These companies with more than 3Moz gold resources could offer a big payoff

With gold at record prices, these companies with resources in excess of 3Moz and a clear pathway to production are poised to explode.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Gold prices have hit a new record high as investors flock to the safe haven asset

Attention turning towards gold explorers with established resources and clear pathways to production

Companies with large resources of more than 3Moz could stand to benefit big time

Gold is in the midst of a bull run that has seen prices hit a new record of US$3115 an ounce at the time of writing, as investors continue to flock to the safe haven asset amidst ongoing market uncertainty.

The demand for the precious metal has been accompanied by growing interest in gold companies that has seen the ASX All Ordinaries Gold (Sub Industry) index rise 43.7% from 7493 points a year ago on April 2, 2024 to 10,767 on March 27, 2025.

It has also seen a rise in merger and acquisition activity in the sector with Northern Star Resources' (ASX:NST) move to acquire De Grey Mining (ASX:DEG) in an all-scrip deal worth $5 billion in December last year and Ramelius Resources' (ASX:RMS) $2.4bn cash and share deal to acquire Spartan Resources (ASX:SPR) in mid-March 2025 being standouts.

While most of the interest has been focused on gold producers, interest has also started to trickle down to explorers thanks to the growing realisation that even companies with relatively small resources or formerly uncommercial ones might have a pathway to quick commercial production if the stars align in just the right way.

Mineralisation that lends itself to easy processing – like gravity separation – or proximity to existing processing plants, are just some factors that are pinging radars.

However, the real prize might well be companies that have big resources exceeding 3 million ounces of gold and have already started or are on the fast-track to production.

Here are some examples that Stockhead has put together.

Ausgold (ASX:AUC)

First up is Ausgold whose Katanning project in the emerging southwestern Yilgarn province of Western Australia ticks off all the right boxes.

The project has a shallow, open-pittable resource of 3.04Moz gold at an average grade of 1.06g/t that includes an ore reserve of 1.28Moz at 1.25g/t.

Mining costs are expected to be low thanks to the anticipated low-strip ratio while the use of a straightforward carbon-in-leach processing plant and expected recoveries of about 90% should also keep processing costs under control.

The company is currently working on a definitive feasibility study that is due for release in Q2 2025 which is based on a plant with proposed throughput of 3.6 million tonne per annum and a 10-year mine life that its preliminary mining schedules have indicated will dig out the higher grades during the first five years of operation.

Plant design is largely complete with pricing underway.

Efforts to further grow the resource are also underway, an effort that’s likely to bear fruit given AUC’s strong track record, which includes the delineation of more than 2Moz of gold over 10 years.

This has been supported by assays from reverse circulation drilling at the Southern Zone, which returned zones of exceptional high-grade gold mineralisation topping out at 10m at 10.55g/t gold from a down-hole depth of 42m.

Brightstar Resources (ASX:BTR)

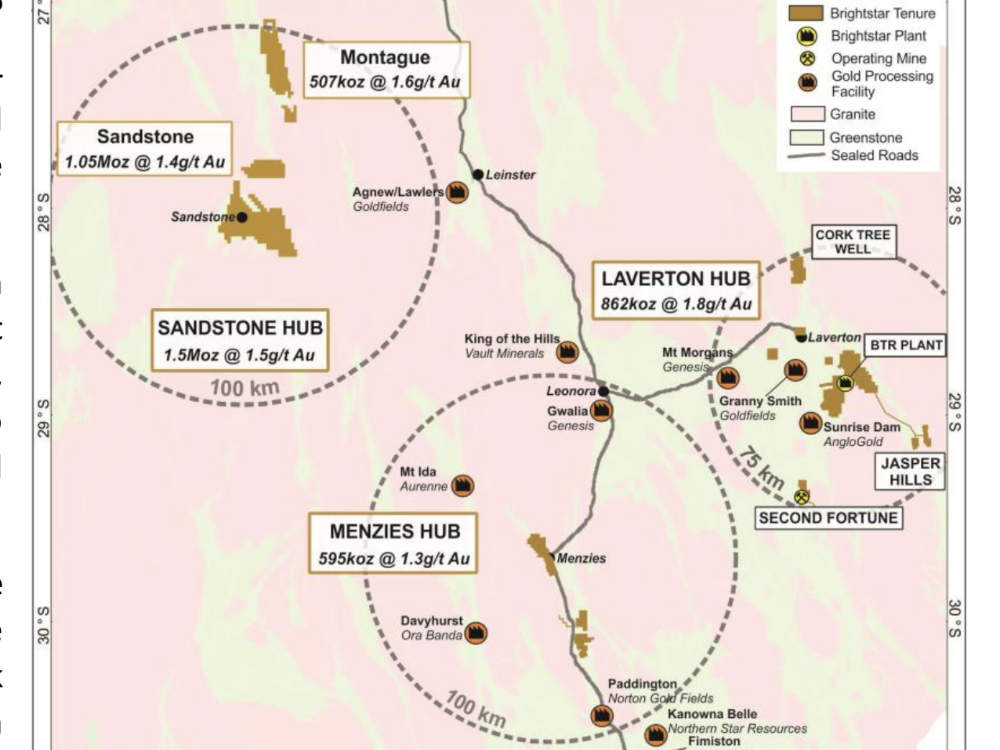

Unlike its peers presented here, Brightstar has already started gold production albeit through an ore purchase agreement with Genesis Minerals (ASX:GMD) that covers the delivery, sale and processing of up to 500,000t of ore from the company’s Laverton Hub to Genesis’ Laverton mill.

The company is well positioned to supply consistent ore volumes for regular processing parcels, which will generate steady revenue throughout 2025 to support its aggressive exploration and development initiatives across its Menzies, Laverton, and Sandstone hubs.

Following its acquisition of Alto Metals in December 2024, BTR currently has more than 3Moz of gold resources spread out across its three hubs with half of that found at the Sandstone hub while Laverton lays claim to the highest average grade of 1.8g/t for its resource of 862,000oz.

Production at Laverton under the OPA will source ore from its operating Second Fortune underground mine, existing stockpiles and the Fish underground project that’s currently under development.

BTR is also advancing definitive feasibility studies for the Sandstone and Menzies hubs in H1 2025.

Nova Minerals (ASX:NVA)

Stepping away from Australia, we have Nova with its Estelle gold and critical minerals project in Alaska’s Tintina gold belt that is described as one of the world’s largest undeveloped projects in a Tier 1 jurisdiction.

And with a resource of 9.9Moz of gold that’s accompanied by high grades close to surface and plenty of room to push it past the 10Moz mark, Estelle certainly earns its position.

The company is currently preparing to drill at the 1.24Moz RPM deposit to follow up on year’s drilling program that extended the high-grade core zone and returned 20 broad intercepts of more than 5g/t gold including one at 52.7g/t gold.

It has also started mine engineering and optimisation studies at RPM that will feed into the pre-feasibility study that is currently underway.

The PFS and the upcoming wider project expansion studies will help Nova decide on whether to proceed with a start-up mine at RPM or a larger-scale option.

The first strategy would involve organic expansion using internal funds. The second, to include the bulk tonnage 6.64Moz Korbel deposit plus other regional prospects, would leverage the interest of larger miners as partners.

The Korbel deposit is part of the Korbel Valley, which already has a resource of 8.65Moz and remains wide open from surface.

NVA is advancing the Korbel pit design to demonstrate the potential of an expanded project, which would include the Korbel Main and Cathedral deposits providing ore feed to the proposed long-life Korbel hub processing plant.

Theta Gold Mines (ASX:TGM)

Over in South Africa, Theta has built a 6.1Moz gold resource at the Eastern Transvaal Gold Fields region where the country’s gold mining industry began almost 130 years ago.

A feasibility study completed over the Beta, CDM, Frankfort and Rietfontein mines – collectively the TGME Underground Project – in July 2022 had highlighted their potential to deliver net present value of $432m.

Its base case will have a mine life of 12.9 years to mine 1.24Moz of contained gold to deliver $500m in post-tax free cash flow.

During the December 2024 quarter, the company advanced development plans with Power China’s subsidiary as the preferred engineering, procurement and construction partner to build Stage One of the TGME gold plant and tailings storage facilities.

It is also in advanced discussions with several other international debt funders to provide part of the CAPEX requirements for the project.

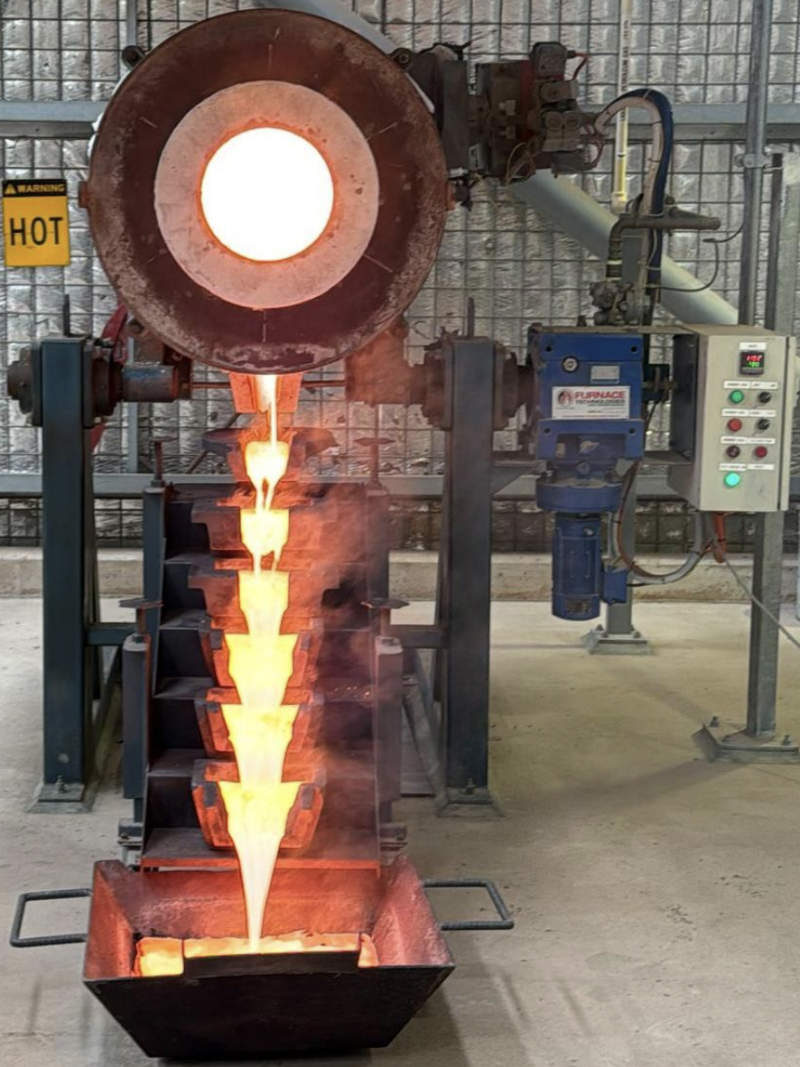

TGM has already finalised the design for the processing plant for TGME that will produce gold doré on site and is currently examining the potential to add 174,000oz of surface gold to the upfront mine schedule.

West Wits Mining (ASX:WWI)

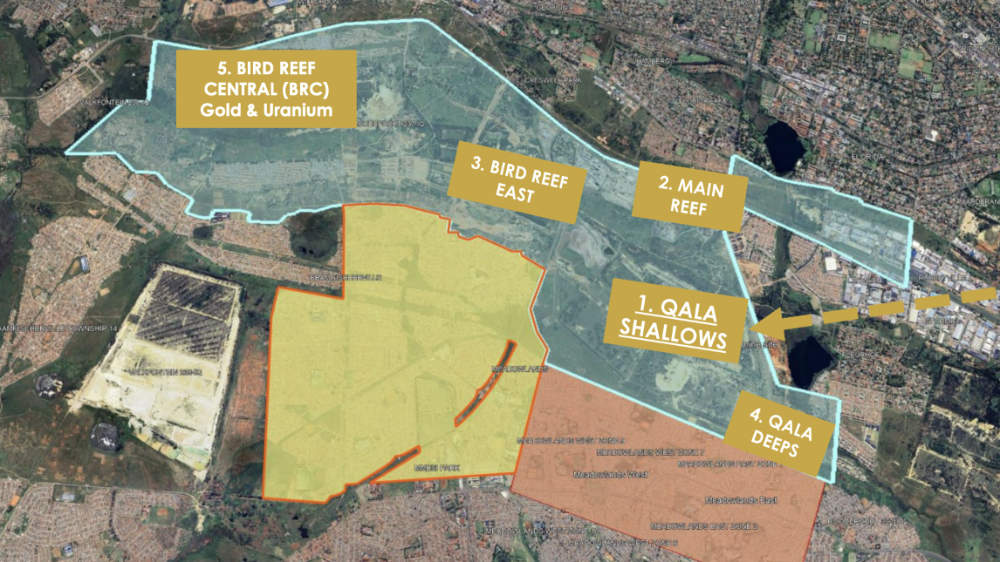

Rounding out our line-up is West Wits with a global resource of 5Moz at 4.66g/t gold at the famed Witwatersrand Basin in South Africa.

This resource has a high level of confidence as 65% is contained within the indicated and measured categories that provide enough certainty for mine planning.

WWI is focused on developing Qala Shallows, which has a resource of 10.28Mt at 3.04g/t for just over 1Moz of contained gold.

Under the definitive feasibility study, the project is expected to produce 924,000oz of gold over a 17-year mine life to deliver post-tax life-of-mine cashflow of US$522m at a conservative gold price of US$2200/oz.

This will deliver post-tax net present value and internal rate of return – both measures of the project’s profitability – of US$366m and 72% respectively.

It recently secured a credit approved term sheet for a ZAR 902.5m (~US$50m) senior debt syndicated loan facility from the Industrial Development Corporation of South Africa and major South African bank Absa, which represents ~55% of all project for Phase 1 of the project.

The company expects to use a combination of equity and leveraging early revenues to fund the remaining 45%.

WWI will carry out underground drilling to convert resources to reserves as decline development progresses in order to maintain a minimum level of reserves.

At Stockhead, we tell it like it is. While Brightstar Resources and West Wits Mining are Stockhead advertisers, they did not sponsor this article.

Originally published as These companies with more than 3Moz gold resources could offer a big payoff