The ups and downs of Shayne Elliott’s long reign as CEO of ANZ

When celebrating the bank’s 50th anniversary of operating in Singapore in October, outgoing CEO Shayne Elliott quipped that he was proud to be part of ANZ, ‘warts and all’.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

When celebrating ANZ’s 50th anniversary of operating in Singapore in October, now outgoing chief executive Shayne Elliott, quipped that he was proud to be part of ANZ, “warts and all”.

That statement perhaps characterises the highs and lows experienced by the Melbourne-based bank during Elliott’s tenure at the top.

It started as a thorough clean-up operation when Elliott took the reins as CEO in early 2016 from Mike Smith, before he was able to come up for air and introduce some key initiatives around boosting returns in the marquee institutional business and then execute a plan to overhaul the bank’s technology platforms.

Not including dividends, ANZ’s shares have rallied about $2.33 over Elliott’s tenure while return on equity sits at 10 per cent in 2024, compared to 14 per cent in late 2015. That partly reflects the pressures the whole sector has faced on net interest margins over the period.

ANZ chairman Paul O’Sullivan on Monday highlighted that Elliott had overseen the divestment of 30 businesses and a strategy to make the bank more efficient.

Elliott has addressed many of the bank’s problems even though it continues to be plagued by cultural and regulatory issues, including an investigation by the corporate regulator into its handling of a government bond issue last year.

The early part of Elliott’s time as CEO was tainted by revelations about a toxic and party-hard culture in ANZ’s dealing room within the institutional bank, the division he led prior to getting the top job. That came as Elliott began moving away from the bank’s super-regional Asia strategy and paring its operations outside Australia and New Zealand. In late 2016, for example, ANZ agreed to sell its Asian retail banking and wealth business to Singapore’s DBS.

The following year damaging rate-rigging allegations against ANZ and its traders came to a head with the bank paying $50m to settle a case brought by the corporate regulator.

There was no respite for Elliott, with 2018 marking the Hayne royal commission which shook many domestic banks to their core, instilling fear in chairmen and CEOs, including Elliott.

“It was pretty harrowing,” Elliott recalled earlier this year. “It’s not something that many of us had any experience with.”

While ANZ fared better than National Australia Bank and Commonwealth Bank, it was still hit by the prudential regulator, which forced it to hold an additional $500m in capital following governance lapses.

Elliott later labelled it the royal commission that the banking industry had to have.

“Undoubtedly, it was a good thing,” he told The Australian earlier this year. “It had a big influence on the way we’ve adopted a sense of purpose, the way we think about customers, the way we think about conduct.”

Since 2020, the ANZ boss has put to bed several issues dogging the bank, but at the same time new problems have arisen around ANZ’s technological transformation and its management of non-financial risks.

ANZ in mid-2020 sealed a deal to sell its NZ asset financing unit UDC Finance, as Elliott continued to simplify the bank.

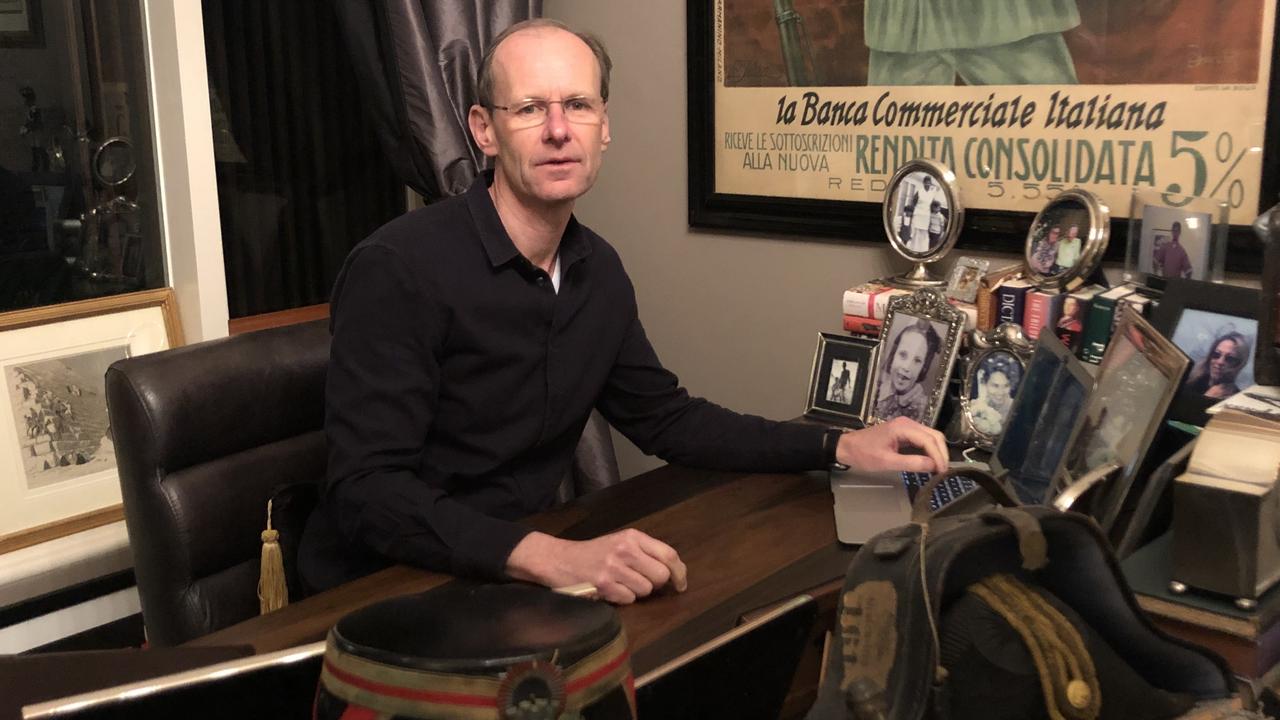

It was in that same year the pandemic forced ANZ into virtual operations while it was also preparing for the worst, including home loan losses and customer distress. Elliott, like many of his almost 40,000 staff, worked from home during the early days of the pandemic beneath a poster of martial arts expert and actor Bruce Lee.

At the time, with interest rates at historic lows, ANZ struggled to match the explosion in home lending during the pandemic. It was a miscalculation that would eventually lead to the departure of executive Mark Hand in 2022.

A key initiative under Elliott around that time was ANZx, as Elliott and his team looked to address customers’ digital banking needs and deal with the lender’s legacy core systems. It was later rebranded ANZ Plus and Elliott touted it as “the foundation of the new ANZ”.

ANZ Plus launched in March 2022, but the bank came under fire over the platform’s limited features and functionality. The initiative is starting to get traction alongside an equivalent new technology platform in the institutional bank.

After merger and acquisition talk surrounding ANZ and companies including real estate portal Domain and MYOB, Elliott appeared to land a target in Suncorp’s bank in mid-2022.

ANZ agreed to pay $4.9bn for it but still needed to convince the competition regulator, federal treasurer and the Queensland government of the transaction’s merits.

The deal, coming after the depths of the pandemic, would see ANZ reclaim market share it had lost since the start of the outbreak.

Selling the deal to shareholders, Elliott said the Suncorp deal could be as significant to ANZ as its 2004 acquisition of the National Bank in New Zealand.

The Australian Competition & Consumer Commission had other ideas and scuttled the Suncorp bank transaction, however, but the decision was appealed.

Thankfully for Elliott, the Australian Competition Tribunal signed off on the deal early this year.

The transaction will mark a milestone for Elliott’s rein at the top, even as the bank now navigates the hard work on the integration and customer migration.

Skirmishes with regulators were ever-present through Elliott’s tenure. The bank was fined in October 2023 over its failure to reveal a shortfall in a $2.5bn share placement in 2015.

ANZ did, however, escape an attempt to prosecute its former treasurer Rick Moscati over the same placement, amid allegations of cartel-like conduct, after the criminal case was withdrawn.

The scandal surrounding ANZ’s role in the government bond issuance hit a crescendo this year when the prudential regulator hit ANZ with a further $250m capital penalty, that also saw Elliott’s bonus docked by $1.1m as the bank was nearing its decision on CEO succession.

More Coverage

Originally published as The ups and downs of Shayne Elliott’s long reign as CEO of ANZ