Up, Up, Down, Down: Here’s how the US-China trade war impacted commodities in April

Gold and uranium rose in April but the impact of the US-China trade war loomed large over commodity markets.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Gold and uranium were the only winners among our eight key Up, Up, Down, Down commodities after hitting new highs in April

Coal, lithium, nickel hit multi-year lows

Iron ore, copper rocked by tariffs, but rare earths capture imagination in spite of price drop

WINNERS

Gold

Price: US$3302.50/oz

% Change: +6.00%

There's nothing that gets the punters going like gold right now.

Futures over in the States charged as high as US$3500/oz after Donald Trump's tariffs on all and sundry sent markets into a tailspin and investors chased sexier forms of safe haven.

US bonds, the investing version of staying in on Friday night to watch reruns of Grand Designs, went haywire and the US dollar dropped hard, sending money flocking into gold.

That subsided somewhat when the Trump Administration pulled a reverse ferret, sending bullion falling into the end of the month. No worries for gold producers, who are tracking to pull in stonking profits this year with spot margins sitting at upwards of $3000/oz plus or minus some hedging and additional royalty payments.

- Investment demand for gold rose 170% year on year in the March quarter, with gold demand hitting a level for a March quarter not seen in nine years.

- ETF inflow remained strong in April, with Chinese inflows immediately after Liberation Day exceeding flows into Chinese ETFs through all of January-March.

DOWN

- Gold prices dipped after hitting their all-time high, coming under pressure as Donald Trump's stance on China trade tariffs softened.

- Chinese gold sales heading into the Labour Day public holiday week also put pressure on the gold price, with around 1Moz of bullion liquidated from Shanghai futures and gold exchange holdings ahead of the break.

READ

Still Going Strong: Gold demand hits a NINE-year March quarter high

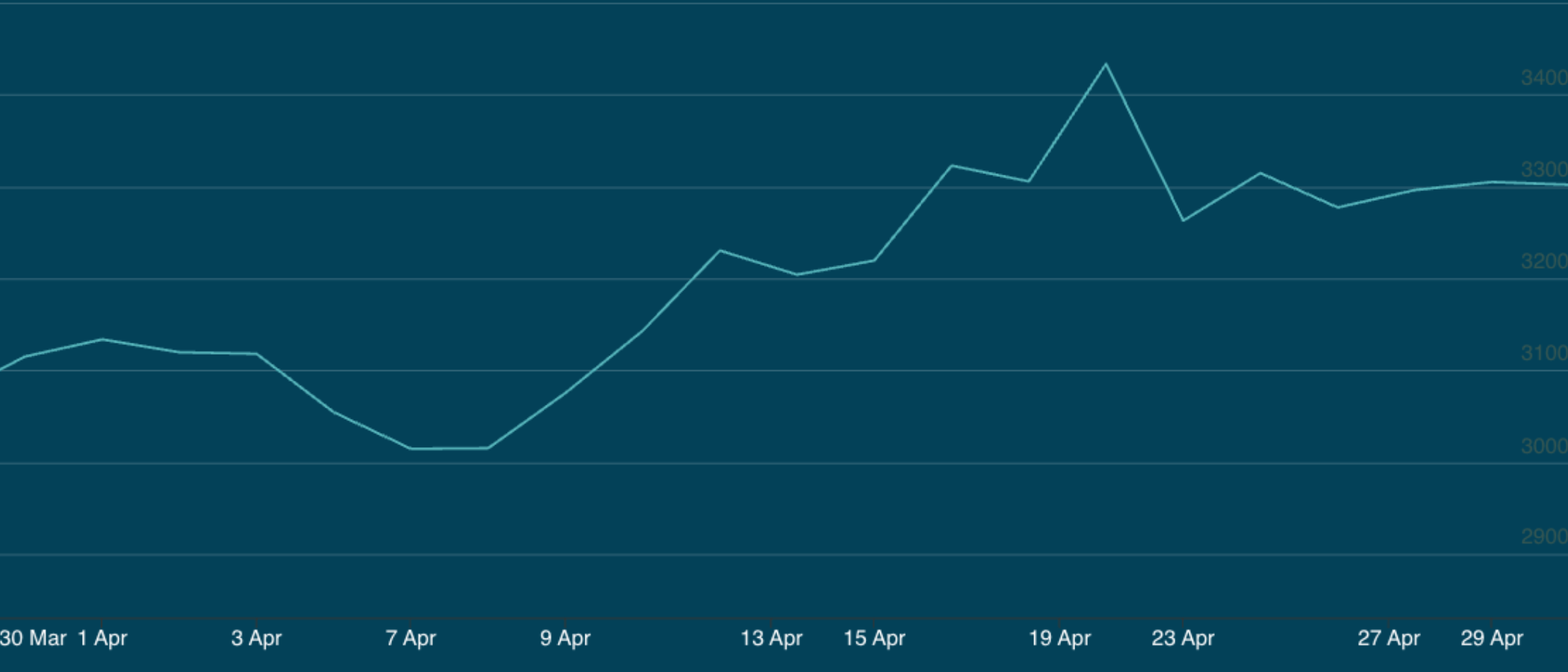

Uranium (Numerco)

Price: US$67.50/lb

% Change: +5.05%

Spot uranium prices finally took a turn back for the better, climbing sharply at the end of April and after month's end.

They're now at US$70/lb, heading back in the direction of contract based term prices which are hovering around US$80/lb and more accurately reflect prices being accepted by utilities.

A major trigger was a disappointing March quarter for the world's largest producer Kazatomprom. The street is growing less certain of its ability to hit guidance this year after a 14% QoQ drop in yellowcake output from its Kazakh mines.

UP

- Cameco's Tim Gitzel told analysts on an investor call that as much as 70% of utility requirements for the next two decades remains uncontracted, suggesting utilities will need to return to the market in a big way.

- Deep Yellow (ASX:DYL) delayed FID again on its Tumas mine in Namibia, suggesting much higher prices were needed to incentivise new supply, prolonging emerging deficits.

DOWN

- It matters little on the global scale, but the strong election win by Anthony Albanese's Labor Party over Peter Dutton's Liberal-National Coalition will chill momentum from the nuclear and uranium lobbies in Australia.

- Chinese scientists have built a thorium reactor out in the Gobi Desert. Could it disrupt the uranium market and nuclear fission sector? It's way to early to even consider it at this stage, but it's also hard to find uranium bears, so this is our second 'down' for this month.

READ

Uranium price rebound is overdue, and these African projects are getting ready

LOSERS

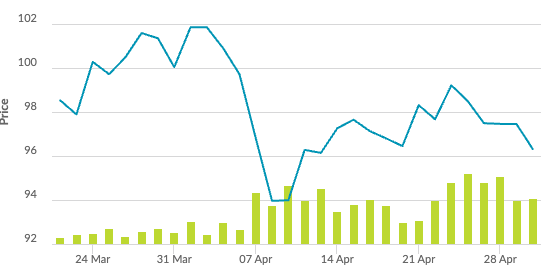

Coal (Newcastle 6000 kcal)

Price: US$97.50/t

% Change: -5.75%

Coal was put under pressure in April, with Newcastle coal futures hitting a four year low of US$93.70/t on April 23, according to Trading Economics.

A ramp up in Chinese domestic coal output and mild Asian winter have combined to reduce demand for seaborne coal at a time of strong supply.

Met coal prices on the other hand rose at the end of the month after a fire at the Moranbah North mine in Queensland and solid steel production numbers out of China and India. Futures surged as high as US$198/t in early April and are now at US$185/t, having crashed in the US$160s in March.

UP

- Glencore has crystallised plans to cut production at Cerrejon in Colombia by up to 10Mt in 2025, a move which could thrust the conglomerate into conflict with local unions.

- Strong quarterly and half year results from New Hope Corp (ASX:NHC), Whitehaven Coal (ASX:WHC)

and Yancoal Australia (ASX:YAL) showed many Australian miners could still make cash with the right cost base and product mix.

DOWN

- Around 10-15% of the coal market is now lossmaking, according to Commbank's Vivek Dhar.

- That means prices could rebound, but high inventories and weaker Chinese demand will likely keep prices in check without mine closures.

READ

Counter Cycle: ‘Sex and violence’ in the US could turn into gold for resources stocks

Rare Earths (NdPr Oxide)

Price: US$56.36/kg

% Change: -7.75%

The fortunes of the rare earths market and rare earths stocks diverged as Trade War mania sent critical minerals explorers soaring at the same time prices were coming off the boil in China.

One big question now is how relevant pricing indices will be if Western governments can subsidise supply chains outside the rare earths heartland into existence.

Lynas (ASX:LYC) is looking to begin producing dysprosium and terbium later this quarter, two heavy rare earths recently placed under export controls by the Chinese Government. It's looking for western buyers, delivering the promise of a supply chain for those metals in which the Chinese price is not relevant.

UP

- Analysts are beginning to project higher consumption for rare earth magnets as tech companies begin to commercialise humanoid robots in China, the US and elsewhere, potentially doubling the size of future rare earths demand.

- Executive orders from Donald Trump's US Administration, and rumours about a planned rare earths stockpile, have sent rare earth stocks on a tear. Lynas is up ~30% YTD and smaller rare earth stocks are also catching tailwinds.

DOWN

- Rare earth demand in the key market of China remains subdued, with the Shanghai Metals Market reporting the market is heading into an 'off-season' for purchases.

- Some market participants are concerned critical minerals stockpiles like the one proposed by Australia could bring uneconomic projects to market, subduing or distorting market pricing in the years ahead.

READ

The US wants to stockpile rare earths, and these miners are running hot as a result

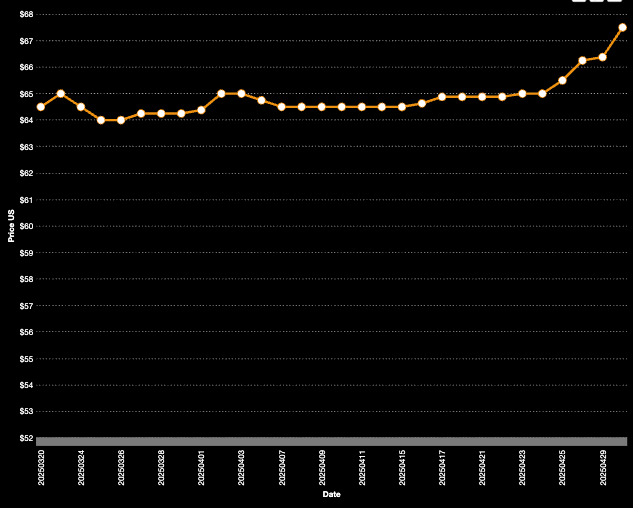

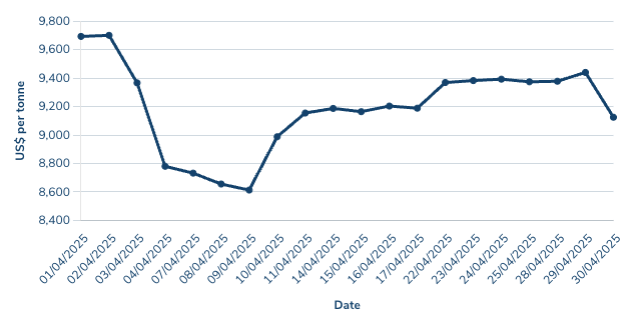

Copper

Price: US$9125/t

% Change: -6.02%

Copper fell at the whim of US President Donald Trump, with the initial surge from the fear tariffs could be imposed on the metal drowned out by the magnitude of the economic damage wrought by reciprocal tariffs.

The market remains delicately balanced, with Chinese buying of inventory stock and creeping backwardation showing there remains tightness in the physical market.

UP

- Copper supply remains a delicate thing, with a death and subsequent outage at BHP's Antamina JV in Peru leading to a late month recovery in prices.

- The threat of copper specific tariffs remains live, with US prices still priced far above the LME benchmarks.

DOWN

- The International Copper Study Group expects to see surpluses of 289,000 tonnes for 2025 and 209,000 tonnes for 2026.

- The ICSG has also revised down its copper usage growth rate for 2025 from 2.7% to 2.4% on account of the trade war, slowing to 1.8% next year.

READ

Kristie Batten: As copper market tightens, Hillgrove is looking to grow

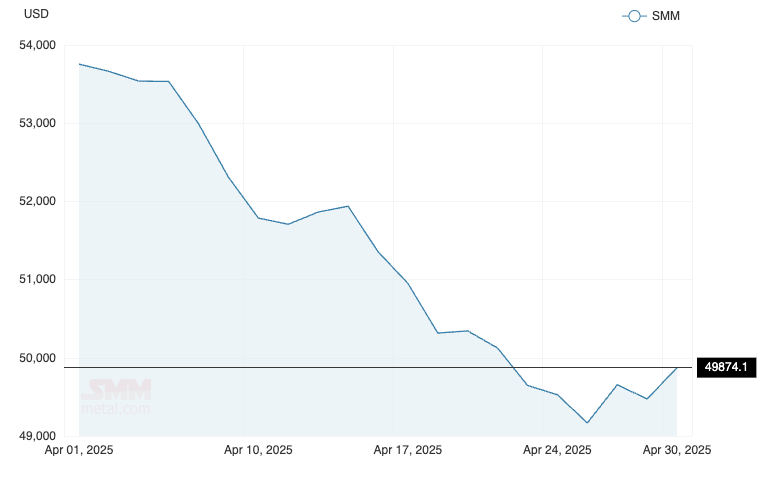

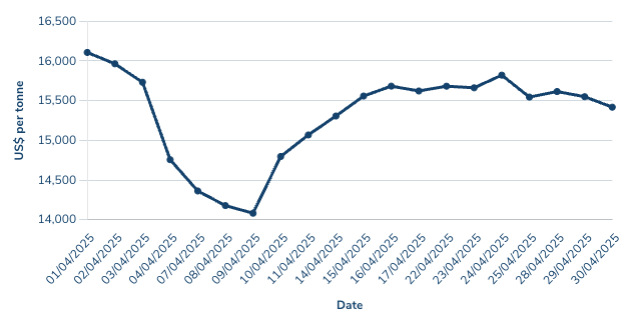

Nickel

Price: US$15,418/t

% Change: -3.14%

Three month LME nickel prices sagged as low as US$14,030/t during the month of April, a low point stretching back to August 2020.

That came as Trump's tariffs roiled markets and a surplus driven by a surge in Indonesian nickel supply, much of it bankrolled by China, kept supply-demand dynamics in check.

UP

- Indonesia has lifted taxes on nickel miners, something which could chill output from the island nation, though the 14-19% price linked royalties will be far higher than rates for refined products like ferronickel and matte.

- ASX bellwether Nickel Industries (ASX:NIC) delivered a strong set of quarterly results, showing it remains profitable even with subdued prices.

DOWN

- The nickel surplus will rise from 179,000t in 2024 to 198,000t in 2025, according to the International Nickel Study Group.

- Supply is expected to rise from 3.363Mt in 2023 and 3.526Mt in 2024 to a forecast 3.735Mt in 2025. Demand will rise as well, though alternative battery chemistries like lithium-iron-phosphate mean growth from the EV market is slower than previously predicted.

READ

High Voltage: Miners welcome Aussie $1.2bn critical minerals stockpile plan

Iron ore (SGX Futures)

Price: US$96.31/t

% Change: -4.63%

Iron ore largely weathered the storm when it comes to tariffs, and fears they would kill the export market for Chinese steel.

That market has propped up the sector, where mills have largely struggled to return profits in the past couple years.

Despite shrinking margins steel production for April is likely to be solid, with MySteel reporting utilisation rates across the blast furnaces it surveys at 92%.

Rio Tinto remains bullish on the outlook for Aussie iron ore, pledging to invest upwards of US$13bn on replacement mines in the next three years.

UP

- China surprise to the upside with a 5.4% lift in GDP in the March quarter.

- Iron ore bosses remain bullish on the downside limits for iron ore, with MinRes CFO last month saying there was support around US$90/t as it looks to get production up and costs into the US$40s/t range at its stuttering Onslow Iron project.

DOWN

- Andrew Forrest delivered a warning to Australia in a speech suggesting high grade African iron ore from the Simandou mine could hurt the Aussie market. It all came as part of a pitch for green iron funding, if you want to be cynical (Forrest's Fortescue owns its own African project at Belinga in Gabon).

- Marginal producers are having to reconsider their investment strategies, with Grange Resources (ASX:GRR) withdrawing a proposal to amend its State Environmental Approval for the Southdown magnetite project near Albany in WA.

READ

Bulk Buys: Majors stay bullish on bulks, even as fears circle

Lithium (Fastmarkets Carbonate CIF China, Japan and Korea)

Price: US$8700/t

% Change: -6.95%

Lithium prices continue to struggle under the weight of a supply rush that took spot pricing from over US$80,000/t to under US$10,000/t for key chemicals between 2022 and 2024.

Fastmarkets lithium carbonate pricing in China, Japan and Korea has recently fallen to its lowest level in four years.

With so much pressure on producers, it can only be a matter of time before supply discipline really starts to take hold.

UP

- Albemarle boss J. Kent Masters estimated some 40% of lithium producers could be lossmaking. Generally when you're that far into the cost curve something has to give.

- EV sales growth is stronger than some naysayers would have you believe, clocking in at around 30% in the March quarter.

DOWN

- CATL unveiled the second generation of its sodium ion batteries, a product its founder Robin Zeng thinks could eventually replace half of all LFP car batteries

- Supply cuts could prove sticky if low cost operations in the US, which could see subsidies and support from the Trump Admin, and Argentina, led by Rio Tinto, are brought online despite low prices.

READ

Lithium could turn quickly, and Argentina is the place to be

OTHER METALS

Prices correct as of April 30, 2025.

Silver

Price: US$32.23/oz

%: -5.37%

Tin

Price: US$31,348/t

%: -14.45%

Zinc

Price: US$2952.50/t

%: +3.52%

Cobalt

Price: $US33,700/t

%: -0.78%

Aluminium

Price: $2399.50/t

%: +5.27%

Lead

Price: $1957.50/t

%: -2.70%

Graphite

Price: US$415/t

%: -3.49%

Originally published as Up, Up, Down, Down: Here’s how the US-China trade war impacted commodities in April