inflation and demand higher wages, so employers wouldn’t boost hiring.

Fischer was part of the “New Keynesian” school, building on the work of Paul Samuelson, Franco Modigliani and Robert Solow.

His 1977 paper, “Long-Term Contracts, Rational Expectations, and the Optimal Money Supply Rule,” argued that wages were “sticky” because of such contracts and didn’t adjust immediately when a central bank changed its policy settings.

That gave scope for well-timed fiscal and monetary stimulus programs to boost jobs without igniting inflation.

“There is some room for maneuver by the monetary authorities,” he concluded.

This assumption is now widespread in today’s central banks.

In his time at the IMF, Fischer led the response to the Asian Financial Crisis. But not everyone agreed with the Fund’s policy prescriptions of the time.

Nobel Prize-winning economist and Columbia University professor Joseph Stiglitz accused the IMF of acting like a “colonial ruler” and in 2002 he told The Times that the World Bank was trying to impose standard approaches that didn’t take full account of differing conditions in each economy.

In a 2003 lecture on globalisation, Fischer defended the IMF’s approach, arguing that the opening up to foreign trade and investment had lifted multitudes out of poverty in China and India.

“He had everyone’s respect,” says Debelle. “He was incredibly smart, an incredibly quick mind, but also a really even-handed, even-tempered man that everyone respected.”

Fischer also liked Australians and always found time to meet with RBA officials, Debelle says.

“He was always happy to chat and quite interested in what he could learn from Australia that might apply to Israel given some of the similarities in terms of being small open economies.

“They (Israel) had a few challenges (during the Financial Crisis) and we used to talk quite often.

“We had a group of sort of smallish countries, and we talked about FX strategy and stuff like that.

“And Stan asked if the Israelis could join that group… just how to think about foreign exchange intervention and the like. I think we had the Swiss, the Israelis, the Brazilians, the Mexicans, Koreans and the Malaysians.”

Indeed Fischer’s academic strength was in the practical application of macroeconomics.

“Being policy relevant and practical and pragmatic was very much a central core of the economics department, certainly on the macro side, at least when I was there, and had been for a long time under Bob Solow, Paul Samuelson and Franco Modigliani,” Debelle says.

“Rudy and Stan really carried that on.”

Originally published as Vale Stanley Fischer, one of the most accomplished and influential economists of his generation