Super funds splash members’ cash, hand millions to CFMEU

Superannuation funds spent more than $400m on marketing and sponsorships in a year, while four funds dished out millions to the construction union | SEE FULL LIST

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Super funds spent more than $400m of members’ retirement savings on marketing and sponsorships in the 2023 financial year and handed $14m to unions, including $3.8m to the CFMEU.

The bulk of the spending was done by just a handful of funds: the 10 biggest spenders, all industry funds, handed out $301m in marketing and sponsorships in the year, with other super funds spending a further $122m, for a total marketing spend of $423m across the sector.

Hostplus spent the most on sponsorships, channelling more than $12m of members’ money, mostly to a variety of sporting deals in the 12 months to June 30, 2023.

Hostplus splashed the cash to the likes of the AFL, the AFL’s Richmond Tigers and the NRL’s South Sydney Rabbitohs, according to detailed Australian Prudential Regulation Authority expense data released on Wednesday.

All up, Hostplus handed over sponsorship payments to 37 groups, including $3.9m to Industry Super Australia, $1.8m to the AFL, $1.3m to the Gold Coast Suns and $720,000 to the Tigers.

The $110bn industry super fund for the hospitality industry spent a total $29.5m on marketing spend in the 2023 financial year, mostly split between sponsorships and advertising. Just $430,000 was spent on member campaigns.

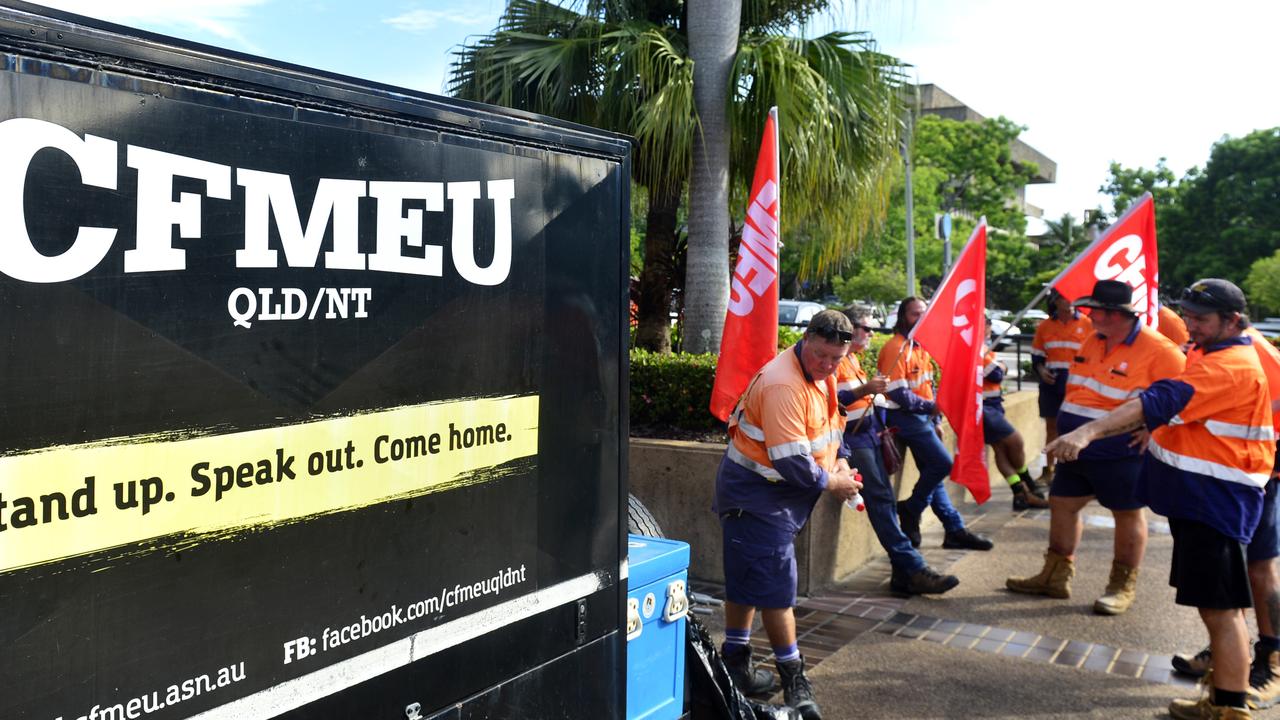

As Hostplus was spending big on sports teams, BUSSQ, Cbus, First Super and Mine Super handed $3.8m to the CFMEU (and CFMMEU) for a mix of sponsorships and administration expenses, with First Super doling out as much as $2.3m to the union in admin costs.

These funds, alongside other industry funds including AustralianSuper, Australian Retirement Trust and Aware Super, gave a total $14m to unions over the year.

The nation’s largest super fund, the $330bn megafund AustralianSuper, meanwhile, spent $167,830 on sponsorships but was the highest in overall marketing spend, at $60m. The bulk of its marketing spend – $43m – went on advertising, followed by a further $17m on member campaigns.

Australian Retirement Trust was a close second on overall marketing spend, handing over $42m in the year, including $11m on sponsorships and $2.3m on member campaigns. The $300bn fund was the second-highest spender on sponsorships, behind Hostplus.

Industry funds accounted for the top 10 spenders on marketing in the year, with AustralianSuper and ART followed by Cbus, HESTA, Aware Super, Hostplus, Unisuper, REST, Care Super and Spirit Super.

In total, super funds spent $10.83bn of members’ money in the 2023 financial year, including $5.6bn on admin and marketing costs in 2023, as well as a further $3.8bn on investment management.

Australian Retirement Trust forked out $650m in admin costs in the year, followed by AustralianSuper’s $470m and Cbus’ $358m.

Despite bringing its investment teams in-house in recent years, AustralianSuper spent much more than any other fund on investment expenses, doling out more than $700m in the year. This compares to Aware’s $484m and Australian Retirement Trust’s $425m. AustralianSuper and Aware are among the funds that have, in recent years, moved to manage more of their investments in-house, in part to reduce costs.

A spokesperson for Australian Super said costs “can can vary from year to year and the (fund’s) ratios have trended lower over the past seven years due to the reduced cost of internal management and benefits of scale as member assets increase.”

While funds individually outline their spending in annual reports each year, this is the first time the expense data has been published in detail by the prudential regulator. It comes amid closer scrutiny of how funds spend members’ money and whether the spend is in members’ best interests.

Ahead of the release of the data, APRA deputy chair Margaret Cole repeated the threat of enforcement action against inappropriate super fund spending, saying some funds were still making questionable expenditure decisions and had variable compliance with the best-interests duty.

“Sports conference sponsorships, conferences, travel, discretionary expenditure … sometimes it’s not obvious what benefits that gives to members,” Ms Cole told a business summit on Tuesday.

“We understand that expenditure is required and that expenditure on marketing is required, but there are some things that just do not look as if they’re going to pass the test.”

But funds defended their spending, with Aware and Cbus among those saying marketing spend was good value for money.

Association of Superannuation Funds of Australia chief executive Mary Delahunty said marketing helped funds communicate effectively with members about their retirement savings.

“APRA has made it clear that their focus is the application of members best financial interest duty in the decision making. Making sure that funds have assessed the value of expenses and that members are getting good value,” Ms Delahunty said.

“The release of expense data presents an opportunity to foster a more informed understanding of the role marketing and other discretionary spending play in helping funds compete, communicate, and deliver value in a free market environment.

“Marketing and member engagement efforts, when designed and managed effectively, are investments that help drive performance and ultimately benefit members,” she added.

More Coverage

Originally published as Super funds splash members’ cash, hand millions to CFMEU