Rio enters the lithium chat: Counter-cyclical deal has lithium bosses primed for more M&A

Pursuit Minerals boss Aaron Revelle says BHP and Rio Tinto’s M&A splurges in South America suggest more deals will follow.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Rio Tinto and BHP spend >$13.2bn on lithium and copper projects in Argentina

Boss of ASX junior Pursuit Minerals Aaron Revelle says recent M&A activity signals the West's confidence in Argentina's mining sector

Lithium carbonate prices have started to show signs of improvement

A sea change in Argentina's political landscape with the election of its now President Javier Milei late last year has led to dramatic reforms to the country's resources sector and has attracted global majors into its ripe lithium scene and long-dormant copper sector.

No longer thought of as 'nice deposit, wrong country', Milei and his cabinet have given Argentina's long-stagnant resources sector the kiss of life, spurring a wave of global majors to pile into projects.

Both Rio Tinto (ASX:RIO) and BHP (ASX:BHP) have now entered the fray, pouring in upwards of $13 billion within the past three months, taking advantage of price bottoms and the Argentine Government’s new Incentive Regime for Large Investments (RIGI) scheme that provides attractive tax incentives for foreign companies.

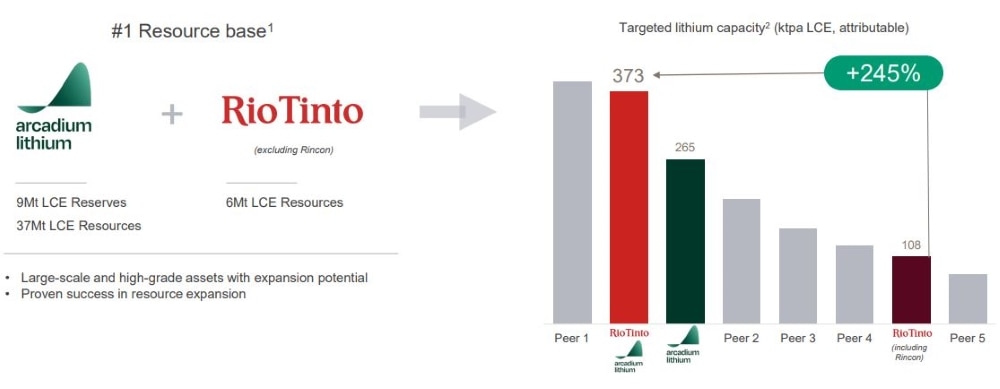

The latest move to shake up the country's mining scene is Rio's $10 billion deal to acquire Arcadium Lithium (ASX:LTM), a counter-cyclical investment that cemented the mining giant's belief in lithium's long term prospects, direct lithium extraction processing tech and Argentina's status as an emerging mining jurisdiction.

And it's not just Arcadium investors sitting up and taking notice of what could be a tectonic shift in the global lithium landscape.

What it means for juniors in the region

We spoke with lithium hunter Pursuit Minerals' (ASX:PUR) MD Aaron Revelle who sees South America – and particularly Argentina – as being a proxy for copper and lithium production looking forward.

Revelle's Pursuit is proving up its Rio Grande Sur project in the country's Salta lithium region, just recently wrapping up drilling to expand the existing inferred 251.3kt LCE at 351mg/L resource and says Argentina is extremely ripe for M&A activity.

“You’ve got both BHP and Rio collectively spending >$13bn to acquire assets in the country and it’s not new news that Chinese bigwigs such as Ganfeng have been sniffing around looking to snap up more deposits,” Revelle says.

“Arcadium is a very significant transaction for Rio and Arcadium's Fenix has been a top four lithium legacy asset since the 90s with top shelf lithium-from-brine grades and a stable customer base.

“Then you have linking the operation’s (DLE) processing technique with its existing Rincon asset, which would be the first logical step after the acquisition is complete in my view."

Reville said the region is ripe for more corporate activity as large players look to position themselves.

“Add to that the Olaroz operation and its other less advanced lithium assets being developed in Europe and Canada, there’s a lot of synergy for well, frankly, for Rio to become the world’s number one lithium producer over the next 5-10 years," he said.

"It's a testament to Argentina's reforms and the desire by the West to shore up ex-China supply chains of critical minerals.

"I wouldn't be surprised if there's more M&A activity in the region in the coming months."

Buying the bottom

With Western governments desperate to see ex-China supply chains for critical minerals, for decades have predominantly been produced and refined in the Middle Kingdom, global mining majors are starting to make further inroads into South America’s mining scene.

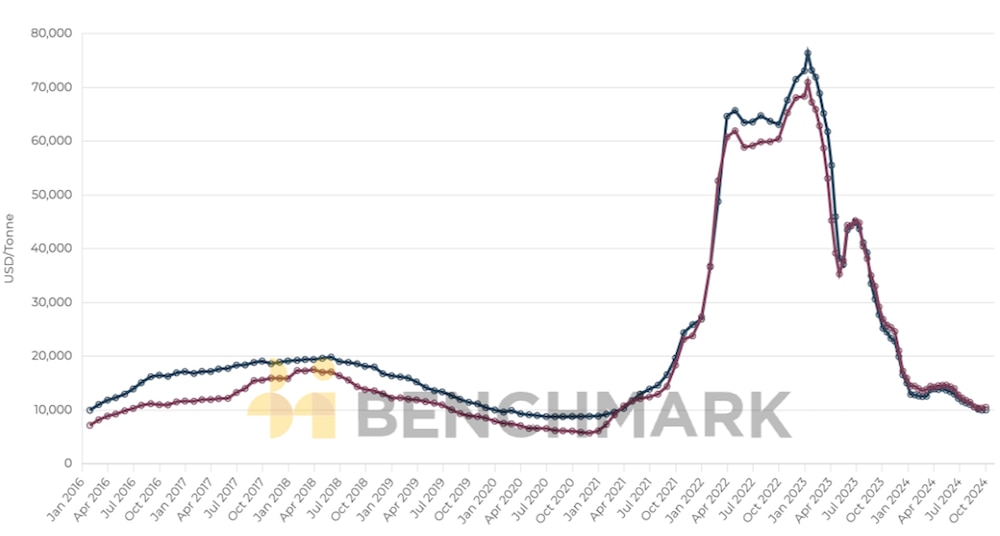

Analysts reckon lithium prices have hit the proverbial floor, with Fastmarkets reporting Chinese carbonate prices rising slightly up from ~US$10,400/t to ~US$10,800/t in the past week.

That's spurred a lot of activity in the lithium scene, which we'll lay out for you below.

‘Started from the bottom’ now Rio’s here

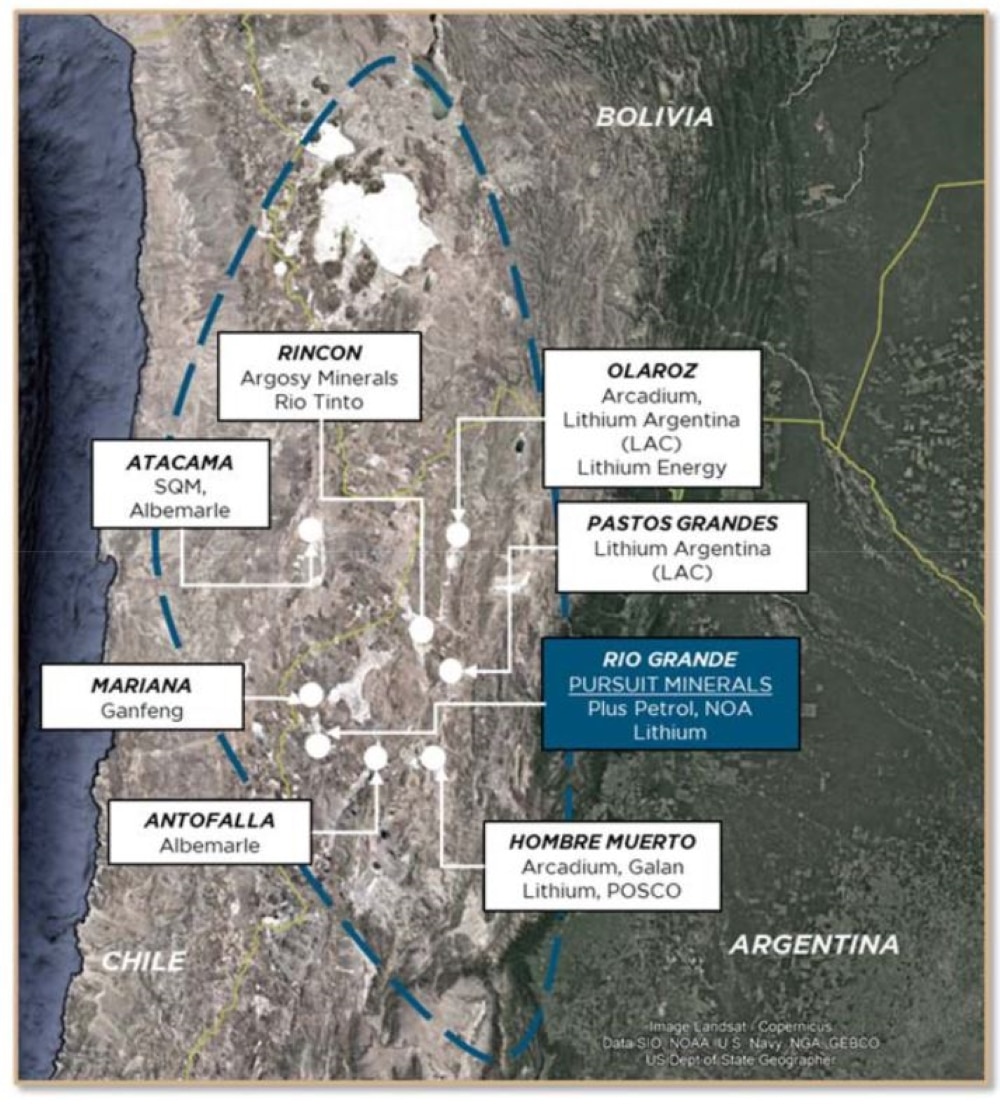

Argentina’s lithium-brine scene is well known as part of South America’s Lithium Triangle and Rio has just forked out $10bn to acquire Arcadium Lithium (ASX:LTM) and its 37Mt LCE global resource base.

While it has operations under development in Canada and soon to shut in Australia, the South American country is the lynchpin of Arcadium's business, with its existing 75,000tpa capacity at the Olaroz and El Fenix projects and additional stages planned at both.

Add the under-construction Sal de Vida and Cauchari and Rio has the scale to rival Albemarle and SQM's Chilean brine assets.

While Rio already has exposure to lithium – notably via the troubled 118Mt hard rock Jadar project in Serbia – the $10bn purchase of Arcadium is a major step up, potentially placing Rio alongside Albemarle and SQM as one of the world's three largest lithium producers.

The deal also gives it additional exposure to the growing James Bay lithium hub in Quebec including the Whabouchi project, the Galaxy project which Arcadium put on pause back in August. Rio already had JVs in the area with Midland Exploration and Saga Metals Corp.

Rio's no stranger to Argentina's slice of South America's Lithium Triangle either after buying the Rincon project in Salta Province back in 2022 for $825m, which is set to get into production in the coming months, as well as investing US$335m in a nearby plant to produce 3000tpa of battery-grade lithium carbonate.

The miner could eventually produce up to 300,000t of lithium carbonate equivalent (LCE), according to Goldman Sachs analysts, assuming it invests in the growth of Arcadium's projects which were put on the backburner as lithium prices fell.

READ MORE: Monsters of Rock: Experts weigh in on Rio’s $10bn Arcadium Lithium deal

Argentina's RIGI scheme

Both Rio and its counterpart BHP, which made a ~US$3bn investment in two major copper JVs high in Argentina's Vicuna region high in the Andes, stand to be big beneficiaries of Argentina's RIGI, a mechanism designed to bring in bucketloads of foreign investment into the country – one of the promises the new President was elected on.

The reforms are geared towards the majors, of course, focusing on big projects between US$200m-US$900m that will receive a 10% discount to Argentina’s standard 35% industry tax rate, reductions in dividend and VAT taxes and benefit from stable international currency exchange regulations and protection from nationalisation.

And if recent history in South American nations is anything to go by – that last point is the real kicker.

“We are super delighted with the new legislation in Argentina, the RIGI legislation super attractive, and that's going to help us, not just in terms of an attractive tax scheme, but also in a downside scenario it provides a lot of protections for our investments in Argentina,” Rio’s CEO Jakob Stausholm said earlier this week.

More than Arcadium

Also pulling up stock in Salta Province is $60m market-capped Argosy Minerals (ASX:AGY) at its own Rincon project near Rio's.

It suspended the 2,000tpa LCE operation with prices sliding but has all the necessary infrastructure in place to prepare for a restart as prices recover.

While production's been halted, the producer has been busy further de-risking the project and recent hydrogeological modelling has indicated Rincon can extract lithium brine for up to 42 years to produce 12,000tpa LCE (or up to 22 years to produce 24,000tpa).

AGY says its current priority is completing project pre-development engineering works to a construction-ready stage for a 10,000tpa LCE run rate from Rincon to further de-risk the project.

And Galan Lithium's (ASX:GLN) dogged pursuit of developing its Hombre Muerto West lithium project may just pay dividends too.

While prices have been in the doldrums, the junior has inked a $40m prepaid offtake deal with Chengdu Cemphys and banked $25m in a cap raise to support the developed of its first phase development at HMW.

The 4000tpa LCE first stage is due to be completed by H2 next year.

Galan has received external interest in its assets, but turned down what it deemed a lowball US$100m cash and share offer from a minor DLE player based in the US called EnergyX.

Power Minerals (ASX:PNN) has announced the progression of a fully-funded JV with China's Heng Li Technology for its Pular lithium project, with all offtake set to flow to Heng Li.

Due diligence has been completed for the proposed JV and while it's still just a proposition, Heng Li brings its combined direct lithium extraction (DLE) and evap tech to the development.

PNN now has development agreements in place for the Incahuasi, Rincon and Pular projects which are all nestled within the Salta province.

BHP’s copper play

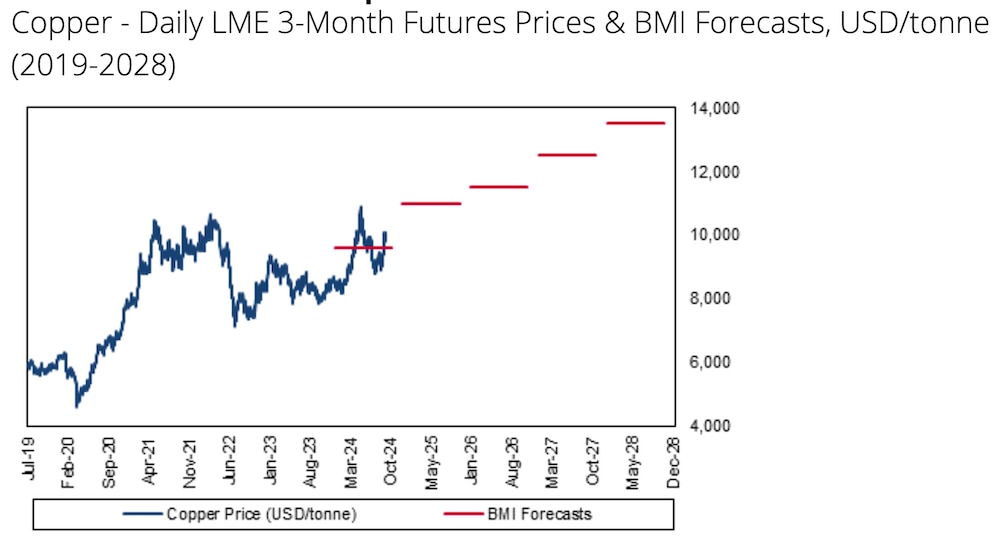

There’s reportedly 75.5Mt of copper reserves in Argentina – putting it in the same league as Russia and the Democratic Republic of Congo – two of the world’s largest producers, according to the nation’s mining chamber CAEM.

Estimates suggest production could jump from a miniscule 4000t this year to more than 1Mtpa by 2035.

The entry of global mining majors such as BHP into the Argentine copper scene bodes well for further M&A activity and explorers building up deposits in the region are potentially big beneficiaries.

Copper has already started to make a comeback. Analysts are bullish on the metal. According to BMI Commodity Insights, for example, prices are projected to rise towards US$14,000/t by the end of 2028 with shortages hard to avoid.

"Tides started to turn in September, fuelled by the latest wave of Mainland Chinese stimulus measures as well as support received from the first US Fed rate cut since March 2020 on September 18 2024," BMI said in its recent copper price outlook.

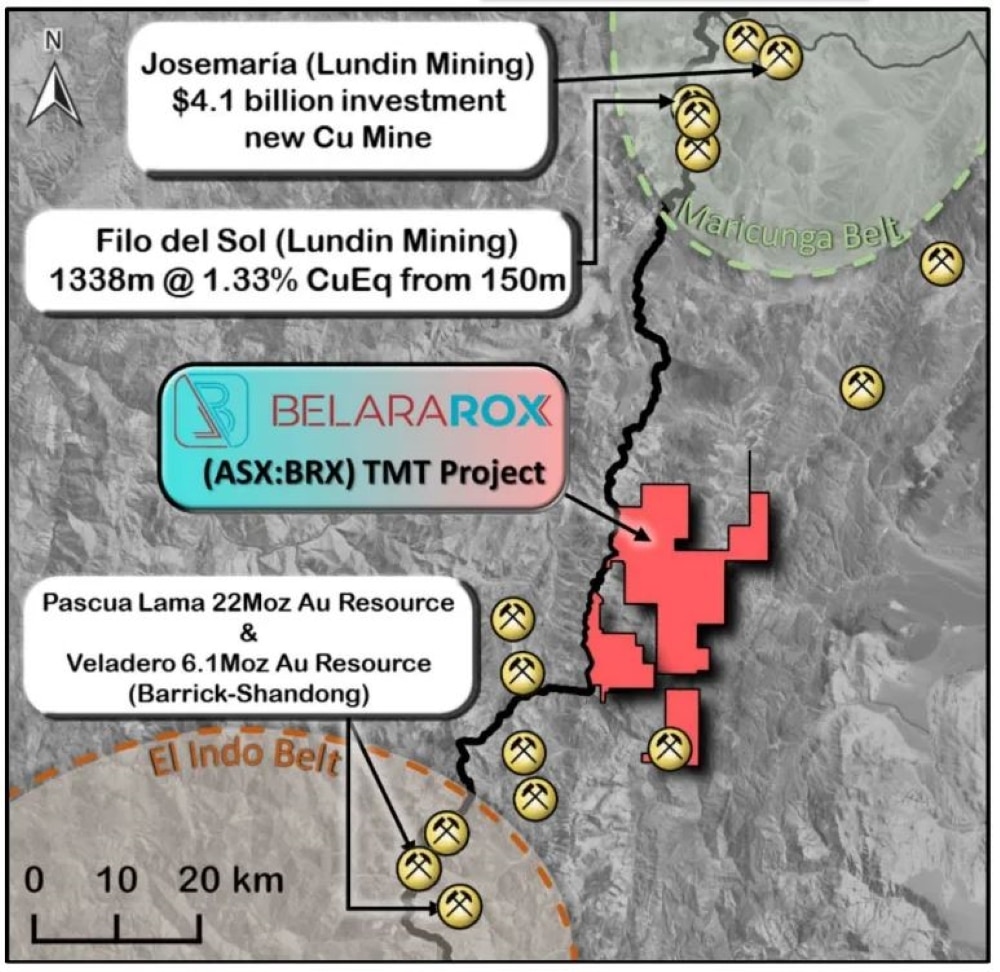

ASX junior Belararox (ASX:BRX) is one explorer with the potential to follow in the footsteps of BHP's target Filo Corp. Its Toro-Malambo-Tambo project sits to the south of Filo del Sol and BRX has boots on the ground exploring a 320km2 landholding that so far has cropped up 12 porphyry copper targets.

While still early days, maiden drilling of BRX’s Toro Malambo-Tambo (TMT) project is about to get underway.

M&A in Brazil

Previous to Rio's foray into Argentina, another renowned WA lithium miner Pilbara Minerals (ASX:PLS) also made waves in South America with the friendly acquisition of fellow Aussie lithium hunter Latin Resources (ASX:LRS).

The $581m takeover sees PLS add LRS' 77Mt at 1.24% Li2O Salinas project in Brazil to its portfolio and is right near US-based Sigma Lithium's already producing Grota do Cirilo which is looking to double plant capacity to 520,000t of concentrate through phase 2 and 3 expansions.

READ MORE: Kristie Batten: Brazil’s lithium potential in focus after Pilbara’s Latin takeover

At Stockhead we tell it like it is. While Pursuit Minerals, Galan Lithium and Belararox are Stockhead advertisers, they did not sponsor this article.

Originally published as Rio enters the lithium chat: Counter-cyclical deal has lithium bosses primed for more M&A