Gold’s record run has the team that built Cardinal racing into development mode at Senegal gold mine

With gold passing US$3000/oz, developments are accelerating including a Senegal gold mine backed by the winners behind Cardinal Resources.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

With gold at record prices above US$3000/oz, miners are speeding up development timelines

Bishop Resources is aiming to bring the Makabingui gold deposit in Senegal into production in the current bull market

Led by the team behind West African success story Cardinal Resources, tens of millions of dollars in installed infrastructure gives them a head start

Gold's charge to record highs continued last week with the US Fed's rate pause pushing bullion to US$3052/oz before a slight dip to US$3023/oz on the weekend.

It's a fertile environment for gold developers, who are accelerating their timelines in a bid to take advantage of all-time high prices.

One of those is Bishop Resources, a public unlisted company led by the team that built Cardinal Resources from an early-stage explorer traversing virgin ground in Ghana into a $600 million takeover target for China's Shandong Gold with the discovery of the 7.5Moz Namdini gold project.

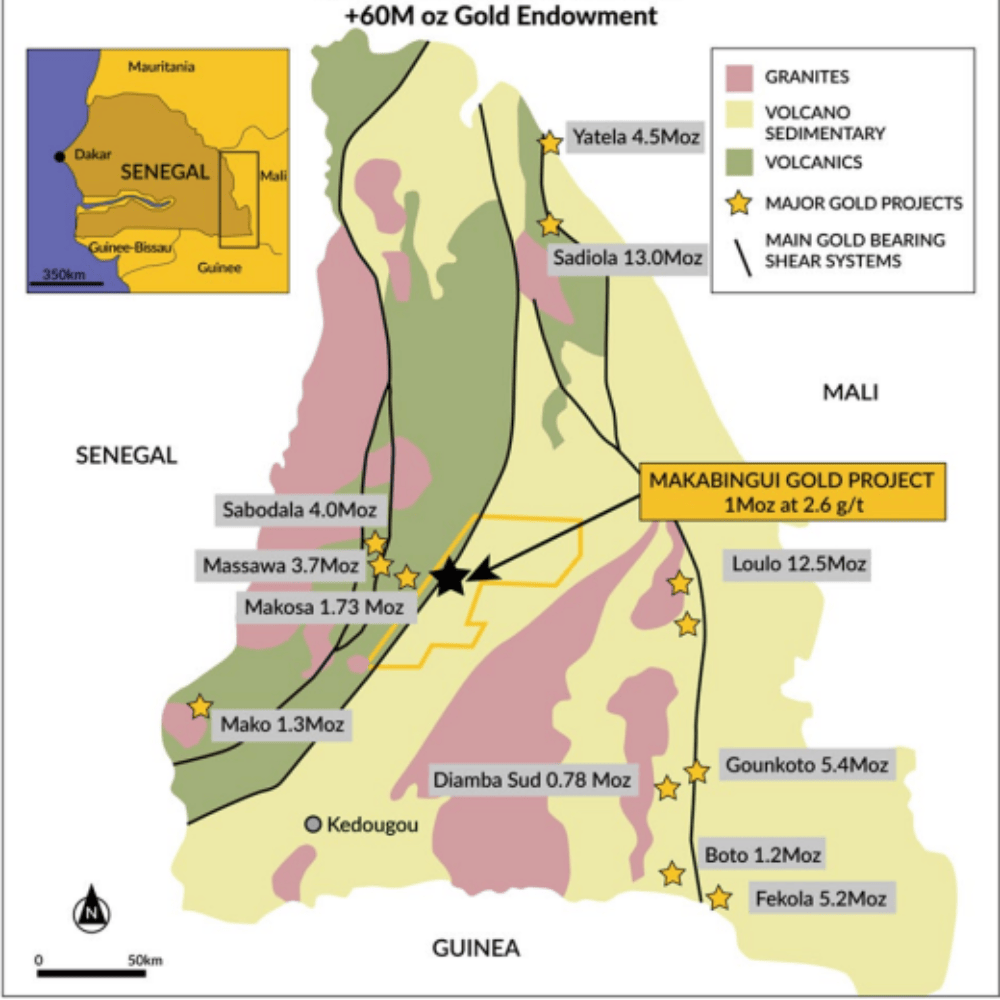

Their new game is the Makabingui gold project near Senegal's border with Mali, where a JORC-2004 resource of over 1Moz has been outlined located just 10km from Endeavour Mining's Sabodala-Massawa, the West African country's largest gold mine with a production profile of ~300,000ozpa.

Previously an exploration story, the seismic shift delivered by the gold bull run, paired with tens of millions of dollars worth of installed infrastructure, has turned it into a development tale.

"The price of gold has changed the economics enormously," director David Michael said.

"So we can now bring this project into production earlier than we anticipated.

"The original feasibility was done at US$1200 an ounce and things have changed so much since then as far as the gold price is concerned.

"Based on the original bankable feasibility – which I don't necessarily want to rely on – every hundred dollars is an additional US$17.5 million to the bottom line for us using those original numbers."

Picking a winner

The Bishop team has a host of familiar faces to ASX investors.

Michael is flanked by Cardinal founding director Malik Easah, who is based in the Ghanaian capital of Accra and also sits on the board of Canadian listed Asante Gold Corporation, a 400,000ozpa West African gold producer, which has seen its share price surge 40x since 2020.

Non-exec director Alex Pismiris is an investment banker who previously sat on the boards of both Cardinal and Papillon, which sold one of Africa's largest gold mines Fekola in a US$570m takeover by B2 Gold in 2014.

Proposed non-exec chairman Michele Muscillo was also on the Cardinal board and worked with Orbis Gold ahead of its $178m 2015 takeover by SEMAFO, which later developed its Natougou gold project into Burkina Faso's Boungou mine.

All up the companies formed by these figures have discovered and developed gold West African gold mines containing ~17Moz of gold, creating billions in value for shareholders and local communities.

Those success stories extend to the company's key consultants. Mincore, which is currently running the feasibility study on Makabingui, is led by Cameron Bain, who knows what it's like to pick a winner.

He was part of the small ownership team behind underdog 2024 Melbourne Cup winner Knight's Choice. And in the mining game his firm has been involved in the refurbishment of the Fosterville gold mine in Victoria and K92's Kainantu mine in Papua New Guinea, two of the world's lowest cost gold operations.

Best known for their success at Namdini, Michael says he and Easah are starting from a much higher base this time around.

Head start

While Cardinal started from scratch, Bishop already has a large resource, albeit not yet upgraded to JORC 2012 status, as well as a 300,000t plant designed to treat alluvial gold.

Containing only a gravity circuit, it's being upgraded with a bolt on carbon-in-leach plant at an internally estimated cost of US$15 million, with long lead items including tanks and a ball mill already on-site and steel works en-route from China at cut price.

"To build this plant (from scratch) would probably cost in the vicinity of US$60-80 million," Michael said, estimating the replacement cost of infrastructure already onsite at US$40-50m. "We think we can do it for a fraction of that of that number."

Expanding the mill to 600,000tpa and then 1.2Mtpa will help grow the scale and life of a project that a 2017 feasibility study suggested could produce 174,000oz over a 3.4 year mine life.

The deposit itself is already fully permitted, with a resource update being targeted for the June quarter and the BFS the quarter following that.

"If I was to compare Cardinal to Bishop, we are probably five years ahead of where we were when we first made the discovery at Namdini, with the resource, the granted mining licence, the camp, the infrastructure we've got already and the ability to bring this into production at a very low cost because of the infrastructure and plant that's already there," Michael said.

"As a consequence, we can get this into a reasonable production (level) that should be very profitable and provide a platform for us to further explore the ground."

The vitals are thus:

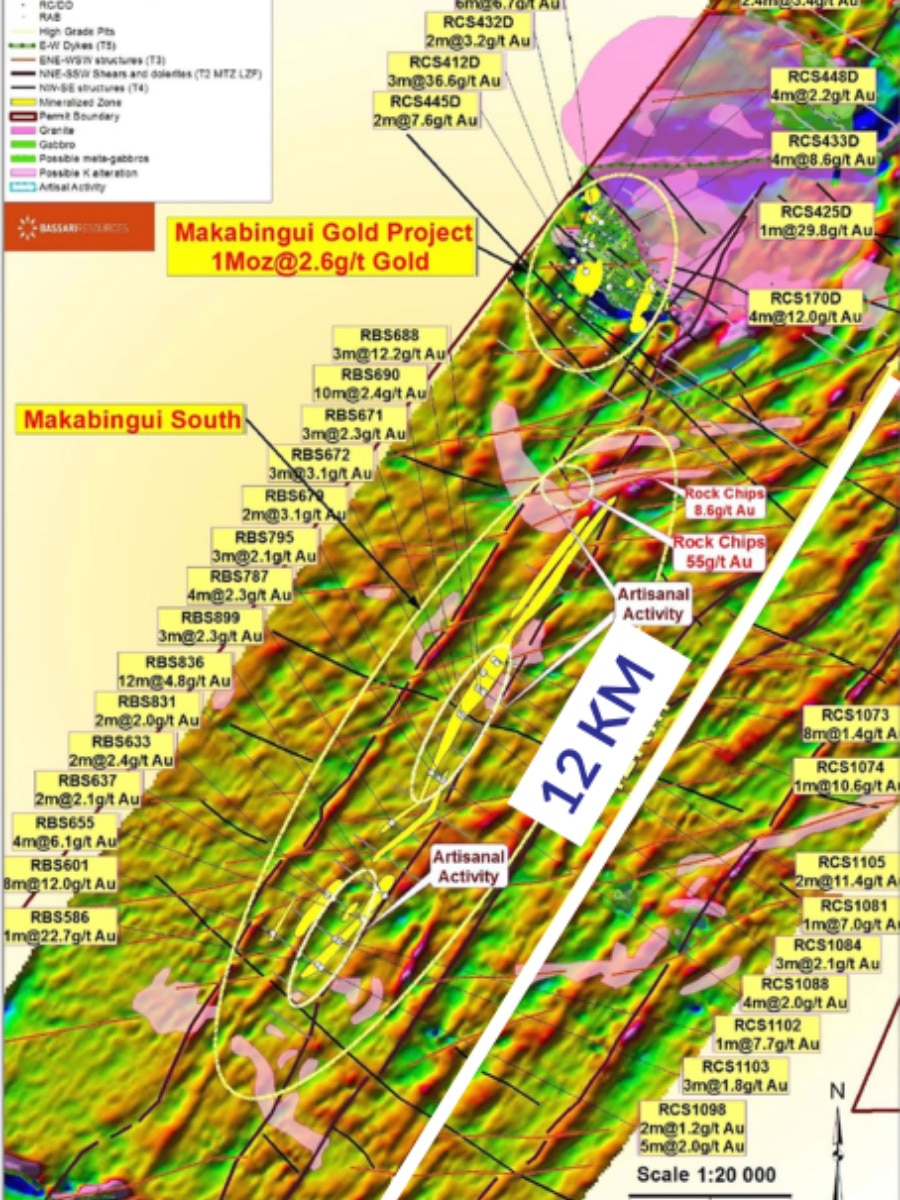

Acquired by Bishop in a cut price deal through the cash-strapped former ASX-listed Bassari Resources in 2023, Makabingui contains 1,005,000oz of gold at 2.6g/t on a JORC 2004 estimate compiled in December 2012 based on 898 holes for 85,000m of drilling.

It's worth noting that the resource was tabled at a gold price of just US$1200/oz, 2.5x below current levels, with numerous analysts expecting it to rise higher – UBS tipping US$3200/oz by June in its latest update. Pit shells will be remodelled at upwards of US$2500/oz, likely to make more ounces economic to mine.

Metallurgical recoveries on the intrusive-related, shear zone controlled deposit, where two discrete open pits are interpreted to extend on gold structures over a respective 400m and 500m, have come in at 96% with an average 80% gravity gold recovery alone.

4600m of drilling has been completed recently by Bishop with assays pending to infill known mineralisation and extend the deposit on targets to the east.

But there's more upside on the tenement package, with 12km of potential gold mineralisation – as long as the drive from Perth to Fremantle – to the south of the known resource.

"The mineralisation is significantly larger and wider in artisanal workings than what we found at Namdini. If that's any indication of what the mineralisation is that sits below, then it is very significant," Michael said.

Two-pronged approach

While the updated feasibility study is the focus, exploration results have hinted at the growth potential of Makabingui as well.

Significant intercepts so far have included near surface rotary air blast drill results of 3m at 12.2g/t from 28m with 1m at 35.1g/t, 4m at 6.1g/t from 6m, 1m at 22.7g/t from 43m and 8m at 12g/t from 14m.

Assays from the resource infill and extensional drilling are due shortly, with screen fire assays having previously shown the potential to upgrade results significantly.

There's good reason to think Makabingui will grow further as well, sitting as it does in the Kedougou-Kenieba Inlier that crosses the borders of Senegal, Guinea and Mali, and which hosts deposits containing over 54Moz of gold.

Indeed, the average scale of deposits surrounding Bishop, including Barrick's Loulo and Gounkoto mines in Mali, is around 6Moz.

That shows the abundance of opportunity on offer in West Africa.

"One of the main reasons I'm in West Africa and made the decision to go there some years ago is it is endowed with a phenomenal amount of gold," Michael said.

"It's very similar to Kalgoorlie at the turn of the (20th) century. Today Australian explorers are having to drill deeper and deal with lower grade orebodies, whereas West Africa is virtually untouched in comparison.

"We are certainly in the elephant country. Senegal is not as well known as other jurisdictions such as Ghana and, more recently, Cote d'Ivoire and Guinea. But it's a republic that seceded from France in 1960. It's got a very stable government based in Dakar.

"They're very supportive of what we're trying to do, we certainly wouldn't be in the position where we are without the help so far."

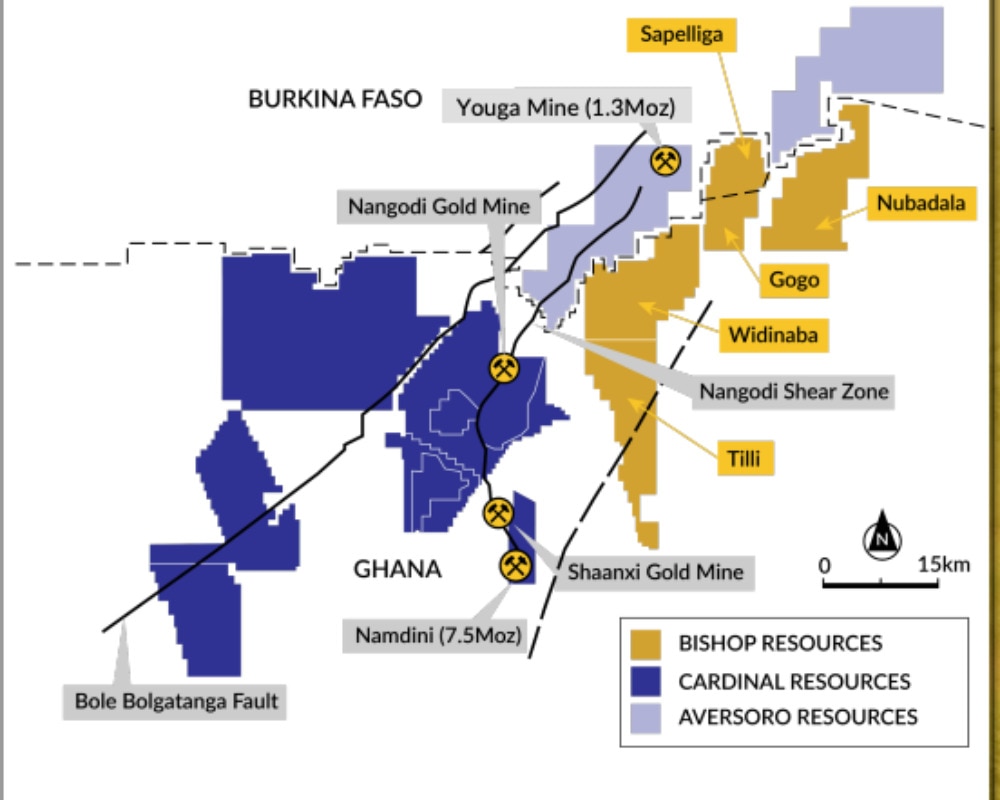

Speaking of elephant country, Bishop's other play is the earlier stage North Ghana project, which covers 478km2 of the Nangodi greenstone belt including the Sapelliga prospect, located adjacent and along the same structure as Namdini and Avesoro Resources' 1.3Moz Youga gold mine.

"We're less than two kilometres from the Youga mine, which is in Burkina Faso," Michael said.

"There are workings and mineralisation along the whole 40km of our structure and we would not be surprised to find something like Namdini on our ground again."

As with Endeavour and Makabingui, North Ghana's proximity to Shandong Gold means high grade discoveries could be attractive to Bishop's large and familiar gold mining neighbour.

Originally published as Gold’s record run has the team that built Cardinal racing into development mode at Senegal gold mine