Felix Gold raising $17m to advance antimony and gold in Alaska

$17m capital raising is aimed at advancing exploration and development of its antimony and gold projects in Alaska.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Felix Gold raising $17m to advance exploration and development of Alaskan antimony and gold projects

Strongly supported two tranche placement to fund permitting, exploration and drilling

Company pushing to start producing antimony at Treasure Creek by the end of 2025

Special Report: Felix Gold has received firm commitments for a $17m two-tranche placement to progress exploration and development activities across its projects in Alaska.

The placement of 110 million shares at 15.5c each – a 9% discount to the 15-day volume weighted average price – was strongly supported by highly credentialled offshore and Australian institutional investors that were introduced to its register.

Click here to hear directly from FXG Executive Director Joe Webb in their upcoming Investor Briefing held by Reach Markets.

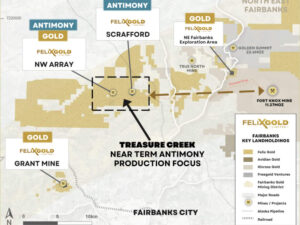

Felix Gold (ASX:FXG) will use the proceeds on exploration, drilling and permitting for its projects, which include the Treasure Creek antimony and gold project as well as the NE Fairbanks gold project and Grant gold mine.

“We are delighted with the support for the placement and welcome a number of highly credentialled offshore and Australian institutional investors to the register,” executive director Joseph Webb said.

“The level and quality of interest in the placement cements the board’s view of the underlying value of the company’s assets.”

The first tranche of the placement is expected to occur on May 8, 2025, while the second tranche is subject to securing shareholder approval at a general meeting on June 19, 2025.

Alaska antimony and gold projects. Pic: Felix Gold

Treasure Creek is within the highly endowed Fairbanks district and on the doorstep of major Kinross Gold and its Fort Knox mine and plant, which is seeking additional ore supply.

Antimony Projects

Recent S&P Global data showed that 5 of the top 7 antimony intercepts worldwide are from Felix’ Treasure Creek Project (9 of the top 10 in the US).

It includes the NW Array and Scrafford Shear target areas where sampling has returned grades up to 65.4% Sb.

Scrafford was Alaska’s second largest antimony producer at one point with production grades reaching as high as 58% Sb.

FXG has flagged the potential to bring the mine back into production by the end of 2025, a timely move given the US interest in friendly or even domestic sources of the metal to replace production previously sourced from China.

Antimony is used for critical defence and industrial applications.

Gold Projects

NW Array has an existing JORC resource of 25Mt at 0.58g/t for 467,000oz of contained gold.

Likewise, Grant Mine has a resource of 5.8Mt at 1.95g/t for 364,000oz of contained gold with the potential for extensional drilling in high-grade areas that have seen assays of up to 18.29m at 11.22g/t gold and 6.07m at 17.2g/t.

It is supported further by host free milling gold that allowed simple gravity and cyanide vat leaching to achieve up to 98% recoveries between 1985 and 1989.

NE Fairbanks features auger holes that returned peak gold values of up to 568 parts per billion (0.57g/t) and is surrounded by major mines.

This article was developed in collaboration with Felix Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Felix Gold raising $17m to advance antimony and gold in Alaska