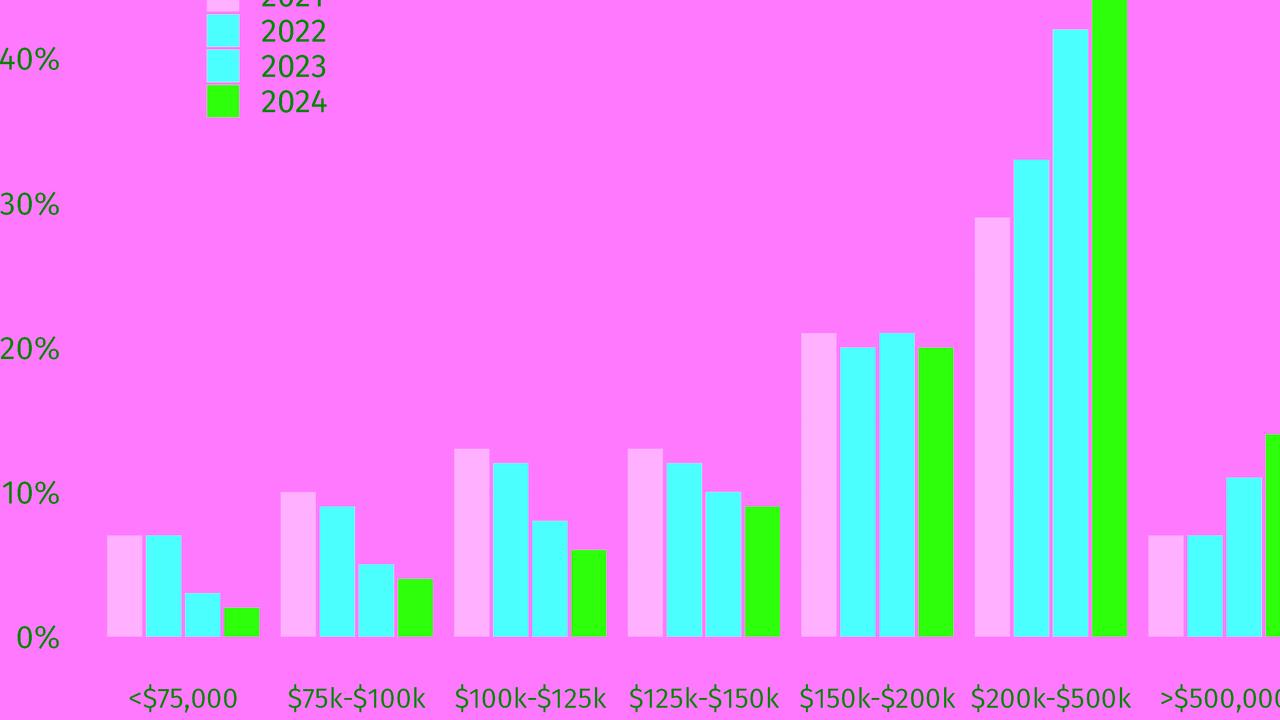

The income sweet spot to get a mortgage: $200,000 to $500,000

New data released by an Aussie banking giant has revealed exactly how much you need to earn to get a mortgage – and it’s not pretty.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Household income of $100,000? That will probably make mortgage brokers sigh. The sweet spot, if you want a loan these days, is to be between $200,000 and $500,000.

That’s the implication of new data from Australia’s second-biggest mortgage lender, Westpac.

As the next chart shows, the proportion of loans given to households making under $200,000 has collapsed. Most lending now goes to families making much, much more. In just the last four years, loans going to households making over $200,000 have gone from being a minority to a majority of lending.

MORE: Sign RBA is creating ticking time bomb

A single person on a teacher salary is a rare sight in the mortgage broker’s life, but that’s been the case for a while. What we are seeing now is that even two teacher salaries may not be enough to get a lender excited.

Now, the chart above is affected by the fact that we are making more money these days. With prices what they are, a $100,000 salary buys what an $80,0000 salary bought a few years ago. And incomes have risen. You would expect the bars at the right to go up slowly as wage inflation continues, and for the bars at the left to go down. But the extent of the rise is shocking. Far higher than you’d see from wage inflation alone.

MORE: Home loan trap taking years to escape

What this chart represents is the collapse of the young struggling homebuyer in our era of high home prices and high interest rates. Houses are still changing hands, but they are being sold to established households with a senior employee or two, perhaps double income no kids, perhaps kids in secondary school or even beyond.

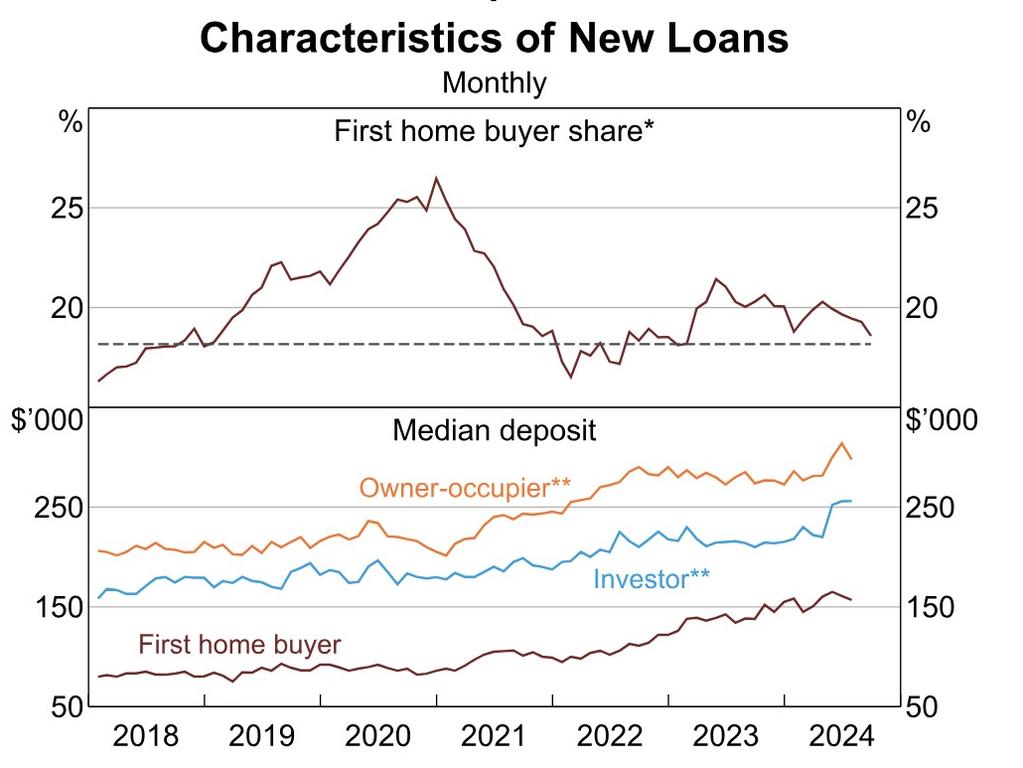

Which is not to say that these people can’t be first home buyers. As the next chart shows, around 20 per cent of buyers are first home buyers now. That’s close to the long-run average but well down on the peak during 2020-21.

What is different is how much the first home buyers are bringing to the table. The bottom part of the next chart shows the size of the deposit that first home buyers are coming up with. The median deposit is now a chunky $155,000. That’s a lot of years of saving up (or some generous parents).

Remember that a median is just the middle number from a group. It’s different to an average. (If a nurse, a teacher and Jeff Bezos are in the room, the median income is around $80,000, while the average income is in the hundreds of millions). So the median deposit in the graph above is not being pulled up by a handful of very wealthy first home buyers at the top end. It’s a widespread phenomenon.

Of course, those first home buyers are often competing with other buyers, and we see that other owner-occupiers are bringing even more money to the table when they buy, close to $300,000. Investors are out there buying houses too, and they have big deposits.

Basically with prices high and interest rates soaring, Australians need a huge deposit to buy a house. That means waiting to buy. The average first homebuyer has a few grey hairs when they first walk into their own home. By the time they pay it off, they will have a lot more greys.

Indeed, many people are retiring with a mortgage, and using their super to pay down the last little bit of housing debt. The more common that becomes, the safer the pension will be. The government can’t change the rules on the pension easily if many people are relying on it.

But of course, the pension isn’t much if you’re paying rent, especially in a capital city. One of the biggest groups living in poverty in Australia is pensioners who don’t own their own home. And with lending increasingly going to older and richer Australians, the number of people who retire before they ever become first home buyers looks set to increase dramatically.

In 2025, interest rates are expected to fall – but it is not clear when. Westpac forecasts the first half of the year to be mixed and for the year to see only moderate growth in housing prices: “(We) expect a second half gain to see dwelling prices up 3 per cent in 2025 with growth lifting to 7 per cent in 2026”.

So long as unemployment doesn’t rise early in the year, there could be an opportunity for some people – even those whose household income isn’t in the $200,000+ sweet spot – to get into a home of their own.

Jason Murphy is an economist | @jasemurphy.bsky.social. He is the author of the book Incentivology

More Coverage

Originally published as The income sweet spot to get a mortgage: $200,000 to $500,000