Closing Bell: ASX holds steady on good day for miners… and Chemist Warehouse

The ASX 200 flattened out to close a Thursday that saw Chemist Warehouse land on the bourse via Sigma. Meanwhile, mining stocks led the sectors.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

The ASX 200 has flattened out to close proceedings on Thursday

Mining/ressie stocks, however, led the gainers

Shares of combined Chemist Warehouse and Sigma Healthcare began trading on ASX following merger

The ASX 200 curbed much of its early enthusiasm from this morning to close pretty flat, just up 0.055%.

A somewhat… 'meh' end to a day that, earlier, saw the S&P/ASX 200 hit an all-time high on the back of Chemist Warehouse's debut on the local bourse and positive earnings results.

At around midday, the ASX 200 briefly surpassed its previous peak of 8566.9 which was set after CPI inflation data topped expectations on January 31.

Pharmaceutical distributor Sigma Healthcare (ASX:SIG) had led the Aussie bourse higher, up ~6.70% on its first day of trade following the official merger with pharmacy chain Chemist Warehouse.

The union combines Sigma’s 400-plus pharmacies, under brands Discount Drug Stores and Amcal, and its wholesale distribution business (servicing more than 4000 chemists) with Chemist Warehouse’s 600 franchised outlets.

The market capitalisation of Sigma has increased from ~$4.5 billion (pre Chemist Warehouse) to ~$31.8bn following the merger.

On Wall Street overnight, the S&P 500 index closed 0.3% lower, the Dow Jones fell 0.5% and the technology-focused Nasdaq index ended flat as US CPI data came in hotter than expected for January.

Latest figures released Wednesday showed the US Consumer Price Index (CPI) increased by 3.0% in January, higher than anticipated by most economists.

Excluding volatile components such as food and energy, core inflation remains elevated at 3.3% year-on-year.

Meanwhile across Asia today, stock markets were mostly up despite the higher than expected US inflation figures.

At 3.45pm (AEDT) Japan's Nikkei was up 1.56%, Hong Kong's Hang Seng index rose 1.52%, while Korea's Kospi gained 1.09%.

Radiology giant Pro Medicus (ASX:PME) hit an all-time high of $298.98 before a bit of what seemed like profit taking and dropping back to close ~$281.77 after reporting its H1 FY25 results.

Pro Medicus reported NPAT of A$51.7m, up 42.7% and in-line with Morgans forecast of $51.6m and above consensus of $50.6m.

Revenue was up 31.1% to $97.2m, below Morgans estimates of $103.3m and consensus of $99.7m.

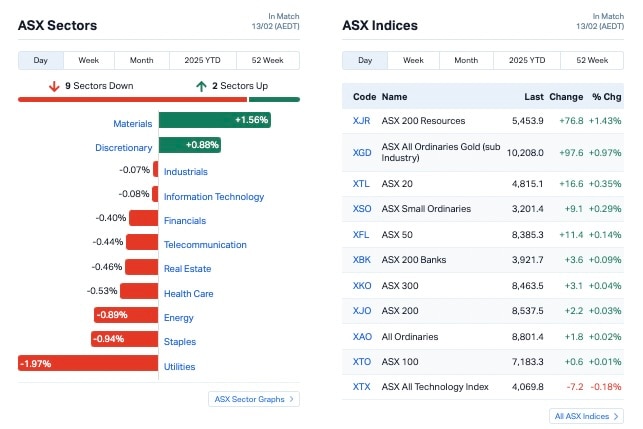

Just two of the 11 sectors ended in the green with materials leading the winners and utilities the laggards.

Monster mining stocks fared well, with BHP (ASX:BHP) closing +2.21%, Fortescue (ASX:FMG) up 1.37% and Rio Tinto (ASX:RIO) climbing 1.42%.

This is how things looked just before closing time…

ASX small cap leaders

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.002 | 100% | 1452410 | $3,224,671 |

| RLL | Rapid Lithium Ltd | 0.005 | 67% | 23091835 | $3,097,334 |

| BGE | Bridge SaaS | 0.031 | 55% | 577180 | $3,997,184 |

| 88E | 88 Energy Ltd | 0.0015 | 50% | 2618158 | $28,933,812 |

| CDT | Castle Minerals | 0.0035 | 40% | 74368391 | $4,742,035 |

| AXP | AXP Energy Ltd | 0.002 | 33% | 5510000 | $8,737,021 |

| BLZ | Blaze Minerals Ltd | 0.004 | 33% | 1250000 | $4,700,843 |

| LNU | Linius Tech Limited | 0.002 | 33% | 310000 | $9,226,824 |

| BNL | Blue Star Helium Ltd | 0.006 | 33% | 3071170 | $12,126,984 |

| MPR | Mpower Group Limited | 0.012 | 33% | 160624 | $3,093,330 |

| ASO | Aston Minerals Ltd | 0.018 | 29% | 5185793 | $18,130,900 |

| MRZ | Mont Royal Resources | 0.032 | 28% | 360000 | $2,125,745 |

| RR1 | Reach Resources Ltd | 0.0115 | 28% | 10199204 | $7,869,882 |

| SPG | Spc Global Holdings | 0.84 | 27% | 158481 | $127,368,042 |

| ADG | Adelong Gold Limited | 0.007 | 27% | 84719758 | $6,148,939 |

| FME | Future Metals NL | 0.014 | 27% | 4123670 | $6,325,445 |

| AMS | Atomos | 0.005 | 25% | 10036017 | $4,860,074 |

| CRR | Critical Resources | 0.005 | 25% | 106419 | $9,727,853 |

| CUL | Cullen Resources | 0.005 | 25% | 18181 | $2,773,607 |

| GMN | Gold Mountain Ltd | 0.0025 | 25% | 1037256 | $9,158,446 |

| KTA | Krakatoa Resources | 0.01 | 25% | 1912401 | $4,721,072 |

| MVL | Marvel Gold Limited | 0.01 | 25% | 1150688 | $6,910,326 |

| RGL | Riversgold | 0.005 | 25% | 54617109 | $6,734,850 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 200000 | $3,220,998 |

| VEN | Vintage Energy | 0.005 | 25% | 1391115 | $6,678,125 |

Adelong Gold (ASX:ADG) has executed a binding purchase agreement to acquire a 100% interest in EL006430, to be renamed the Apollo Gold Project in Victoria. Adelong said the project was located within the highly prospective Melbourne Zone that hosts Southern Cross Gold’s Sunday Creek project and features multiple zones of thick, high-grade gold mineralisation, presenting an immediate exploration and development opportunity.

AXP Energy (ASX:AXP) is up 33% after reporting that its Pathfinder #2 well’s current production of 20 barrels of oil and 280,000 cubic feet of gas from the Niobrara Formation demonstrates the ability for additional production to be brought online over the coming months. It added that additional gas production from the Amerigo Vespucci well has now been tied into the gas to power operation at the Pathfinder #2 production hub with the well to start pumping operations once the well head pressure stabilises the next 7-10 days.

ASX small cap losers

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MEL | Metgasco Ltd | 0.003 | -40% | 135,000 | $7,287,934 |

| 1TT | Thrive Tribe Tech | 0.002 | -33% | 557,000 | $6,095,169 |

| DUN | Dundasminerals | 0.033 | -27% | 1,356,551 | $4,824,826 |

| CTN | Catalina Resources | 0.003 | -25% | 500,000 | $5,265,048 |

| M2R | Miramar | 0.003 | -25% | 4,426,970 | $1,587,293 |

| RAS | Ragusa Minerals Ltd | 0.02 | -20% | 565,901 | $3,564,970 |

| ECT | Env Clean Tech Ltd. | 0.002 | -20% | 450,311 | $7,929,526 |

| HCD | Hydrocarbon Dynamics | 0.002 | -20% | 2,000 | $2,695,273 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 25,000 | $1,946,223 |

| XGL | Xamble Group Limited | 0.016 | -20% | 200,000 | $6,780,285 |

| PBL | Parabellumresources | 0.043 | -19% | 11,000 | $3,301,900 |

| HPC | Thehydration | 0.009 | -18% | 159,136 | $3,354,044 |

| MGL | Magontec Limited | 0.21 | -18% | 133 | $14,525,266 |

| SSH | Sshgroupltd | 0.125 | -17% | 25,360 | $9,884,978 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 8,606,237 | $9,518,072 |

| IPB | IPB Petroleum Ltd | 0.005 | -17% | 140,000 | $4,238,418 |

| MTB | Mount Burgess Mining | 0.005 | -17% | 90 | $2,037,225 |

| TEG | Triangle Energy Ltd | 0.005 | -17% | 4,583,520 | $12,535,404 |

| PVE | Po Valley Energy Ltd | 0.036 | -14% | 112,406 | $48,676,388 |

| ENT | Enterprise Metals | 0.003 | -14% | 536,666 | $4,124,110 |

| RNX | Renegade Exploration | 0.006 | -14% | 740,000 | $8,988,024 |

| SPQ | Superior Resources | 0.006 | -14% | 230,000 | $15,189,047 |

| STM | Sunstone Metals Ltd | 0.006 | -14% | 2,023,245 | $36,050,025 |

| BUX | Buxton Resources Ltd | 0.033 | -13% | 719,834 | $8,446,734 |

| SVG | Savannah Goldfields | 0.02 | -13% | 179,932 | $10,605,662 |

In case you missed it

Latitude 66 (ASX:LAT) has kicked off RC drilling at its Kuusamo gold-cobalt project in Finland, zeroing in on targets near its 7.3Mt resource, which contains 650,000oz gold at 2.7g/t and 0.08% cobalt for 5840t. The company is also moving ahead with a scoping study, due out in late Q1, to map out the development pathway but also scalability potential.

Miramar Resources (ASX:M2R) is raising $1.8 million to restart drilling at its Gidji JV gold project near Kalgoorlie in the midst of a record gold price environment. The funds will also support exploration at its Gascoyne polymetallic projects, including nickel, copper, and base metals targets.

Neurotech International (ASX:NTI) has partnered with RH Farma, a subsidiary of European Cannabis Company, to develop a pharmaceutical-grade broad-spectrum cannabinoid drug for paediatric neurological disorders. The deal supports NTI’s expansion into new markets and ensures scalable production to meet future demand upon regulatory approval.

OzAurum Resources (ASX:OZM) has hit consistent high-grade gold at the newly mapped New Cross Fault within its Mulgabbie North project, with results like 16m at 3.21g/t and 9m at 6.76g/t defining a 400m mineralised zone. With mineralisation open along strike and at depth, and assays pending for 32 more aircore holes, the company sees potential for more discoveries and is advancing a heap leach feasibility study for near-term production.

At Stockhead, we tell it like it is. While Latitude 66, Miramar Resources, Neurotech International, OzAurum, Riversgold, Arika Resources and Koonenberry Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX holds steady on good day for miners… and Chemist Warehouse