Medallion Metals in the fast lane to Ravensthorpe gold, copper production with $27.5m placement

Medallion Metals is raising $27.5m through a strongly supported placement to accelerate its Ravensthorpe project development strategy.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Medallion Metals has received strong support for a two-tranche placement to raise $27.5m

Proceeds will be used to accelerate plans for near-term gold and copper production at Ravensthorpe

Company expects material updates to FNO acquisition and permitting across Q2 and Q3 2025

Special Report: A select group of long-term resources investors have demonstrated their confidence in Medallion Metals and its plans for near-term gold and copper production at its Ravensthorpe project by backing a $27.5m placement.

Binding commitments were received from the group of new and existing high-quality Australian, European and United States resource-focused institutions for the two-tranche placement of 130.95 million shares priced at 21c each.

Following completion of the second tranche of 102.3 million shares to raise ~$21.5m following a general meeting to be held in mid-June 2025, Medallion Metals (ASX:MM8) will have circa $31m in cash to progress the near-term gold and copper production opportunity at its Ravensthorpe gold project at Forrestania, WA.

Proceeds from the placement will de-risk and accelerate the proposed acquisition from IGO of the Forrestania Nickel Operation, which includes the Cosmic Boy plant and associated infrastructure, along with contributing to relevant pre-development activities and general working capital.

“Medallion emerges from this capital raising in an extremely strong position to accelerate the sulphide development strategy,” managing director Paul Bennett said.

“The board has confidence that tremendous value can be unlocked for Medallion shareholders by bringing Ravensthorpe resources together with the Forrestania infrastructure.

“Recent drill results suggest that opportunity will continue to grow with continued investment.

“Additionally, the recent amendments to proposed transaction terms to acquire the Forrestania tenure add a broader strategic dimension to the growth options open to the business.”

Ravensthorpe gold project

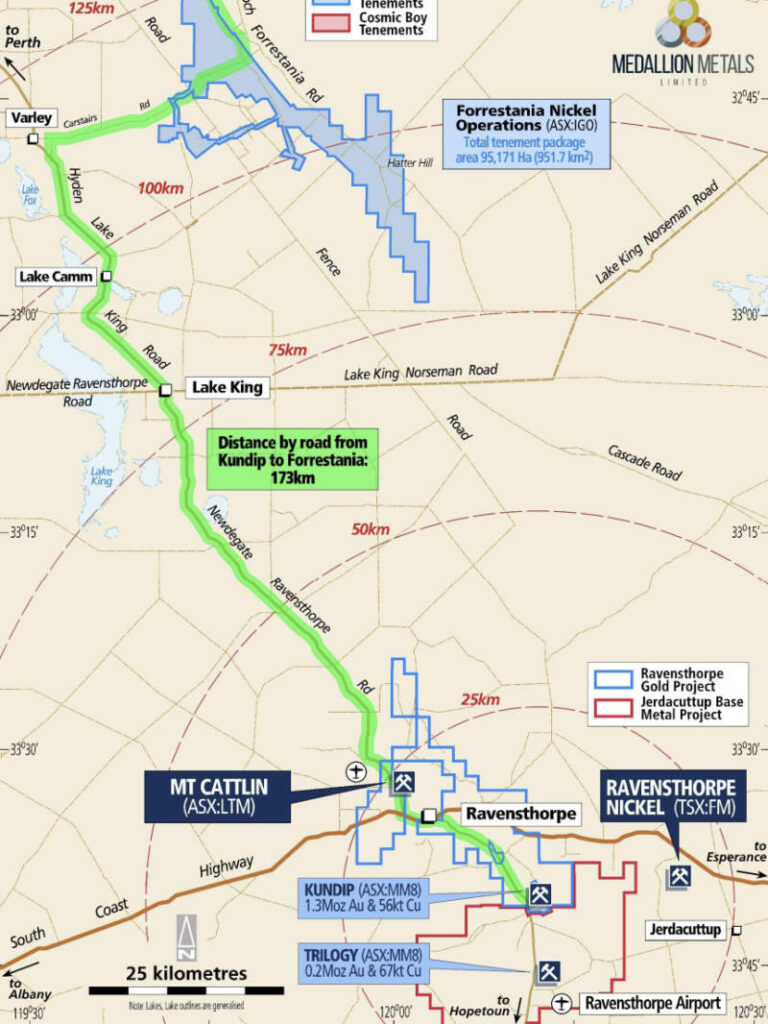

The ~300km2 Ravensthorpe project is centred on the historical Kundip mining centre that is midway between the regional centres of Ravensthorpe and Hopetoun.

It benefits from excellent infrastructure and is easily accessed by sealed roads with a sealed airstrip located 10km to the south of the project.

In August 2024, MM8 entered an exclusivity agreement with IGO to negotiate the acquisition of the Forrestania Nickel Operation, which includes the Cosmic Boy plant and associated infrastructure.

The company subsequently completed an initial scoping study in December 2024 that outlined the robust technical and commercial merits of the unique low capex, rapid pathway to gold and copper production through the FNO infrastructure.

Under the study, Ravensthorpe is expected to produce 336,000oz of gold and 13,000t of copper from a production inventory of 2.7Mt grading 3.9g/t gold and 0.6% copper, or 342,000oz of contained gold and 16,000t of contained copper, over a mine life of 5.5 years.

This will generate pre-tax free cash flow of $498m using a very conservative base case assumed gold price of $3615/oz and copper price of $5.54/lb, which increases to $637m at a gold price of $4000/oz and copper price of $6.15/lb.

Gold is currently priced at about $5040/oz (about US$3228) while copper commands a price of US$4.65 ($7.27)/lb.

Forecast average all-in-sustaining cost is estimated at just $1845/oz of gold inclusive of net by-product credits while total pre-production capex is expected to be about $73m including mine establishment and process plant modifications.

Pre-tax NPV and IRR is estimated at $329m and 129% respectively in the base case with payback expected within just 12 months.

Establishment of the proven, industry standard process route of gravity-flotation-CIL at Forrestania will deliver high gold recovery of 98% and copper recovery of 80%.

MM8 adds there’s potential to enhance project returns through increased throughput rate and mine life extension.

Additionally, multiple strategic growth opportunities present themselves through the establishment of gold processing capability at FNO as the Forrestania greenstone belt is a historically significant gold producing region which remains highly prospective for gold with multiple deposits and prospects situated within economic trucking distance.

Listen: Medallion Metals holding golden upside heading to production

Next steps

Proceeds from the placement will fund various work streams that will progress the company’s sulphide development strategy with material updates relating to the acquisition of FNO and Ravensthorpe permitting expected over the June and September quarters of 2025.

MM8 adds the current 17,000m infill and extensional drill program is expected to conclude in May this year.

Results from this program will continue to flow through June and July with assays to inform a resource update that will in turn underpin an updated mine plan completed to the bankable feasibility study level.

The company adds it is alert to opportunities to compress development timelines subject to the successful conclusion of negotiations to acquire FNO assets including certain pre-development works and securing of long lead time items.

This article was developed in collaboration with Medallion Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Medallion Metals in the fast lane to Ravensthorpe gold, copper production with $27.5m placement