Lunch Wrap: Tech stocks rally, Andromeda nails ultra-pure alumina as shares double

ASX continues winning streak, Tesla quietly preps for life after Elon, and Andromeda hits ultra-pure alumina breakthrough.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX holds the line as Wall Street flips

Tesla apparently looking for Musk replacement

Andromeda hits alumina milestone, shares soar

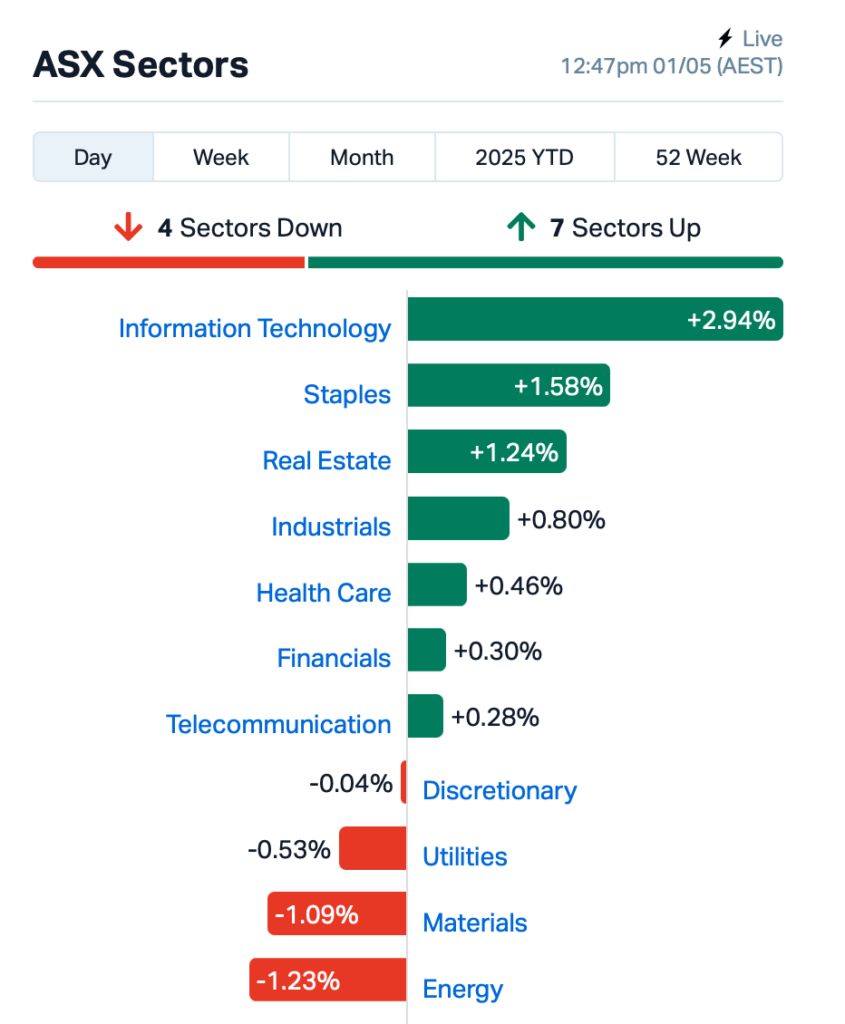

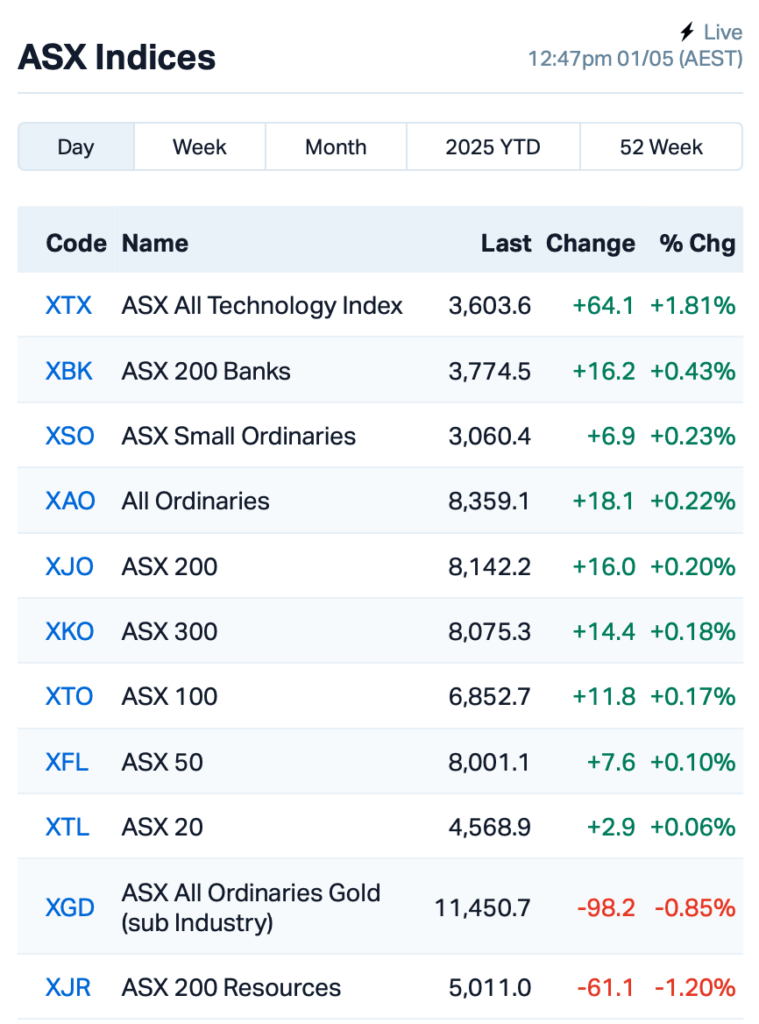

The ASX 200 is eyeing a sixth straight win, with the index cruising 0.2% higher by Thursday lunch time, AEST.

Overnight in the US, it was a rollercoaster. The S&P 500 crashed by 2% out the gates before coming back to life to close in the green, up 0.15%. The Nasdaq wobbled its way to a 0.1% loss.

The trigger was a mixed bag of US economic data.

First, a GDP shocker: the US economy shrank in Q1, the first time since 2022, thanks to (surprise!) an import surge, and slowing spending.

But then US inflation data came in flat, and word leaked that Washington had been quietly reaching out to Beijing to cool the tariff heat.

Behind closed doors, the US had reportedly been chatting with China to restart trade talks, with state-run Chinese media, CCTV, confirming Washington has made contact “through various channels”.

Trump, meanwhile, admitted that his big tariff play might be rattling the political fence, maybe even costing the Republicans a few votes in the mid-term, but told a town hall he’s not about to cut deals just to calm the voters.

“Yeah , but I’m an honest guy, and we have to save the country,” Trump said.

Elsewhere, the Tesla’s board is reported to be quietly started hunting for Elon Musk’s successor as CEO, according to a story from the Wall Street Journal.

They’ve apparently tapped a top search firm, though no one’s quite sure if Elon’s even been told.

Investors are getting twitchy about his side hustle in politics, and reckon someone needs to keep both hands on Tesla’s steering wheel.

Back home on the ASX, tech stocks rode the coattails of that US optimism.

WiseTech Global (ASX:WTC) climbed 6%, and NextDC (ASX:NXT) popped 5%.

But that glow was dimmed by a familiar drag, miners doing what miners do when China sneezes.

China’s factory data faded again, dragging iron ore prices lower and taking the heat out of the big miners. BHP (ASX:BHP) and Rio Tinto (ASX:RIO) gave up more than 1%.

Gold lost some of its shine, too, sliding for the third straight day to around $US3,240/oz. Traders reckon any real shot at US-China trade talks could dull demand for safe-haven assets.

In large caps news, mining services stock Worley (ASX:WOR) has locked in a tidy win, scoring a two-year contract extension with Woodside Energy Group (ASX:WDS) to keep running the show on brownfield engineering work at the Karratha and Pluto gas sites.

Worley has been in the trenches with Woodside for over two decades, and it’s been working on these same plants since 2018. Worley’s shares, however, were down 0.5%.

And, Pantoro (ASX:PNR) is about to wipe the slate clean, telling the market it will knock off its loan debt to Nebari Partners by May 12, which will save $1.5 million in interest. Shares were still down 3%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 1 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ADN | Andromeda Metals Ltd | 0.027 | 89% | 82,149,686 | $48,002,188 |

| EDE | Eden Inv Ltd | 0.002 | 50% | 1,037,767 | $4,109,881 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 4,910,073 | $3,253,779 |

| PAB | Patrys Limited | 0.003 | 50% | 170,000 | $4,114,895 |

| DXB | Dimerix Ltd | 0.685 | 43% | 26,142,136 | $268,540,866 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 401,000 | $6,379,103 |

| C7A | Clara Resources | 0.005 | 25% | 115,402 | $2,046,417 |

| CAV | Carnavale Resources | 0.005 | 25% | 176,000 | $16,360,874 |

| RLL | Rapid Lithium Ltd | 0.003 | 25% | 501,948 | $2,489,889 |

| ADG | Adelong Gold Limited | 0.006 | 20% | 464,910 | $6,987,431 |

| DTR | Dateline Resources | 0.012 | 20% | 26,588,544 | $27,655,686 |

| FRX | Flexiroam Limited | 0.006 | 20% | 81,250 | $7,586,993 |

| NES | Nelson Resources. | 0.003 | 20% | 10,676,742 | $5,429,819 |

| ODE | Odessa Minerals Ltd | 0.006 | 20% | 2,585 | $7,997,663 |

| RLG | Roolife Group Ltd | 0.006 | 20% | 837,877 | $7,480,156 |

| TMK | TMK Energy Limited | 0.003 | 20% | 629,590 | $25,555,958 |

| VAR | Variscan Mines Ltd | 0.006 | 20% | 288,271 | $3,914,289 |

| AMA | AMA Group Limited | 0.073 | 18% | 54,251,811 | $296,520,922 |

| RAC | Race Oncology Ltd | 1.220 | 17% | 187,535 | $181,539,342 |

| PPG | Pro-Pac Packaging | 0.021 | 17% | 476,424 | $3,270,379 |

| HHR | Hartshead Resources | 0.007 | 17% | 95,230 | $16,852,093 |

| SHP | South Harz Potash | 0.007 | 17% | 7,769 | $6,495,472 |

| SGA | Sarytogan | 0.043 | 16% | 208,868 | $6,696,383 |

| GW1 | Greenwing Resources | 0.030 | 15% | 515,889 | $6,256,939 |

Andromeda Metals (ASX:ADN) has pulled off a major breakthrough, with lab tests showing it can produce ultra-high purity 4N HPA (99.9985%) using its own low-cost process and kaolin from the Great White Project in SA. The results have been confirmed by top labs in the US and CSIRO.

What sets this apart is the process. No high-pressure acid, no extreme heat, and no expensive aluminium metal. It’s cleaner, cheaper, and slashes carbon emissions by over two-thirds, ADN said.

Andromeda is now heading into a scoping study and will start working with customers to fine-tune the product for everything from semiconductors to batteries. After seven years of R&D, this could put it in the box seat as global HPA (high purity alumina) demand heats up, it said.

Dimerix (ASX:DXB) has just inked a big-ticket deal, handing over exclusive US rights to its kidney drug DMX-200 to Amicus Therapeutics for US$30 million up front, with another US$560 million on the table in milestone payments plus royalties down the track.

DMX-200 is currently in a pivotal Phase 3 trial for FSGS, a rare and deadly kidney disease with no approved treatments. The FDA has already agreed that proteinuria - a marker of excess protein in urine and a key sign of kidney damage – can be used in the primary measure for approval. Full trial enrolment is expected by the end of 2025.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 1 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.001 | -50% | 68,648 | $4,063,446 |

| DY6 | Dy6Metalsltd | 0.100 | -39% | 5,847,707 | $8,317,787 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 45,000 | $7,254,899 |

| XPN | Xpon Technologies | 0.005 | -29% | 1,666,660 | $2,537,090 |

| ARN | Aldoro Resources | 0.350 | -26% | 1,321,672 | $84,270,788 |

| BLG | Bluglass Limited | 0.012 | -25% | 5,843,960 | $29,448,965 |

| QXR | Qx Resources Limited | 0.003 | -25% | 50,000 | $5,241,315 |

| WOA | Wide Open Agricultur | 0.027 | -24% | 17,677,229 | $18,945,875 |

| ADY | Admiralty Resources. | 0.004 | -20% | 443,615 | $13,147,397 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 1,097,213 | $15,867,318 |

| RMI | Resource Mining Corp | 0.004 | -20% | 100,010 | $3,327,029 |

| SPN | Sparc Tech Ltd | 0.170 | -19% | 413,688 | $20,133,319 |

| KNO | Knosys Limited | 0.035 | -19% | 644,342 | $9,293,964 |

| EG1 | Evergreenlithium | 0.040 | -18% | 371,093 | $9,534,337 |

| 1AD | Adalta Limited | 0.005 | -17% | 3,686,373 | $3,859,337 |

| AUR | Auris Minerals Ltd | 0.005 | -17% | 3,995 | $2,859,756 |

| BP8 | Bph Global Ltd | 0.003 | -17% | 41,636 | $2,239,454 |

| VML | Vital Metals Limited | 0.003 | -17% | 170,000 | $17,685,201 |

| PFT | Pure Foods Tas Ltd | 0.018 | -14% | 22,319 | $2,843,938 |

| NWM | Norwest Minerals | 0.012 | -14% | 2,244,755 | $6,791,673 |

| RNX | Renegade Exploration | 0.003 | -14% | 2,000,832 | $4,509,272 |

| SKK | Stakk Limited | 0.006 | -14% | 306,897 | $14,525,558 |

| BUR | Burleyminerals | 0.043 | -14% | 289,363 | $8,118,547 |

| VR1 | Vection Technologies | 0.016 | -14% | 5,277,040 | $27,549,994 |

Originally published as Lunch Wrap: Tech stocks rally, Andromeda nails ultra-pure alumina as shares double