Lunch Wrap: Traders snap up battered stocks; Trump lays out his ‘crypto reserve’ plans

ASX traders have been scooping up battered stocks on Monday, while Trump’s crypto reserve plans have lifted Bitcoin and Ethereum.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX bounces back as traders snap up battered stocks

Trump’s crypto reserve plan lifts Bitcoin and Ethereum

Star Entertainment suspended while Pro Medicus bags $40m deal

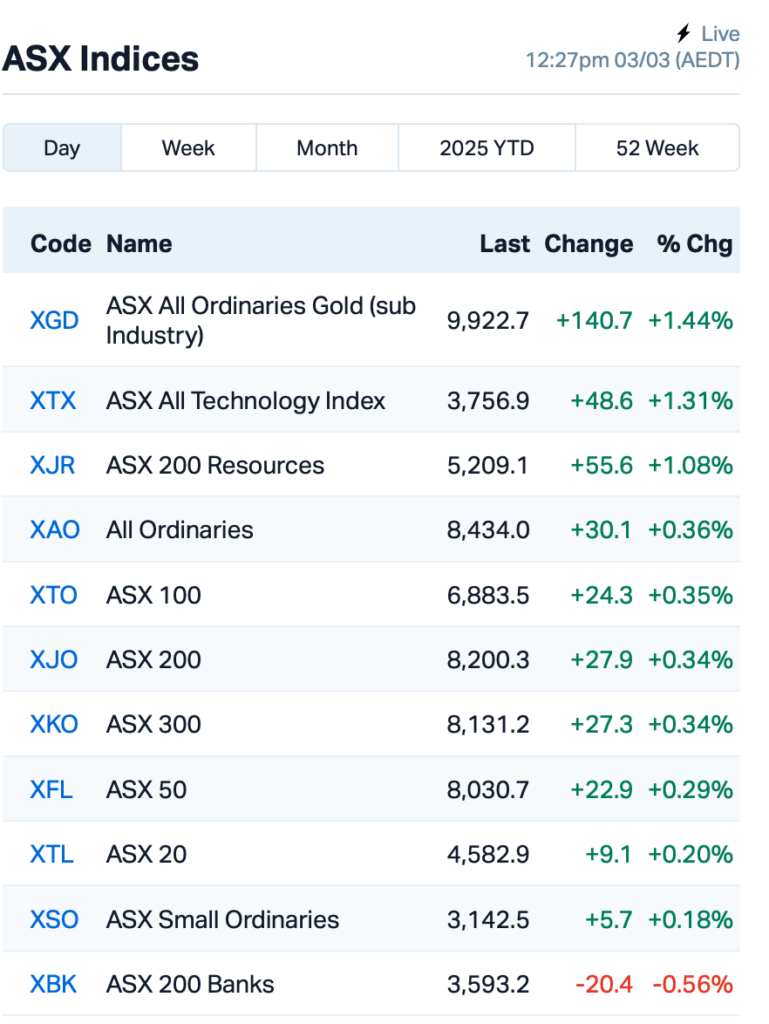

The ASX bounced back from a rough Friday, kicking off the week higher with the benchmark S&P/ASX 200 climbing by 0.3% at about lunch time.

After a big sell-off sparked by Trump’s new tariffs, it looks like local traders are jumping on some of the market’s most battered stocks.

This came as Wall Street closed off February with a relief rally on Friday. The S&P 500 rose 1.6%, while the Nasdaq gained about 1.5%, bouncing back from the previous day’s Nvidia-led sell-off.

Meanwhile, Bitcoin surged back up above US$90k and is holding steady at about $92k or thereabouts after Trump announced his “crypto strategic reserve” plans over the weekend.

The reserve will include major cryptos Bitcoin and Ethereum, plus others that so far consist of Solana, XRP, and Cardano, with Trump calling them the "heart of the reserve". There may well be others yet to be announced.

The fund will initially be built using cryptocurrencies already seized by law enforcement, with the US government currently holding an estimated US$19 billion in Bitcoin.

Instead of selling off these assets like in the past (which often sent prices tumbling), the reserve would hold onto them to stabilise and grow the market.

In time, Trump said he may also try to acquire new crypto to build the stockpile, though that would need Congressional approval.

After the announcement, Bitcoin prices jumped over 10% and Ethereum saw a 13% rise, while slightly smaller capped coins including XRP, Cardano and Solana surged by 20% or more.

"For retail investors, this could lend further legitimacy to these assets, potentially accelerating mainstream adoption and institutional participation in a way not previously seen," said Edward Carroll at MHC Digital.

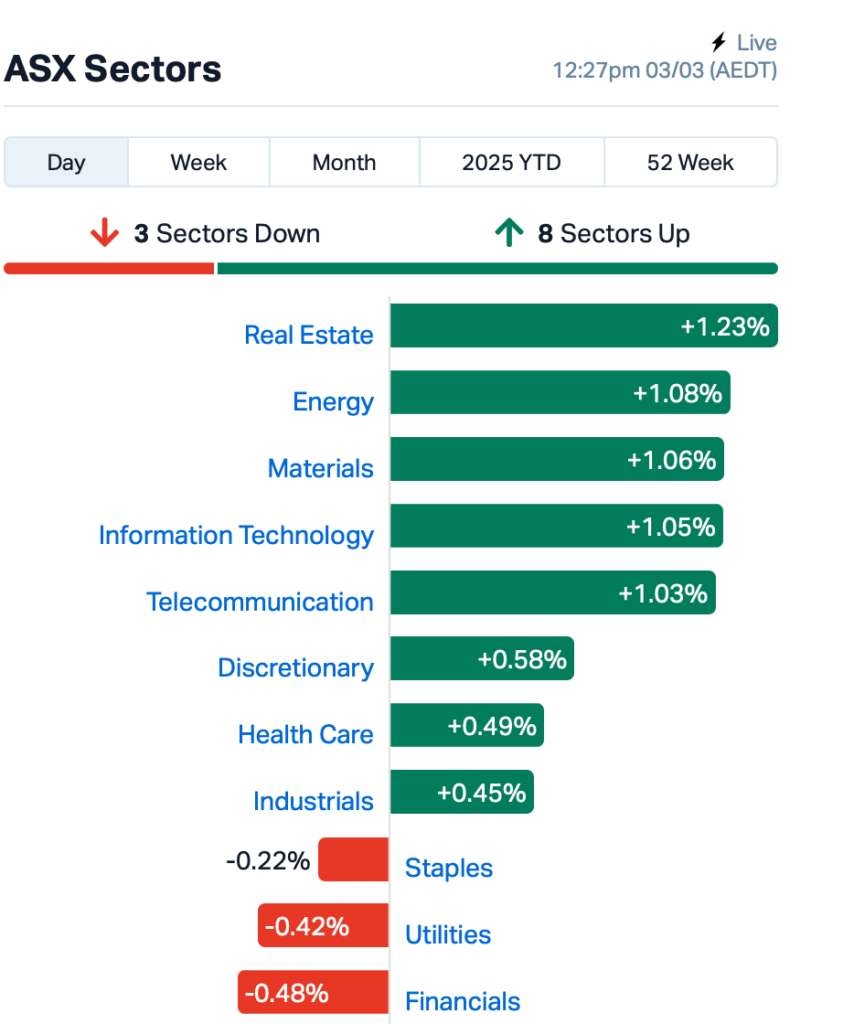

Back home on the ASX, all sectors were in the green this morning, with real estate stocks leading the charge.

In the large caps space, Star Entertainment Group (ASX:SGR) found itself suspended from trading after failing to lodge its accounts, leaving the casino operator's future uncertain.

ProMedicus (ASX:PME) has just bagged a massive $40 million deal with LucidHealth, a big player in the US radiology space. Over the next seven years, the Aussie tech company’s diagnostic imaging tool, Visage 7, will be rolled out across LucidHealth’s 140 care sites.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 3 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AOK | Australian Oil. | 0.003 | 50% | 2,193,441 | $2,003,566 |

| GUL | Gullewa Limited | 0.065 | 35% | 70,667 | $10,465,064 |

| RFT | Rectifier Technolog | 0.008 | 33% | 5,535,265 | $8,291,904 |

| BMR | Ballymore Resources | 0.135 | 29% | 3,400 | $18,556,711 |

| PEB | Pacific Edge | 0.145 | 26% | 219,562 | $93,370,337 |

| RDN | Raiden Resources Ltd | 0.005 | 25% | 3,369,472 | $13,803,566 |

| SPA | Spacetalk Ltd | 0.295 | 23% | 301,961 | $15,306,327 |

| LNR | Lanthanein Resources | 0.003 | 20% | 100,000 | $6,109,090 |

| AHF | Aust Dairy Limited | 0.056 | 19% | 999,767 | $34,936,125 |

| MNC | Merino and Co | 0.190 | 19% | 73,954 | $8,492,251 |

| SGI | Stealth Grp Holding | 0.800 | 18% | 172,714 | $79,582,408 |

| TOY | Toys R Us | 0.042 | 17% | 163,330 | $5,445,438 |

| SRN | Surefire Rescs NL | 0.004 | 17% | 1,708,500 | $7,248,923 |

| DCC | Digitalx Limited | 0.052 | 16% | 9,112,191 | $54,119,299 |

| BLU | Blue Energy Limited | 0.008 | 14% | 494,000 | $12,956,815 |

| CTQ | Careteq Limited | 0.016 | 14% | 62,500 | $3,319,662 |

| TOU | Tlou Energy Ltd | 0.016 | 14% | 22,743 | $18,180,180 |

| TRU | Truscreen | 0.033 | 14% | 205,147 | $16,025,142 |

| SFM | Santa Fe Minerals | 0.042 | 14% | 30,000 | $2,694,295 |

| PEK | Peak Rare Earths Ltd | 0.110 | 13% | 440,218 | $34,153,129 |

| APC | APC Minerals | 0.017 | 13% | 209,672 | $1,757,597 |

| GNM | Great Northern | 0.017 | 13% | 58,820 | $2,319,436 |

| RC1 | Redcastle Resources | 0.009 | 13% | 356,000 | $5,948,535 |

| MTH | Mithril Silver Gold | 0.345 | 11% | 661,079 | $45,155,692 |

| AUE | Aurumresources | 0.300 | 11% | 1,411,265 | $59,728,722 |

Ballymore Resources (ASX:BMR) has kicked off Stage 5 drilling at its Dittmer gold project in North Queensland, with a 100% success rate so far. All 42 holes drilled to date have hit gold, including some stellar intersections like 4.3m at 29.02 g/t Au. The Dittmer project, which includes the historic Dittmer mine, could be a prime spot for mining again, the company said, especially with gold prices soaring.

Cervical cancer screening devices maker Truscreen Group (ASX:TRU) has signed an MOU with Hangzhou Dalton Bioscience to expand its HPV product range, and a launch in Ho Chi Minh City is locked in for April. In Indonesia, commercial sales are set to kick off next month, while in Uzbekistan, product registration is expected by March for national screening trials. TruScreen’s also targeting China’s massive market, aiming for growth in six key provinces and expanding into the private health sector.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 3 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CDT | Castle Minerals | 0.002 | -33% | 39,166,246 | $5,690,442 |

| PAB | Patrys Limited | 0.002 | -33% | 455,657 | $6,172,342 |

| VML | Vital Metals Limited | 0.002 | -33% | 24,557,370 | $17,685,201 |

| WEL | Winchester Energy | 0.001 | -33% | 182 | $2,044,528 |

| BRX | Belararoxlimited | 0.100 | -29% | 2,071,623 | $20,154,976 |

| RR1 | Reach Resources Ltd | 0.010 | -29% | 10,773,708 | $12,242,039 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 1,538,587 | $57,867,624 |

| BYH | Bryah Resources Ltd | 0.003 | -25% | 200,000 | $2,507,203 |

| CT1 | Constellation Tech | 0.002 | -25% | 540,467 | $2,949,467 |

| CU6 | Clarity Pharma | 2.730 | -23% | 2,261,681 | $1,143,922,739 |

| PLN | Pioneer Lithium | 0.150 | -21% | 10,000 | $7,279,220 |

| PFT | Pure Foods Tas Ltd | 0.034 | -21% | 534,664 | $5,823,302 |

| 1TT | Thrive Tribe Tech | 0.002 | -20% | 3,073,725 | $5,079,308 |

| BUY | Bounty Oil & Gas NL | 0.002 | -20% | 50,000 | $3,903,680 |

| CRR | Critical Resources | 0.004 | -20% | 54,500 | $12,321,106 |

| WMG | Western Mines | 0.100 | -17% | 233,516 | $10,842,401 |

| 1AI | Algorae Pharma | 0.005 | -17% | 104,665 | $10,124,368 |

| LML | Lincoln Minerals | 0.005 | -17% | 62,320 | $12,337,557 |

| OSL | Oncosil Medical | 0.005 | -17% | 15,750 | $27,639,481 |

| AVC | Auctus Invest Grp | 0.530 | -16% | 71,371 | $50,576,599 |

| XGL | Xamble Group Limited | 0.017 | -15% | 42,610 | $6,780,285 |

| EM2 | Eagle Mountain | 0.006 | -14% | 712,938 | $7,945,261 |

| TYX | Tyranna Res Ltd | 0.006 | -14% | 102,804 | $23,015,477 |

| WBE | Whitebark Energy | 0.006 | -14% | 138,407 | $2,157,464 |

SSR Mining (ASX:SSR) has announced it will be delisting from the ASX on April 8, following approval from the ASX. The company cited low trading volumes on the ASX, which represent just 1.74% of its total shares, compared to higher trading activity on Nasdaq and the Toronto Stock Exchange (TSX). SSR has a diverse portfolio of gold and silver mining operations across North America, South America, and Turkey.

IN CASE YOU MISSED IT

Copper explorer Belararox (ASX:BRX) is seeing promising indications of porphyry systems at both the Tambo South and Malambo prospects within its TMT project in Argentina’s San Juan Province. Drilling is progressing at both, with the company fully funded and targeting completion by April.

Canadian lithium developer Green Technology Metals (ASX:GT1) has appointed Han Seung Cho as a non-executive director. Cho is the general manager of EcoPro Innovation’s Strategic Business team, where he has played a key role for more than five years. Most important for GT1 is Cho’s experience in managing North American OEM relationships and exposure to strategic business development. Prior to working with EcoPro, Cho worked at an automotive interior parts manufacturing specialist where he managed projects and oversaw sales operations across several North American OEMs.

Gold explorer OzAurum Resources (ASX:OZM) has received firm commitments to raise $1.74m via a share placement to professional and sophisticated investors, which will see the company issue 29,100,00 shares at 6c apiece. The money will be spent on exploration at OZM’s Mulgabbie and Patricia projects as well as its niobium project in Brazil.

Moab Minerals (ASX:MOM) has secured a $500k investment from European Lithium (ASX:EUR) via a placement to advance exploration at its Manyoni uranium project in Tanzania. The placement is priced at 0.3 cents per share, with EUR also receiving one free-attaching option for every two placement shares.

At Stockhead, we tell it like it is. While Belararox, Green Technology Metals, OzAurum Resources, and Moab Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: Traders snap up battered stocks; Trump lays out his ‘crypto reserve’ plans