Waratah Minerals fills its coffers to push Spur exploration into overdrive

Waratah Minerals is raising $8.4m through a placement to extend the Spur gold corridor and test the Breccia West porphyry.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Waratah Minerals raising $8.4m through placement to accelerate exploration at its Spur copper-gold project

Special Report: Waratah Minerals has received a vote of confidence from investors who backed an $8.4m placement to accelerate exploration activity at its Spur copper-gold project in NSW’s Lachlan Fold Belt.

Firm commitments were received from institutional, sophisticated and professional investors for the placement of 30.5 million shares priced at 27.5c.

This represents a 10% discount on the last traded price of 30.5c on May 7, 2025, and premiums to the 5, 10 and 15-day volume weighted average prices.

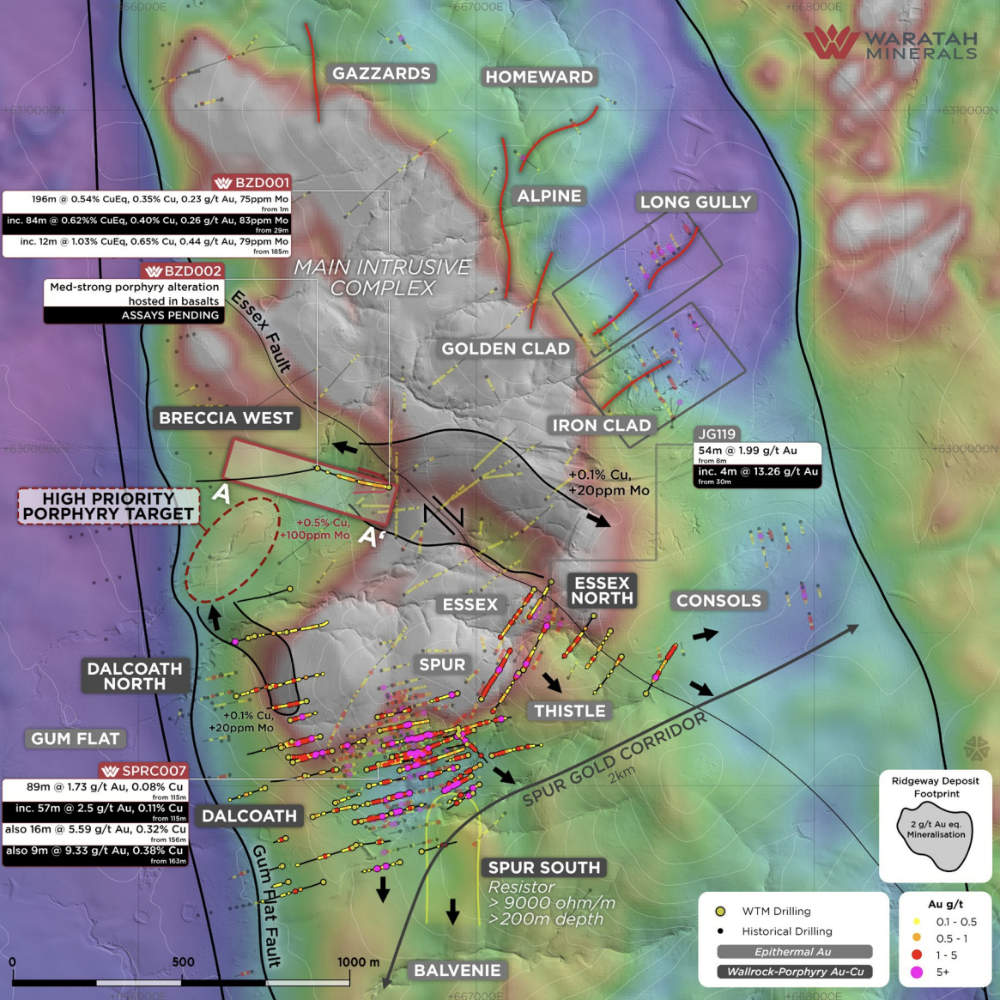

Proceeds will enable Waratah Minerals (ASX:WTM) to accelerate exploration activity at Spur to follow-up on recent encouraging drill results with a focus on the Spur gold corridor where epithermal mineralisation has been mapped along 1km of strike.

Previous drilling has returned results such as 11m grading 10.82g/t gold from 154m (SPRC002), 89m at 1.73g/t old and 0.08% copper from 115m (SPRC007) and 196m at 0.54% copper equivalent – 0.35% copper and 0.23g/t gold – from 1m (BZD001).

“This cash injection will accelerate our exploration activity targeting epithermal gold at the Spur Gold Corridor and porphyry copper-gold at Breccia West,” managing director Peter Duerden said.

“It is very exciting to have these opportunities at a time of historically strong gold and copper prices, against a backdrop of heightened exploration efforts by the world’s major mining companies across the Lachlan Fold Belt.

“With our strategic location, only 5 kilometres west of Newmont’s Cadia Valley project, and our accomplished and dedicated team, we are ready and funded for a period of aggressive and systematic drilling that has the potential to unlock material value for shareholders.”

Spur project

The Spur copper-gold project sits within the Macquarie Arc of the Lachlan Fold Belt, which hosts world-class gold-copper mines such as Cadia along with high value, gold-rich porphyry and epithermal deposits.

It is surrounded by recent investments by gold majors such as Newmont, AngloGold Ashanti and Gold Fields.

Exploration at Spur has defined a zone of widespread epithermal sulphide stringer/lode mineralisation and porphyry alteration.

This is interpreted to be the upper levels of a broader porphyry system as seen at major East Lachlan deposits such as the 9.6Moz Cowal and 6.4Moz Boda projects.

Porphyries also tend to form in clusters over several kilometres and are vertically extensive, which could be potentially very lucrative for the company.

WTM has identified two high-value targets at the project.

The first is the epithermal gold hosted within the Spur gold corridor on the southern margin of the main intrusive complex that has similarities to the Cowal gold corridor.

Just 20% of the target area has been tested to date, leaving it well positioned for continued expansion.

The other major target is the porphyry copper-gold mineralisation intersected at Breccia West, where recent hole BZD001 returned an intersection of 84m at 0.62% copper equivalent – 0.4% copper and 0.26g/t gold – from a depth of 29m.

Breccia West mineralisation, host rock and assay intercepts show strong similarities to Newmont’s nearby Ridgeway deposit.

With the raising under its belt, the company plans to test for extensions to the Spur gold corridor, which is open in multiple directions.

Notably, drilling will be carried out at Balvenie and Consols looking to double the strike length to 2km.

At Breccia West, WTM has identified a high priority ‘Porphyry core’ drill target ,marking the intersection of mineralised magmatic -hydrothermal breccia and magnetite anomaly in wallrock position.

This article was developed in collaboration with Waratah Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Waratah Minerals fills its coffers to push Spur exploration into overdrive