Micros with Majors: Here’s why Kingsrose thinks BHP’s Xplor program is a fine idea indeed

Kingsrose Mining believes BHP’s Xplor accelerator program will help drive much needed greenfields exploration.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Micros with Majors is Stockhead’s column profiling, and examining the stories behind, micro-cap ASX companies in partnerships with some of Australia’s, and the world’s, leading organisations.

Companies selected in the latest round of BHP’s Xplor program have good reason to be upbeat given that Kingsrose Mining (ASX:KRM) has described its selection in the very first round of the program in 2023 as “transformative”.

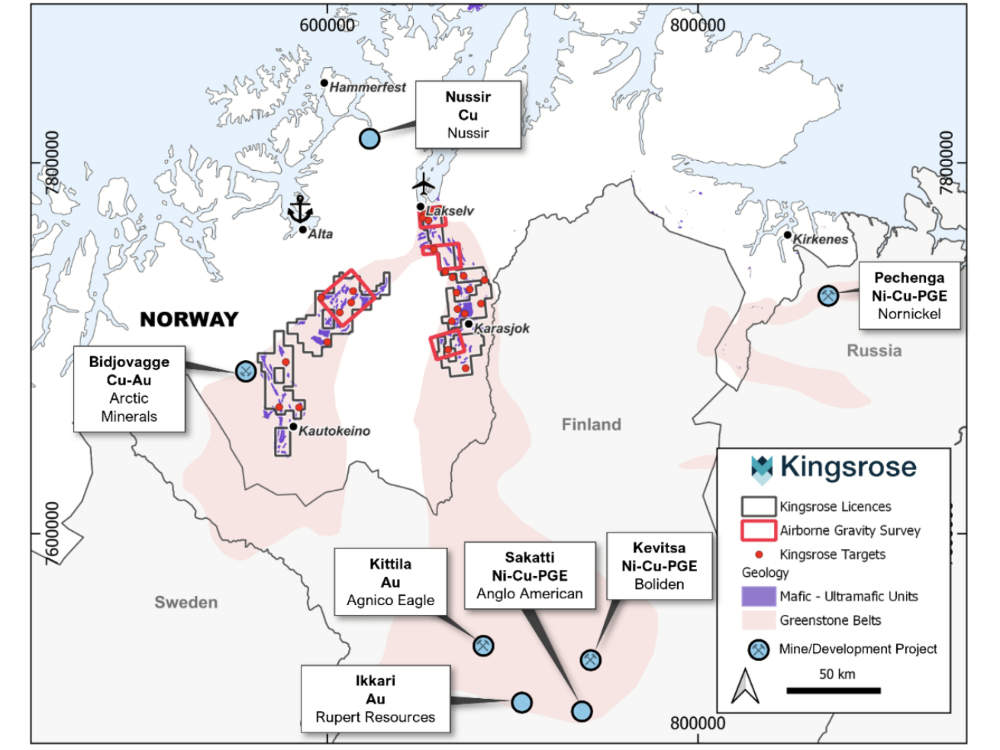

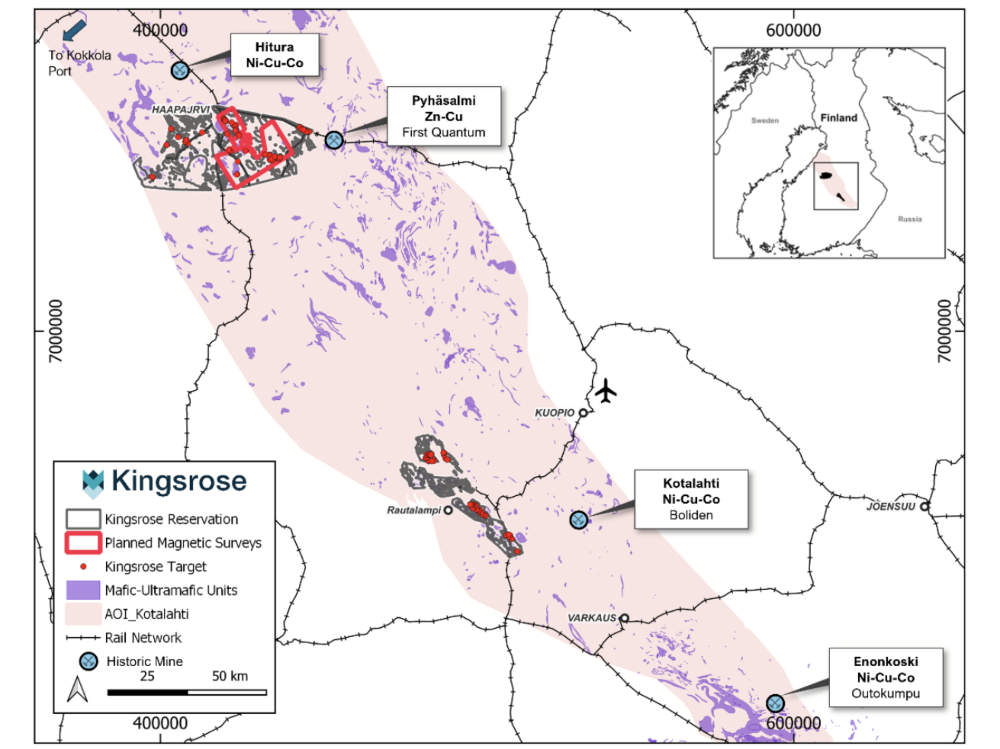

During the initial six-month period of the program, the company exposed the mining giant to underexplored belts in Norway and Finland that have seen little modern-day exploration despite hosting some of Europe’s largest mines.

This potential was apparently recognised by BHP, which had first offered “invaluable insights” and significant strategic value during the program before returning in 2024 with two ‘industry-leading’ exploration alliance agreements.

These will see the major sole fund up to US$20 million ($31m) over up to four years looking for belt-scale base metal targets in Norway and Finland.

Should this work identify a ‘defined project’, BHP will then have the right to earn up to 75% in two stages by sole funding up US$36m over seven years from the start of an earn-in phase.

While the agreements exclude KRM’s existing Penikat and Råna projects, the agreements place BHP at the front door as an interested party if they deliver the goods.

Xplor's not a one-way street

KRM notes that being part of the Xplor program was a pivotal moment, providing it with access to BHP’s extensive resources, networks and technical expertise, which significantly bolstered its capabilities and validated its strategic approach.

It also allowed the company to learn from BHP's world-class practices in exploration, project management and stakeholder engagement, which in turn enabled it to refine methodologies, adopt innovative approaches, and gain a deeper understanding of global best practices in exploration and development.

Speaking to Stockhead in a Long Shortz video, managing director Fabian Baker said the company’s selection from hundreds of applicants to form part of the first cohort to participate in BHP’s accelerator program was a great validation of its exploration ideas and team.

“We have planes in there, teams on the ground, exploring huge mineral belts that we control and exploring for high-grade copper, nickel and PGEs,” he added.

However, it wasn’t a one-way street with the company expressing its belief that BHP had valued its technical expertise, ability to drive forward a large-scale exploration opportunity, and commitment to responsible exploration practices.

Support for this belief is clear in KRM being the only public company – out of potentially thousands that have presented their ideas – to have secured an advanced deal with BHP in the past three years.

Majors aiding minors

One clear point that the company has taken away from its experience with the BHP Xplor program is the importance of having major companies back juniors engaged in grassroots – or frontier/greenfields – exploration.

It noted that a recent S&P report had indicated that just 22% of all exploration capital is being spent on grassroots exploration with remainder going to brownfields and near-mine exploration.

While these do serve to extend the lives of existing mines, they are inherently limited in their ability to solve growing supply gaps for critical minerals.

This is compounded by a reluctance from capital markets to support juniors engaged in greenfields exploration.

BHP and other majors could address this by either conducting greenfields exploration themselves or creating programs like Xplor to fund juniors.

Kingsrose well positioned for opportunities

For KRM, another benefit of having BHP drive greenfields exploration is preserving its significant cash position of ~$26m for exploration at its wholly owned Penikat and Råna projects, which are high-grade PGE-nickel-copper exploration opportunities.

This cash pool also means the company is well positioned to seize on the best exploration ideas.

Baker noted that at Penikat, the company expects an appeal on the project to be resolved this year and for drilling to occur at the end of 2025.

He also said that KRM’s team dedicated to business development and new acquisition opportunities had screened hundreds of assets and that it expected to bring new opportunities to the company in the coming months.

At Stockhead we tell it like it is. While Kingsrose Mining is a Stockhead advertiser, it did not sponsor this article.

Originally published as Micros with Majors: Here’s why Kingsrose thinks BHP’s Xplor program is a fine idea indeed