Closing Bell: ASX sinks as soft earnings melt hopes; Fortescue and Magellan hit hard

The ASX dropped 1% as jobs and earnings missed. Fortescue, banks and Super Retail were down, while Whitehaven and Telstra were up.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX tumbles heavily on jobs and earnings miss

Fortescue, banks and Super Retail dive; Whitehaven, Telstra rise

Whitehaven, Telstra among the winners

The ASX tumbled heavily on Thursday, down 1.3%, continuing from where it left off yesterday.

There’s a couple of reasons for the bloodbath.

First, the January jobs report from the ABS came in hotter than expected, with 44,000 jobs added to the economy in January.

On paper, that sounds good, but it pushed bond traders to reduce their bets on any hopes of another RBA interest rate cut in May.

Secondly, earnings season is in full swing, and some of the large cap names just didn't come up with the goods.

Banks copped a battering once again, with Australia and New Zealand Banking Group’s (ASX:ANZ) down over 3% after it revealed a rise in impaired loans, which is dragging down the whole banking sector.

Fortescue (ASX:FMG) also got smashed, down 7% after a brutal 53% profit drop for the half year. Despite record iron ore shipments, revenue from hematite tanked 21%, costs shot up 8%, and as a result, interim dividend got chopped by over half.

Magellan Financial Group (ASX:MFG) had a rough session, its shares fell 9.5% after the company’s profit dropped by 10% in the half. The company said it was reviewing its balance sheet after announcing the appointment of Dean McGuire as its new CFO.

Goodman Group (ASX:GMG) brought the property sector down after falling by over 6% on announcing a $4 billion capital raise to boost its focus on data centres. It’s been 12 years since the company did a cap raise, and it seems investors weren’t thrilled about it.

Global gaming company Aristocrat Leisure (ASX:ALL) didn’t fare much better, retreating 4% despite announcing a new share buyback worth up to $750 million.

Then we’ve got Super Retail Group (ASX:SUL), the owner of Rebel stores, which was just getting roasted, down 12% after reporting a 10% drop in NPAT for the half.

But not all was doom and gloom, as there were a few bright spots.

Wesfarmers (ASX:WES) jumped over 1%, buoyed by strong sales and earnings, mostly due its retail brands Bunnings and Kmart.

Telstra (ASX:TLS) also had a solid session, rising 5% after it posted a 6.5% rise in net profit in H1 and announced a share buyback program.

Meanwhile, Whitehaven Coal (ASX:WHC) crushed it with a 33% profit jump to $328m and revenue doubling to $3.4b in H1. The company said it was restarting its buyback and paying a 9¢ dividend. Shares soared 8%.

And, tech company Megaport (ASX:MP1) skyrocketed 14% after it raised its revenue guidance for the year. Megaport has been growing strong across all regions, with revenue and gross profit both rising by 12% in the half.

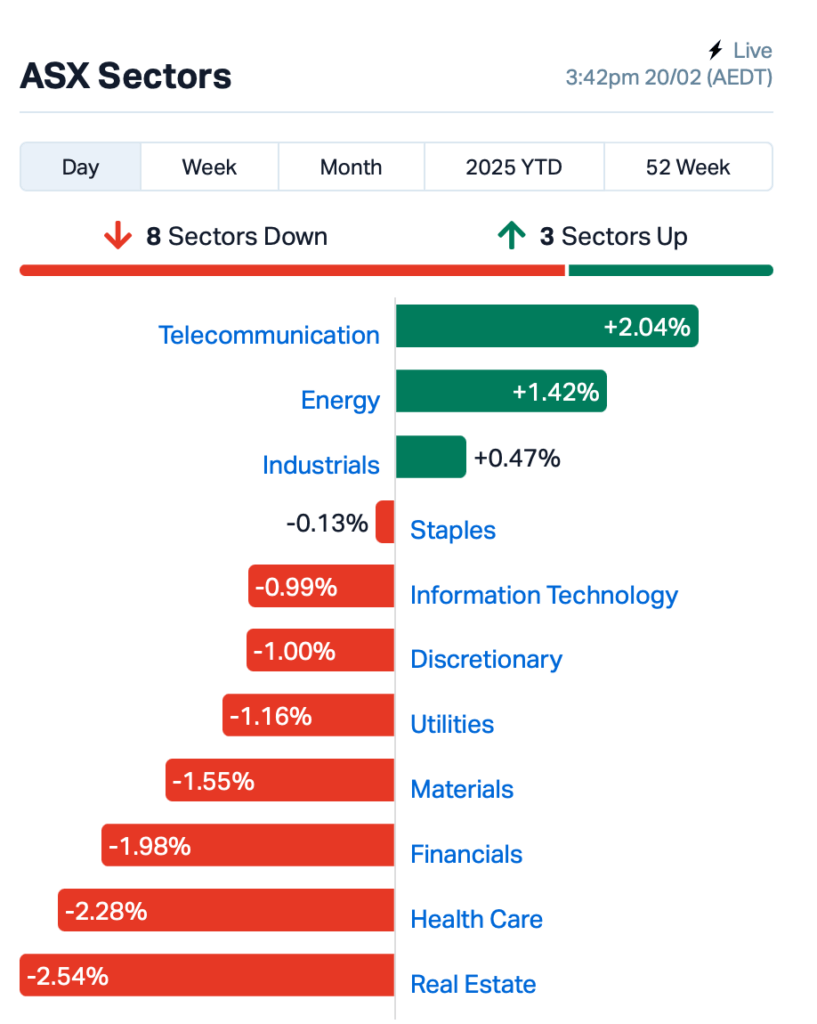

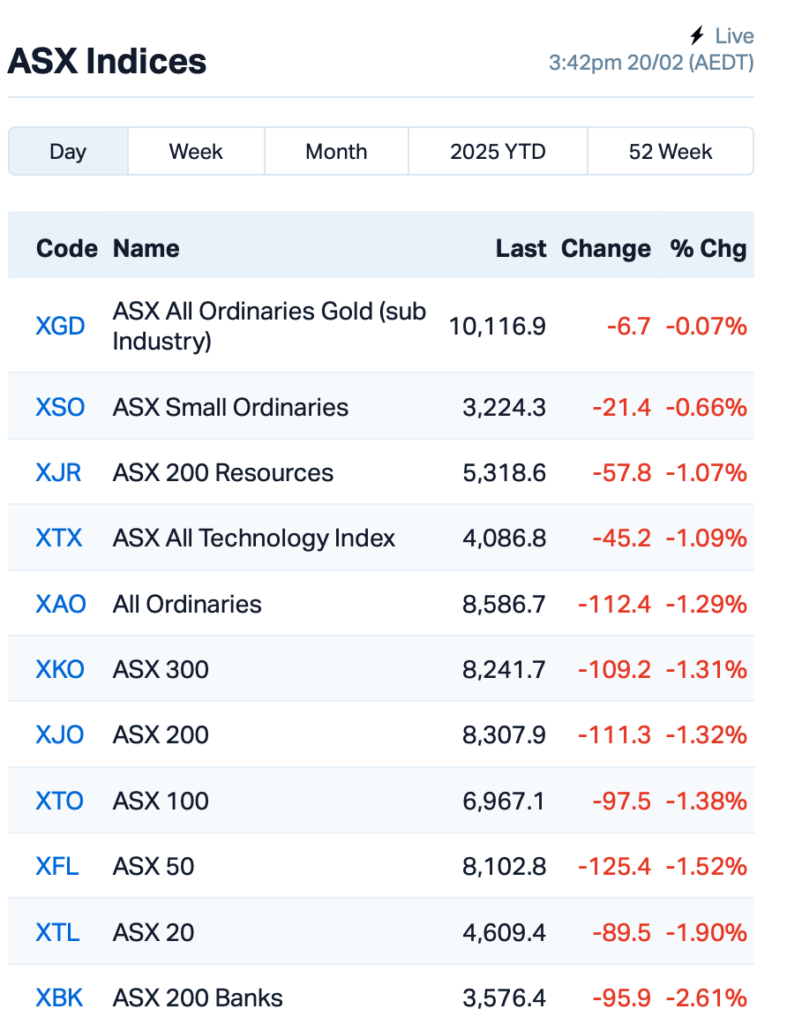

This is where things stood leading up to Thursday’s close:

Meanwhile across Asia, stocks mostly dropped, too, as investors reacted to the Federal Reserve's cautious stance on interest rate cuts.

According to the Fed's minutes last night, officials aren’t keen on more rate cuts just yet. They want to see inflation drop more first.

The big concern, the minutes noted, is Trump’s tariffs. The Fed’s worried these tariffs could push inflation higher and mess with the progress already made.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap VPR Volt Group 0.002 50% 252,355 $10,716,208 PER Percheron 0.013 44% 50,247,542 $9,786,939 PVW PVW Res Ltd 0.017 42% 4,514,244 $2,386,857 CVR Cavalierresources 0.120 40% 793,861 $4,974,431 HLX Helix Resources 0.004 33% 9,068,048 $10,092,581 RLL Rapid Lithium Ltd 0.004 33% 3,087,133 $3,097,334 ANR Anatara Ls Ltd 0.055 31% 76,612 $8,962,117 AVE Avecho Biotech Ltd 0.007 30% 7,458,497 $15,846,485 OMX Orangeminerals 0.039 30% 518,242 $3,333,068 HMY Harmoney Corp Ltd 0.695 26% 354,510 $56,080,281 1TT Thrive Tribe Tech 0.003 25% 427,201 $4,063,446 ERA Energy Resources 0.003 25% 4,107,168 $810,792,482 PGO Pacgold 0.070 23% 1,443,537 $7,492,897 KTA Krakatoa Resources 0.011 22% 4,518,908 $5,311,206 WWI West Wits Mining Ltd 0.020 22% 51,170,433 $41,199,687 WC1 Westcobarmetals 0.029 21% 20,942,235 $4,221,898 ADY Admiralty Resources. 0.006 20% 303,442 $13,147,397 BNL Blue Star Helium Ltd 0.006 20% 10,854,594 $13,474,426 RNX Renegade Exploration 0.006 20% 142,000 $6,420,017 ZMI Zinc of Ireland NL 0.012 20% 5,153,703 $5,670,107 CTQ Careteq Limited 0.013 18% 50,000 $2,608,306 NAN Nanosonics Limited 4.070 18% 1,980,602 $1,050,274,959 MGU Magnum Mining & Exp 0.007 17% 185,841 $4,856,168 NSM Northstaw 0.029 16% 1,878,848 $6,816,913 SSR SSR Mining Inc. 16.270 16% 42,947 $49,491,954

PVW Resources (ASX:PVW) has reported strong results from its drilling program at the Capão Bonito project in Brazil. Out of 32 holes drilled, 29 (94%) returned Total Rare Earth Oxide (TREO) concentrations above 500 ppm, with some hitting impressive grades up to 3,267 ppm. The mineralisation is shallow, making it easily accessible, and the project shows significant potential with mineralisation still open.

Cavalier Resources (ASX:CVR) has signed a non-binding deal for an US$11 million stream finance facility with Raptor to fund the Crawford Gold Project’s Stage 1 open pit development. The funds will also support drilling to upgrade more resources into ore reserves. The deal involves delivering up to 11,000 ounces of gold, but Cavalier won’t have to raise additional equity capital, so no dilution for shareholders. A 60-day due diligence period is now underway before moving to a binding agreement.

Anatara Lifesciences (ASX:ANR) said it was nearly done with Stage 2 of its GaRP-IBS trial, with results expected in March. Recruitment has been paused since December, but the final follow-up period is underway. The trial’s on track with 71 participants, and the company is set to analyse the data soon.

Non-bank lender Harmoney Corp (ASX:HMY) reported a strong first half of FY25, with Cash NPAT hitting $2.3m, a 350% increase compared to 1H24. Statutory NPAT was $2.0m. The company said it’s on track to meet its Cash NPAT guidance of $5m for FY25, with a target of $10m+ for FY26.

Pacgold (ASX:PGO) has just finished a big aircore drilling campaign at Alice River and found a massive 12km gold anomaly, stretching from the Shadows to the Victoria Prospect. With RC drilling set to start in April, the focus is on testing these new gold targets and following up on the high-grade areas.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TX3 | Trinex Minerals Ltd | 0.001 | -50% | 337,778 | $3,757,305 |

| AOK | Australian Oil. | 0.002 | -33% | 1,100,000 | $3,005,349 |

| WYX | Western Yilgarn NL | 0.028 | -30% | 111,530 | $4,952,382 |

| BMH | Baumart Holdings Ltd | 0.050 | -30% | 4,915 | $10,276,878 |

| PKO | Peako Limited | 0.003 | -25% | 65,450 | $5,950,968 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 439,936 | $9,673,198 |

| PHL | Propell Holdings Ltd | 0.009 | -25% | 482,593 | $3,340,057 |

| RDX | Redox Limited | 3.390 | -21% | 1,683,149 | $2,263,100,955 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 99,500 | $5,781,575 |

| CDT | Castle Minerals | 0.002 | -20% | 5,100,000 | $4,742,035 |

| CRR | Critical Resources | 0.004 | -20% | 101,135 | $12,321,106 |

| PNT | Panthermetalsltd | 0.014 | -18% | 3,140,220 | $4,218,903 |

| RFA | Rare Foods Australia | 0.019 | -17% | 40,000 | $6,255,615 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 517,001 | $9,518,072 |

| HE8 | Helios Energy Ltd | 0.010 | -17% | 8,022,429 | $31,248,593 |

| PLG | Pearlgullironlimited | 0.010 | -17% | 412,877 | $2,454,501 |

| VFX | Visionflex Group Ltd | 0.003 | -17% | 111,115 | $10,103,581 |

| GRV | Greenvale Energy Ltd | 0.055 | -15% | 708,126 | $31,646,766 |

| EPX | Ept Global Limited | 0.028 | -15% | 100,300 | $21,654,864 |

| ZNO | Zoono Group Ltd | 0.028 | -15% | 14,561 | $11,729,316 |

| LAM | Laramide Res Ltd | 0.595 | -15% | 72,904 | $14,408,342 |

| NAG | Nagambie Resources | 0.017 | -15% | 3,086,560 | $16,066,047 |

| TRM | Truscott Mining Corp | 0.075 | -15% | 56,200 | $16,847,473 |

| RWD | Reward Minerals Ltd | 0.052 | -15% | 192,243 | $16,239,394 |

IN CASE YOU MISSED IT

Green Critical Minerals' (ASX:GCM)VHD graphite technology has achieved a record density of 2071kg/m3, exceeding the industry standard for nuclear and electrode graphite. This density, along with proven high thermal diffusivity and conductivity, positions it as an ideal material for next-generation cooling solutions.

An independent review of Zenith Minerals' (ASX: ZNC) Red Mountain project in Queensland has confirmed key features of a Mt Wright-style intrusion-related gold system, validating the company’s belief that the project is evolving into a major gold system. Zenith is now seeking a Queensland government grant to accelerate deep drilling and further geophysical studies.

Wellnex Life (ASX:WNX) has secured binding commitments of $14.3 million at 65 cents per share, meeting the company’s estimated minimum capital requirement for a listing on the London Stock Exchange’s AIM. The funds will also strengthen Wellnex's financial position as it targets global expansion.

Pursuit Minerals (ASX:PUR) has updated its phased development plan for the Rio Grande Sur lithium project to support scalable, long-term production. The modular design will begin with Phase 1, which involves relocating the existing 250tpa lithium carbonate plant to the site. Phase 2 and Phase 3 will expand production by 5000tpa at Sal Rio 02 and 10,000tpa at Mito, ultimately increasing output to 15,250tpa.

Victory Metals (ASX:VTM)has boosted its cash position with a $751,909 tax credit for R&D activities in FY24, tied to exploration at its North Stanmore REE and critical minerals project in WA. The funds will go toward ongoing development at the project.

Bubalus Resources (ASX:BUS) has kicked off field programs at its recently optioned gold-antimony projects in Victoria's goldfields, highlighted by a major geochemical sampling program at the Crosbie North target. Previous rock chip sampling returned results of up to 12.1 g/t gold and 2.02% antimony.

Scorpion Minerals (ASX:SCN)has appointed experienced capital markets executive Peter Koller as a non-executive director. Bronwyn Barnes has resigned as non-executive chairman, with Michael Kitney succeeding her in the role.

At Stockhead, we tell it like it is. While Green Critical Minerals, Zenith Minerals, Wellnex Life, Pursuit Minerals, Victory Metals, Bubalus Resources and Scorpion Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX sinks as soft earnings melt hopes; Fortescue and Magellan hit hard