High Voltage: South American lithium investment heats up even as prices fall

Analysts predict the lithium market will face a surplus in the near term but big miners like Rio are playing the long game.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Rio to invest $400m in Chilean lithium project with Codelco

Lithium price hits lowest point since back in Feb 2021

Woodmac predicts oversupply then deficit again in early 2030s

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

The global lithium market is expected to face a significant supply surplus over the next decade, with deflationary pressures from China’s overcapacity in processing and trade tensions with the U.S. threatening to reshape the market’s dynamics.

According to Wood Mackenzie, the current oversupply is projected to peak in 2027, followed by a potential shift to deficit by the early 2030s.

But big miners are playing the long game, not at all fazed by this week's spodumene concentrate price drop to US$625/tonne – the lowest level since February 2021.

Case in point, mining giant Rio Tinto (ASX:RIO) just entered a joint venture with the world’s largest copper producer, state-owned Codelco (Corporación Nacional Del Cobre de Chile) to develop and operate a high-grade lithium project in the Salar de Maricunga in Chile.

Rio is investing $350m in initial funding and another $500m towards construction costs (if it goes ahead) and another $50m if the project achieves its aim of delivering first lithium by the end of 2030.

It follows the mining mammoth's $10bn takeover of Allkem this year, along with its sanctioning of the US$2.5bn, 60,000tpa Rincon lithium carbonate operation in Argentina.

According to Benchmark Mineral Intelligence, Rio Tinto will be the second largest lithium producer in the world behind the pure play US stock Albemarle by 2035.

Rio is the latest and biggest gun splashing cash around South America, which has emerged as one of the world’s preferred lithium hot spots.

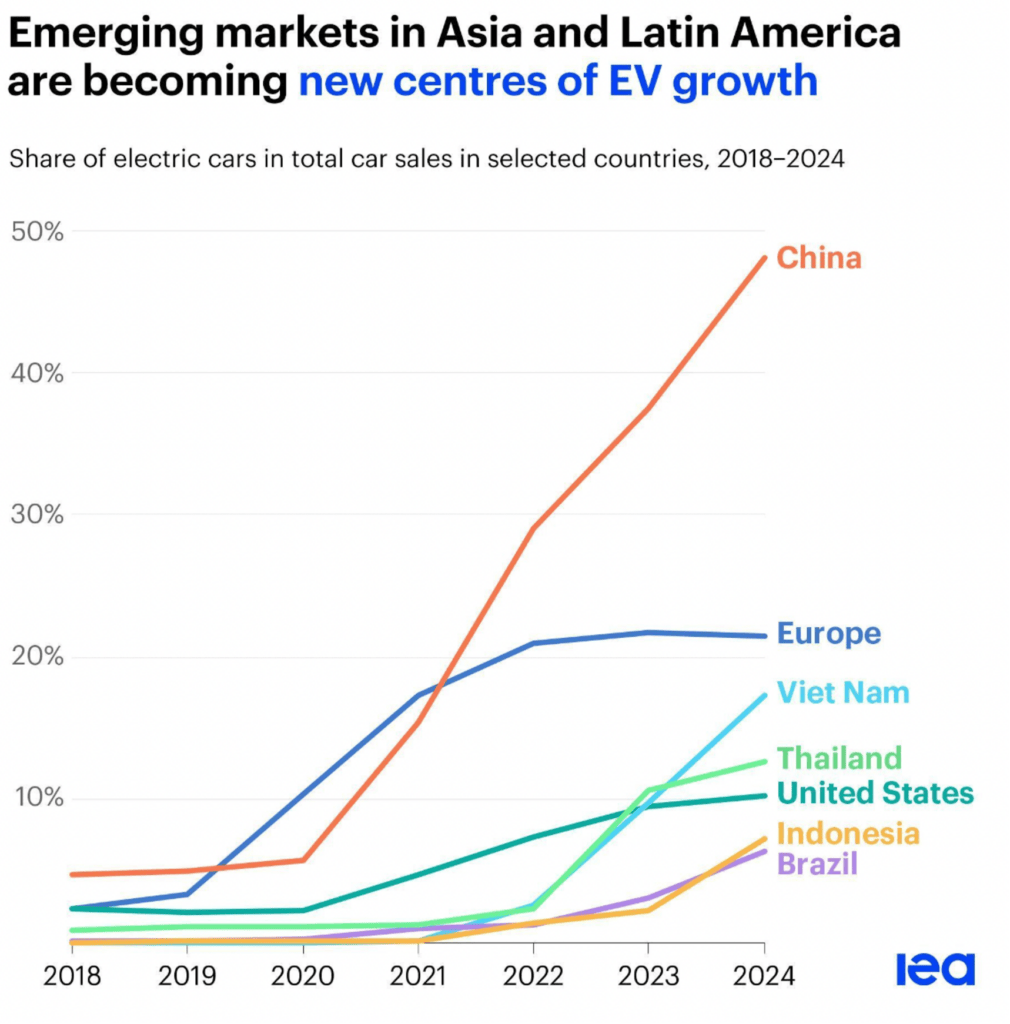

According to the International Energy Agency, Latin America (along with Asia) have become new centres for EV growth, with electric car sales across these regions surged by more than 60% last year.

Brazil-liant

No surprise then, that explorers and developers alike are flocking to Argentina, Chile and Brazil to nab a slice of pie as suppliers of materials for the global energy transition.

Just look at Pilbara Minerals (ASX:PLS), which picked up Latin Resources (ASX:LRS) and its Salinas project in Brazil earlier this year.

It’s a move CEO Dale Henderson said was because the asset would be cheaper to develop than anything similar in WA.

“It’s a fantastic proposition, which is frankly hard to beat globally,” he said at the AFR Mining Summit in Perth this week.

“We considered opportunities in our backyard. Brazil just stacked up on every dimension.”

With Latin off the table, that's a positive outlook for juniors keeping the faith in lithium in the region, who are trading on far lower valuations.

CSE-listed American Salars Lithium is one example. Its Jaguaribe project in the State of Ceará could open up a new pegmatite district with high grade results from rock chip sampling of lithium-caesium-tantalum pegmatites. It also hosts mulitple lithium rock types such as lepidolite, spodumene and amblygonite as well as rare earths, tantalum, niobium and tin.

"These multi-mineral deposits enhance the economic viability of the Jaguaribe Project, with lithium oxide grades reaching up to 3.72%," CEO Nick Horsley told Stockhead.

"Geologically, Ceará’s Solonópole region, part of the Borborema Pegmatite Province, benefits from well-exposed, high-grade pegmatite swarms and a favorable structural setting, ideal for cost-effective exploration."

"The Jaguaribe Project distinguishes itself through its large scale, high-grade lithium and multi-mineral potential, historical mining validation, logistical advantages, and strategic exploration approach, positioning it as a leading hardrock lithium project in Ceará compared to smaller or less diversified regional plays."

With prices so low more mine shuts are a distinct possibility, Horsley says a 10-30,000t lithium carbonate surplus globally implies we only need one hard rock mine to shut to bring about a faster than expected surplus, potentially as soon as next year.

That's informed the company's approach to exploring early stage lithium projects that could come to life in the next upturn, with assets across Canada, Brazil, the US and Argentina, where it boasts 13880 hectares of brine-prospective salar tenure at the Pocitos project.

This month, the company appointed veteran hydrogeologist Dr Mark King as its technical advisor to help steer its search for significant lithium salar projects.

King has +30 years international experience in groundwater modelling and geochemistry, and 15 years specialising in exploration and evaluation of lithium brine projects including for Albemarle at Salar Atacama, Silver Peak and Antofalla Salar, Vulcan at its geothermal lithium projects in Germany's Rhine Valley and Lithium Americas and the Cauchari Salar.

That makes his resource and reserve estimation experience among 'arguably the most extensive of any geologist, hydrogeologist, or engineer in the world', American Salars said.

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese and vanadium is performing >>>

Code Company Price % Week % Month % Six Month % Year Market Cap XTC XTC Lithium Limited 0.2 19900% 19900% 19900% 19900% $17,528,272 PEK Peak Rare Earths Ltd 0.27 157% 92% 180% 31% $93,310,902 OCN Oceanalithiumlimited 0.063 103% 133% 142% 62% $7,424,805 NWC New World Resources 0.047 62% 124% 124% 9% $99,155,888 MRD Mount Ridley Mines 0.003 50% 20% -70% -85% $1,556,978 VML Vital Metals Limited 0.003 50% 0% 50% 0% $17,685,201 FRS Forrestaniaresources 0.069 41% 73% 360% 263% $20,734,491 AZI Altamin Limited 0.03 30% 25% 7% -16% $14,937,075 MTM MTM Critical Metals 0.325 30% 44% 378% 525% $135,309,988 PAT Patriot Resourcesltd 0.064 28% -9% 31% -21% $8,090,750 EGR Ecograf Limited 0.345 28% 25% 354% 146% $168,028,773 BYH Bryah Resources Ltd 0.005 25% 25% 25% -38% $4,349,768 STM Sunstone Metals Ltd 0.016 23% 33% 129% 45% $83,788,251 DYM Dynamicmetalslimited 0.28 22% -18% 40% 51% $14,725,302 MOH Moho Resources 0.006 20% 100% 20% 20% $4,472,484 AKN Auking Mining Ltd 0.006 20% -14% 50% -68% $4,023,451 MRR Minrex Resources Ltd 0.01 18% 33% 25% -9% $11,933,543 ALY Alchemy Resource Ltd 0.007 17% 17% 0% 17% $8,246,534 G88 Golden Mile Res Ltd 0.014 17% 40% 27% 0% $7,619,470 PVT Pivotal Metals Ltd 0.007 17% -13% -22% -65% $6,350,581 KAI Kairos Minerals Ltd 0.028 17% 33% 87% 155% $71,034,629 ASO Aston Minerals Ltd 0.021 17% 11% 133% 31% $25,901,285 TOR Torque Met 0.11 16% 15% 112% -48% $31,011,351 BUR Burleyminerals 0.052 16% 0% -12% -63% $9,420,700 M24 Mamba Exploration 0.015 15% 36% 25% -29% $4,427,484 CDT Castle Minerals 0.093 15% 58% 24% -38% $11,136,919 BUX Buxton Resources Ltd 0.04 14% 33% -26% -60% $11,210,188 AVW Avira Resources Ltd 0.008 14% 14% -60% -60% $1,464,902 NMT Neometals Ltd 0.09 14% 55% -1% -25% $71,556,533 TMB Tambourahmetals 0.025 14% -11% -4% -67% $2,939,751 EVG Evion Group NL 0.018 13% 0% -45% -25% $8,263,479 GSM Golden State Mining 0.009 13% 0% 0% -18% $2,514,336 1AE Auroraenergymetals 0.072 13% 44% 18% -20% $12,355,398 IPX Iperionx Limited 3.61 11% 15% -14% 67% $1,139,404,806 SCN Scorpion Minerals 0.02 11% 5% 82% -5% $10,481,124 RR1 Reach Resources Ltd 0.01 11% 0% 11% -29% $9,618,745 DM1 Desert Metals 0.02 11% 5% -26% -5% $8,403,445 KTA Krakatoa Resources 0.01 11% 11% 0% -44% $6,201,340 EV1 Evolutionenergy 0.01 11% -29% -64% -85% $3,626,505 ODE Odessa Minerals Ltd 0.0055 10% -8% -21% 38% $8,797,429 KOB Kobaresourceslimited 0.044 10% -6% -44% -71% $6,659,588 LU7 Lithium Universe Ltd 0.0055 10% 10% -39% -69% $3,929,898 GAL Galileo Mining Ltd 0.12 9% 4% 0% -56% $23,714,991 LIN Lindian Resources 0.12 9% 0% 14% -8% $141,263,599 ICL Iceni Gold 0.061 9% 2% 7% -15% $19,459,785 VTM Victory Metals Ltd 0.77 8% 81% 108% 185% $112,240,282 SRI Sipa Resources Ltd 0.013 8% -4% -7% -24% $5,413,178 MHK Metalhawk. 0.485 8% 15% 80% 782% $56,563,792 WMG Western Mines 0.215 8% 39% 23% -46% $18,070,669 LYC Lynas Rare Earths 8.025 7% -9% 17% 13% $7,109,396,227 FTL Firetail Resources 0.059 7% 18% -20% 24% $22,421,651 LEG Legend Mining 0.008 7% 0% -30% -52% $23,291,817 FRB Firebird Metals 0.08 7% -6% -33% -62% $11,388,912 HRE Heavy Rare Earths 0.032 7% 39% 19% -9% $6,241,016 GRE Greentechmetals 0.05 6% -15% -47% -77% $5,494,981 WC1 Westcobarmetals 0.017 6% 21% 13% -69% $3,525,451 GED Golden Deeps 0.019 6% 6% -30% -58% $3,188,263 MEK Meeka Metals Limited 0.1425 6% -11% 116% 285% $339,586,448 RXL Rox Resources 0.3 5% -21% 88% 71% $216,086,368 INF Infinity Lithium 0.021 5% 11% -32% -60% $9,451,842 FG1 Flynngold 0.025 4% 4% -19% -26% $9,782,912 SLM Solismineralsltd 0.084 4% 8% -10% -30% $9,994,956 LLI Loyal Lithium Ltd 0.088 4% 19% -16% -65% $8,864,510 S32 South32 Limited 3.095 4% 15% -17% -21% $13,886,137,576 PNN Power Minerals Ltd 0.06 3% -14% -39% -57% $7,641,764 WCN White Cliff Min Ltd 0.03 3% 58% 88% 100% $58,163,122 AXN Alliance Nickel Ltd 0.034 3% 3% -19% -28% $22,501,028 DVP Develop Global Ltd 3.77 3% 43% 88% 55% $1,017,971,849 CTM Centaurus Metals Ltd 0.375 3% -9% -7% -25% $181,295,943 VMC Venus Metals Cor Ltd 0.1025 3% 4% 46% 14% $20,593,512 TVN Tivan Limited 0.1075 2% 2% 95% 115% $217,121,138 WA1 Wa1Resourcesltd 12.81 2% 13% -17% -39% $829,518,256 KM1 Kalimetalslimited 0.09 2% -3% -28% -78% $6,664,659 CHR Charger Metals 0.046 2% 12% -41% -35% $3,561,332 MEI Meteoric Resources 0.098 2% -25% 1% -50% $231,349,415 NIC Nickel Industries 0.6525 2% 27% -28% -39% $2,864,357,678 CHN Chalice Mining Ltd 1.09 2% 3% -20% -35% $435,710,003 RNU Renascor Res Ltd 0.069 1% 3% 5% -43% $170,388,739 NC1 Nicoresourceslimited 0.073 1% -3% -37% -57% $8,008,142 PVW PVW Res Ltd 0.012 0% -14% -25% -52% $2,386,857 PSC Prospect Res Ltd 0.14 0% -7% 44% -7% $91,583,349 QXR Qx Resources Limited 0.004 0% 33% -11% -64% $5,241,315 RIL Redivium Limited 0.004 0% 0% 0% 100% $13,609,422 LPD Lepidico Ltd 0.002 0% 0% 0% -50% $17,178,371 CZN Corazon Ltd 0.002 0% 0% -50% -78% $2,369,145 MAN Mandrake Res Ltd 0.018 0% 0% -25% -49% $11,290,679 STK Strickland Metals 0.12 0% 26% 54% 24% $237,547,779 CLA Celsius Resource Ltd 0.007 0% 0% -30% -30% $21,948,419 MNS Magnis Energy Tech 0.042 0% 0% 0% 0% $50,378,922 QEM QEM Limited 0.054 0% -4% 20% -64% $10,305,019 ESR Estrella Res Ltd 0.036 0% 29% 125% 620% $75,922,404 SBR Sabre Resources 0.008 0% 33% -27% -60% $3,155,695 VRC Volt Resources Ltd 0.005 0% 25% 43% 0% $23,423,890 ADV Ardiden Ltd 0.145 0% 0% 12% -3% $9,065,038 NTU Northern Min Ltd 0.028 0% -30% 40% -20% $225,643,207 AXE Archer Materials 0.26 0% 0% -13% -33% $71,357,164 PGM Platina Resources 0.02 0% 0% -9% -29% $13,086,787 AAJ Aruma Resources Ltd 0.01 0% 0% -33% -47% $3,053,300 HAS Hastings Tech Met 0.32 0% -14% 21% 19% $59,492,832 SGQ St George Min Ltd 0.026 0% 0% 4% 44% $72,031,206 TKL Traka Resources 0.0015 0% 50% 50% -25% $3,188,685 IPT Impact Minerals 0.006 0% 20% -47% -71% $23,731,980 JRV Jervois Global Ltd 0.011 0% 0% 0% -39% $29,730,402 ADD Adavale Resource Ltd 0.002 0% 0% -20% -64% $4,574,558 GL1 Globallith 0.17 0% 3% -8% -56% $44,494,461 ATM Aneka Tambang 0.98 0% 0% 14% -9% $1,277,576 LEL Lithenergy 0.37 0% 0% 0% -12% $41,440,581 RMX Red Mount Min Ltd 0.007 0% -13% -30% -30% $3,254,705 GW1 Greenwing Resources 0.028 0% -22% -36% -65% $7,685,997 1MC Morella Corporation 0.019 0% 0% -34% -75% $6,897,131 MRC Mineral Commodities 0.026 0% 0% 0% 13% $25,596,288 BMM Bayanminingandmin 0.029 0% -19% -43% -52% $2,985,707 WKT Walkabout Resources 0.095 0% 0% 0% -24% $63,769,838 TON Triton Min Ltd 0.006 0% 20% -40% -50% $9,410,332 CNJ Conico Ltd 0.007 0% 0% -30% -53% $1,662,411 BOA BOA Resources Ltd 0.018 0% 0% -18% -22% $2,220,351 SLZ Sultan Resources Ltd 0.006 0% -33% -14% -40% $1,388,819 NVA Nova Minerals Ltd 0.325 0% -2% 51% 35% $104,974,161 MQR Marquee Resource Ltd 0.009 0% -25% -36% -31% $3,883,844 EFE Eastern Resources 0.026 0% 0% -35% -63% $3,404,429 CNB Carnaby Resource Ltd 0.3 0% 13% -19% -65% $63,948,881 AX8 Accelerate Resources 0.008 0% 14% -11% -83% $6,377,510 DTM Dart Mining NL 0.004 0% -11% -64% -85% $4,792,222 EMS Eastern Metals 0.01 0% 0% -38% -75% $1,394,262 IMI Infinitymining 0.009 0% -31% -36% -80% $3,807,142 RAG Ragnar Metals Ltd 0.019 0% -10% -10% -5% $9,005,734 TEM Tempest Minerals 0.004 0% 0% -33% -53% $2,938,119 OB1 Orbminco Limited 0.001 0% 0% -40% -70% $2,397,568 LMG Latrobe Magnesium 0.011 0% 10% -58% -82% $28,892,490 KOR Korab Resources 0.008 0% 0% 0% 33% $2,936,400 CMX Chemxmaterials 0.026 0% 0% -30% -45% $3,354,580 CMO Cosmometalslimited 0.016 0% 0% 7% -49% $5,154,170 KGD Kula Gold Limited 0.008 0% 14% 41% -6% $7,370,029 ENT Enterprise Metals 0.002 0% 0% -50% -50% $2,356,635 ENV Enova Mining Limited 0.008 0% 0% 14% -58% $11,308,006 RBX Resource B 0.028 0% 0% -24% -7% $3,225,166 EMT Emetals Limited 0.003 0% 0% -40% -50% $2,550,000 PNT Panthermetalsltd 0.014 0% 0% -33% -60% $3,911,759 RGL Riversgold 0.004 0% -11% 33% -50% $6,734,850 SRZ Stellar Resources 0.017 0% 6% -8% -19% $35,355,760 YAR Yari Minerals Ltd 0.006 0% 20% 50% 50% $3,328,269 IG6 Internationalgraphit 0.055 0% 17% -5% -54% $11,226,383 CLZ Classic Min Ltd 0.001 0% 0% 0% -83% $1,544,026 SUM Summitminerals 0.037 0% -26% -78% -80% $3,485,120 IDA Indiana Resources 0.08 0% -2% 40% 79% $50,775,864 M2R Miramar 0.003 0% 0% -45% -68% $2,990,470 AOA Ausmon Resorces 0.002 0% 0% 0% -20% $2,622,427 TKM Trek Metals Ltd 0.06 0% -13% 140% 50% $33,443,203 BCA Black Canyon Limited 0.05 0% -17% -9% -58% $6,482,535 KNI Kunikolimited 0.145 0% 0% -24% -34% $11,300,155 BC8 Black Cat Syndicate 0.855 0% -15% 40% 167% $594,184,482 OM1 Omnia Metals Group 0.009 0% 0% -88% -88% $2,170,917 LLL Leolithiumlimited 0.332997 0% 0% 0% 0% $401,204,047 TMX Terrain Minerals 0.003 0% 0% 0% -14% $6,745,670 MHC Manhattan Corp Ltd 0.023 0% 35% 15% -45% $5,637,574 FIN FIN Resources Ltd 0.006 0% 20% 0% -45% $4,169,331 LCY Legacy Iron Ore 0.009 0% -10% -28% -42% $87,858,383 RON Roninresourcesltd 0.2 0% 11% 25% 54% $8,075,002 PFE Pantera Lithium 0.014 0% -7% -33% -72% $6,632,972 ASN Anson Resources Ltd 0.0525 -1% -6% -24% -61% $73,497,037 E25 Element 25 Ltd 0.2275 -1% 6% -17% -16% $51,437,790 ARL Ardea Resources Ltd 0.415 -1% -6% 14% -30% $85,217,231 CY5 Cygnus Metals Ltd 0.075 -1% -22% -38% -9% $59,579,217 A8G Australasian Metals 0.069 -1% -1% -7% -9% $3,994,391 LRV Larvottoresources 0.67 -1% -23% 37% 483% $273,467,373 BHP BHP Group Limited 38.675 -2% 6% -3% -16% $196,187,099,883 VHM Vhmlimited 0.24 -2% -37% -38% -52% $60,515,988 ASL Andean Silver 0.945 -2% -1% -5% 23% $146,865,723 EMH European Metals Hldg 0.21 -2% -2% 45% -52% $43,563,388 GLN Galan Lithium Ltd 0.1025 -2% -2% -27% -56% $94,584,206 JMS Jupiter Mines. 0.185 -3% 32% 28% -42% $362,792,726 DLI Delta Lithium 0.185 -3% 19% -10% -44% $132,560,232 BSX Blackstone Ltd 0.069 -3% 11% 156% 18% $48,726,339 ITM Itech Minerals Ltd 0.034 -3% -28% -48% -55% $5,808,403 GBR Greatbould Resources 0.063 -3% -26% 47% 2% $47,153,038 MLX Metals X Limited 0.5275 -3% 3% 27% 11% $491,947,304 EMC Everest Metals Corp 0.145 -3% -3% 12% 7% $33,619,688 RVT Richmond Vanadium 0.14 -3% -7% -53% -48% $29,573,789 A11 Atlantic Lithium 0.135 -4% -7% -40% -67% $93,574,887 DEV Devex Resources Ltd 0.08 -4% 13% -27% -79% $35,335,254 EUR European Lithium Ltd 0.051 -4% -2% 104% 11% $73,704,255 ASM Ausstratmaterials 0.5 -4% -35% -1% -51% $90,670,341 CWX Carawine Resources 0.096 -4% 0% -17% -4% $22,668,043 KFM Kingfisher Mining 0.048 -4% 0% -6% -28% $2,578,320 PMT Patriotbatterymetals 0.235 -4% -6% -6% -76% $127,464,747 FLG Flagship Min Ltd 0.069 -4% -1% 10% -57% $14,658,783 S2R S2 Resources 0.092 -4% -6% 14% -29% $41,210,077 ARU Arafura Rare Earths 0.1675 -4% -22% 29% -12% $406,614,234 OMH OM Holdings Limited 0.325 -4% -6% -6% -35% $252,864,744 LPM Lithium Plus 0.065 -4% 10% -41% -32% $8,634,600 ILU Iluka Resources 3.92 -5% 4% -27% -50% $1,649,902,284 L1M Lightning Minerals 0.06 -5% 0% -28% -29% $6,199,699 LIT Livium Ltd 0.0095 -5% 6% -47% -65% $15,214,564 PTR Petratherm Ltd 0.285 -5% 27% 58% 1400% $103,684,431 TLG Talga Group Ltd 0.4125 -5% -11% -10% -48% $178,408,813 MLS Metals Australia 0.018 -5% -10% -31% -18% $13,116,951 IGO IGO Limited 4.075 -5% 14% -18% -49% $3,082,079,999 ARR American Rare Earths 0.25 -6% -21% -6% -9% $126,855,825 LKE Lake Resources 0.032 -6% 0% -33% -52% $57,700,793 HAW Hawthorn Resources 0.048 -6% 9% 2% -31% $16,080,749 SYA Sayona Mining Ltd 0.015 -6% -17% -56% -65% $184,692,736 KZR Kalamazoo Resources 0.085 -7% 0% 2% -23% $19,087,236 COB Cobalt Blue Ltd 0.056 -7% -15% -21% -41% $24,466,137 VR8 Vanadium Resources 0.014 -7% -13% -46% -75% $7,900,086 SMX Strata Minerals 0.014 -7% -62% -33% -46% $3,418,079 OD6 Od6Metalsltd 0.028 -7% 12% -30% -58% $4,493,103 LM1 Leeuwin Metals Ltd 0.14 -7% -33% 92% 100% $15,120,958 SRL Sunrise 0.415 -7% -42% 66% -30% $37,444,412 LOT Lotus Resources Ltd 0.1725 -7% 11% -25% -64% $391,004,304 PUR Pursuit Minerals 0.039 -7% -11% -74% -83% $3,989,359 GCM Green Critical Min 0.013 -7% 44% 86% 271% $25,521,318 BKT Black Rock Mining 0.025 -7% 25% -44% -62% $39,674,877 FBM Future Battery 0.0165 -8% -6% -18% -61% $11,035,298 AVL Aust Vanadium Ltd 0.011 -8% 0% -21% -35% $94,981,239 WC8 Wildcat Resources 0.165 -8% -13% -38% -69% $208,408,108 EG1 Evergreenlithium 0.033 -8% -38% -59% -66% $6,421,084 FGR First Graphene Ltd 0.032 -9% -18% -3% -44% $26,208,474 THR Thor Energy PLC 0.01 -9% 0% -23% -38% $7,107,898 WR1 Winsome Resources 0.15 -9% -27% -70% -89% $35,364,550 VUL Vulcan Energy 4.15 -9% -8% -38% -19% $920,341,489 ARN Aldoro Resources 0.29 -9% -44% 241% 277% $56,058,088 ETM Energy Transition 0.047 -10% -38% 96% 47% $76,019,025 MIN Mineral Resources. 23.5 -10% 38% -31% -70% $4,620,152,380 AUZ Australian Mines Ltd 0.009 -10% -18% -14% 0% $13,285,865 LML Lincoln Minerals 0.0045 -10% -10% -25% -44% $10,512,849 GRL Godolphin Resources 0.009 -10% -18% -40% -68% $4,039,860 WSR Westar Resources 0.0045 -10% -25% -44% -55% $1,794,262 CXO Core Lithium 0.089 -10% 31% -7% -41% $192,871,399 BM8 Battery Age Minerals 0.053 -10% -12% -41% -65% $6,216,483 ABX ABX Group Limited 0.043 -10% 8% 8% -22% $11,041,056 AGY Argosy Minerals Ltd 0.017 -11% -8% -51% -87% $26,206,577 AQD Ausquest Limited 0.051 -11% -2% 538% 229% $66,568,370 INR Ioneer Ltd 0.125 -11% -11% -38% -49% $294,459,065 DRE Dreadnought Resources Ltd 0.0125 -11% -4% -11% -26% $66,033,500 KNG Kingsland Minerals 0.098 -11% -22% -47% -52% $7,256,091 JLL Jindalee Lithium Ltd 0.48 -11% 88% 81% -14% $37,600,518 TAR Taruga Minerals 0.008 -11% -11% -27% -11% $5,710,032 ANX Anax Metals Ltd 0.008 -11% 33% -27% -82% $7,062,461 GT1 Greentechnology 0.023 -12% -43% -66% -78% $10,928,911 RAS Ragusa Minerals Ltd 0.015 -12% -12% 7% -21% $2,138,982 REC Rechargemetals 0.015 -12% 7% -46% -58% $3,854,850 CAE Cannindah Resources 0.036 -12% -39% -16% -31% $26,938,958 IXR Ionic Rare Earths 0.007 -13% -22% -22% -46% $41,907,427 CRR Critical Resources 0.0035 -13% -13% -42% -73% $7,842,664 PBL Parabellumresources 0.041 -13% -18% -18% -2% $2,554,300 BNR Bulletin Res Ltd 0.068 -13% 10% 70% 39% $19,965,706 PGD Peregrine Gold 0.135 -13% -21% 4% -51% $11,454,445 SYR Syrah Resources 0.335 -13% 46% 46% -35% $349,152,013 SYR Syrah Resources 0.335 -13% 46% 46% -35% $349,152,013 ZNC Zenith Minerals Ltd 0.04 -13% -20% -7% -45% $16,297,657 PLL Piedmont Lithium Inc 0.094 -15% -10% -41% -60% $59,076,491 NH3 Nh3Cleanenergyltd 0.022 -15% -15% 5% 16% $13,550,515 AR3 Austrare 0.054 -16% -43% -42% -48% $12,083,280 AM7 Arcadia Minerals 0.015 -17% -17% -46% -77% $2,347,669 NWM Norwest Minerals 0.01 -17% -25% -42% -70% $5,336,315 CRI Criticalim 0.015 -17% 0% 67% -32% $45,703,626 LTR Liontown Resources 0.64 -18% 20% -19% -56% $1,589,992,020 NVX Novonix Limited 0.44 -19% 10% -41% -48% $273,516,739 PLS Pilbara Min Ltd 1.3325 -19% -7% -52% -68% $4,392,474,458 EMN Euromanganese 0.185 -20% -34% -23% -55% $8,922,448 AS2 Askarimetalslimited 0.008 -20% -20% -50% -86% $3,233,365 CTN Catalina Resources 0.002 -20% -20% -29% -47% $4,852,038 ASR Asra Minerals Ltd 0.002 -20% 0% -33% -60% $6,916,340 WIN WIN Metals 0.019 -21% -14% -5% -55% $11,001,162 QPM QPM Energy Limited 0.036 -22% -5% -14% -8% $85,859,861 LSR Lodestar Minerals 0.007 -22% -61% -65% -78% $1,910,543 RLC Reedy Lagoon Corp. 0.0015 -25% -25% -25% -50% $1,165,060 EVR Ev Resources Ltd 0.0045 -25% -10% 50% -45% $8,936,265 LNR Lanthanein Resources 0.0015 -25% -25% -50% -70% $3,665,454 LNR Lanthanein Resources 0.0015 -25% -25% -50% -70% $3,665,454 SRN Surefire Rescs NL 0.003 -25% 0% -14% -70% $7,459,336 REE Rarex Limited 0.017 -32% -54% 55% 21% $15,216,071 AZL Arizona Lithium Ltd 0.0065 -35% 8% -54% -72% $34,257,044 PRL Province Resources 0 -100% -100% -100% -100% $0 POS Poseidon Nick Ltd 0 -100% -100% -100% -100% $23,380,727 AML Aeon Metals Ltd. 0 -100% -100% -100% -100% $5,482,003 LRS Latin Resources Ltd 0 -100% -100% -100% -100% $477,661,711 CAI Calidus Resources 0 -100% -100% -100% -100% $93,678,206 LTM Arcadium Lithium PLC 0 -100% -100% -100% -100% $1,994,929,982 Code Company Price % Week % Month % Six Month % Year Market Cap XTC XTC Lithium Limited 0.2 19900% 19900% 19900% 19900% $17,528,272

Weekly Small Cap Standouts

Oceana Lithium (ASX:OCN)

This week the explorer secured commitments to raise $667,000 towards progressing its Aussie and Brazilian projects, and to identify and assess new complimentary project opportunities.

OCN holds the Napperby project in NT which covers around ~650km2 within within the Northern Arunta pegmatite province.

It also has the Solonópole project in Brazil where an exploration licence extension is pending for the promising Nera prospect.

“Securing additional funds ensures Oceana is well placed to progress the company’s existing assets in Brazil and Australia, as well as continue to assess new project opportunities,” non-executive chairman Martin Helean said.

“We look forward to providing updates on exploration activities across our portfolio in the near term.

“We thank our existing shareholders for their ongoing support, and are pleased to welcome new shareholders to the company.”

Arizona Lithium (ASX:AZL)

AZL has secured approval from the Ministry of Energy and Resources in Saskatchewan, Canada for Phase 1 operations at its Prairie project, starting at 150tpa of lithium carbonate equivalent.

Prairie holds a 6.3Mt lithium carbonate equivalent resource over 345,000 acres of mineral rights and hosts an operational Koch Li-Pro direct lithium extraction (DLE) pilot plant – the largest ever deployed by Koch.

This approval represents a full commercial scale Direct Lithium Extraction (DLE) unit that can be replicated to increase production.

In addition to receiving project approvals, an updated well network model has been constructed for the resource, based on information acquired during the 2024 drilling and completion program, increasing the indicated resource that is producible per year by 120% to a new total of 17,000tpa LCE.

Astute Metals (ASX:ASE)

The company says drilling at its Red Mountain project in Nevada has delivered the highest-ever drill intersection to date, extending lithium mineralisation to a strike length of more than 5.6km.

The first of six diamond holes in the program returned an outstanding intersection of 8.6m grading 5060ppm lithium (2.69% lithium carbonate equivalent) from a down-hole depth of 67.7m within a broader 32.4m zone at 3260ppm lithium from 57.2m.

“This provides further indication that Red Mountain is unfolding as a lithium discovery of significance in North America. With mineralisation now defined by drilling over a strike length of almost 6 kilometres, we are looking forward to seeing what the remaining drill-holes will deliver,” chairman Tony Leibowitz said.

“The information obtained from this round of drilling should put us on a clear trajectory to advance Red Mountain towards a maiden JORC mineral resource estimate later this year.”

Delta Lithium (ASX:DLI)

Delta has expanded the footprint of its Yinnetharra lithium and tantalum project in Western Australia by acquiring Minerals 260 (ASX:MI6) adjacent Aston project.

This gives the company a dominant 3100km2 landholding in the Upper Gascoyne lithium province and grants a strong opportunity to undertake regional exploration immediately along strike of its existing deposits.

DLI will now start systematic geochemical sampling and mapping over priority areas as well as geophysical surveys.

The company is also spinning out its 1.1Moz Mt Ida gold project into the Simon Lill chaired Ballard Mining in a $25-30m IPO.

At Stockhead, we tell it like it is. While American Salars Lithium, Astute Metals and Delta Lithium are Stockhead advertisers, they did not sponsor this article.

Originally published as High Voltage: South American lithium investment heats up even as prices fall