Lunch Wrap: Markets skyrocket after Trump’s 180 on tariffs, ASX tech stocks rally hard

ASX shoots up, Aussie dollar surges, Bitcoin flies and tech stocks lead the way on Thursday.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX skyrockets after Trump pauses tariffs

Aussie dollar jumps, Bitcoin flies

ASX tech stocks lead the charge, miners and fund managers rally

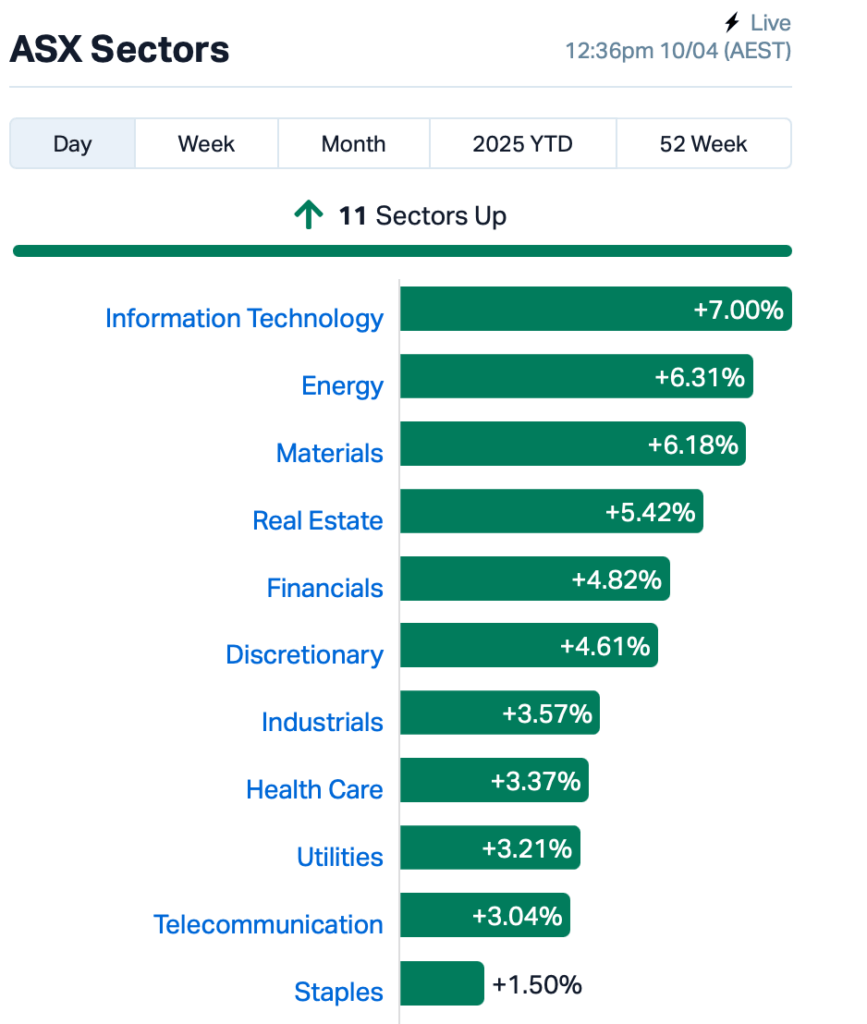

The ASX went absolutely gangbusters on Thursday after US President Trump did a 180 and paused tariffs on more than 75 countries.

The ASX 200 kicked off the day with a bang, jumping by almost 7%, which would've been the biggest rise since March 2020, before settling back to around 4.75% by lunchtime, AEST.

Overnight, Trump’s announcement to hit pause on those tariffs set off a wild rally.

"I have authorised a 90-day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately," part of Trump's post read.

The S&P 500 surged by 9.5%, marking its biggest one-day gain since 2008. That’s a huge $US4.5 trillion (yep, trillion) in market value added in just a session. The tech-heavy Nasdaq did even better, up by 12%.

But Trump also took more swings at China, cranking tariffs up to 125% from 104% after China slapped an 84% tariff on US goods. He also blasted China on social media, accusing them of showing him "a lack of respect".

Before trading started in New York, Trump tweeted “This is a great time to buy.”

Eric Diton at Wealth Alliance said “We are living minute-to-minute… I don’t think this is the bottom, that can’t be called until we see actual deals signed.”

"Something may be about to blow up in the capital markets as a result of the stress created by the administration's trade war,” added Ed Yardeni of Yardeni Research.

The bond markets, meanwhile, went absolutely nuts with wild swings in yields as traders ditched bonds and piled into stocks again.

The VIX index, the so-called “fear gauge”, plummeted as investors tried to make sense of the chaos.

The Aussie dollar shot up over 3% to US61.30 cents right now, its biggest one-day jump since the GFC of 2008.

Money markets are now betting on big rate cuts from the RBA by Christmas, with NAB expecting a big move in May.

Meanwhile, Bitcoin surged to as high as $83.5k before settling at about US$82.3k right now... so it’s all happening.

Back on the ASX, tech stocks were leading the charge this morning, with WiseTech Global (ASX:WTC) up by 6% and Life360 (ASX:360) rocketing higher by 10%.

Goodman Group (ASX:GMG), an infrastructure juggernaut, saw a massive 9.5% rise.

Qube Logistics (ASX:QUB) was up 5.5% after getting the green light from the ACCC to acquire the Melbourne International RoRo & Automotive Terminal (MIRRAT).

Most major miners were also up today, and fund managers were right there, too.

The share prices of Pinnacle Investment (ASX:PNI), HMC Capital (ASX:HMC) and Magellan Financial Group (ASX:MFG) all posted strong gains.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 10 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| OSX | Osteopore Limited | 0.045 | 181% | 36,618,975 | $1,933,897 |

| ENT | Enterprise Metals | 0.003 | 50% | 333,333 | $2,356,635 |

| VML | Vital Metals Limited | 0.003 | 50% | 1,265,416 | $11,790,134 |

| AJL | AJ Lucas Group | 0.007 | 40% | 2,641,039 | $6,878,648 |

| PVT | Pivotal Metals Ltd | 0.009 | 38% | 5,704,797 | $5,896,968 |

| AOA | Ausmon Resorces | 0.002 | 33% | 450,000 | $1,966,820 |

| GGE | Grand Gulf Energy | 0.002 | 33% | 508,000 | $3,675,581 |

| JAY | Jayride Group | 0.002 | 33% | 3,000,000 | $2,117,588 |

| NNL | Nordicresourcesltd | 0.115 | 24% | 131,173 | $13,706,698 |

| BMM | Bayan Mining | 0.043 | 23% | 13,700,273 | $3,366,631 |

| CND | Condor Energy Ltd | 0.028 | 22% | 25,878,575 | $16,139,521 |

| OD6 | Od6Metalsltd | 0.035 | 21% | 135,500 | $4,618,126 |

| ATG | Articore Group Ltd | 0.175 | 21% | 1,144,513 | $41,307,145 |

| GAS | State GAS Limited | 0.030 | 20% | 200,647 | $9,815,022 |

| LM1 | Leeuwin Metals Ltd | 0.180 | 20% | 1,770,234 | $12,644,957 |

| FBR | FBR Ltd | 0.006 | 20% | 2,961,166 | $28,178,159 |

| ROG | Red Sky Energy. | 0.006 | 20% | 1,958,647 | $27,111,136 |

| CTQ | Careteq Limited | 0.014 | 17% | 14,501 | $2,845,425 |

| EE1 | Earths Energy Ltd | 0.007 | 17% | 902,602 | $3,179,785 |

| FCT | Firstwave Cloud Tech | 0.014 | 17% | 49,999 | $20,562,224 |

| IXR | Ionic Rare Earths | 0.007 | 17% | 12,615,696 | $31,430,570 |

| SHN | Sunshine Metals Ltd | 0.007 | 17% | 22,029,731 | $11,905,869 |

| SPX | Spenda Limited | 0.007 | 17% | 81,269 | $27,691,293 |

| EMD | Emyria Limited | 0.029 | 16% | 97,162 | $12,281,104 |

| GED | Golden Deeps | 0.022 | 16% | 11,782,681 | $3,365,388 |

Golden Horse Minerals (ASX:GHM) reported some cracking results from drilling at Hopes Hill in WA, with a standout 43m at 4.5 g/t gold, part of an even bigger 83m zone. This, it said, confirms a solid gold system under the old pit, with drilling now hitting depths and along strike to uncover more. So far, 29 holes have been drilled since January, and the team will keep on testing this 1.3km-long mineralised zone.

Arika Resources (ASX:ARI) jumped after hitting multiple high-grade gold intersections in maiden drilling at the Pennyweight Point prospect, part of the Yundamindra gold joint venture project. With gold prices hovering close to all-time highs, ARI struck gold up to 35.76m at 2.14 g/t gold from 104.27 metres of depth, with intersections including 13.46m at 5.28 g/t gold from 150m and 14 metres at 15.48 g/t gold from 46m.

Noronex (ASX:NRX) has kicked off diamond drilling at the Fiesta Copper Project in Namibia to test the depth extensions of the Western Lens. The first hole, 25FIEDD26, will follow up on recent promising results, including copper and silver hits. The drill program, funded by South32, is set to cover 2,000m, aiming to better understand the mineralisation and guide future exploration.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 10 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MOM | Moab Minerals Ltd | 0.001 | -50% | 719,849 | $3,467,332 |

| CDT | Castle Minerals | 0.002 | -33% | 771,452 | $5,783,469 |

| RAS | Ragusa Minerals Ltd | 0.016 | -30% | 592,667 | $3,279,772 |

| MEG | Megado Minerals Ltd | 0.011 | -27% | 1,609,543 | $6,295,249 |

| AOK | Australian Oil. | 0.002 | -25% | 1,000,000 | $2,003,566 |

| ABE | Ausbondexchange | 0.031 | -23% | 26,333 | $4,506,725 |

| PKD | Parkd Ltd | 0.028 | -20% | 9,445 | $3,640,486 |

| AMS | Atomos | 0.004 | -20% | 1,800 | $6,075,092 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 112,489 | $15,846,485 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 280,000 | $7,870,957 |

| CTN | Catalina Resources | 0.002 | -20% | 39,285 | $3,790,655 |

| IPB | IPB Petroleum Ltd | 0.004 | -20% | 75,000 | $3,532,015 |

| OVT | Ovanti Limited | 0.004 | -20% | 3,000,000 | $13,507,739 |

| APC | APC Minerals | 0.009 | -18% | 3,065,222 | $1,288,904 |

| ENL | Enlitic Inc. | 0.046 | -18% | 516,105 | $32,234,120 |

| PBL | Parabellumresources | 0.035 | -17% | 670,638 | $2,616,600 |

| BTC | BTC Health Ltd | 0.050 | -17% | 9,092 | $19,519,398 |

| ADO | Anteotech Ltd | 0.010 | -17% | 1,301,812 | $32,463,604 |

| AZL | Arizona Lithium Ltd | 0.005 | -17% | 1,870,857 | $27,370,887 |

| BP8 | Bph Global Ltd | 0.003 | -17% | 203,588 | $1,824,924 |

| EMU | EMU NL | 0.020 | -17% | 137,300 | $4,646,434 |

| W2V | Way2Vatltd | 0.005 | -17% | 75,000 | $5,604,001 |

| SPN | Sparc Tech Ltd | 0.135 | -16% | 142,129 | $15,339,672 |

| PCL | Pancontinental Energ | 0.006 | -14% | 8,456,193 | $56,956,101 |

IN CASE YOU MISSED IT

Zenith Energy (ASX:ZEN) is gearing up for a deep drilling campaign at the Red Mountain gold project after securing a $275,000 collaborative exploration initiative grant from the Queensland government, with the goal of unlocking the project’s gold potential, as well as associated copper and molybdenum mineralisation at depth.

Peregrine Gold (ASX:PGD) has secured $807,566 with the completion of a shortfall offer, part of a non-renounceable entitlement offer first offered October last year. The funding will go to scaling PGD’s gold assets, which include the Newman and Mallina gold projects in Western Australia.

Targeting a bedrock gold source, Miramar Resources (ASX:M2R) has launched a drilling program at the Gidji joint venture project in Western Australia, with an eye to also extending the Marylebone, Blackfriars and Highway gold discoveries.

A long-standing dispute between Conrad Asia Energy (ASX:CRD) and Coro Energy Duyung has been resolved after the two parties signed a settlement agreement. CRD will obtain Coro Duyung’s 15% interest in the Duyung Production Sharing Contract, in return for cash consideration of US$300,000 and 500,000 new CRD shares, contingent on government approval. A further US$750,000 worth of CRD shares will also be issued to Coro within the first 45 days of commercial production at the Duyung facility.

HyTerra Limited (ASX:HYT) has taken the first steps in executing a 12-month exploration program at the Nemaha project in the US, seeking to unlock the potential natural or white hydrogen within the area. The company has completed an aerial survey, with initial results providing important geological insights, and has mobilised a drilling rig to the Sue Duroche 3 well location, expected to arrive early next week.

At Stockhead, we tell it like it is. While Zenith Minerals, Peregrine Gold, Miramar Resources, Conrad Asia Energy and Hyterra are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: Markets skyrocket after Trump’s 180 on tariffs, ASX tech stocks rally hard