Tax returns: Five ways the ATO is tracking Australians’ money moves

Sneaky tax deductions and deliberately forgotten income are a thing of the past as the ATO flexes this tech to catch out cheats.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The Australian Taxation Office is sharpening its technology systems that catch people cheating on their tax returns, making it harder than ever to hide income or claim dodgy deductions.

After Covid-19 stimulus payments such as JobKeeper dominated the ATO’s efforts in 2020, a stronger compliance focus has emerged this tax time and a rising number of third parties are supplying people’s financial data for Tax Office supercomputers to process.

Tax and law specialists say most Australians don’t realise just how much information the ATO is legally collecting about them.

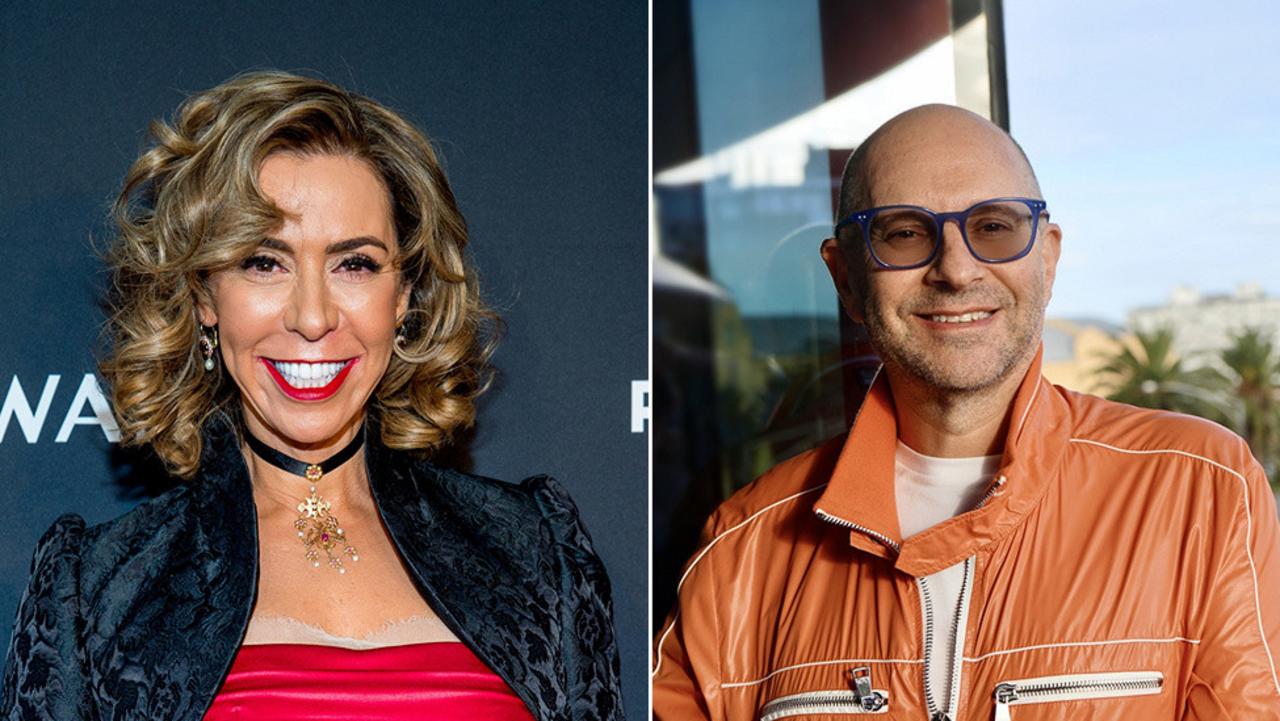

ATO assistant commissioner Tim Loh said it was expanding its data sources and refining its analytics to include areas that previously were off the radar such as cryptocurrency traders and the sharing economy.

“We are focusing on addressing over-claiming of deductions and under-reporting of income – especially those that are deliberately doing the wrong thing,” he said.

“The ATO is receiving income data from a range of organisations be it the banks, state revenue offices, land title offices, motor vehicle registries, share registries, ASIC, online selling and payment platforms, sharing economy platforms and cryptocurrency exchanges,” he said.

Mr Loh said the ATO also sourced information from insurance companies about assets including luxury cars over $65,000, boats over $100,000, fine art over $100,000 and racehorses over $65,000. It could then examine whether people’s assets reflected their declared income.

NDA Law senior associate and tax specialist Lisa Christo said the ATO had multiple avenues to track spending and income, even for small transactions.

“I sympathise that people do not like paying tax but do not underestimate the abilities of the ATO,” she said.

“Just because you think you may be a comparatively insignificant taxpayer does not mean that the ATO can’t or won’t ask you to substantiate your claims.

“Then you will not only have to pay the additional tax but also interest and penalties which could more than double the cost to you.”

Ms Christo said the ATO was using its increased data-matching capabilities to clamp down on “cash under the table” businesses.

Senior accountant Kate Bruce from dmca advisory said people could not sell assets such as property and shares without being monitored.

“It is becoming easier for the ATO to review information in a tax return,” she said.

And if your work-related deductions differ significantly from others in your industry, you will be questioned.

“The ATO uses data matching to assess the level of deductions being claimed by a taxpayer with a similar income using the occupation code entered in the tax return,” Ms Bruce said.

Mr Loh said this nearest neighbour technology would spot deductions that “stick out like a sore thumb” and people doing their tax return online were often queried with real-time warnings.

“We are using super computers and have got data scientists looking at all the data we have got – it’s not like the old days where we had to go through one by one,” he said.

“We have processes running in the background every day to make sure people are doing the right thing.”

Originally published as Tax returns: Five ways the ATO is tracking Australians’ money moves