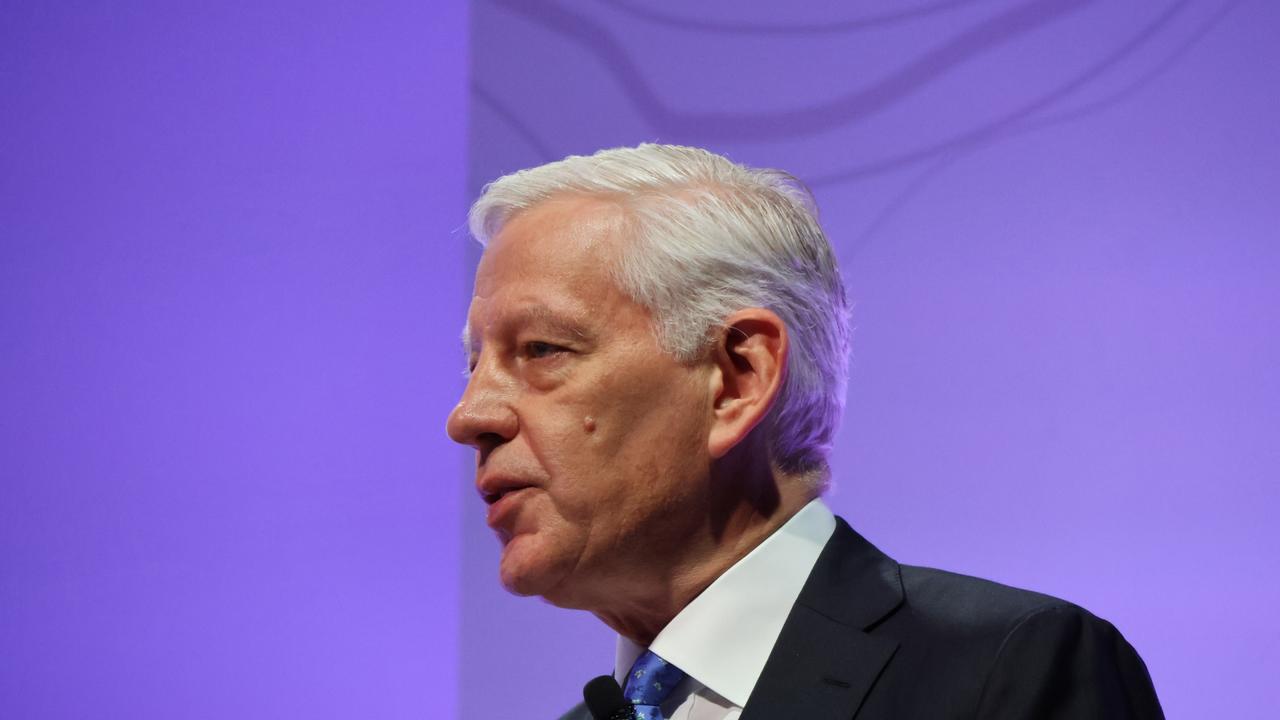

The ANZ deal was always right, says Suncorp chief Steve Johnston

Everything is in place to complete the ownership transfer by August 1 but customers won’t notice any change, says Suncorp chief executive Steve Johnston.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Suncorp chief executive Steve Johnston says Queenslanders won’t notice any change in services following the successful completion of the $4.9bn sale of the group’s bank to ANZ.

The deal means the bank’s so-called mum-and-dad shareholders will receive about $500m as part of a capital return from the sale.

Mr Johnston said he was confident everything was in place to complete the ownership transfer by August 1 after the final green light was given by federal Treasurer Jim Chalmers.

He said customers of both the insurance and banking arms of Brisbane-based Suncorp would not see any differences once the split off was completed, except the addition of the word “bank” to the Suncorp signs outside its branches.

ANZ will be required to maintain its and Suncorp Bank’s regional branch numbers throughout Australia for three years and there will be no net job losses across the country as a direct result of the acquisition over the same period.

“We will now emerge as a pure play insurance company and won’t have to balance capital allocation between the bank and the insurance operations,” Mr Johnston said. “It means every dollar can now go into the insurance business.”

Suncorp shareholders will be the beneficiaries of the $4.1bn net proceeds from the sale of the bank, and the Queensland insurer promised to return “the majority” of funds to investors. That could equate to an estimated $3 per share by way of a pro-rata capital return and a fully franked special dividend.

Suncorp has 60,000 retail shareholders in Queensland, equating to about $500m of total proceeds.

Mr Johnston said the completion of the deal would allow Suncorp to focus on efficiencies in its insurance operations and product development as climate change posed growing challenges for the sector.

ANZ has committed to investing in a new tech hub in Brisbane and plans to hire up 700 Queensland-based roles over five years.

Meanwhile, Suncorp will invest at least $19m in a Disaster Response Centre of Excellence in Brisbane as well as $2m in a Suncorp Regional Hub in Townsville with 120 new jobs.

Mr Johnston said he was confident recent steep increases in insurance premiums across the sector, which were feeding into cost-of-living pressures, would start to moderate as inflation eased.

He never doubted the strategy to sell the banking operation, but conceded he was worried the deal might never be completed following the earlier rejection by the Australian Competition and Consumer Commission. That was later overturned following an appeal to the Australian Competition Tribunal.

“Following completion, Suncorp will focus on meeting the evolving needs of insurance customers and addressing increasingly complex challenges such as climate change and affordability,” Mr Johnston said.

“This decision also brings us another step closer to the delivery of the jobs and investment package Suncorp agreed with the Queensland government as part of the sale process, with benefits not only for Queensland but across Australia and New Zealand more broadly.

“It is an important step towards Suncorp Group becoming a dedicated trans-Tasman insurer, proudly headquartered in Queensland.”

ANZ chief executive Shayne Elliott said the approval was a significant milestone in its plans to expand its presence in Queensland and bring the best of ANZ to Suncorp Bank customers. “Queensland is thriving,” Mr Elliott said. “With strong economic growth, high workforce participation and more interstate migration than any other state or territory, we’re excited about the opportunities Queensland presents for ANZ and our customers.”

ANZ has promised to inject $15bn into new lending to support “green” Olympic Games infrastructure and renewables projects.

“We are another step closer to welcoming Suncorp Bank customers into the ANZ Group. Suncorp Bank customers will continue to receive the same great service, from the same exceptional Suncorp Bank staff,” Mr Elliott said.

“Over time, we’ll make available to them ANZ’s leading technology, giving them access to the very latest in banking services.”

More Coverage

Originally published as The ANZ deal was always right, says Suncorp chief Steve Johnston