Lunch Wrap: ASX powers ahead after core inflation slides into RBA target zone

Inflation’s cooling but still sticky, keeping rate cut hopes alive; meanwhile Trump’s back throwing punches at the Fed.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Aussie inflation back in the zone

ASX pares gains as rate cut bets hold strong

Trump swings at the Fed boss again

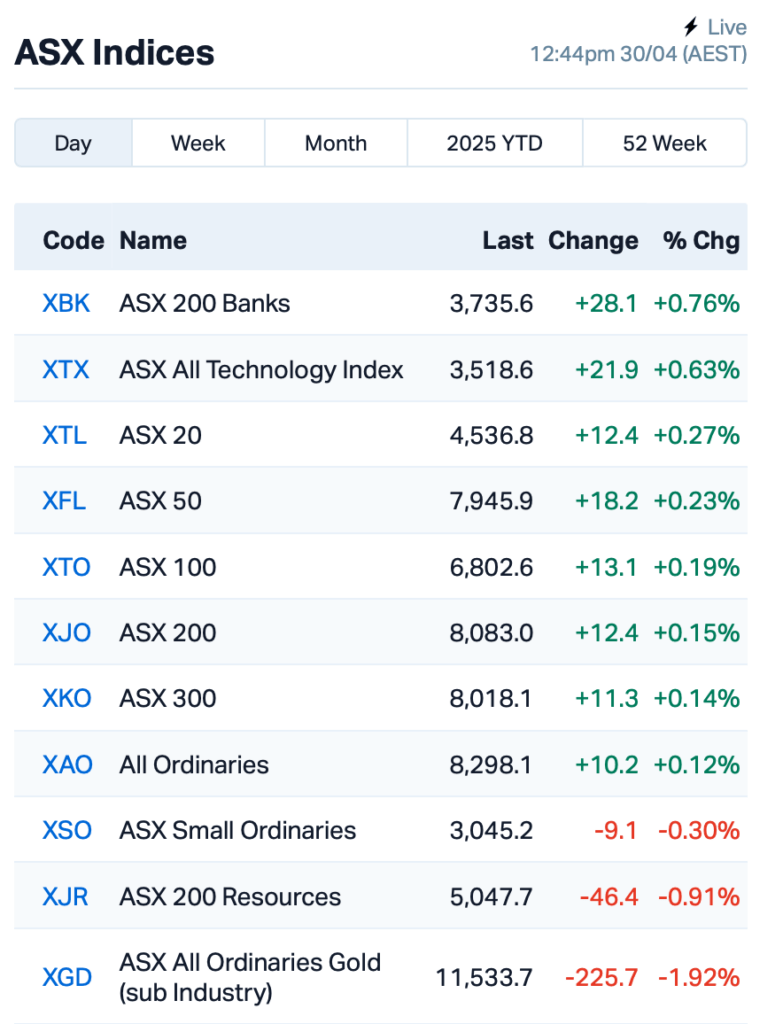

The ASX 200 was up 0.2% by late morning Wednesday, paring back earlier gains after fresh inflation data landed just a touch hotter than expected.

Headline inflation rose 0.9% in the March quarter, higher than the 0.8% economists tipped, while annual CPI held steady at 2.4%.

Not a blowout, but enough to make markets twitch.

But here’s the good news: for the first time since 2021, core inflation – the RBA’s preferred yardstick – is finally back in the target range of 2 to 3%.

It came in at 2.9% year-on-year. Still a little sticky, but heading in the right direction.

The Aussie dollar nudged higher on the news. Aussie bond yields crept up, too (bond prices lower).

But even so, the money market still tells us the RBA will still move ahead with a rate cut in May, with a 98% chance of a 25 basis point trim.

All eyes now turn to retail sales due Friday, which will show whether Aussie consumers are still spending or starting to tighten up.

There’s also the federal election this weekend, just to keep things interesting.

Meanwhile, over in the States last night, Donald Trump is back on the mic, and back bashing Fed boss Jerome Powell.

Speaking at a rally in Michigan marking his 100th day back in office, Trump said, “Inflation is basically down and interest rates came down despite the fact that I have a Fed person who’s not really doing a good job.”

“You’re not supposed to criticise the Fed,” he added, “but I know much more than he does about interest rates."

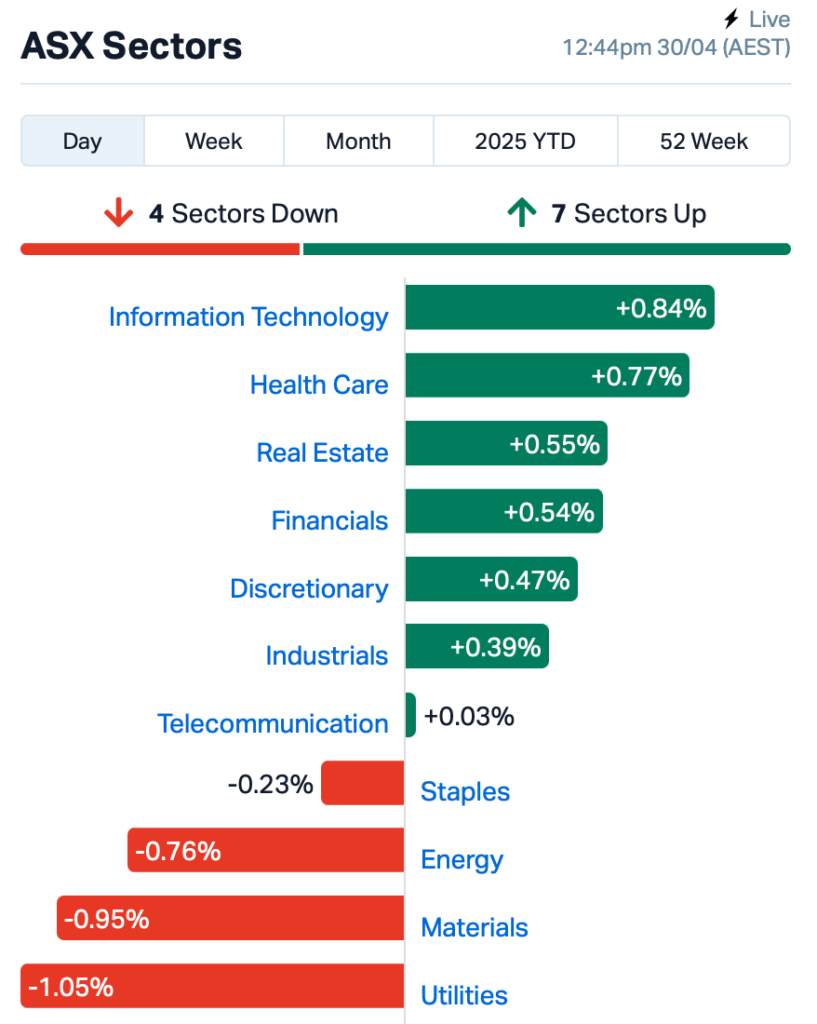

Back on the ASX, it was a mixed bag.

Early gains faded after the CPI numbers, but rate-sensitive sectors like tech held up.

Defensive names didn’t fare as well. Utilities took a hit, with Origin Energy (ASX:ORG) sliding more than 2%.

In large caps news, gold producer Ora Banda (ASX:OBM) dropped 5% after slashing its production guidance for FY25.

Champion Iron (ASX:CIA) fell 2% despite posting record March-quarter sales, while Alcoa Corporation (ASX:AAI), the aluminium giant, slipped 1.5% after a Spanish power outage hit its operations.

And, Woodside Energy Group (ASX:WDS) has locked in a big deal with BP, signing a long-term agreement to supply gas to its $27 billion Louisiana LNG project. WDS shares fell 0.5%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 30 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| MOM | Moab Minerals Ltd | 0.002 | 50% | 245,980 | $1,733,666 |

| JLL | Jindalee Lithium Ltd | 0.585 | 43% | 423,814 | $30,172,658 |

| WOA | Wide Open Agricultur | 0.037 | 35% | 32,227,195 | $14,409,538 |

| ERA | Energy Resources | 0.002 | 33% | 3,517,904 | $608,094,361 |

| AZL | Arizona Lithium Ltd | 0.007 | 30% | 1,151,832 | $22,809,073 |

| CYQ | Cycliq Group Ltd | 0.003 | 25% | 249,999 | $921,033 |

| ERL | Empire Resources | 0.005 | 25% | 500,000 | $5,935,653 |

| OVT | Ovanti Limited | 0.005 | 25% | 4,047,687 | $10,806,191 |

| TEM | Tempest Minerals | 0.005 | 25% | 55,324 | $2,538,119 |

| NMT | Neometals Ltd | 0.077 | 20% | 1,281,797 | $49,243,205 |

| BMR | Ballymore Resources | 0.120 | 20% | 182,966 | $17,673,059 |

| RIM | Rimfire Pacific | 0.024 | 20% | 6,062,522 | $50,357,878 |

| SKK | Stakk Limited | 0.006 | 20% | 4,132 | $10,375,398 |

| TMX | Terrain Minerals | 0.003 | 20% | 1,000,000 | $5,008,892 |

| SCN | Scorpion Minerals | 0.020 | 18% | 370,695 | $8,908,955 |

| AKN | Auking Mining Ltd | 0.007 | 17% | 500,000 | $3,448,673 |

| AUR | Auris Minerals Ltd | 0.007 | 17% | 14,000 | $2,859,756 |

| CRR | Critical Resources | 0.004 | 17% | 1,019,002 | $7,842,664 |

| NWM | Norwest Minerals | 0.014 | 17% | 3,226,872 | $5,821,434 |

| AMO | Ambertech Limited | 0.180 | 16% | 190,457 | $14,787,741 |

| CYM | Cyprium Metals Ltd | 0.022 | 16% | 3,039,437 | $39,210,806 |

| REM | Remsensetechnologies | 0.060 | 15% | 1,059,555 | $8,696,167 |

| LAT | Latitude 66 Limited | 0.061 | 15% | 428,928 | $7,600,237 |

| FLC | Fluence Corporation | 0.054 | 15% | 1,059,723 | $50,805,421 |

Wide Open Agriculture (ASX:WOA) has signed a deal with Univar Solutions China, naming it the exclusive distributor of its lupin protein products across mainland China. Univar’s no small player, it’s the second-biggest ingredient distributor in the world, pulling in over $11 billion in sales last year. Under the deal, Univar has agreed to buy at least 50 tonnes of lupin protein over 12 months (after a 6-month prep phase), with pricing to be sorted between the two.

Arizona Lithium (ASX:AZL) is powering ahead with its Prairie Project in Canada, locking in approvals to kick off brine production and raising $1.3 million to fund its first facility. It’s also reworking plans at Big Sandy alongside key shareholder NTEC. With DLE tech in hand and the lithium market tipped to bounce back, AZL reckons it’s in prime position to make a splash.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 30 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ICU | Investor Centre Ltd | 0.001 | -50% | 103,990 | $609,023 |

| IVT | Inventis Limited | 0.010 | -38% | 51,005 | $1,222,790 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 6,454,216 | $4,880,668 |

| WEL | Winchester Energy | 0.001 | -33% | 100,000 | $2,044,528 |

| 3DP | Pointerra Limited | 0.062 | -25% | 7,657,217 | $66,821,374 |

| 1TT | Thrive Tribe Tech | 0.002 | -25% | 3,075,017 | $4,063,446 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 1,909,621 | $57,867,624 |

| CT1 | Constellation Tech | 0.002 | -25% | 1,000,000 | $2,949,467 |

| M2R | Miramar | 0.003 | -25% | 5,000,012 | $3,987,293 |

| QXR | Qx Resources Limited | 0.003 | -25% | 1,560,322 | $5,241,315 |

| RFA | Rare Foods Australia | 0.006 | -25% | 361,486 | $2,175,866 |

| TFL | Tasfoods Ltd | 0.003 | -25% | 60,261 | $1,748,382 |

| TMS | Tennant Minerals Ltd | 0.007 | -22% | 2,768,978 | $8,603,014 |

| ODE | Odessa Minerals Ltd | 0.006 | -21% | 1,829,889 | $11,196,728 |

| BLZ | Blaze Minerals Ltd | 0.002 | -20% | 300,000 | $3,917,370 |

| HLX | Helix Resources | 0.002 | -20% | 160,999 | $8,410,484 |

| MGU | Magnum Mining & Exp | 0.004 | -20% | 139,999 | $4,046,807 |

| MMR | Mec Resources | 0.004 | -20% | 1,000,000 | $9,248,829 |

| PHL | Propell Holdings Ltd | 0.008 | -20% | 125,431 | $2,783,381 |

| MAP | Microbalifesciences | 0.185 | -18% | 559,491 | $100,766,695 |

| CUF | Cufe Ltd | 0.005 | -17% | 50,000 | $8,079,449 |

| IMI | Infinitymining | 0.010 | -17% | 1,009,090 | $5,076,189 |

| MRD | Mount Ridley Mines | 0.003 | -17% | 100,000 | $2,335,467 |

| SER | Strategic Energy | 0.005 | -17% | 3 | $4,026,200 |

IN CASE YOU MISSED IT

Hot Chili (ASX:HCH) has taken a step toward obtaining priority status for both its Costa Fuego copper-gold project and Huasco water project in Chile, after securing registration with the Office for Sustainable Project Management of the Chilean Ministry of Economy. Both projects fulfilled key requirements to be considered in the government’s list of strategic investment projects to be expedited through a streamlined approval process.

In an effort to focus resources on the flagship Yarramba uranium project, Koba Resources (ASX:KOB) has entered into agreements to offload 100% of its interest in the Harrier uranium project in Newfoundland and Labrador to Azincourt Energy Corp in return for C$50,000 and 30m Azincourt shares.

Silver Mines (ASX:SVL) submitted an application with the Department of Planning, Housing and Infrastructure to determine whether a transmission line to power the Bowdens Silver project forms part of a single proposed development in an ongoing effort to reinstate development consent for the project. The development application itself remains alive, with the final decision to be made by the consent authority, the NSW Independent Planning Commission.

Refurbishment of the Casposo toll milling track is on schedule, supporting a binding agreement between Challenger Gold (ASX:CEL) and the plant operator to process a minimum of 450,000t of material from the Hualilan gold project over three years. CEL is looking to capitalise on current high gold prices.

At Stockhead, we tell it like it is. While Hot Chili, Koba Resources, Silver Mines and Challenger Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX powers ahead after core inflation slides into RBA target zone