Closing Bell: Tech and bank stocks flex as RBA cuts rates as expected

The RBA has cut rates as expected, delighting investors who piled into growth stocks in the Info Tech and Finance sectors.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

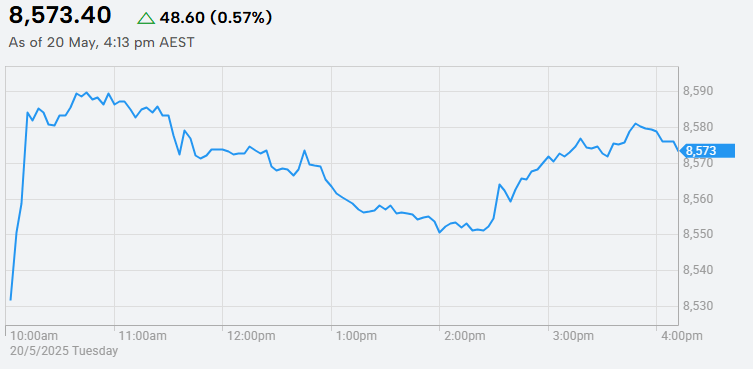

ASX gains 0.62pc in trading today

RBA cut rates as expected, lopping 25 basis points off the cash rate

Rate-sensitive tech and banking stocks make strong gains

With inflation falling firmly in the RBA’s 2-3% target range, another rate cut was all but inevitable, and the Central Bank has delivered.

That said, the RBA is still trying to keep future interest rate cut expectations in check, citing uncertainty from both the current tariff environment and the local jobs market.

“While recent announcements on tariffs have resulted in a rebound in financial market prices, there is still considerable uncertainty about the final scope of the tariffs and policy responses in other countries,” the RBA’s note read.

"Geopolitical uncertainties also remain pronounced. These developments are expected to have an adverse effect on global economic activity, particularly if households and firms delay expenditure pending greater clarity on the outlook.

"This has also contributed to a weaker outlook for growth, employment and inflation in Australia."

The big banks have promptly begun to pass on the cut in their variable rate products – NAB (ASX:NAB), ANZ (ASX:ANZ) and Commonwealth Bank (ASX:CBA) have already pulled the trigger.

Tech and finance stocks soar

Back in the market, rate-sensitive stocks in tech and finance took full advantage of the injection of liquidity, flexing their growth credentials and lifting the bourse higher after the cut was announced at 2:30pm AEST.

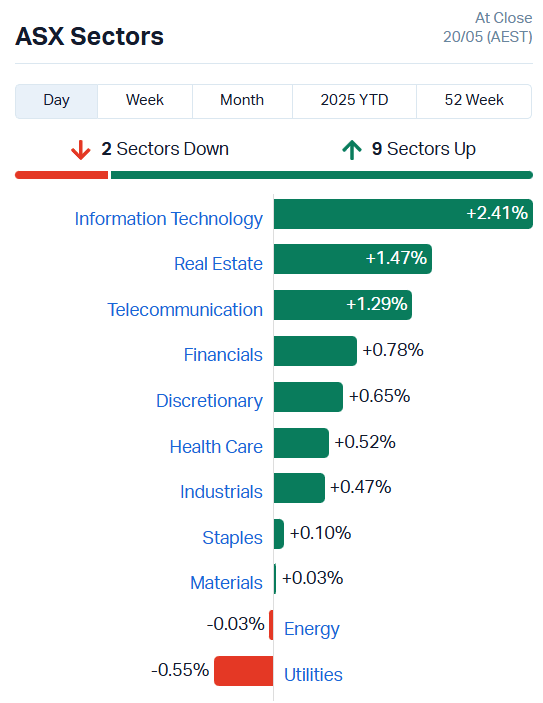

While Info Tech and Financials are carrying much of the bourse’s momentum today, they’re not the only sectors in the green.

Telecoms and Real Estate, both traditionally debt financing-heavy sectors, are also making gains.

On the other side of the table, defensive stocks like those in the Utilities sector are suffering, as investors rotate into securities with more growth potential.

Over on the index table, the All Tech and ASX 200 Banks are dominating, but the bottom of the table is also telling a story – gold is trending down as market sentiment improves, slipping 0.42% in trade today to settle near US$3216.13/oz.

That’s had a knock-on effect for the Materials sector and Resources index, which are fairly gold-heavy at the moment.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ZNO | Zoono Group Ltd | 0.064 | 64% | 9063244 | $13,861,919 |

| EEL | Enrg Elements Ltd | 0.0015 | 50% | 500001 | $3,253,779 |

| MEL | Metgasco Ltd | 0.003 | 50% | 570268 | $2,915,173 |

| WEL | Winchester Energy | 0.003 | 50% | 534385 | $2,726,038 |

| TSL | Titanium Sands Ltd | 0.007 | 40% | 5000 | $11,683,736 |

| VAR | Variscan Mines Ltd | 0.007 | 40% | 412368 | $3,914,289 |

| MM1 | Midasmineralsltd | 0.22 | 40% | 4381871 | $19,550,424 |

| DTR | Dateline Resources | 0.051 | 38% | 1.01E+08 | $102,326,039 |

| LTP | Ltr Pharma Limited | 0.38 | 36% | 2461920 | $31,349,630 |

| CTO | Citigold Corp Ltd | 0.004 | 33% | 3200000 | $9,000,000 |

| ATV | Activeportgroupltd | 0.009 | 29% | 2859781 | $4,794,840 |

| KSN | Kingston Resources | 0.1175 | 28% | 22677693 | $75,619,851 |

| ALY | Alchemy Resource Ltd | 0.007 | 27% | 1428571 | $6,479,419 |

| PPY | Papyrus Australia | 0.015 | 25% | 2417830 | $6,872,181 |

| C7A | Clara Resources | 0.005 | 25% | 581680 | $2,046,417 |

| ERL | Empire Resources | 0.005 | 25% | 300002 | $5,935,653 |

| VFX | Visionflex Group Ltd | 0.0025 | 25% | 5965586 | $6,735,721 |

| VML | Vital Metals Limited | 0.0025 | 25% | 5953969 | $11,790,134 |

| 8CO | 8Common Limited | 0.021 | 24% | 767746 | $3,809,613 |

| LM1 | Leeuwin Metals Ltd | 0.16 | 23% | 564309 | $13,104,830 |

| MRR | Minrex Resources Ltd | 0.011 | 22% | 4540213 | $9,763,808 |

| JCS | Jcurve Solutions | 0.033 | 22% | 354953 | $8,919,273 |

| MPK | Many Peaks Minerals | 0.6 | 21% | 1442928 | $49,122,365 |

| AS1 | Asara Resources Ltd | 0.048 | 20% | 198199 | $44,047,114 |

| CP8 | Canphosphateltd | 0.024 | 20% | 40000 | $6,135,211 |

Making news…

Zoono Group (ASX:ZNO) has signed an exclusive UK deal with packaging giant Sharpak and its long-time food supply chain partner OSY. The agreement will see Zoono’s shelf-life-extending tech used on soft fruit packaging, sold to big UK supermarkets.

It’s a big step for Zoono, which pivoted into food packaging after its core antimicrobial business took a hit during the post-COVID crisis. The deal runs to the end of 2029, and includes minimum orders starting at NZ$4.3 million in year one, rising to NZ$8.6 million by year five.

Biotech LTR Pharma (ASX:LTP) has taken a big step with Spontan, its fast-acting erectile dysfunction spray, which is now available across TerryWhite Chemmart’s 600+ pharmacies nationwide.

It means patients with a script can finally get Spontan filled at major pharmacies under the TGA’s Special Access and Authorised Prescriber schemes. To support the rollout, LTR has built new barcoded packaging ready for pharmacy shelves and telehealth integration down the track.

Clara Resources Australia (ASX:C7A) has kicked off a strategic review of its Kildanga cobalt-nickel-copper-gold project in southeast Queensland after receiving unsolicited interest from third parties.

It’s now weighing up a potential sale, joint venture or partnership to unlock value from the asset. Clara said the Kildanga project’s got strong near-term potential, sitting near Gympie with good infrastructure and high-grade historical hits.

Telehealth tech outfit Visionflex (ASX:VFX) has locked in a deal with BHP (ASX:BHP) to roll out its virtual care system across 13 remote medical centres and one emergency helicopter in WA. The contract’s worth $400k in year one, all paid upfront.

The full rollout is due to be wrapped up by the end of FY25. For BHP, it means better healthcare on-site, fewer medevac flights, and less time lost to travel.

Midas Minerals (ASX:MM1) is on the up, despite raising $6.5m in a placement at $0.15 a share, a 6.25% discount to its VWAP.

The company is in the midst of acquiring the Otavi project in Namibia, where MM1 recently acquired an option over a 195-square-kilometre licence. Historical exploration points to a large bedrock gold anomaly on the site, confirmed by a 60m drill core interval that revealed elevated levels of gold, silver, arsenic, lead, zinc, antimony and molybdenum.

Kingston Resources (ASX:KSN) is also enjoying some gold success, although in a very different way. KSN just sold its Misima gold project for total consideration of $95m, with a 0.5% revenue royalty on all gold production after 500k ounces are produced from the asset.

The company reckons the sale sets it up as a well-funded copper and gold producer with plenty of flexibility to pursue growth. KSN plans to pay off its $15m debt facility in full from the sale proceeds.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DUB | Dubber Corp Ltd | 0.021 | -45% | 40514881 | $99,687,964 |

| CHM | Chimeric Therapeutic | 0.005 | -38% | 43385282 | $14,805,490 |

| OFX | OFX Group Ltd | 0.865 | -34% | 10017578 | $306,555,705 |

| BP8 | Bph Global Ltd | 0.002 | -33% | 431221 | $3,152,954 |

| EDE | Eden Inv Ltd | 0.001 | -33% | 500820 | $6,164,822 |

| DTZ | Dotz Nano Ltd | 0.062 | -29% | 458368 | $49,668,093 |

| CDEDC | Codeifai Limited | 0.005 | -29% | 1056736 | $2,219,220 |

| RDN | Raiden Resources Ltd | 0.005 | -29% | 19769867 | $24,156,240 |

| CRR | Critical Resources | 0.003 | -25% | 94856 | $10,456,885 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 1987967 | $9,673,198 |

| EPX | Ept Global Limited | 0.021 | -25% | 1920508 | $18,444,609 |

| DAL | Dalaroometalsltd | 0.023 | -23% | 379254 | $7,468,558 |

| ARV | Artemis Resources | 0.0055 | -21% | 19718067 | $17,699,705 |

| PLN | Pioneer Lithium | 0.091 | -21% | 446425 | $4,894,594 |

| AUG | Augustus Minerals | 0.027 | -21% | 706147 | $4,052,509 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 650000 | $16,442,127 |

| PHO | Phosco Ltd | 0.065 | -19% | 867810 | $35,065,716 |

| GBE | Globe Metals &Mining | 0.024 | -17% | 200000 | $20,144,937 |

| ICE | Icetana Limited | 0.015 | -17% | 144146 | $7,886,568 |

| BIT | Biotron Limited | 0.0025 | -17% | 400000 | $3,981,738 |

| EPM | Eclipse Metals | 0.005 | -17% | 1688000 | $17,194,914 |

| HCF | Hghighconviction | 0.031 | -16% | 59624 | $718,040 |

| WIN | WIN Metals | 0.018 | -14% | 1228943 | $11,551,220 |

| AZL | Arizona Lithium Ltd | 0.006 | -14% | 36482457 | $31,932,702 |

| BLU | Blue Energy Limited | 0.006 | -14% | 3795052 | $12,956,815 |

IN CASE YOU MISSED IT

Asra Minerals (ASX:ASR) has secured $200k in cash from the sale of its Boorara tenement package to a subsidiary of Northern Star Resources after inking a binding head of sale agreement. The sale will streamline ASR’s portfolio, allowing the company to concentrate resources on its core Leonora gold project, which already holds a global gold resource of about 200,000 ounces of gold.

Andromeda Metals (ASX:ADN) is also cashed up after completing a $5m placement. The new funds will go to the Great White high purity alumina project, supporting early works, advanced plant design and engineering, and technical, financial and legal requirements for the project’s funding and development.

European Lithium (ASX:EUR) has revealed assays from deep historical drilling, which have further reinforced the Tanbreez deposit’s massive potential in Greenland. EUR said all deep drill holes delivered consistently well-mineralised total rare earth oxide levels and they come alongside a spread of high-value commodities as the company moves on the next milestones towards uncovering the deposit’s true promise.

Trading Halts

Resource Mining Corporation (ASX:RMI) – cap raise

At Stockhead, we tell it like it is. While LTR Pharma, Asra Minerals, and Andromeda Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Tech and bank stocks flex as RBA cuts rates as expected