Stocks hit new record high, pulled higher by global moves

Aussie shares have rocketed more than 18 per cent higher in just nine months, but stockbrokers see a more subdued future.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s share market has broken through the 8000-point barrier for the first time, but its new record highs may not hold for too long.

The benchmark S&P/ASX 200 index hit 8037 points during trading on Monday before closing 58 points higher at 8017.6, up 0.7 per cent for the day.

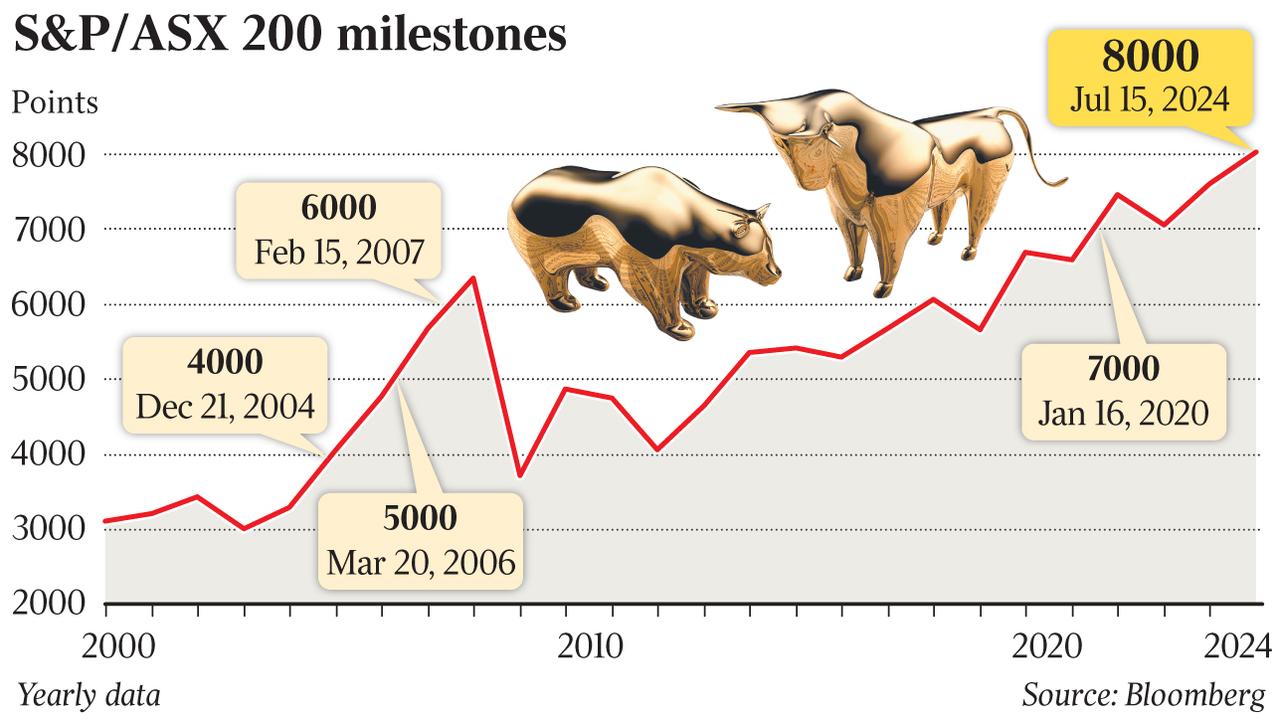

It only took 4.5 years for the index to rise from 7000 to 8000 points, after taking 13 years to get from 6000 to 7000 because of the carnage of the global financial crisis.

Shaw and Partners senior investment adviser Jed Richards said he was taking a conservative approach to the market because Aussie company valuations were stretched.

He said Aussie shares were being “dragged along behind” the booming US stockmarket, which had tech companies delivering surging profits and strong growth outlooks.

“But we don’t have the growth that they have got,” Mr Richards said.

“You have to have the earnings to back up the higher prices.

“To think we were only 6800 in October last year, that’s an incredible rally.”

Mr Richards said the domestic rally could come unstuck when local companies delivered earnings results that did not match the stellar performance of US stocks.

IG market analyst Tony Sycamore said some sectors of the Australian market were “looking a little rich”.

“There’s pockets looking stretched, particularly the banks, but we have earnings season starting in about a month from now,” he said.’

Mr Sycamore said July was historically one of the best-performing months for Australian shares so the current strength could continue. “And then in the earnings season I think we will get our usual mix of beats and bombs,” he said.

Mr Sycamore said a 1000-point gain by the ASX 200 was not as significant today as it was when the market was 3000 or 4000 points because the percentage change was now smaller, but “any upside milestone is a good milestone”.

He said Aussie shares had benefited from talk in the US that an interest-rate cut there in September was now a near-certainty, while New Zealand’s central bank was also hinting at rate cuts.

“It means that chances of another rate hike here in Australia are somewhat diminished,” he said.

“If inflation is cooling elsewhere, you probably have to assume that it’s going to cool here as well.”

Australia’s Consumer Price Index figures, due for release on July 31, would be closely watched, but the global movements gave our Reserve Bank more breathing space to stay on hold, Mr Sycamore said.

TIME TAKEN FOR ASX 200 TO HIT 1000-POINT MILESTONES

2000: July 1987, 21 months

3000: March 1999, 12 years

4000: December 2004, 5 years and 10 months

5000: March 2006, 15 months

6000: February 2007, 11 months

7000: January 2020, 13 years

8000: July 2024, 4.5 years

Source: IG

Originally published as Stocks hit new record high, pulled higher by global moves