Lunch Wrap: ASX inches higher, Yari doubles after snapping up Queensland coal project

The ASX edged up as traders watched US-China talks, oil and iron ore climbed, and markets held their breath for the Fed’s big decision.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX edges up on US-China talks hopes

Oil and iron ore bounce back

Fed decision looms, markets hold breath

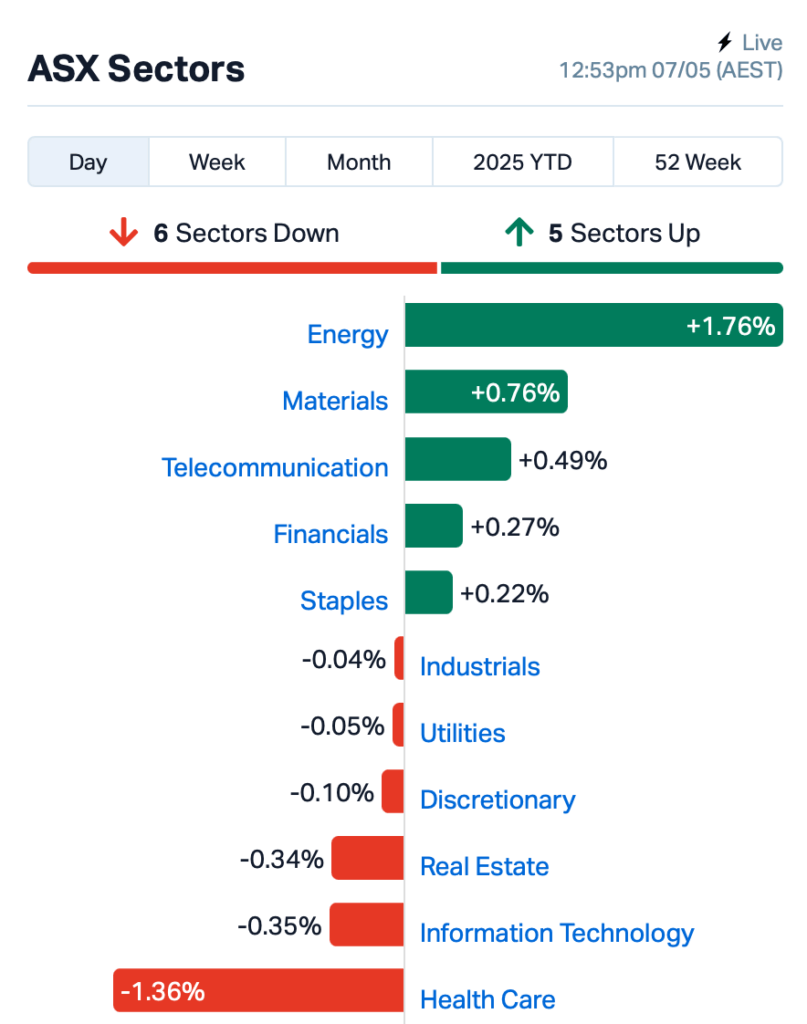

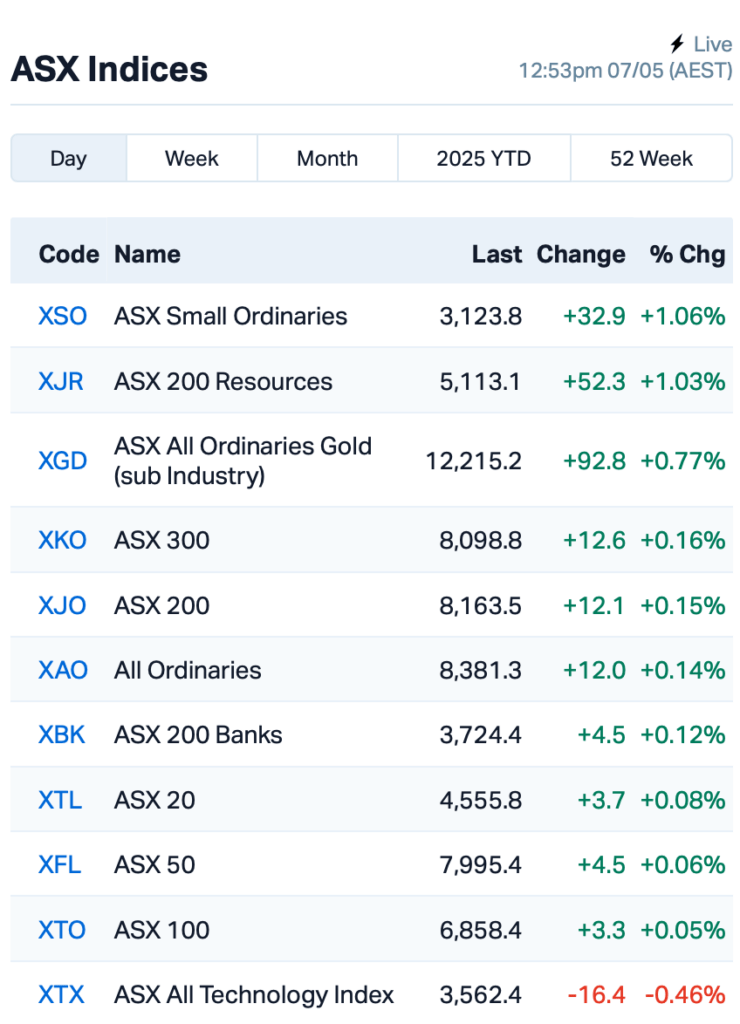

The ASX opened with a bit more sparkle on Wednesday, with the benchmark ASX 200 climbing up 0.15% by lunch time, AEST.

All eyes are on that crucial meeting between US Treasury Secretary Scott Bessent and Chinese officials in Switzerland.

The flicker of optimism on what the meeting could bring sent oil and iron ore prices ticking up this morning.

But with the Fed’s big decision looming (due to land Thursday morning AEST), some traders on Wall Street have gone into risk-off mode.

The S&P 500 was down by 0.8% last night as traders brace for whatever Jerome Powell might pull out of the hat.

Markets are mostly betting on the Fed to hold rates this time, despite Trump cranking up the pressure.

“If traders wish to believe that the Fed will come to the rescue of the world tomorrow, and assuage the recent rise in policy uncertainty and political uncertainty with a signal of overt ‘dovishness’, they should think again,” said Thierry Wizman at Macquarie.

Despite the Wall Street sell-off, the promise of a potential dead-lock with China kept a floor on stock prices.

Elsewhere, gold, that old faithful, took a bit of a breather as traders ditched the safe havens in favour of hopes for better US-China relations.

Oil is on the up again. WTI prices climbed 3%, pushing back above $US59 a barrel after six straight sessions in the red.

Back home on the ASX, energy was the best performer on the back of higher crude prices.

The big four banks shook off Tuesday’s stumble and found their feet again.

National Australia Bank (ASX:NAB) led the charge, up 2% despite missing the mark on core earnings and revenue for the half.

The Healthcare sector was dragged down by CSL (ASX:CSL), which fell almost 2% on no specific news.

Still in large caps, JB HiFi (ASX:JBH) was clipped by 3% despite posting decent growth across all its business lines in Q3. Good numbers, but just not enough to get the market excited.

Boss Energy (ASX:BOE) shot up 10% after talking up its spot in the uranium market at the Macquarie Australia Conference. Triuranium octoxide prices are on the rise, and Boss says it’s right where it needs to be.

Meanwhile in China today, the People’s Bank of China trimmed its 7-day reverse repo rate to 1.4% from 1.5%.

It’s a small cut but good news for markets nevertheless, enough to remind everyone that Beijing’s not just watching from the sidelines.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 7 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| YAR | Yari Minerals Ltd | 0.011 | 120% | 48,008,478 | $2,411,789 |

| RFT | Rectifier Technolog | 0.009 | 50% | 2,124,107 | $8,291,904 |

| IS3 | I Synergy Group Ltd | 0.004 | 33% | 126,261 | $1,502,190 |

| LCL | LCL Resources Ltd | 0.008 | 33% | 13,405,390 | $7,168,876 |

| NAE | New Age Exploration | 0.004 | 33% | 1,153,676 | $7,978,197 |

| MDR | Medadvisor Limited | 0.130 | 30% | 1,195,245 | $59,771,564 |

| CXU | Cauldron Energy Ltd | 0.009 | 29% | 240,955 | $10,229,832 |

| ASR | Asra Minerals Ltd | 0.003 | 25% | 1,922,945 | $5,412,094 |

| CAV | Carnavale Resources | 0.005 | 25% | 7,000 | $16,360,874 |

| ENT | Enterprise Metals | 0.003 | 25% | 1,001,627 | $2,356,635 |

| M4M | Macro Metals Limited | 0.011 | 22% | 283,725 | $35,796,758 |

| BCB | Bowen Coal Limited | 0.490 | 21% | 398,778 | $43,641,810 |

| AUE | Aurumresources | 0.435 | 21% | 4,953,834 | $83,590,986 |

| FAU | First Au Ltd | 0.003 | 20% | 869,816 | $5,179,983 |

| ODE | Odessa Minerals Ltd | 0.006 | 20% | 2,479,811 | $7,997,663 |

| RDN | Raiden Resources Ltd | 0.006 | 20% | 731,006 | $17,254,457 |

| TMK | TMK Energy Limited | 0.003 | 20% | 7,388,848 | $25,555,958 |

| TMX | Terrain Minerals | 0.003 | 20% | 1,729,706 | $5,563,058 |

| 1AD | Adalta Limited | 0.005 | 19% | 230,383 | $2,701,536 |

| 1CG | One Click Group Ltd | 0.007 | 17% | 1,535,557 | $7,067,279 |

| DUN | Dundasminerals | 0.028 | 17% | 42,501 | $2,573,240 |

| GBE | Globe Metals &Mining | 0.031 | 15% | 155,492 | $18,755,631 |

| AHK | Ark Mines Limited | 0.195 | 15% | 22,803 | $9,425,890 |

| BSN | Basinenergylimited | 0.016 | 14% | 167,988 | $1,719,610 |

Yari Minerals (ASX:YAR) will be snapping up the Rolleston South coal project in Queensland’s Bowen Basin, with a 78.9Mt JORC inferred resource already confirmed. It’s surrounded by Glencore and Peabody mines, so infrastructure is top-notch. Yari plans to start drilling soon, aiming for semi-soft metallurgical coal, and the deal includes a 19.9% shareholding and performance rights for a bigger resource. Yari’s CEO Anthony Italiano says it’s primed for growth with big exploration upside.

LCL Resources (ASX:LCL) has reworked its deal with Tiger Gold Corp to sell its Andes gold project and Quinchia gold project in Colombia for a total of $14 million. The new terms include a bigger payout on the first gold pour, bumped up from $2.5 million to $6.5 million, and the 'Stay Private' option has been scrapped. Payments will be staggered: $1 million upfront, $2 million after 8 months, $4.5 million after 12 months, and $6.5 million once gold starts flowing. LCL is seeking shareholder approval at its upcoming AGM.

Telehealth company MedAdvisor (ASX:MDR) has received a non-binding letter of intent (LOI) from a major multinational software company to buy its ANZ business division for cash. The offer is confidential for now, but MedAdvisor reckons it's well above its current share price. The deal is part of MedAdvisor's strategy to close the gap between its market value and what it thinks it's really worth. MedAdvisor’s ANZ business pulled in a record $2.9 million in April.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 7 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.001 | -50% | 65,125,322 | $57,867,624 |

| HCF | Hghighconviction | 0.020 | -33% | 521,879 | $582,194 |

| FRX | Flexiroam Limited | 0.004 | -33% | 131,772 | $9,104,392 |

| MOM | Moab Minerals Ltd | 0.001 | -33% | 234,888 | $2,600,499 |

| TSL | Titanium Sands Ltd | 0.004 | -33% | 1,367,786 | $14,020,483 |

| VML | Vital Metals Limited | 0.002 | -33% | 212,036 | $17,685,201 |

| HIQ | Hitiq Limited | 0.021 | -30% | 3,261,873 | $11,026,874 |

| EEL | Enrg Elements Ltd | 0.002 | -25% | 2,537,936 | $6,507,557 |

| MTB | Mount Burgess Mining | 0.003 | -25% | 11,855,544 | $1,406,811 |

| OVT | Ovanti Limited | 0.003 | -25% | 3,655,295 | $10,806,191 |

| NPM | Newpeak Metals | 0.012 | -20% | 134,485 | $4,831,076 |

| CR9 | Corellares | 0.002 | -20% | 200,000 | $2,342,915 |

| IMI | Infinitymining | 0.008 | -20% | 10,000 | $4,230,158 |

| MIO | Macarthur Minerals | 0.022 | -19% | 567,628 | $5,390,969 |

| CHM | Chimeric Therapeutic | 0.005 | -17% | 425,648 | $10,904,117 |

| PIL | Peppermint Inv Ltd | 0.003 | -17% | 2,000,000 | $6,712,918 |

| ROG | Red Sky Energy. | 0.005 | -17% | 32,235 | $32,533,363 |

| HTM | High-Tech Metals Ltd | 0.155 | -16% | 15,488 | $8,542,068 |

| IRD | Iron Road Ltd | 0.031 | -16% | 154,926 | $30,661,633 |

| SVY | Stavely Minerals Ltd | 0.011 | -15% | 1,202,517 | $7,072,547 |

| PFT | Pure Foods Tas Ltd | 0.017 | -15% | 28,730 | $2,708,512 |

| IFG | Infocusgroup Hldltd | 0.006 | -14% | 460,350 | $1,836,988 |

| TEG | Triangle Energy Ltd | 0.003 | -14% | 1,330,004 | $7,312,319 |

| SNS | Sensen Networks Ltd | 0.025 | -14% | 475,709 | $22,998,087 |

The train wreck this morning was at Nuix (ASX:NXL). The software firm nosedived a brutal 16% after pulling its full-year guidance on revenue growth and cash flow, citing "uncertainty in the geopolitical landscape". Seems like clients are dragging their heels on new IT contracts, and investors didn’t take that well.

IN CASE YOU MISSED IT

Future Metals (ASX:FME) has kicked off a 1-for-3 non-renounceable offer to raise up to $2.64m before costs, partially underwritten by CPS Capital Group Pty Ltd.

The company intends to use the funds to advance the Eileen Bore copper-nickel-platinum group metal project, which has generated results up to 120m at 0.73% copper, 0.29% nickel and 0.86 g/t platinum group metals from surface.

At Stockhead, we tell it like it is. While Future Metals is a Stockhead advertiser, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX inches higher, Yari doubles after snapping up Queensland coal project