Closing Bell: ASX swings as coal stocks weigh; but all eyes turn to US jobs report for Fed clues

The ASX was up and down on Friday, with coal stocks dropping while Domino’s jumped. meanwhile all (okay many) eyes await the US jobs report for Fed clues.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX rides the wave ahead of US jobs report

Coal stocks tank, but Domino’s soars

Traders eye US jobs data for clues on Fed moves

ASX had a bit of a rollercoaster ride on Friday, with the market flipping between gains and losses, as traders wait to see how the US jobs report due later tonight will shake out.

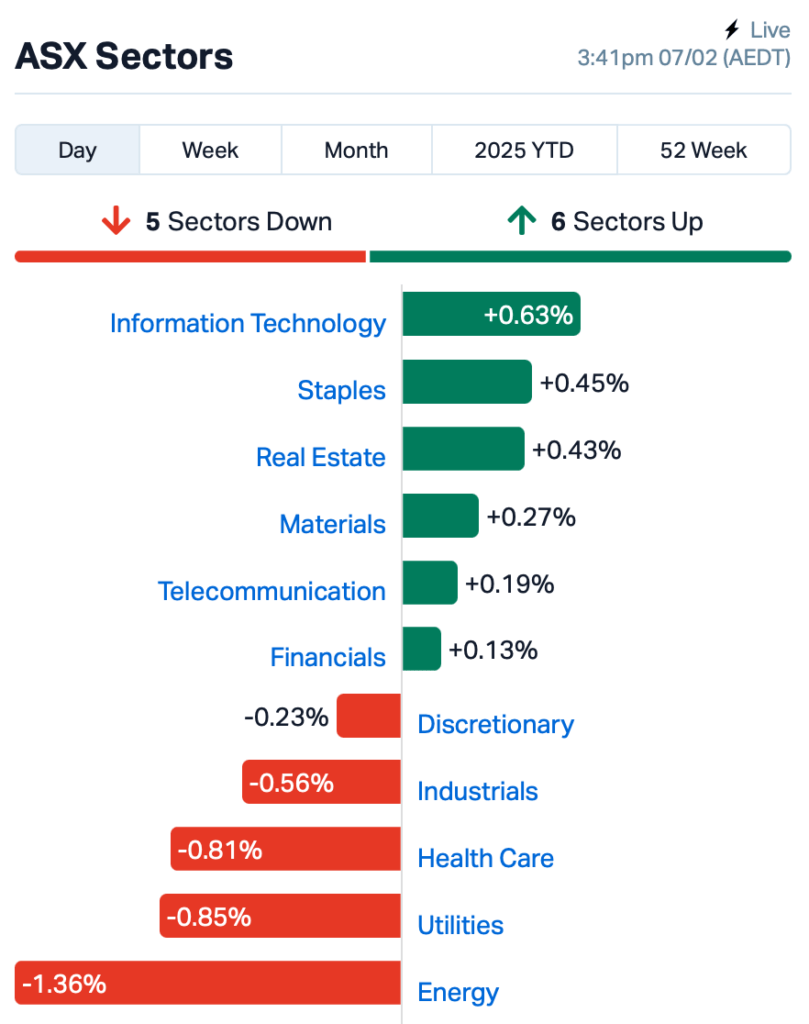

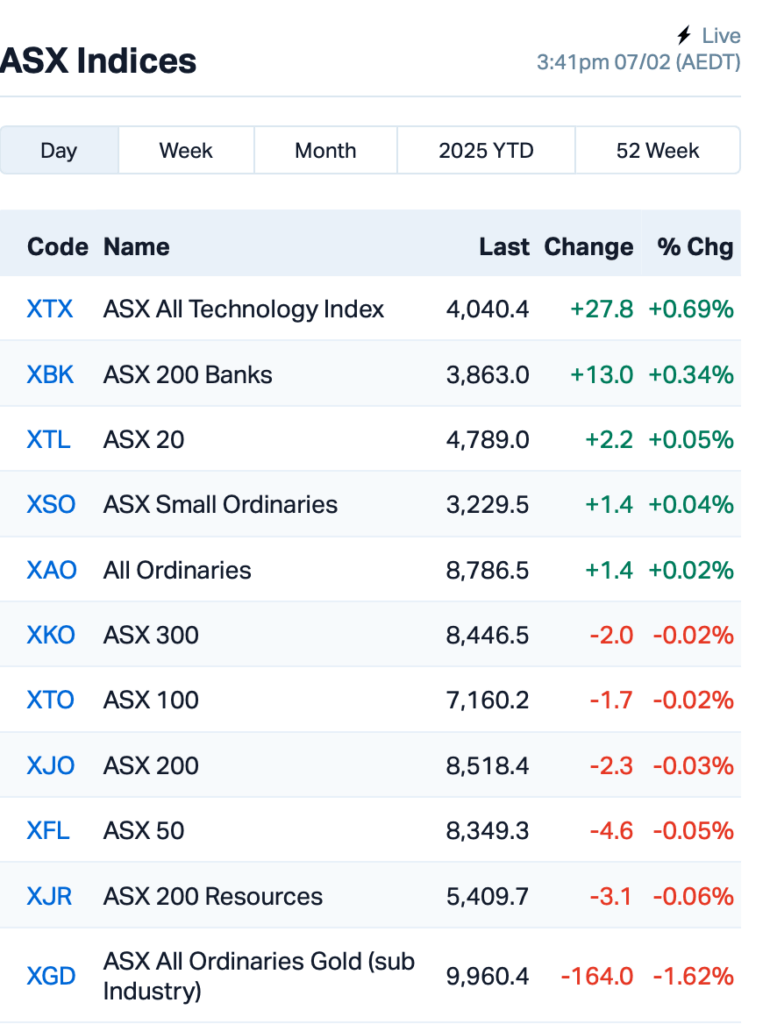

The ASX 200 benchmark ended up 0.05% lower; and for the week, it was down around 0.2%.

The energy sector took the biggest hit as oil prices dropped 1% overnight.

Coal miners also had a rough day; with Yancoal Australia (ASX:YAL) dropping by 5% and Whitehaven Coal (ASX:WHC) by 4.5% on the back of falling thermal coal prices.

The market was rattled by a major US coal miner, Peabody Energy, which reported a 49% drop in revenue last night.

Meanwhile, Domino's Pizza Enterprises (ASX:DMP)surged by 22% after announcing the closure of 205 loss-making stores, mostly in Japan.

Nick Scali’s (ASX:NCK) shares also jumped 13% after reporting a net profit of $36 million for the half-year, smashing expectations.

This is where things stood leading up to Friday's close:

Across the water, China's tech sector got a boost today, with AI excitement helping a rally in Chinese tech stocks.

But all eyes are really on the US jobs report tonight, as traders look for signs of the Fed’s next move.

Consensus says that January’s non-farm payrolls are expected to come in at 165,000 new jobs, down from December’s strong 256,000.

“The Fed will closely analyse this report as it weighs the timing of potential rate cuts in 2025,” said a note from IG’s chief market analyst, Chris Beauchamp.

“A stronger-than-expected report could push the US dollar up and keep rate cuts on hold, while a weaker report could fuel hopes for earlier rate cuts, giving stocks a boost.”

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap KAL Kalgoorlie Gold 0.083 261% 89,044,795 $6,281,493 PKD Parkd Ltd 0.070 63% 3,527,293 $4,472,597 E79 E79Goldmineslimited 0.029 53% 8,389,841 $1,941,090 BP8 Bph Global Ltd 0.003 50% 166,697 $966,616 ABE Ausbondexchange 0.030 43% 90,422 $2,366,030 OKJ Oakajee Corp Ltd 0.011 38% 614 $731,568 POS Poseidon Nick Ltd 0.006 38% 36,180,755 $16,815,567 IKE Ikegps Group Ltd 0.770 38% 638,964 $90,019,853 PRS Prospech Limited 0.027 35% 6,466,909 $6,576,518 MRQ Mrg Metals Limited 0.004 33% 1,110,285 $8,179,556 NTM Nt Minerals Limited 0.004 33% 1,102,703 $3,632,709 SLZ Sultan Resources Ltd 0.008 33% 1,926,713 $1,388,819 SVG Savannah Goldfields 0.025 32% 752,507 $5,340,613 M2M Mtmalcolmminesnl 0.017 31% 125,618 $2,944,183 HCT Holista CollTech Ltd 0.030 25% 460,319 $6,858,401 COV Cleo Diagnostics 0.450 25% 480,678 $29,376,000 AAU Antilles Gold Ltd 0.005 25% 208,783 $7,431,504 AMS Atomos 0.005 25% 193,415 $4,860,074 CDT Castle Minerals 0.003 25% 5,965 $3,793,628 MEL Metgasco Ltd 0.005 25% 100,000 $5,830,347

Kalgoorlie Gold Mining’s (ASX:KAL) shares more than tripled after the company made a ripper gold discovery at Lighthorse, located at its Pinjin site in the Eastern Goldfields. KalGold hit some impressive high-grade gold, with one drill hole showing 17m at 4.81g/t of gold, including 8m at 9.21g/t. The mineralisation is open along strike and down dip, meaning it could extend further. This find is smack-bang in the middle of a solid 600m strike, and the company said it’s clear this gold system has got some size to it.

What makes this discovery even more exciting is the location. Lighthorse is just 1km from KalGold’s Kirgella Gift deposit and surrounded by some big players like Hawthorn Resources’ Anglo Saxon Gold Mine and Ramelius Resources’ Rebecca Gold Project. KalGold said it’s keen to push ahead with further drilling, and the area’s definitely turning into a hot spot for gold exploration.

Parkd (ASX:PKD) has locked in a five-year exclusive licensing deal with Fielders (part of BlueScope Steel) for its metal decking support bracket (MDSB) and system (MDSS) for the construction industry. This agreement allows Fielders to manufacture, market, and sell the MDSB in Australia, while also giving them first dibs on international markets like the US, NZ, and others. No immediate revenue is guaranteed, PKD said.

Prospech (ASX:PRS) has reported some top-notch assay results from its Korsnäs Rare Earths Project, and it’s looking like a winner. The new results are extending the resource estimate, showing off some seriously high-grade mineralisation. Assays have hit impressive numbers like 21.5m at 25,827 ppm TREO and 17.5m at 13,737 ppm TREO, plus significant heavy rare earth elements (HREEs), including up to 58 ppm Terbium and 206 ppm Dysprosium.

The Supreme Court of Western Australia has approved the merger deal between Poseidon Nickel (ASX:POS) and Horizon Minerals (ASX:HRZ). Under the deal, Horizon will acquire all shares and options in Poseidon.

Utility infrastructure tech company, ikeGPS (ASX:IKE), said it received an unsolicited, non-binding offer from a private equity group looking to buy IKE for around NZ$1.00 per share, a 62% premium on its share price. After talks, IKE’s board decided that the offer wouldn't get enough shareholder support, so discussions were stopped.

NT Minerals (ASX:NTM) has shared initial results from its Ultrafine Soil Sampling Program at the Premiership Prospect within the Twin Peaks Project in WA. The samples show notable copper and gold anomalies, with copper peaking at 178.01 ppm and gold at 3.697 ppb. The anomalies are linked to a potential structure and remain open to the south, creating a new exploration target.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap EEL Enrg Elements Ltd 0.001 -50% 1,050,000 $6,507,557 1TT Thrive Tribe Tech 0.002 -33% 99,556,666 $6,095,169 MMR Mec Resources 0.003 -25% 1,234,301 $7,399,063 PNT Panthermetalsltd 0.007 -22% 4,548,774 $2,233,537 CVR Cavalierresources 0.079 -21% 1,426,563 $5,784,222 BGE Bridgesaaslimited 0.024 -20% 10,000 $5,995,776 BNL Blue Star Helium Ltd 0.004 -20% 1,300,006 $13,474,426 NRZ Neurizer Ltd 0.002 -20% 43,007,061 $7,662,177 PRX Prodigy Gold NL 0.002 -20% 180,000 $7,937,639 CSS Clean Seas Ltd 0.090 -18% 1,256,370 $22,144,461 PIM Pinnacleminerals 0.045 -17% 62,988 $2,455,019 ASR Asra Minerals Ltd 0.003 -17% 2,580,166 $6,937,890 CCO The Calmer Co Int 0.005 -17% 1,760,000 $15,251,350 ERA Energy Resources 0.003 -17% 823,746 $1,216,188,722 LML Lincoln Minerals 0.005 -17% 1,478,666 $12,337,557 VML Vital Metals Limited 0.003 -17% 32,033,318 $17,685,201 BIT Biotron Limited 0.011 -15% 13,256,379 $11,730,976 EMS Eastern Metals 0.011 -15% 492,635 $1,477,791 TKM Trek Metals Ltd 0.023 -15% 228,004 $14,043,317 BCB Bowen Coal Limited 0.006 -14% 538,492 $75,429,481 EPM Eclipse Metals 0.006 -14% 10,526,166 $20,018,733 HLX Helix Resources 0.003 -14% 206,670 $11,774,678

IN CASE YOU MISSED IT

New World Resources’ (ASX:NWC) is on track for full permitting within 12 months after its Federal Mine Plan of Operations application received the Determination of Adequacy under NEPA. The key milestone paves the way for an environmental assessment, with construction at the Antler project expected to begin in the second half of this year.

Largely European Lithium (ASX:EUR)-held Critical Metals Corp is raising US$22.5 million via a private placement to advance development at its critical mineral assets in Greenland and Austria. The raise follows this week’s Chinese export bans, which have increased focus on the Western rare earths industry.

Lanthanein Resources (ASX:LNR) has completed the first stage of diamond drilling at its Lady Grey project at Mt Holland in WA’s Yilgarn, testing the modelled conductor plate under MLEM Survey Line #6. Lady Grey sits adjacent to the historic Bounty gold mine, which produced ~1.3Moz. First assays are expected this quarter.

At Stockhead, we tell it like it is. While New World Resources, European Lithium and Lanthanein Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX swings as coal stocks weigh; but all eyes turn to US jobs report for Fed clues