Closing Bell: Energy stocks lead gains as ASX touches record; Karoon pops 8pc on buyback

ASX hits record high on rate cut hopes, energy stocks up as Karoon rallies and SoftBank eyes $25bn stake in OpenAI.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX hits record high on rate cut hopes

Energy stocks lead gains; Karoon rallies

SoftBank eyes US$25bn stake in OpenAI

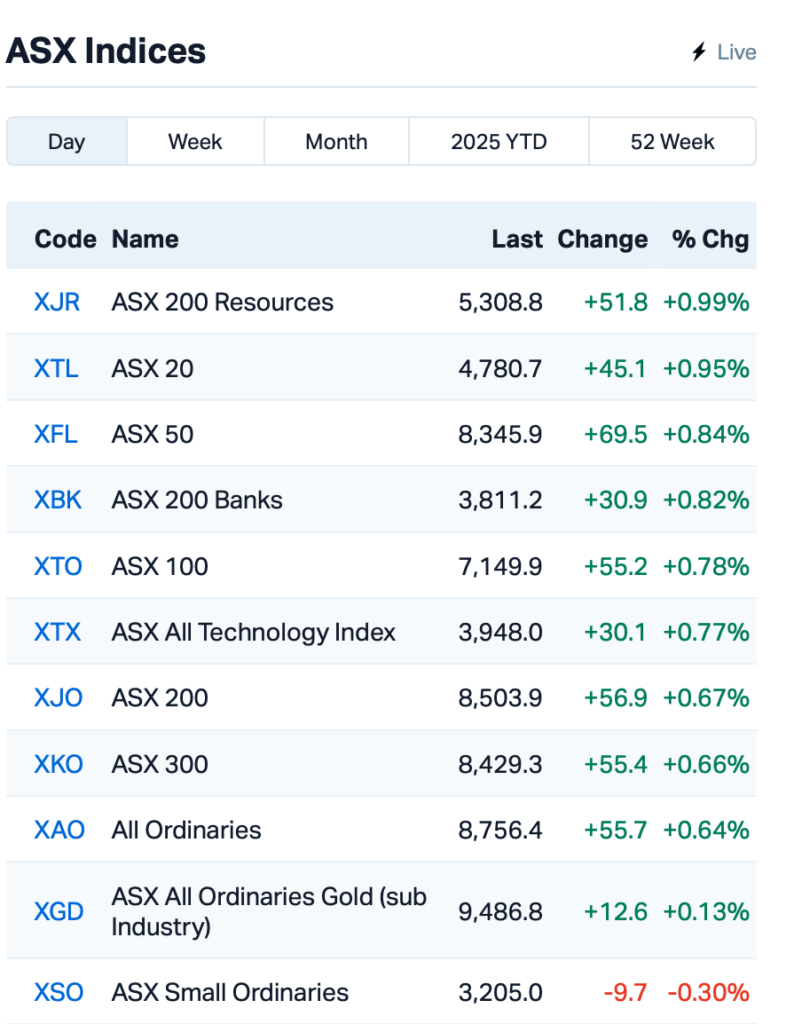

The ASX 200 index closed 0.6% higher on Thursday after briefly hitting a record high of 8515 points as investors eyed the chance of a rate cut from the RBA.

Investors were buoyed after National Australia Bank (ASX:NAB) joined the other big banks in bringing forward predictions for the RBA's first rate cut to February.

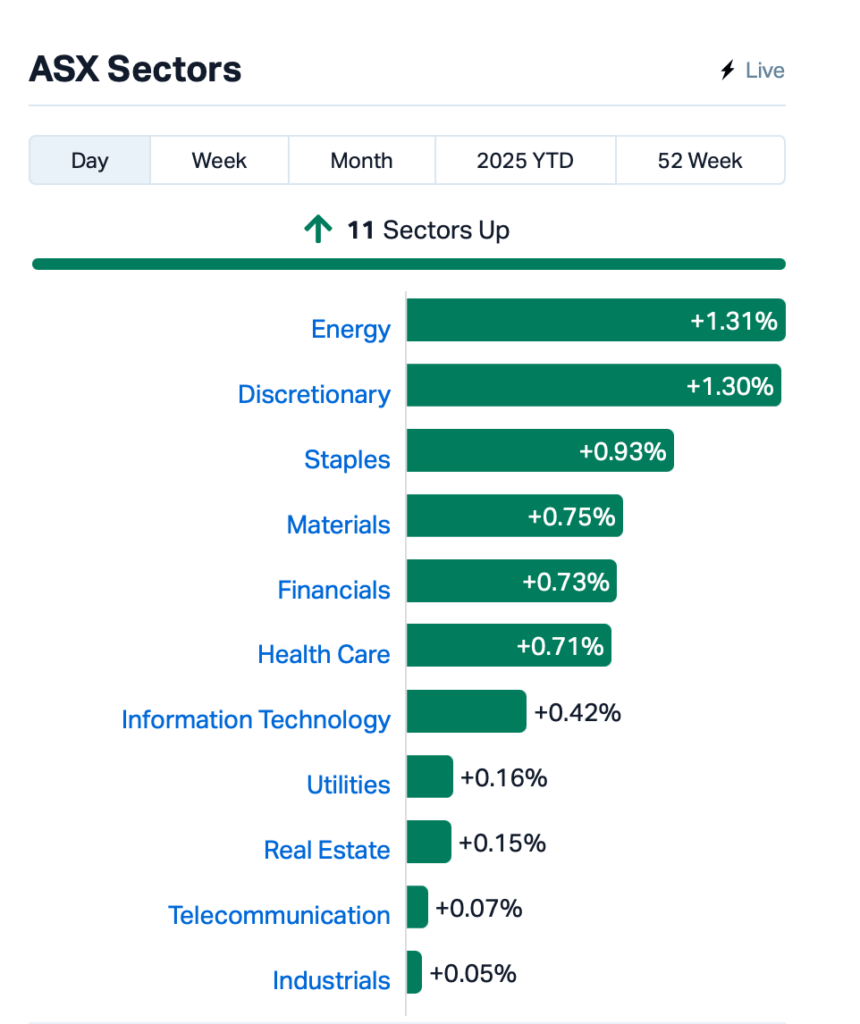

Despite the Federal Reserve’s decision to hold rates last night, optimism at home remained strong, with all 11 ASX sectors closing in the green today.

Earlier, Fed Chair Jerome Powell indicated the US central bank isn’t in a hurry to lower rates, prompting investors to dump stocks on Wall Street and an angry rejoinder from Donald Trump.

But back to the ASX, energy stocks powered the gains today, with consumer stocks also getting a good lift.

Karoon Energy (ASX:KAR) was the biggest gainer in the ASX 200 index, surging 8% after announcing a US$75 million share buyback to prop up its underperforming stock.

Magellan Financial Group (ASX:MFG) dropped 6% after the exit of veteran infrastructure boss, Gerald Stack.

Still in large caps, IGO (ASX:IGO) lost 2%, dragged down by a $79 million loss in the December quarter, mainly due to weaker revenues from its Tianqi Lithium Energy Australia joint venture.

Credit Corp Group (ASX:CCP) had a rough day, dropping 11% despite a 12% increase in US collections for the first half of FY25.

Meanwhile, Mineral Resources (ASX:MIN) said it was on track for FY25, with Onslow Iron ramping up towards 35 million tonnes per year. It has $1.5 billion in liquidity, including $700 million in cash and an untouched $800 million credit line. Shares still fell by 1% despite improved pricing and product grades for its Wodgina and Mt Marion lithium concentrate.

Elsewhere, Japan’s SoftBank is eyeing a US$25 billion stake in OpenAI, possibly making it the AI startup’s biggest backer.

The talks are still early, but if it happens, it’s on top of the US$15 billion Softbank already committed to Project Stargate last week to build AI infrastructure in the US.

Meanwhile, Trump’s team is eyeing tighter controls on Nvidia’s chip sales to China, potentially expanding restrictions to the H20 model designed for the Chinese market.

No decision is imminent, but talks are underway as the new administration intensifies efforts to curb China's growing AI power.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap ATH Alterity Therap Ltd 0.018 125% 393,303,164 $42,563,451 SFG Seafarms Group Ltd 0.002 100% 132,208 $4,836,599 CBY Canterbury Resources 0.032 52% 8,411,085 $4,146,259 NRZ Neurizer Ltd 0.003 50% 986,029 $5,929,741 ERL Empire Resources 0.004 33% 150,000 $4,451,740 MOM Moab Minerals Ltd 0.002 33% 120,000 $2,350,499 WYX Western Yilgarn NL 0.030 30% 920,606 $2,847,620 NVU Nanoveu Limited 0.037 28% 11,137,839 $16,073,062 C1X Cosmosexploration 0.070 27% 1,283,722 $4,590,663 CR3 Core Energy Minerals 0.025 25% 351,100 $3,410,442 TMK TMK Energy Limited 0.003 25% 496,831 $18,651,130 TMX Terrain Minerals 0.005 25% 6,061,000 $7,242,782 REE Rarex Limited 0.011 22% 2,748,692 $7,207,613 T3D 333D Limited 0.011 22% 80,083 $1,585,651 ASP Aspermont Limited 0.006 20% 1,050,000 $12,350,058 LML Lincoln Minerals 0.006 20% 121,000 $10,281,298 HMI Hiremii 0.050 19% 119,017 $6,178,847 BLZ Blaze Minerals Ltd 0.004 17% 116,733 $4,700,843 CTN Catalina Resources 0.004 17% 585,088 $3,948,786 EPM Eclipse Metals 0.007 17% 347,100 $17,158,914

Alterity Therapeutics’ (ASX:ATH) shares more than doubled after announcing positive results from its Phase 2 trial of ATH434 in early-stage multiple system atrophy (MSA), showing significant clinical improvement. ATH434 slowed disease progression by up to 48% at the 50mg dose and reduced iron accumulation in key brain regions, with a strong safety profile. The results have the company optimistic about future FDA discussions, as there’s currently no approved treatment for MSA.

Alma Metals (ASX:ALM) and Canterbury Resources’ (ASX:CBY) Briggs copper-molybdenum project in Queensland just wrapped up its 2024 drilling program, revealing some positive results. A new discovery was located at the Southern porphyry target, located 300m southeast of the current resource, showing good copper and molybdenum grades. All this data is now feeding into an updated resource estimate and mining study, with results due mid-2025. While Alma was unchanged, CBY rose 52%.

Western Yilgarn (ASX:WYX)’s Julimar West Bauxite Project, just 90km north of Perth, is looking promising for bauxite. The area has a long history of bauxite exploration and is known for its high-quality gibbsite, which is perfect for alumina refineries. The company said it’s now working on a maiden resource estimate, aiming to unlock an economic bauxite resource for export to global refineries.

Nanoveu (ASX:NVU) just tapped Mark Goranson as CEO of its Semiconductor Technologies division. With 40+ years in the game, including top roles at TE Connectivity, ON Semiconductor, and Intel, Goranson is set to lead the charge in developing ultra-low-power SoC tech. This comes as Nanoveu wraps up its acquisition of EMASS, a leader in AI-enabling chips.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap MIO Macarthur Minerals 0.032 -26% 78,238 $8,585,617 88E 88 Energy Ltd 0.002 -25% 6,912,287 $57,867,624 AXP AXP Energy Ltd 0.002 -25% 63,018,913 $11,649,361 NAE New Age Exploration 0.003 -25% 1,384,075 $8,575,596 OB1 Orbminco Limited 0.002 -25% 410,669 $4,333,180 ZIP ZIP Co Ltd.. 2.465 -25% 67,175,733 $4,269,282,122 AGD Austral Gold 0.035 -22% 737,653 $27,554,011 VN8 Vonex Limited. 0.035 -22% 842,677 $16,933,579 FNR Far Northern Res 0.120 -20% 10,000 $5,439,874 AKN Auking Mining Ltd 0.004 -20% 3,092,196 $2,573,894 CNJ Conico Ltd 0.008 -20% 3,736,150 $2,374,873 RAN Range International 0.004 -20% 122,176 $4,696,452 BCB Bowen Coal Limited 0.007 -19% 65,823,458 $86,204,221 LSR Lodestar Minerals 0.012 -18% 2,742,098 $2,710,638 MAG Magmatic Resrce Ltd 0.042 -18% 1,213,108 $21,269,586 BDG Black Dragon Gold 0.054 -17% 388,761 $19,692,794 ALV Alvomin 0.050 -17% 154,689 $7,029,533 ENV Enova Mining Limited 0.005 -17% 3,720,363 $5,909,576 ERA Energy Resources 0.003 -17% 412,209 $1,216,188,722 VFX Visionflex Group Ltd 0.003 -17% 75,586,000 $10,103,581 QPM QPM Energy Limited 0.063 -16% 20,212,274 $189,095,680 TG6 Tgmetalslimited 0.105 -16% 149,247 $8,888,443

88 Energy (ASX:88E)’s shares dropped despite announcing a maiden Prospective Resource estimate of 283 million barrels of oil at its Canning Prospect, part of the bigger Project Leonis in Alaska. The company is optimistic about the potential, with a multi-zone exploration well (Tiri-1) planned for 2026.

IN CASE YOU MISSED IT

Tungsten Mining (ASX:TGN)has struck high-grade tungsten and copper through recently completed exploration drilling at its Hatches Creek project in the Northern Territory. The drilling extended mineralisation at the Hit or Miss prospect, while also confirming the continuity of high-grade tungsten at the Treasure prospect. TGN’s focus shifts to the release of a maiden resource estimate in the March quarter.

Online marketplace for local services Airtasker (ASX:ART)has reported positive free cash flow of $500,000 and positive operating cashflow of $1 million in Q2 FY25, a 40% jump on the same period in FY24. The company saw strong UK and US revenue growth, with both up 95.2% and 278.6%, respectively. Airtasker marketplaces revenue also lifted 15.8 % pcp to $11.7 million, thanks to an increasing focus on marketing.

Kingsrose Mining (ASX:KRM) has completed a 5,067-line km airborne gravity survey in Norway, identifying high-grade copper in polymetallic sulphide veins, including 29.7% Cu at Porsanger and 4.4% Cu at Virdnechokka. In Finland, the company completed 4,980-line km of drone and ground magnetic surveys, collecting 795 soil and 87 rock chip samples, with new mineralisation discovered at the Rehula target, including 0.46% Cu and 110 ppm Co. Backed by BHP’s Xplor program, Kingsrose is driving exploration with upcoming helicopter EM surveys and geochemical studies to pinpoint deeper magmatic sulphide targets.

At Stockhead, we tell it like it is. While Tungsten Mining, Airtasker, Western Yilgarn and Kingsrose Mining are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Energy stocks lead gains as ASX touches record; Karoon pops 8pc on buyback