Trump administration claim China controls Australia’s aluminium sector doesn’t wash

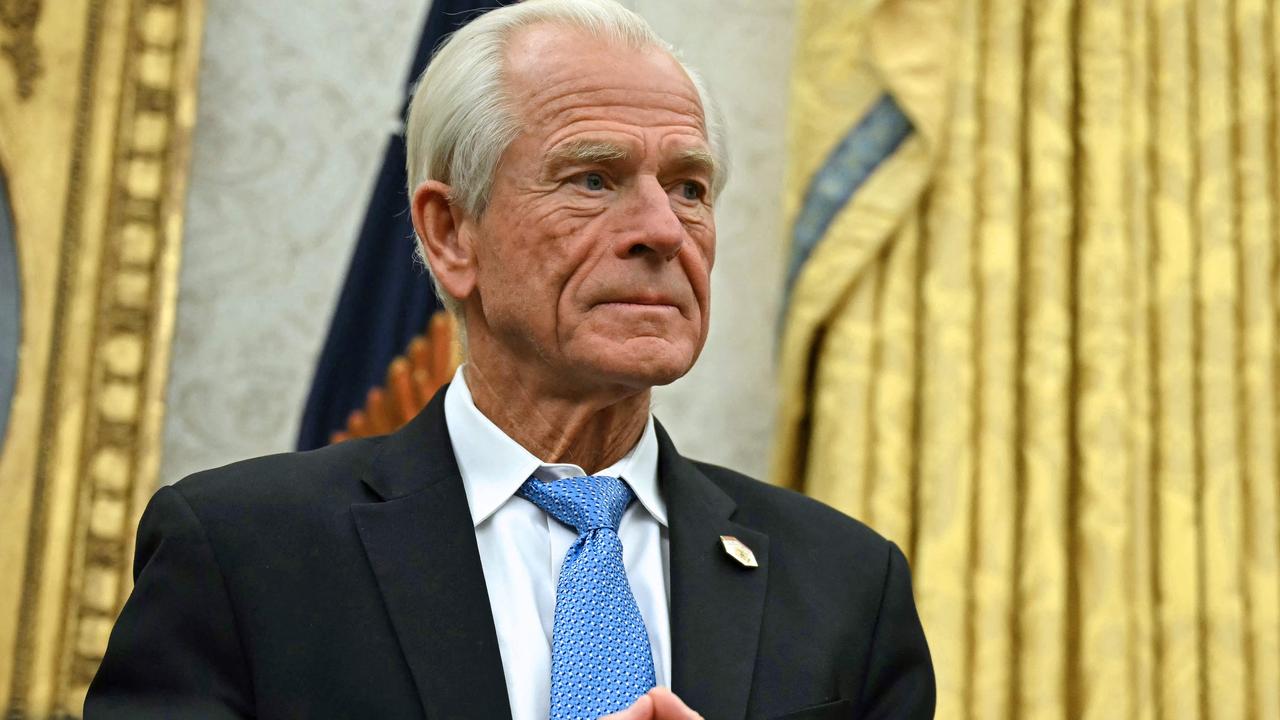

Assertions from a senior Trump spokesman on trade claiming Australia’s aluminium sector is controlled by China is factually wrong, while our share of the US market is modest.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Assertions by Donald Trump’s senior counsellor for trade and manufacturing Peter Navarro claiming Australia’s aluminium sector is controlled by Chinese entities have no basis in fact, while industry figures say Australia’s share of US imports is too small to “flood” their market.

Mr Navarro is also arguing that Australian producers have breached an agreement made with the Biden administration at a governmental level to restrain excess exports into the US, however figures from the US Department of Commerce show Australian aluminium exports to the US in recent years peaked during Mr Trump’s first term in office.

Mr Navarro, speaking on CNN, suggested the White House is more concerned with Australia’s aluminium exports to the US than steel exports when it comes to tariffs, because Australia was flooding its market in breach of an agreement with the Biden administration not to.

“The major companies in Australia are majority held by — the largest shareholder is China,” Mr Navarro told CNN.

“And what they do is they just flood our markets. After Biden let them, they gave them an agreement. They said, don’t flood the market. You can have a reasonable amount. That’s what we’re dealing with. Our aluminium industry … is on its back.’’

This followed President Trump’s announcement this week he would impose a blanket 25 per cent tariff on all steel and aluminium imports into the US.

Australia has a large aluminium sector, starting with bauxite mining, through to alumina refining and finally aluminium refining. The sector overall generates total export revenue greater than $15bn annually, with more than $13bn coming from the alumina and aluminium sectors.

But, The Australian Aluminium Council, in a statement issued this week, said on average Australia exports about 10 per cent of its 1.5 million tonnes of aluminium production to the US each year, which accounts for, on average, just 2.5 per cent of total US imports.

Analysis by The Australian shows Mr Navarro’s comments about China controlling the Australian aluminium sector are wrong.

The refining sector is dominated by global miner Rio Tinto — which does count Chinese company Chinalco as a major shareholder with about an 11 per cent stake.

Rio owns the Bell Bay aluminium smelter in Tasmania and the Boyne Island smelter in Queensland.

The Portland smelter in Victoria is actually owned by US company Alcoa, and Tomago Aluminium in New South Wales is majority owned by Rio Tinto with small stakes owned by Gove Aluminium Finance and Norwegian company Hydro Aluminium.

The alumina refining sector is dominated by four companies — Alcoa, Rio Tinto, South32, and Queensland Alumina, which is a joint venture between Rio Tinto and Russian company Rusal.

Mr Navarro also said Australian imports to the US had doubled from 2015 to 2017.

However, an industry source contacted by The Australian and speaking on the condition of anonymity said even if this was the case, Australia’s market share would have remained so small as to be inconsequential from a price-setting perspective.

Data on the website of the US government’s International Trade Administration website indicates Australia’s exports of aluminium to the US were at a 10-year low of 22,550 tonnes in 2016, when President Trump was elected for the first time, before rapidly shooting up to more than 100,000 tonnes the following year and hitting a recent peak of 268,580 tonnes in 2019 while President Trump remained in office. The figure for 2024 was 82,800 tonnes.

For context, Canada exported about 5.43 million tonnes of aluminium to the US in 2024.

While the figures bolster Mr Navarro’s claim that imports from Australia have increased over the specific periods he mentioned - from 2015-217 until 2024 - the figures also show year to year imports are volatile and that the overall imports were much higher during the previous Trump presidency.

The AAC said earlier this week it was “early days” regarding President Donald Trump’s decision to impose blanket 25 per cent tariffs on imports of steel and aluminium.

“Bauxite, alumina and aluminium are globally traded and there are interdependencies in these supply chains,’’ the AAC said.

“It’s early days and we are still working to understand the impact of any potential tariffs on Australia’s aluminium trade.

“We will continue working with the Australian government and its representatives on this important issue.’’

The Minerals Council of Australia said in a statement this week: “While these tariffs are not yet final, any such move would have significant implications for Australian industry.

“These proposed tariffs set a concerning precedent,’’ the MCA said.

“Action is needed now to ensure that trade restrictions do not expand to critical minerals and other resources that are vital to Australia’s economic future and global supply chains.’’

China is by far the largest global producer of aluminium, accounting for about 60 per cent of the market, followed by India, Russia, Canada, The United Arab Emirates and Bahrain, with Australia seventh, AAC figures show.

More Coverage

Originally published as Trump administration claim China controls Australia’s aluminium sector doesn’t wash