Deposit could be antidote to China’s critical minerals squeeze

Cummins Range is the largest scandium deposit in the West, making it a crucial source of metals dominated and controlled by China.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Special Report: Lost in the shuffle as Trump’s tariffs flew and China launched retaliatory controls on heavy rare earth minerals was the inclusion of scandium on the list of commodities the manufacturing superpower could withhold from the West.

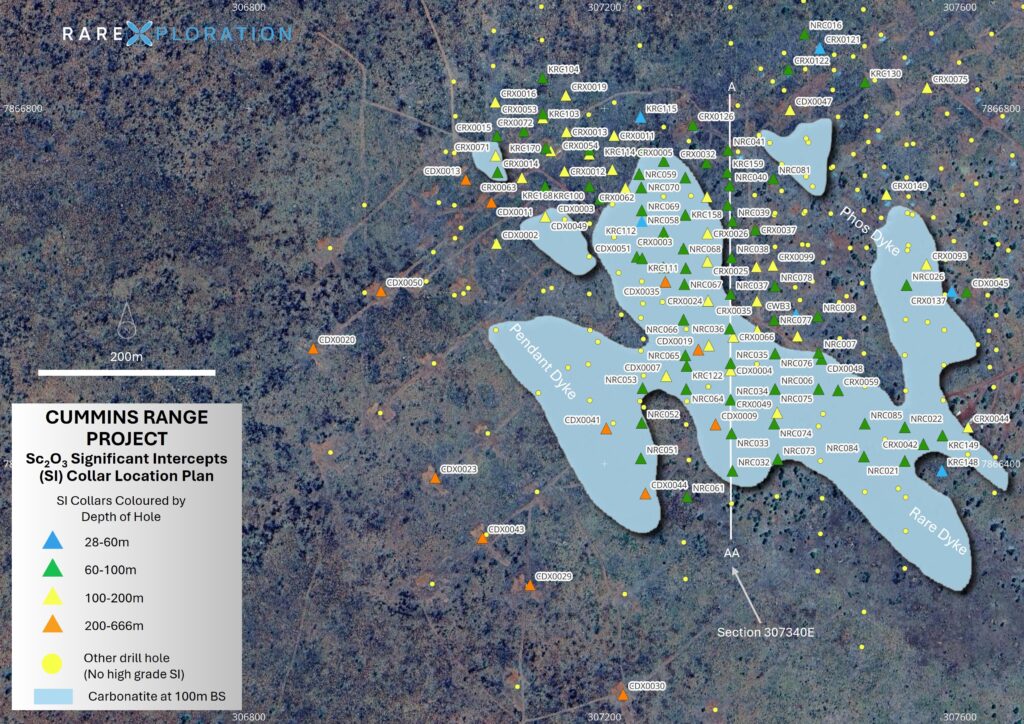

- RareX’s Cummins Range phosphate and rare earths project is also considered the largest scandium deposit in the western world

- Grades ranging as high as 2330g/t have been hit with 248 intercepts above 200g/t

- Supply concerns raised with scandium among the metals placed on export control list by China

This has shone a spotlight on Australian companies with the extremely rare and lightly traded metal, which is used in aerospace and defence.

And there’s a new player in the market, with rare earths, phosphate and gallium explorer RareX (ASX:REE) revealing “extraordinary values” that add another critical mineral to its potential product mix.

The resource of its Cummins Range deposit in WA’s Kimberley makes RareX a strategic player in the geopolitical game of thrones to secure critical minerals for essential industries like energy, aviation and military.

Compiled in January 2024, the latest mineral resource estimate contains 524.3Mt at 4.6% phosphate, 3120ppm total rare earth oxides and yttrium, 190ppm heavy rare earths, 70g/t scandium oxide as well as large portions of neodymium, praseodymium and a small amount of thorium/uranium.

That clocks in at 38,250t scandium oxide, with 6980t of Sc2O3 in the higher grade indicated resource category.

Some of the best drill hits at Cummins Range delivered extraordinarily high grade scandium zones including:

- CRX0035 – 60m at 320g/t Sc2O3, including 8m at 824g/t Sc2O3 and 3m at 1131g/t Sc2O3; and

- CRX0063 – 53m at 482g/t Sc2O3, including 30m at 744g/t Sc2O3 and 3m at 1021g/t Sc2O3.

It comes hot on the heels of news Cummins Range contained some of the highest grade hits of gallium ever found in Australia, prompting a review of the historic drill core at the project.

“Scandium at Cummins Range contains values up to 2,330g/t, making it clear that Cummins Range is evolving into something far more significant than originally considered – a large-scale, long-life and geopolitically significant critical minerals asset,” REE managing director James Durrant said.

“With gallium and phosphate already defined on top of the rare earths, and now scandium emerging at globally competitive grades, this project should be recognised as one of the most strategically valuable critical minerals systems in the country.”

Best in the West

While much of the scandium interest in the Australian market has been trained on deposits in New South Wales, where Rio Tinto made the shock $14m acquisition of the Platina project a couple years ago, RareX’s Cummins Range stands as the largest deposit of scandium in not just the country, but the western world.

That’s on top of 24Mt of phosphate and 1.6Mt of rare earths oxides, and in future gallium, presenting exposure to a range of metals leveraged to the US-China trade war.

“With rapid geopolitical shifts occurring almost daily, it is clearly the right environment to profile assets like Cummins Range for what they are: multi-critical-mineral projects in stable jurisdictions, with de-risked pathways to production,” Durrant said.

“With the US actively seeking secure supply of critical inputs, China continuing to restrict exports and the Australian Government now advancing a bipartisan strategic reserve, the imperative to bring forward independent, large-scale supply is clear.

“Cummins Range can now be described as the most advanced gallium project — and the largest scandium deposit — in Australia. We will continue to methodically progress the path to production across all four critical mineral streams: rare earths, phosphate, gallium and scandium.”

The carbonatite hosted Cummins Range has the benefit of hosting higher grade indicated resources close to surface in its upper 100m, with 248 intercepts of greater than 200g/t Sc2O3 reported to date.

A mining lease at Cummins range is in the final stages of approval, making it one of the most advanced undeveloped critical minerals assets in Australia.

RareX said work to date was proving very valuable and this along with a number of other advantages had positioned the project very favourably.

Advantages include the Tanami road being sealed by Mains Roads WA; the Port of Wyndham given port of first entry designation by the Feds; RareX's land option at the port and infrastructure sharing agreement for boat loading; completion of enviro baselines; and imminent Native Title agreement.

Market moves

The value of the niche but important scandium market is expected to grow from US$548.9 million in 2022 to a projected US$859 million by 2028 and possibly as high as US$1.53bn by 2030 on more optimistic forecasts – a CAGR if 14.7% over the next five years.

But consumption has largely been restrained by supply, which doubled from 15-25t in 2021 to 30-40t in 2023 as new sources came online. Production is largely a by-product of other processes, such as Rio Tinto’s titanium slag production in Canada, a small producer that counts as the only substantive operation in the West.

Scandium's magic lies in its ability to enhance aluminium alloys, making them lighter and stronger, important for space tech.

It's also used in solid oxide fuel cells, which account for 36% of demand, thanks to its role in stabilising zirconium for better efficiency at lower temperatures.

China dominates the scene, creating a supply chain headache for the West, exemplified in the metal’s inclusion on the April 4 announcement by the Ministry of Commerce (MOFCOM) and General Administration of Customs.

Prices for scandium oxide hover around US$650/kg in China, but have hit highs of US$2000/kg in the past decade. High-purity scandium metal fetches even more, at about US$5000/kg.

Listen: James Durrant chats with Barry FitzGerald

In a previous Explorers Podcast, Barry FitzGerald spoke with RareX CEO James Durrant about the Cummins Range project, which has quickly become Australia’s most advanced gallium opportunity.

This article was developed in collaboration with RareX, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Deposit could be antidote to China’s critical minerals squeeze