Lunch Wrap: ASX on the front foot despite a Powell googly; gold hits record again

Gold has hit another record, sending the ASX up. Powell’s rate cut warning slammed Wall Street overnight but BHP and Santos have rallied.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Gold hits a record, boosting the ASX

Fed chief Powell’s rate cut warning sends Wall Street crashing

BHP and Santos rally, Nvidia takes a hit

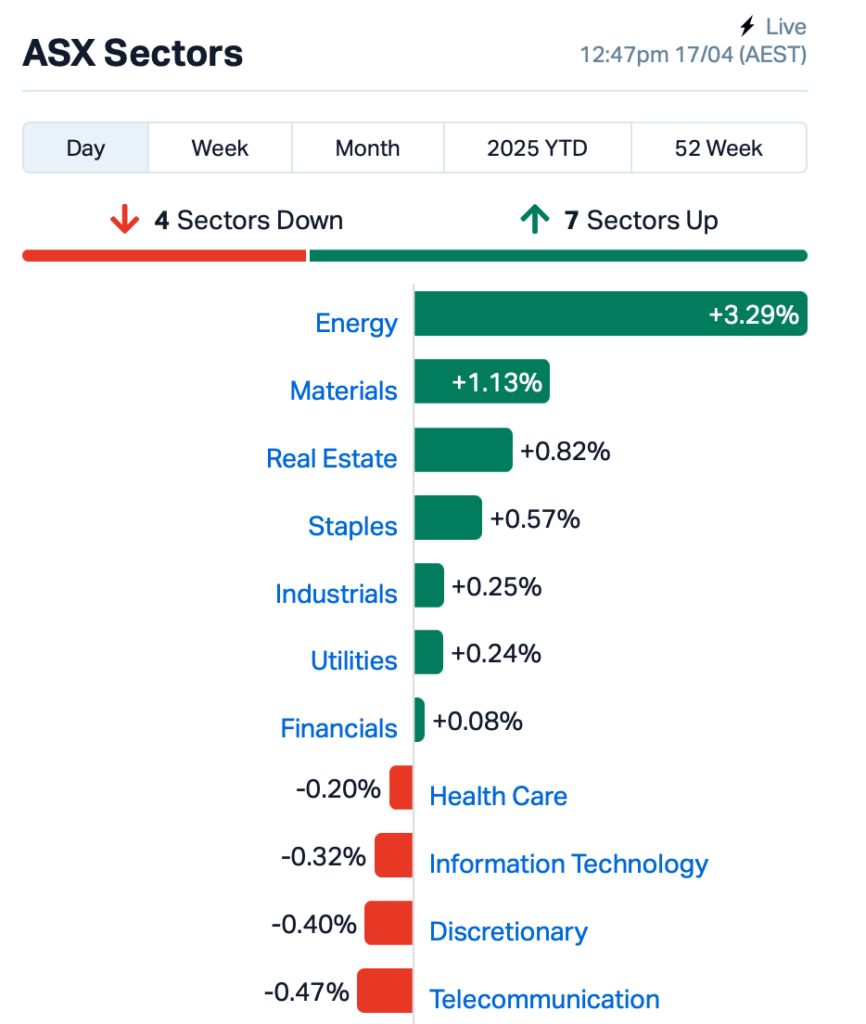

The ASX was up by 0.4% at lunch time, with gold miners leading the charge after bullion prices hit yet another record high.

But while gold was flexing, Wall Street copped a hiding as the market wakes up to the fact the Fed isn’t here to save the day.

Overnight, Fed boss Jerome Powell warned that tariffs and trade wars would fire up inflation, and that rate cuts are off the table for now.

“The level of the tariff increases announced so far is significantly larger than anticipated,” Powell said.

“In all likelihood, inflation is likely to go up as well."

He added the Fed’s best play right now is to sit tight and wait for the data to show how the US economy is actually handling Trump’s tariff chaos.

After his comments, the S&P 500 closed the day down by 2.2% and the tech-heavy Nasdaq by over 3%.

The headline stock was Nvidia, which got belted 7% after fresh US export rules are expected to clip its chip sales to China, forcing the chips giant to flag a US$5.5 billion charge this quarter.

Rival chipmaker AMD also took a hit, down 7.35%.

Closer to home, ASX investors looked past Wall Street volatility and picked up a few local bargains.

Gold stocks, as mentioned, were the stars of the morning. Their run followed gold’s surge to the current price of $US3,332/oz, a new all-time high, as investors chased safe-haven assets.

Energy stocks were the biggest movers as Brent jumped 2% to above US$66 last night as the US slapped new sanctions on Iran.

Elsewhere, Aussie market added 32,200 new jobs in March, but the jobless rate nudged up to 4.1% from 4%.

“The Australian interest rate market is pricing in 31bp of RBA rate cuts for May, and a cumulative 122bp of RBA rate cuts this year,” said Tony Sycamore at IG.

Here’s where things stood at around lunch time, AEST:

In the large caps space, BHP (ASX:BHP) reported a surprising record iron ore and copper production for the quarter in the midst of tough market conditions.

Copper production was up 10%, with Escondida’s output jumping 20%, while WA iron ore operations are smashing it despite the heaviest rainfall in years. BHP’s shares were up 1%.

Santos (ASX:STO) had a cracker of a quarter, too, with free cash flow up 9% to US$465 million from sales of US$1.3 billion.

Santos’ production went up 2%, and it hit a new record output at Scotia. STO shares were up 2%.

And, investment manager Challenger (ASX:CGF) rallied 7% after it narrowed its FY25 profit guidance, now expecting between $450m and $465m, a slightly tighter range that signals more clarity on its outlook.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 17 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AVM | Advance Metals Ltd | 0.053 | 51% | 38,676,345 | $7,491,219 |

| TTI | Traffic Technologies | 0.003 | 50% | 1,630,346 | $2,514,294 |

| SUH | Southern Hem Min | 0.041 | 37% | 2,928,775 | $22,087,201 |

| PRM | Prominence Energy | 0.004 | 33% | 750,000 | $1,167,529 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 172,883 | $7,254,899 |

| GBZ | GBM Rsources Ltd | 0.009 | 29% | 910,712 | $8,197,490 |

| VKA | Viking Mines Ltd | 0.009 | 29% | 2,832,073 | $9,297,031 |

| ANR | Anatara Ls Ltd | 0.008 | 25% | 24,764,790 | $1,280,302 |

| ALM | Alma Metals Ltd | 0.005 | 25% | 100,000 | $6,345,381 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 605,379 | $6,296,765 |

| ERL | Empire Resources | 0.005 | 25% | 75,000 | $5,935,653 |

| BUR | Burleyminerals | 0.055 | 25% | 282,551 | $6,616,322 |

| MEI | Meteoric Resources | 0.135 | 23% | 16,280,672 | $257,054,906 |

| IRX | Inhalerx Limited | 0.022 | 22% | 76,323 | $3,842,068 |

| ARC | ARC Funds Limited | 0.110 | 21% | 10,500 | $4,207,362 |

| LIN | Lindian Resources | 0.120 | 20% | 2,113,710 | $115,317,224 |

| ALY | Alchemy Resource Ltd | 0.006 | 20% | 70,000 | $5,890,381 |

| CTN | Catalina Resources | 0.003 | 20% | 273,190 | $4,159,399 |

| ROG | Red Sky Energy. | 0.006 | 20% | 157,219 | $27,111,136 |

| TMS | Tennant Minerals Ltd | 0.006 | 20% | 3,868,864 | $4,779,452 |

| CDR | Codrus Minerals Ltd | 0.019 | 19% | 15,001 | $2,646,200 |

| LDX | Lumos Diagnostics | 0.026 | 18% | 8,864,930 | $16,467,506 |

| ASM | Ausstratmaterials | 0.750 | 18% | 1,279,401 | $115,151,333 |

| DTZ | Dotz Nano Ltd | 0.067 | 18% | 316,963 | $32,280,652 |

Advance Metals (ASX:AVM) has announced another set of promising gold hits at Myrtleford. Drilling at the Happy Valley Prospect has returned up to 446g/t gold, with a standout intercept of 7.5 metres at 47.9g/t, including a red-hot 1.3m at 271.6g/t.

That’s now three straight diamond holes delivering high-grade results, proving Myrtleford isn’t just a one-off, it’s a system. Only about 1% of the full 13km Happy Valley trend has seen been drilled, and Advance is now pushing north to Twist Creek, where past hits have topped 40g/t.

Anatara Lifesciences (ASX:ANR) ’s GaRP-IBS trial has missed its main goal but delivered some wins. The Phase II trial didn’t hit statistical significance for reducing IBS symptoms versus placebo, but showed a clear trend of improvement and no safety concerns.

Anxiety scores improved significantly, and the “adequate relief” measure was a standout, with a strong result at the 10-week mark. The company now plans to tighten spending, explore commercial options for GaRP, and keep pushing ahead on its anti-obesity project.

InhaleRX (ASX:IRX) has locked in its clinical partner to kick off human trials for its panic disorder treatment, IRX-616a. The Study Order with iNGENū CRO puts the Phase 1 trial in motion, testing the safety and effects of its cannabidiol inhaler in healthy volunteers.

Backed by up to $38.5 million in funding from Clendon Biotech, IRX said it’s aiming to fast-track development through to Phase 3. The trial will run out of CMAX in Adelaide, with dosing planned for later this year.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 17 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EGY | Energy Tech Ltd | 0.019 | -37% | 12 | $13,387,418 |

| ASR | Asra Minerals Ltd | 0.002 | -33% | 16,845,721 | $7,119,380 |

| NTM | Nt Minerals Limited | 0.001 | -33% | 19,905,433 | $1,816,354 |

| SIS | Simble Solutions | 0.003 | -25% | 30,000 | $3,505,321 |

| TAS | Tasman Resources Ltd | 0.003 | -25% | 153,818 | $3,220,998 |

| BPM | BPM Minerals | 0.028 | -22% | 2,889,564 | $3,142,812 |

| IPB | IPB Petroleum Ltd | 0.004 | -20% | 1,484 | $3,532,015 |

| OLI | Oliver'S Real Food | 0.004 | -20% | 1,624,887 | $2,703,660 |

| RAN | Range International | 0.002 | -20% | 202,782 | $2,348,226 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 154,000 | $23,423,890 |

| MEG | Megado Minerals Ltd | 0.009 | -18% | 1,273,804 | $4,616,516 |

| AMS | Atomos | 0.005 | -17% | 5,725 | $7,290,111 |

| ANX | Anax Metals Ltd | 0.005 | -17% | 84,267 | $5,296,845 |

| FRX | Flexiroam Limited | 0.005 | -17% | 80,000 | $9,104,392 |

| PFT | Pure Foods Tas Ltd | 0.017 | -15% | 200,000 | $2,708,512 |

| MMR | Mec Resources | 0.003 | -14% | 272,009 | $6,474,180 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 1,300,779 | $11,196,728 |

| TSL | Titanium Sands Ltd | 0.006 | -14% | 333,400 | $16,357,230 |

| NSB | Neuroscientific | 0.045 | -13% | 1,624,619 | $7,519,453 |

| DRE | Dreadnought Resources | 0.013 | -13% | 17,479,133 | $70,047,500 |

| CRR | Critical Resources | 0.004 | -13% | 37,608 | $9,856,885 |

| KGD | Kula Gold Limited | 0.007 | -13% | 1,017,732 | $7,370,029 |

| RIM | Rimfire Pacific | 0.021 | -13% | 228,180 | $60,429,453 |

| AI1 | Adisyn Ltd | 0.052 | -12% | 502,760 | $42,617,210 |

IN CASE YOU MISSED IT

In a bid to streamline its Australian portfolio and sharpen focus on the Rio Grande Sur project in Argentina, Pursuit Minerals (ASX:PUR) has offloaded the Commando and Warrior projects for total consideration of $300,000. Pursuit has already begun lithium carbonate production at Rio Grande Sur.

“This transaction clears the path to accelerate that momentum, sharpen our development focus, and strengthen our position as an emerging lithium producer in Argentina,” PUR managing director and CEO Aaron Revelle said.

Recce Pharmaceuticals (ASX:RCE) has added $5m to the war chest with a share placement with a private Australian investor. The funds will support the Phase 3 diabetic foot infection Registrational Topical Clinical Trial in Indonesia, and the Phase III acute bacterial skin and skin-structure infections (ABSSSI) Registrational Topical Clinical Trial in Australia.

At Stockhead, we tell it like it is. While Pursuit Minerals and Recce Pharmaceuticals are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX on the front foot despite a Powell googly; gold hits record again